Stocks hit new highs yesterday as positive sentiment momentum kept the party alive. Leading Economic Indicators came in better than expected, but still in decline, which is good-bad.

When I find myself in times of trouble. The S&P500 put another record in the books yesterday. The Dow Jones Industrial Average and perennial favorite Nasdaq Composite also gained some new accolades. It’s just one big happy-fest! We, after all, deserve some happiness with 2022 still in the rearview mirror, albeit smaller than 2023, which was no walk in the park either. Last year ended up a good one but not without lots of stress. And finally, we are here in what I call the “promise year,” in which everything is supposed to be perfect. The first potentially normal year since we first caught wind of a mysterious virus that broke out in China in the closing days of 2019. But what is “normal” anyway?

The S&P500 is up by just +1.69% for the year and we are at a new high. Mind you, that is +20.66% above where we were a year ago. Oh, and the large cap index printed a +24.23% gain for 2023. What ever happened to a solid +10% yearly gain on average? All this begs the question “are we getting ahead of ourselves?” There are many so-called indicators that show us at dangerously high levels… but on the flip side there are just as many that indicate the opposite. That’s Wall Street for you. Though your brother-in-law makes it seem so simple, boasting HUGE returns at the holiday table, you know that it is not simple at all. Every day in the market seems to bring a new adventure that will either make you feel like a genius… or a total loser. Have I gotten your head spinning yet?

It’s OK, I am with you. Here is a little simple secret. It is the market equivalent of remembering to breathe when things get crazy. When trying to make sense of what appears to be senselessness in the markets, I simply plot a chart going back to a time I can remember being fraught with lots of uncertainty. Here is one for you. Take a look and then follow me to the close.

This is a chart that compares percent returns of the S&P500 (white), the S&P500 Growth Index (red dashed), and the S&P500 Value Index (yellow dotted). I took it back to the start of 2017. Brexit was just announced the summer before, there was a new US president with unconventional methods, interest rates were rising, and trouble was brewing between the US and China. Oh, economic growth in the US was starting to wane. There was a lot of uncertainty. Then came a new tax package which was a large win for US corporations in 2017, but it would only put off the inevitable earnings recession that everyone knew was coming. And it did in 2018 ruining everyone’s holiday. The Fed stepped up in 2019 and growth stocks led the charge higher. It was to be smooth sailing… if not for the start of the pandemic in 2020. Remember the first half of 2020. Would it be fair to say that was a time of uncertainty. The Fed stepped in to save the day once more. Growth stocks led the way higher, lagged by value stocks. But value stocks would come back in vogue in 2022 as the Fed threw a bucket of ice on your 401k. Growth suffered the most and value stocks would prove to be the best place to hide out in the rapidly rising rate environment. Last year’s spectacular finish is still too recent to fully comprehend. The beginning of the year was hugely uncertain as far as interest rates were concerned. Then came some unexpected bank failures. One day’s numbers which predicted the coming of recession of epic proportions gave way to the next day’s numbers which predicted a boom. Projections of constraining interest rates swung wildly from north to south, and back to north. If you don’t mind my nautical reference, those were tough conditions to navigate in, wouldn’t you say?

So, here we are in what we would have hoped to be calm waters, and on the horizon, we see nothing but more clouds forming, wondering if they will bring more storms and uncertainty. It is an election year, there is no lack of geopolitical turmoil, stocks are at all-time highs, interest rates have yet to be cut, and a recession is still a very real possibility. Confused? Concerned? Look at the chart. Over all of that tumult that I just detailed for you, the S&P500 returned +113%! Looking at the chart you will notice that growth stocks are breaking away from the pack, as they have at the start of all past expansions. Will that expansion continue? Only time will tell, but I can tell you that uncertainty can be expected and with it some discomfort. But ultimately, success will be ours, as it has in the past. Just take a breath and look at the chart above one more time. There you go, you got this.

WHAT’S HEADING NORTH OR SOUTH IN THE PREMARKET

3M Co (MMM) shares are lower by -7.14% in the premarket after it announced that it beat on EPS and Revenues but provided full-year guidance that missed analyst projections. Only 9% of analysts that cover the stock rate it the equivalent of a BUY, while 85.7% rate it a HOLD. Dividend yield: 5.55%. Potential average analyst target upside: +2.5%.

United Airlines Holdings Inc (UAL) shares are higher by +6.40% in the premarket after it announced that it beat EPS and Revenues by +18.10% and +0.60% respectively. The company provided full-year guidance that topped analysts’ expectations. United’s forward PE of 4.02x is lower than the median 5.65x of its peer group. Potential average analyst target upside: +53.3%.

Also, this morning… Synchrony Financial, J&J, General Electric, RTX, Verizon Communications, and Lockheed Martin all beat on EPS and Revenues while DR Horton, Halliburton, Invesco, and P&G came up short.

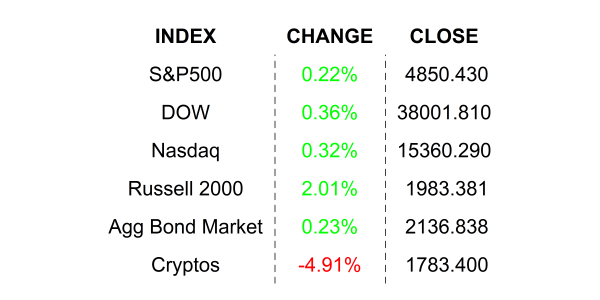

YESTERDAY’S MARKETS

NEXT UP

- No major economic releases today.

- Earnings after the closing bell: Netflix, Intuitive Surgical, TI, and Baker Hughes.

.png)