Stocks dillydallied through yesterday’s session with little in the way of news to chew on. A mixed close and lots of trading ahead of today’s big employment figure captured the on-edge sentiment of traders.

Out of the comfort zone. It was a mic-drop heard ‘round the world… or at least the private equity world. When I saw the comment race across the tape, I certainly dropped everything and took to my Bloomberg and mashed at its keys in search of answers. I wondered, “did Apollo Asset Management Co-President Scott Kleinman really say that ‘everything is not going to be OK in PE?’” In my search, I quickly found a quote fragment from Kleinman that read, “… until the pig moves through the python.” With that, I edged my behind to the front of my chair and leaned in, because that one got my hackles up.

I have written many times about private company valuations and the hidden pains of “higher for longer” interest rates, though not in the same context. Let’s first address the private company valuation thing and then close in on interest rates. On valuation, we can start with a quote. “What do you think it’s worth?” Private equity firms acquire companies at what they perceive as low multiples, or undervalued. They are typically, but not always, public and the rationale for the acquisition is that the “market” may not fully appreciate the value of the company. So, PE firms will buy a company, tidy up a bit, wait a minute, and then exit with the hopes of making 10 times their initial investment. Wow – can a company really be THAT undervalued? No, of course not. You see the PE firm will use massive amounts of leverage to buy a company or asset. As much as 70% or even 80% of the purchase may be financed through a complicated debt structure. Here is how it works. Borrow $9 million and invest $1 million of your own money in the purchase of a company. Turn around in 3 – 5 years and sell the company for $20 million, pay back the $ 9 million in debt and you are left with the remaining $11 million. One of those millions is used to pay you back for your initial investment… WITH INTEREST HAVING BEEN COLLECTED OF COURSE, and the remaining $10 million is pure profit. Congratulations, you have earned your, what PE firms call,10x return. In order for that to work, the PE firm had to buy the company for, say a PE multiple of 2x and sell it for a multiple of 4x, assuming earnings stayed the same.

I know this is a lot but be patient with me. In a PE purchase, how do we know what the company is worth after it is purchased? The last known price is what the firm paid for it. The only real re-valuation will come only when the firm is brought public or sold. In that period between those two liquidity events the acquired firm or asset is worth… I don’t know, what do you think it’s worth. Well, the Ivy League analysts at the PE firm surely have complicated models that support a high valuation… on paper at least. However, that is meaningless until the company or asset is sold. HEREIN LIES PROBLEM #1.

What if the market is soft and the PE firm cannot get the 4x multiple it projected when it purchased the company? Last year was the worst year for IPOs (by value) in 10 years, and 2022 was only slightly better. That lack of demand by stock investors can only mean 1 thing: lower valuations. Now, no PE firm wants to sell at a price lower than its projections and soil its 10x record. Worse yet, what if the current market would value the company at A LOSS?

There is only one solution to this very real problem. Create an extremely complicated financial model that shows the asset worth more than it can actually get in the public market, wait, and hope. That is, wait for the IPO market to improve and eventually get that liquidity event. Hope… well you all know my favorite line on that: “hope is not a financial strategy!” Would you believe that the “wait and hope” approach is currently being employed by all these supersmart PE firms?

OK, OK, so, flexibility in investing is very important because in reality, things rarely, if ever work out exactly as expected. If a company is healthy and well managed, what are a few extra years of staying private until markets free up again? Here comes the wrinkle, and PROBLEM #2. HAVE YOU SEEN INTEREST RATES RECENTLY? Do you remember how the PE firm used debt to buy that company or asset? Well, if it was bought prior to 2022 when interest rates were super, super low there is a high likelihood that the debt will either mature soon or have its rate adjusted. You see, the interest on that debt is paid by the company or asset, and because PE purchases are so highly leveraged, it is not likely that the company has much room to increase payments. This puts pressure on PE firms to try and sell before this readjustment occurs.

With nowhere to go with these assets and interest rate increases on the debt looming, I would say that Kleinman’s assessment of Private Equity is pretty close to accurate. Apollo, after all, does manage about $651 billion in assets. The amount of money tied up in private equity waiting for liquidity events is estimated at $3.2 trillion. On that, I would say that the image of a pig moving through a python may be quite accurate as well.

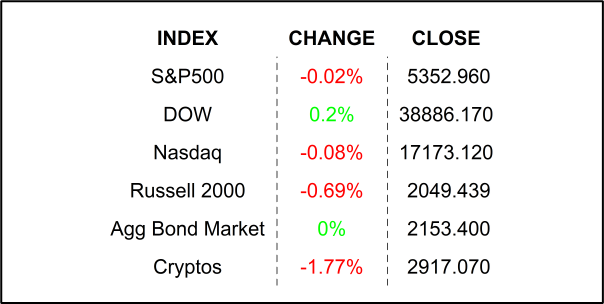

YESTERDAY’S MARKETS

NEXT UP

- Change in Nonfarm Payrolls (May) is expected to have risen to 180k from the prior month’s 175k.

- Unemployment Rate (May) may have remained unchanged at 3.9%.

- Next week we will get Consumer Price Index / CPI, Producer Price Index /PPI, University of Michigan Sentiment, and the FOMC Policy meeting. That should be enough to keep us busy. Prepare for it by checking in on Monday for calendars, details, and enough charts to be in the know.

.png)