Stocks had another losing session yesterday as traders came to the reality that rates will not drop so far so fast. Consumers continue to carry the US Economy, going gangbusters in December, according to the latest Retail Sales numbers.

Slip slidin’ away. What a great lyric from 1977! Thanks, Paul Simon, for helping kick off this morning’s note. What’s up with crude oil? I briefly touched on it yesterday when I highlighted the importance of the Red Sea / Suez Canal shipping route and how tensions with Yemen could cause inflation to flare up in Europe. If you looked really closely at the map, you would notice lots and lots of shipping activity coming from the Persian Gulf, east of the Red Sea, going to India and Asia. Can you guess what that might be?

China and India are the world’s 2nd and 3rd largest consumers of Oil. Wouldn’t you know it, the countries around the Persian Gulf, Saudi Arabia, Iraq, United Arab Emirates, Iran, and Kuwait are amongst the world’s largest producers of Crude Oil, ranking 3, 5, 8, 9, and 10 respectively. Not incidentally, all those countries are members of OPEC. Oh, by the way, China is a top 10 producer, outputting around 4 million barrels per day. However, China consumes 16 million barrels per day, so it is safe to assume that Chinese demand is an important driver of global Crude demand, especially in the region. Despite whom sells it to whom, when demand is strong, and supply is scarce prices go up worldwide. That has certainly been a driver of crude oil prices which have been in roughly $70 – $90 range for the past few years, still quite a bit higher than it was in the years prior to the pandemic.

As you might imagine, global crude demand dipped in the initial stages of the pandemic. As most of the world slowly emerged from the pandemic, China maintained some of the strictest lockdowns which certainly impacted demand for oil. However, OPEC further tightened output which helped push prices higher. Ultimately, in 2022, China cut back on travel restrictions causing a massive surge in demand for crude, while the war in Ukraine caused mayhem in the energy markets. That perfect storm helped crude reach $120 / barrel, a price not seen since 2008. So, where can it go from here?

I am not foolish enough to even attempt to project the price of crude oil in the future. But for those experts in the area, projecting is going to get more challenging going forward. If you look at most of the reports out of OPEC, you will see that the group expects demand to continue to be strong this year. Despite the high demand, OPEC is still throttling back on production, which serves to keep prices higher. Just last night the International Energy Agency (IEA) released its January OMR, or Oil Market Report. In it the agency projected that crude oil supply will rise to a new high this year, driven by “record-setting” output from the US, Brazil, Guyana, and Canada. The same report also projects that global demand for oil will drop by nearly -50% this year. That is not a typo. The reason for the drop is a normalization of demand in the wake of China’s post-lockdown surge. Additionally, according to the report, macro headwinds along with expanding EV usage will accentuate the drop in demand. While EV usage has not quite taken over the world just yet, demand is certainly gaining ground, which cannot be ignored.

The US has been in the grips of a deep freeze over the past week. The other day, I caught a glimpse of a picture of a large line of electric vehicles lined up at a charging station. EV owners reportedly waited hours to “fill up” as their batteries drained more quickly than normal in the cold weather. The first thing that came to mind was the memory of waiting on long lines for gas in the 1970’s during the OPEC embargo. I chuckled to myself, muttering something like “full circle” under my breath. It should be clear to you at this point that there are many, many more moving parts in the global energy economy these days, and it is only going to get more complicated. For me, I am glad to be able to get around on foot most days, and I have at least 1 car which will never, ever get replaced by an EV. Oil analysts, I am not envious of you.

WHAT’S SLIPPIN’ AND SLIDIN’ IN THE PREMARKET

Humana Inc (HUM) shares are lower by -12.23% in the premarket after the company cut its full-year guidance far below analysts’ expectations. The company cited “industry wide” challenges for the cut. If you agree with them and you own managed care stocks, you might want to check in with them. The company is expected to announce earnings on 2/5. Dividend yield: 0.79%. Potential average analyst target upside: +28.9%.

Fastenal Co (FAST) shares are up by +2.95% in the premarket after it announced that it beat EPS and Revenue estimates by +2.06% and +0.27% respectively. In the past month 2 analysts have raised their price targets while 1 lowered. Dividend yield: 2.46%. Potential average analyst target upside: -4.8%. WHY IS THIS NEGATIVE? Because the stock’s current price is currently trading higher than the median analyst price target. While that may be viewed as the company being expensive, it does not mean that the stock cannot continue to climb.

Also, this morning: M&T Bank and First Horizon both beat on EPS and Revenues while KeyCorp, Truist, and Northern Trust came up short.

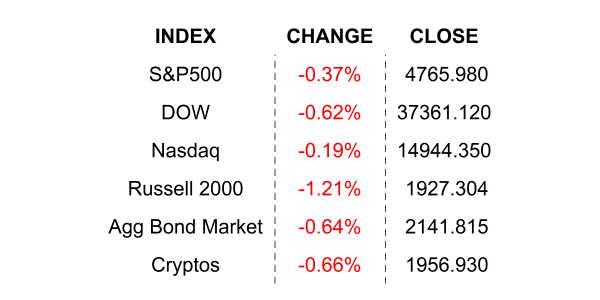

YESTERDAY’S MARKETS

NEXT UP

- Housing Starts (Dec) are expected to have slipped by -6.7% after gaining +14.8% in November.

- Building Permits (Dec) may have climbed by +0.6% after falling by a revised -2.1% in the prior period.

- Initial Jobless Claims (Jan 13) is expected to come in at 205k, slightly higher than last week’s 202k claims.

- Atlanta Fed President Raphael Bostic will speak today.

.png)