Stocks gained ground yesterday as investors, in an info vacuum, went for tried-and-true stock. The FOMC begins its 2-day confab today and the deafening silence in today’s session will add to the unwarranted rising anxiety over the future of interest rates.

Where she stops, nobody knows. I grew up in a little shore town just next to another little shore town which sports a boardwalk and famous concert venue. When I was still in short pants, that boardwalk had an amusement park complete with a roller coaster and rows of stalls with spinning wheels, milk bottles, and balloons. On many summer evenings my father would bring me and my sister to the boardwalk for some sea air, a few games, a ride or two, a handful of saltwater taffy, and, for him, a box of chocolate covered orange peels (that’s a thing). I can still remember the smell of the heavy, salty air, the wooden boards, and a hint of tar. In the background there were hawkers beckoning folks to take a chance, the clickity clack of the spinning wheels, balloons being popped by darts, wooden rings clinking around glass milk-bottles, and the cheerful music of the carousel off in the distance, all punctuated by the screams of the daring souls riding the roller coaster.

With a pocket full of nickels (probably quarters) one could take a chance and win a stuffed animal or some other trinkets. We would pass those stalls on the way to the rides and my father would encourage us each with a handful of coins. My returns on that investment were simply awful. In fact, I could not remember winning a single thing! I know, I know, you are probably thinking to yourself, “Marko, don’t you know those things are rigged?” Sorry to ruin your hypothesis, but my sister ALWAYS WON! Her bed was awash with all manner of brightly colored plush toys. I wondered, “how did she do it – what was her method?” I observed her closely. Did she have some strategy of spreading several coins across the field of possibilities thereby increasing the probability of a hit? NO, she would simply walk up and slap down a few coins on some random numbers… and BAM, “another winner!” But how can that be? Even if it were random, her chances of having the spinner land on her number were the same for each spin.

I am not sure if you noticed, buy there were bunch of elections that occurred across the EU and their results have injected a bit of volatility into the European burses. Oh, wait, is it an election here in the US? Indeed, folks it is. I have not written much about it yet as there has been very little in the way of promised economic policy that could impact our purses. A few minor concessions have slipped out of the Biden Administration and Trump did offer some sort of tax break for tip-earners, but nothing worth a recalculation of my economic models just yet. I have heard some folks speculating about what one candidate might do for stocks versus another candidate. That is always a tricky thing to forecast, but I am sure that you are wondering.

The common belief is that Republicans are pro-business and fiscally conservative, while Democrats are pro-regulation and big spenders, the former being good for stocks and the latter not so much. Now, I don’t have enough ink to get too far into that today, but suffice it to say, that common belief is a sweeping generalization and not at all true. Let’s have a look at the numbers, shall we? Since 1945, the S&P500 gained around +11% annually under Democratic presidents while it only gained some +7% under Republican presidents. Hmm, that seems to go against that common belief, doesn’t it? So, if you want to make money in your portfolio, shouldn’t you just vote Democrat then? HOLD ON, HOLD ON, don’t get hot under the collar. Here is the thing with some of these “statistics.”

CORELLATION DOES NOT IMPLY CAUSALITY!

Wow, what does that mean? In simple terms, it means that there are many factors that affect the stock market’s performance, most of which are completely independent of the prevailing President’s political affiliation. Just because it happened in the past doesn’t mean that it portends the same success in the future. There are macro events, systematic factors, and cyclical influences that simply cannot be controlled with the swish of a sharpie. Oh, there can be so-called black swan events like the COVID-19 Pandemic which erupted during the Trump presidency. His policies didn’t cause it, but it did cause worldwide lockdowns impacting markets. The funny thing is that, despite the black swan pandemic and market volatility in 2020, the markets did really well during his time in the White House. Now, I know that I am generalizing a bit now, because Trump did champion some market-stimulating policies. However, on the other hand, so did the Biden Administration with massive, unprecedented stimulus. Despite this, markets have vastly underperformed during his time in the White House, to date. What am I getting at here? Perhaps there is bit of luck when it comes to being in the White House at the right time 😉.

It took me a long time to realize that, unfortunately, there was no strategy that I could deploy that would mimic the success my sister had on the boardwalk. Thinking back, I did spend a lot of time analyzing my sister’s strategy, choosing to save my coins while she threw herself at the fates. Now I don’t know how much she actually spent to get all those stuffed animals, so I cannot calculate her return on investment, but it sure seemed like she had fun. Perhaps, if I was less conservative, I would have won a few plush friends as well. I might have even had some fun trying.

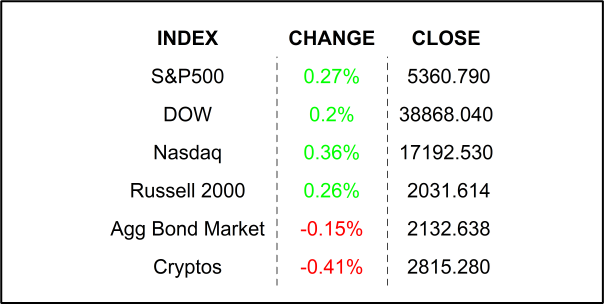

YESTERDAY’S MARKETS

NEXT UP

- NFIB Small Business Optimism (May) came in this morning above estimates at 90.5, higher than last month’s read of 89.7.

- The FOMC starts its 2-day policy meeting today. They will reveal their policy tomorrow along with update forecasts and Dotplot.

- The Treasury will auction $39 billion 10-year Notes.

.png)