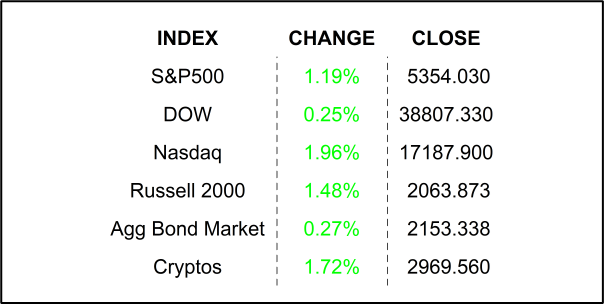

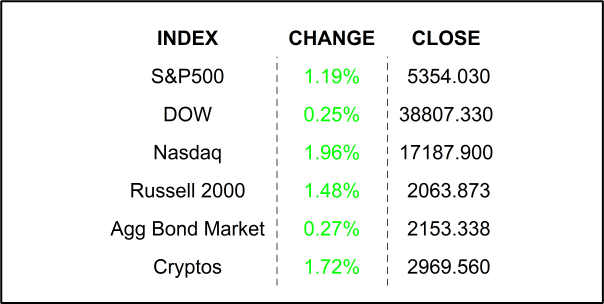

Stocks rallied yesterday, ushered higher by NVIDIA, because AI is real, and NVIDIA is at its center. The ADP monthly employment report came up short of estimates, a sign that employment is losing steam.

A tale of two economies. The Eurozone is known to be fashion forward. Now, I am not saying that here in the US we are devoid of high fashion. I am just saying that… well, before I get too far astray of my mission, let’s just say the Europeans have a knack for fashion. AND, BESIDES, I have no desire, nor the bona fides to write a fashion blog. In any case, be THAT as it may, the US has a special knack for… um, wealth generation and economic growth… amongst other things. The US is the largest economy in the world with the strongest currency and military, pretty much assuring that it will always be a leader in the global economy (that’s um, all of us, like on the Small World ride at Disney). Now that I, low-key, mentioned it, that It’s A Small World ride premiered in the US in 1964 at the New York World’s Fair. Oh, yeah, the US is known to be an innovation engine, as well.

Now, this is NOT at all a hype piece for the US. You know that I am setting you up for an information drop. Hang on… let’s go. The Eurozone is set to cut interest rates TODAY! Now, it hasn’t happened at the time I am writing this, but it is widely expected, and Eurozone Overnight Interest Rates swaps give it a 100% probability. Wait, are the Europeans leading on this one? Where is the Fed? Isn’t IT supposed to be the leader?

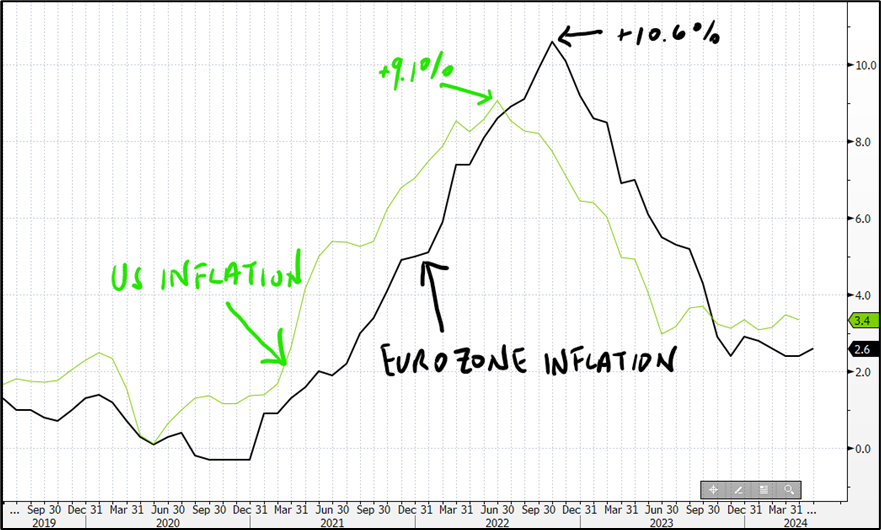

I know, I know, the Eurozone economy is very different than the US. But it would seem to me that, that economic ship, made up of many different economies all with different strengths and weaknesses, would make it even more challenging to pilot in the treacherous waters of the global economy. Hmm, shall we have a look at that? Let us START with a CHART.

Here you go in black and white… and green. You can see how inflation spiked and peaked in both the US and the Eurozone in 2022. The US hit a high of +9.1% and the EZ +10.6%. The US peaked earlier and lower while the EZ peaked higher but declined faster. In December of 2019, US inflation was just around the Fed’s +2.0% target while EZ inflation was just below. It is clear that, as of the latest readings, that US inflation is a bit higher. I suppose some context is in order. The European Central Bank equivalent to the Fed Funds Rate is the ECB Deposit Facility Announcement Rate. That rate was at -0.50% in June 2022 before the ECB hiked it up to +4.00% where it has been since Fall 2023. Fed Funds Rate was at +0.25% until the Fed hiked to 5.50% where it has been since last August.

This is all very close, but it is important to appreciate the nuances and why the ECB may be more comfortable with making a cut at the moment. Of course, I haven’t even touched on the differences between the economic numbers between the two but suffice it to say that those are not clearcut either, both showing mixed signals of strengths and weaknesses.

SO, here is what may happen by the time you butter your toast this morning. The ECB will cut its key lending rate by -25 basis points. This may cause funds to flow from the EU to the differentially higher interest rate US. That may cause the dollar to strengthen. You probably think that a strong dollar is a good thing. Well, it is if you live in the US and are traveling to Europe with your family. But if you are a central banker, you would prefer a weaker currency especially in times of economic weakness. A weaker currency makes your domestic goods cheaper and more attractive to foreign buyers. Going back to travel, if the dollar is strong, you will be happy to spend more money on European goods when you travel. Just be careful if you are buying leading edge European fashion with your stronger dollar, it can go out of style very quickly… a drawback of being too fashion forward 😉.

WHAT IS IN AND OUT OF FASHION IN THE PREMARKET

Dollar Tree Inc (DLTR) shares are lower by -1.21% in the premarket after the company announced an EPS miss. The company also lowered its full-year Sales guidance drawing a downgrade to NEUTRAL from Citi. The company announced that it is assessing “strategic initiatives” for its Family Dollar division that may include a spinoff. With a forward PE of 16.94x, DLTR is the cheapest of its peer group with a 21.44x forward PE. Potential average analyst target upside: +22.1%.

Lululemon Athletica Inc (LULU) shares are higher by +8.99% in the premarket after it announced an EPS and Revenue beat. The company also raised current quarter and full-year guidance. In the past 30 days 21 analysts have lowered their price targets while only 1 has raised them. Still, 67.6% of them rate the company a buy while only 8.1% are sellers. Potential average analyst target upside: +34.1%.

YESTERDAY’S MARKETS

NEXT UP

- Initial Jobless Claims (June 1) is expected to come in at 220k, a touch higher than last week’s 219k.

- The ECB decision this morning and revised bets on US interest rates will set the market’s tone today.

.png)