Stocks fell on Friday after Nonfarm payrolls came in hotter than expected. The unemployment rate rose leaving many wondering what makes news good or bad these days.

Hot or not.Each morning, I set foot on land on Pier 11 in lower Manhattan which sits right about where Wall Street touches the east river. It is a perfect start to my day as I walk up the iconic, sometimes-cobblestone street, under which the storied bones of the greedy are buried. There is spring in my step as I pass by the front of the New York Stock Exchange. I have passed it a million times and I still turn my head left to get a good glimpse of it through the throngs of selfie-taking tourists. I continue on my trek as Wall Street makes a slight leftward bend at which time Trinity Church comes into full view. The church is another Wall Street icon, originally founded 1698; the one that currently overlooks Wall Street was constructed in 1846. Its impact on Wall Street is far taller than its understated spires. For over a century the church has stood as a refuge for traders of all religions seeking answers and perhaps, inspiration from the great beyond. The church also served as a place of sanctuary for first responders in the aftermath of 9/11 providing much needed comfort. Adjacent to the church is the Trinity Churchyard in which many important historical figures have been laid to rest. Its most notable tenant is Alexander Hamilton, and I am not referring to the Broadway show hero. No, this Hamilton was the first Secretary of the Treasury. Most remember him for being killed in a duel with Aaron burr, but his legacy and impact on the US financial system is far broader than many know. It is fitting that he presides over the most important street in global finance.

I turn right on Broadway at the Canyon of Heros where ticker tape parades of decades past forged their way uptown. I am but halfway to my office at that point with still much to see and talk about. I will reserve those important sights for another morning note, but as I make my way through Zuccotti Park, I typically feel the heat of almost-summer hit me. Like most New Yorkers I am walking fast and weaving and bobbing between the slow walking tourists. Last week was a hot one, and it was punctuated by Friday’s hot employment figure. Hot, as in way more jobs were created last month than were expected by economists.

That is great news for the US Economy that continues to move along despite the Fed’s best efforts to squelch its growth. However, if you were hoping for the Fed to cut interest rates soon and often, you were left flat. According to Fed Funds Futures the probability of a -25 basis-point rate cut in September quickly went down from 83% to 53%, which can be simplified into a good chance to just a possibility. Treasury bond yields jumped as well, putting further pressure on stocks. Yeah, it was a hot print, coming in at 272k when economists were expecting 180k. Where did all those jobs come from? Let’s have a quick look at the chart and then wrap up.

Looking at that chart we note that there is more than just a hint of lime. That lime-colored bar is Education and Health Services which dominates the chart over the past year and half. It was certainly there in the years prior, but it certainly did not dominate. Digging further into the number, we see that most of the new hires in that category came from healthcare and not education. Digging further yet, Home Health Care Services hired some 20,000 workers in May while Hospitals added 15,000 new workers. This healthy rate of hiring is a continuation of a trend that can be traced back to March of 2022.

So, will the FOMC, who will meet later this week, use these strong jobs numbers to dig in further on their recent “higher rates for longer” campaign? Perhaps, but I am sure that the rising unemployment rate which came in at 4% on Friday will certainly not escape them. That number has certainly been inching higher in recent months, but with Average Hourly Earnings climbing by +0.4% after gaining +0.2% in the prior month, the Fed will find it tough to celebrate.

This weather forecast in New York for the upcoming week calls for hot, sunny days. Looking ahead at the economic calendar with inflation numbers and an FOMC meeting, it looks like it may be a hot week as well and I will not be the only one breaking a sweat on Wall Street.

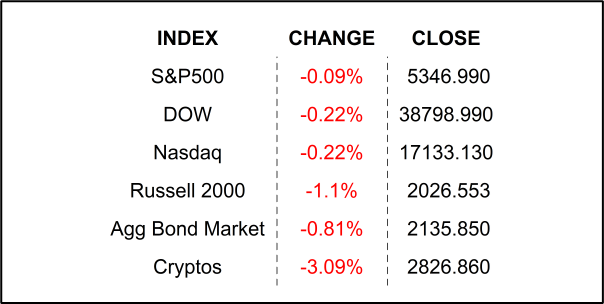

FRIDAY’S MARKETS

NEXT UP

- NY Fed 1-Year Inflation Expectations (May) will be closely watched after the last print came in at +3.26%, far higher than the Fed’s +2% target.

- Later this week we will get Consumer Price Index / CPI, Producer Price Index / PPI, University of Michigan Sentiment, but the showstopper will be the Fed’s FOMC Meeting along with a fresh Dotplot release. Download the attached economic calendar for times and details.

.png)