Stocks slipped on Friday, giving up solid, early gains, led into the red by NVIDIA on profit taking. Monthly employment figures showed a healthy labor market… but not too healthy, which should keep the Fed at ease.

I don’t know about you. I refuse! I simply refuse to ignore the fact that the United States economy is rather healthy. Everyone who reads my daily note knows how much import I place on consumption. Likewise, you should all know, BY HEART, the number I always cite as my reason. Come on, out with it… yes, it’s 2/3! That is roughly the amount of GDP attributed to yours and my spending. Let’s not leave it at that. What makes us want to spend money, or put a different way, what would make us NOT spend money.

That penchant to purchase or not, comes from our confidence. Confidence in the economy today as well as where we expect things to be in the 12 months or so. I am sure that you agree, when you are feeling like things are going Ok, you are a little more willing to throw down some Benjamins, the plastic… or double click and smile (Apple Pay 🍎💲😊). For my non-US readers, Benjamins is a slang term for $100 bills, also known as C-notes.

I don’t know about you, but I am quite satisfied to receive my paycheck. If I were worried that my paycheck was in jeopardy, well, I have to say that I might be a bit less willing to spend on non-essentials. I may even slow down on the essentials. Why? Unless you have a money tree in your yard, your primary source of income is from your salary. You see where I am going with this? If companies are doing well and hiring new employees, that is a good sign of a strong labor market. Last month, according to the Bureau of Labor Statistics (BLS), 275,000 new jobs were filled. What’s more, BLS announced, earlier in the week, that there were 8.863 million job openings in the US. That should give you some confidence. Corporate earnings were not too terrible in Q4 (just reported) and analysts are predicting solid earnings growth in the coming quarters. That should make you confident.

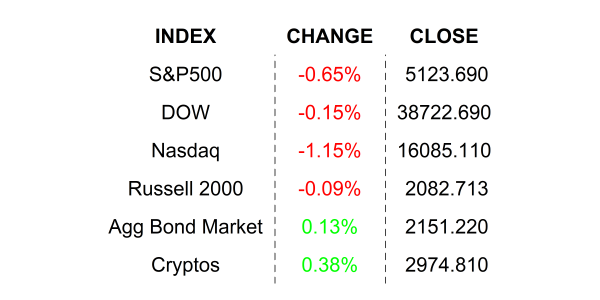

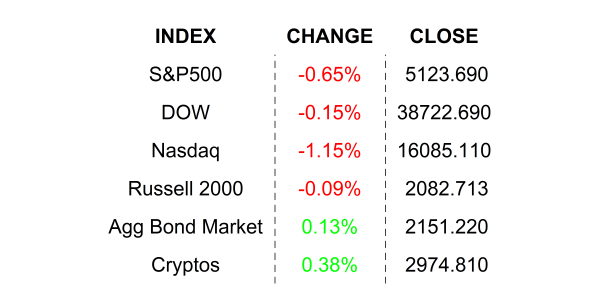

Do you know what else should make you confident? Even with recent volatility, the S&P500 is up by +7.42% year to date and is +32.68% higher than it was a year ago. Did you know that consumers are more confident when they hear that stocks are rising… even if they don’t own stocks? There is plenty of research out there, even from the Fed itself. So then, a strong labor market and a strong stock market should be a good for the economy. Well, let’s have a look at consumer confidence. There are two principal indicators of that from The Conference Board and University of Michigan. Both of those show increasing confidence but at levels still lower than they were prior to the pandemic. Let’s call it… subdued confidence along with a solid labor market. I would say that would be positive enough for you to at least crack a smile. If it is the Fed that you are worried about, please don’t. Friday’s number also showed that hourly wage growth is slowing. The Fed focuses heavily on that as it is also considered an indicator of future inflation.

Finally, if you look closely at the inflation figures, you will note that the last holdout from the post-COVID-pandemic-inflation-pandemic is services. If you drill down, the blame lies quite squarely on Rent… not eggs, TV’s, cars, or even Taylor Swift tickets (those are not cheap, but their cost growth has slowed 🤘😏)… rent. Now, I don’t have a solution for the rent inflation problem for you this morning, but I do have to say, I am feeling OK with the strongish employment figures, and you should be too. Tomorrow brings the release of February’s Consumer Price Index / CPI, where we can see exactly where we are in our fight with inflation. Pay attention, but at least go into it feeling confident.

FRIDAY’S MARKETS

NEXT UP

- No major economic releases today BUT we have some big ones in the week ahead. The release schedule includes Consumer Price Index / CPI, Producer Price Index / PPI, Retail Sales, Industrial Production, and University of Michigan Sentiment. Though earnings season is mostly over, there are still some notable stragglers this week, so download the attached earnings calendar along with the weekly economic calendar for times and details.

.png)