Stocks went on a wild ride yesterday as traders struggled to figure out whether or not a lukewarm inflation figure was important or not. Consumer Price Index / CPI showed a higher-than-expected increase in December, but still it was still muted compared to a year ago.

The last front in the war on inflation. Yes, my friends, there will be a time where I will no longer have to write about inflation and the Fed rate hikes, however those items, though lower on the worry list, still stubbornly remain. Yesterday’s Consumer Price Index / CPI release was expected to show a slight increase over the prior month, though the Core CPI, which excludes food and energy, was expected to continue its trend of decline. Both came in slightly higher than expected and markets, rightly so, reacted with disappointment. The fact remains that the market is betting heavily on a dovish Fed this year. More so, in fact, than the Fed itself, which published its member guesses on rates for the year and beyond. Any Fedspeak on rates is consistent with the Fed’s projections. The Fed’s projections, though still dovish, show a more measured approach to rate cuts, factoring in less cuts and a later launch date. After yesterday’s economic release, rate cut bets in the futures markets were little changed. According to Fed Funds futures, there is a 4.5% probability of a rate cut later this month. You can hang on that if you like, but I will tell you that it is a low probability as far as Wall Street is concerned. If you look at the March meeting futures (the Fed takes February off), the probability jumps to around 75%, which is a high probability on Wall Street. Still many experts are pointing to the Fed’s May meeting for a meaningful jump-off point for cuts. I will repeat what I have said several times over the past few weeks. When and how much are not really that meaningful at this point, but what is important is that all those numbers are negative, which at a very high level, is supported by Fed projections and the Fed’s general speaking spirit. Though the stock market may be on the more bullish side of the bet, what’s important is that everything stays consistent to avoid any major reversals.

That being said, I am not positing that we should not follow inflation’s path anymore, but I am suggesting that we shift focus to economic health and corporate health going forward. Economic health because, we are certainly not out of the gravitational pull of recession just yet. There is still plenty of “stuff” that could still hit the fan in the next 2 quarters. Regarding corporate health, sharp 4th quarter rises in stocks, especially magnificent 7 stocks (mainly tech), were largely spurred by prospects of the Fed’s dovish turn. Of course, we cannot forget to mention AI’s role in the bull run. AI will be, indeed, an important and very credible opportunity going forward, but companies will have to prove it in the numbers. Markets will not continue to reward companies for simply mentioning AI in their presentation (most do these days, similar to adding the “.com” to their names in the 1990s). It’s going to have to be put up or shut up.

So, was there anything notable in yesterday’s CPI release? Let’s take a quick look, but first look at one of my favorite Bloomberg charts which captures the major CPI components in one bar chart.

At first glance this chart should make you feel good because we can see the clear improvement from the painful days of 2022. Remember crazy food inflation? You can see by looking at the blue bars how significantly that diminished. Similarly with the purple-colored bars representing goods, or stuff as I like to call it. Energy had a clear inflationary impact for much of 2021 and 2022, while it was disinflationary for most of 2023. However, it should be noted that the disinflationary impact has been lessening in recent readings. That lessening pattern on those rust-colored energy bars played a big role in the slight uptick in the latest reading. Given the news that US and UK forces struck targets in Yemen overnight, there is a chance that energy prices may climb if things continue to escalate in the Red Sea. What cannot be overlooked on this chart is the massive impact services (gold bars) still has on inflation. In services Rent of Shelter remains stubbornly high and is the single biggest contributor to lingering inflation. I am not exactly sure what might reverse that trend, though there is an outside chance that falling mortgage rates may increase home buying and possibly lessen demand for rentals. Notice, my careful use of the word “outside” in the last sentence. Anyway, the watch is on for services, mainly rents, and energy.

Now let’s please turn our sights onto corporate health. Earnings season kicks off today with the big banks and should keep us busy enough in the coming weeks. Low bars are set, so simply beating estimates should not be good enough to keep the party going. As I mentioned in recent posts, we must listen carefully to growth plans and forward guidance, and please, do not accept casual use of the word AI. Of course, everyone has it, uses it, or whatever, but before we start buying stocks at the high end of their valuation bands, let’s please just do a quick acid test to determine if indeed AI will bring those companies increased revenue growth, because that is the only reason to buy a stock that is overvalued. Stay focused, there will be plenty of this in the days ahead.

PREMARKET ACTION

Delta Airlines Inc (DAL) shares are lower by -5.58% in the premarket. The company announced that it beat EPS and Revenue estimates last quarter but pulled back on its revenue targets for the year, though the guidance is still within the range of analysts’ estimates. The company pointed to increasing costs being a limiting factor in the year ahead. The other major carriers are down in the premarket following Delta’s announcement. Dividend yield: 0.94%. Potential average analyst target upside: +24.2%.

The premarket S&P500 leaderboard is topped with Marathon Oil, Halliburton, Schlumberger, Occidental Petroleum, APA Corp, Marathon Petroleum, Chevron, Devon Energy, Cotera Energy, ConocoPhillips, and Exxon Mobile, all up in the range of +2.66% to +1.65% on last night’s news that the US and UK struck targets in Yemen to thwart its terror efforts in the Red Sea and middle east in general. Not surprisingly, Crude Oil futures are up by +4.11% to $74.95 per barrel.

Also, this morning: United Health Group and Bank of New York / Mellon beat on EPS and Revenues, while BlackRock, Bank of America, and JPMorgan Chase came up short.

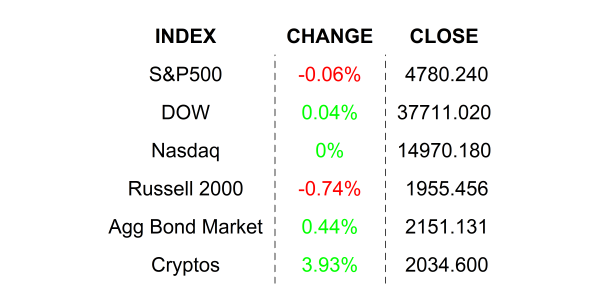

YESTERDAY’S MARKETS

NEXT UP

- Producer Price Index / PPI (Dec) is expected to have ticked up to +1.3% from November’s +0.9% reading.

- Next week we will have a steady stream of earnings releases in addition to regional Fed reports, housing numbers, Retail Sales, Industrial Production, The Fed Beige Book, and University Of Michigan Sentiment. Markets will be closed on Monday for Martin Luther King Jr. Day, so check back in on Tuesday for detailed earnings and economic calendars.

.png)