Stocks struggled yesterday in the wake of Powell’s primetime weekend wakeup call and continued economic strength. The services sector is expanding… and with it prices paid, which jumped last month.

What do you expect? I know that you don’t spend hours of your free time looking at charts of Treasury Notes. It’s OK, I get it, bonds are kind of boring. To be clear, they are quite exciting from a quant finance perspective, but bonds, especially Treasuries, lack the juicy stories that come with owning stocks. While Tesla stockholders are grappling with news reports of its CEO’s use of drugs, his many children, and Cybertrucks being driven by nerds wearing Apple VR headsets, Treasury holders are limited to dry economic releases, and who wants to talk about that when you are out with friends. “Guys, did you notice that Jerome Powell didn’t wear his glasses for his interview?” How scandalous… do you think that means something deep 🤓? You don’t have to answer that, it was geek-humor. In reality, I am sure that you know that stocks’ behavior recently has very much been under the spell of Treasury yields, which I am sure you have noticed, have been very volatile recently.

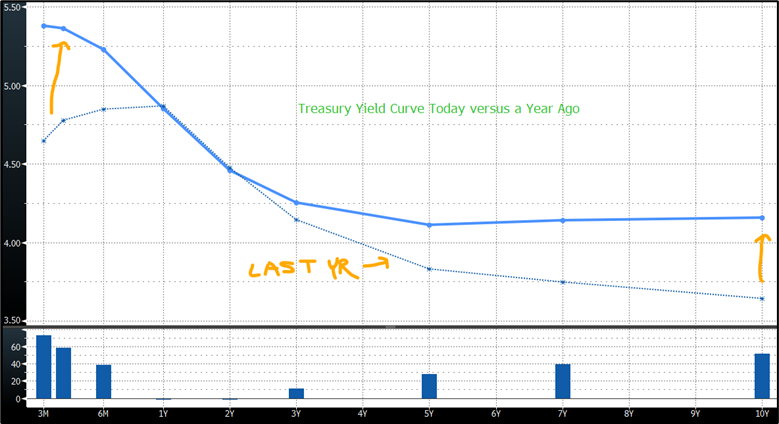

That has everything to do with expectations of upcoming rate hikes and the state of the economy, both of which were INCORRECTLY forecasted by the bond market in the past year. How do I know? You simply have to look at the yield curve. Just bear with me and have a look at the following chart then keep reading for an explanation.

This chart shows the yield curve between 3-month bills and 10-year notes. The solid blue line is this morning’s curve, and the dotted line is the curve from exactly a year ago. The first thing that should stand out to you is that yields are higher on the front and the back end of the curve. “Wait,” you’re probably thinking, “aren’t rates supposed to be coming down this year?” Well, they are… kind of. First of all, rates being cut is purely speculation, expectation until the Fed actually cuts them. So, the front end of the yield curve only represents what investors are expecting in the year or so ahead. Knowing that and observing the chart, you can see that investors were more confident of imminent rate cuts a year ago than they are today… go figure.

Now, as far as the back end of the curve (right-hand side of the chart) is concerned, we can observe a similar occurrence, but for very different reasons. Yields are higher from 3-year tenors and out. What is causing that? I sort-of touched on that in yesterday’s note, but I wanted to solidify your understanding of it this morning. Yields on that part of the yield curve have very little to do with Fed policy. I mean, how can we possibly know what the Fed will be doing with rates 5 years from now. No, those yields represent investors’ assessment of economic growth and the inflation that comes with a strong economy. Investors, if they expect inflation in the futures, demand higher yields to compensate for their diminished purchasing power. There is more baked into those yields. Investors require a liquidity premium, sometimes called term premium. Very simplistically, investors need to be compensated for locking in their money up for a long period of time, and if they are unsure of what the future holds, they are likely to require higher yields for the risk. This difference in the long end of these curves, therefore, reflects investors’ beliefs of a stronger economy and volatility has increased over the past year. Futures, not shown on this chart, are predicting that Fed Funds will be around 4% by the end of the year. It is clear by looking at the curves, that bond traders are not completely in sync with futures traders, but one is clear. If the very front of the curve were at 4%, the yield curve would no long be inverted. The final point that I would make is that hopes of a strong economy in the future should be positive for your stocks. Dashed hopes of what the Fed might do tomorrow is only fodder for day traders. The yield curve is sending you a message, and it is not altogether as bad as you might think. Stay focused.

WHAT’S HAPPENING BEFORE THE OPENING BELL

FMC Corp (FMC) shares are lower by -13.26% in the premarket after the agg-chemical manufacturer announced misses on EPS and Revenues last quarter. The company also provided weaker full-year and current-quarter guidance. The company attributes the soft patch to weaker demand from Brazil, a large producer of corn and soy, which is currently experiencing a drought. Dividend yield: 3.83%. Potential average analyst target upside: +14.7%.

Eli Lilly & Co. (LLY) shares are higher by +3.30% in the premarket after the company announced that it beat EPS and Revenues by +14.1% and +4.42% respectively. The company provided full-year Revenue guidance that exceeded analyst expectations. Dividend yield: 0.73%. Potential average analyst target upside: -8.2%. WHY IS THIS NEGATIVE? Because the current share price is above the median analyst target. While this can be viewed as the stock being expensive, it does not mean it will not continue to climb.

YESTERDAY’S MARKETS

NEXT UP

- Today’s Fedspeak: Mester, Kashkari, Collins, and Harper. Given the market’s recent indigestion from Fed disappointment, their speeches are likely to cause some gyrations today.

- After the closing bell earnings: Fortinet, Kyndryl, Snap, Chipotle, Carlisle, Gilead, MicroStrategy, Enphase Energy, Lumen, Amgen, and Edwards Lifesciences.

.png)