Stocks had a rare mixed close yesterday in which the cobwebbed Dow rose to fresh highs while its distant cousin Nasdaq was trounced. Tough Biden Administration trade talk caused discomfort amongst the semiconductor faithful.

A little patience. And just like that, we went from business as usual to two guys desperately vying for headlines, hoping to occupy America’s corner office next year. Think back for a moment. I am sure you can remember those hotly contested class president jobs from your middle school years. Campaigns back then worked something like this. 1) Acquire a big pile of construction paper from art teacher (have a ream of loose-leaf paper as backup. 2) Get your 2 best friends to help you make posters (hope that they bring their multicolor pens). 3) Think up some sort of catchy slogan that rhymes with your name. 4) Promise long recesses and better tasting cafeteria food. 5) Hand out free candy. 6) Have all your friends spread nasty rumors about your opponent.

Wouldn’t you agree that I have just laid out a truly bulletproof election strategy? Come on, you know it worked! Now keep thinking back. Were any of those election promises ever delivered? Why not? Because there is no way that a school could lengthen recess without extending the school day. The cost would be too high. Besides, students would rather leave earlier than have more recess; there are costs. Costs? What costs? That was a joke. Now, I am not here to poke fun at election politics, and we all understand that all election promises start with the best of intensions.

Let’s get something out of the way first. Everyone recognizes that something must be done to secure supply chains which were the initial catalyst for this era of inflation. Not to mention implications to national security, also critically important. We also recognize that staying competitive on the world stage takes resolve and stoutness. It is a game of hardball that ends up with only winners and losers. That said, no presidential candidate would like to be associated with the latter. So, how to remain the leader and maintain national security?

Well, the “longer recess” strategy would be to impose painful restrictions on your competitor. Simply embargo any goods manufactured in your competitor’s country. Ok, so where would we get those products then? The answer is obvious; switch manufacturing to another less-ominous competitor’s country. Well, that takes time and will likely come at a cost to the manufacturer, which would lead to lower margins. Being rational (an economics term of art), those manufacturers will almost certainly pass those costs on to consumers. Simply put, price inflation. Is an embargo too rough for you? Perhaps try some tariffs to force the competing country to bear. Nope, rational firms would have none of that, and put the tariff cost directly to the consumer.

Ok let’s stop beating around the bush. China is a fierce competitor of the US as well as one of its principal suppliers. Right next to China lies an island the size of Maryland that is responsible for some 65% of the world’s semiconductor manufacturing. I am, of course, referring to Taiwan. I don’t know if you have noticed, but pretty much everything you use on a daily basis contains semiconductors. Would you say that Taiwan is of strategic importance? You don’t have to answer that question. This is not a new challenge; it is well known. The solution is obvious: rely less on Taiwan and spread the risks geographically… um, diversify. Seems simple, right? Build some new facilities somewhere else. Why not build them here? We have plenty of room and we can have the military protect it from would-be aggressors. That would mean more jobs for Americans. Longer recess!! Did you know that the minimum monthly wage in Taiwan is around $850 a month? An average US salary is… um, much higher. Would American workers be willing to work for those low wages? Of course, not. Manufacturers would have to pay going wages which would increase their costs of production. Who do you think would pay for that? Should I keep going?

Yesterday morning, news of a Biden Administration plan to “restrict” semiconductors caused investors to panic a bit. Why? Because companies with exposure to Chinese manufacturing are going to incur more costs. Those companies’ stocks going down is just the beginning of the problem. Who do you think will bear the costs of manufacturing setbacks? This morning, I read that, though not officially policy, a would-be Trump 2025 Administration would not take such a hard line on Taiwan as the Biden Administration. Remember that stuff about 65% and a higher wage cost from above?

I think we all know that these priorities are important, but wouldn’t it be nice if someone would explain to us exactly how the costs would be borne and by whom? In fairness, efforts are underway to invest in and bolster semiconductor manufacturing here in the US, but those will not happen overnight and will require ongoing support. What would make me feel better about the whole situation is to see some real plans and timelines. I haven’t seen that yet. Until then, I suppose that I will just have to be satisfied with the dream scenario of longer recess without extending the school day. And there is no way to improve school cafeteria food; it is perfect just the way it is 🤣🤣🤣.

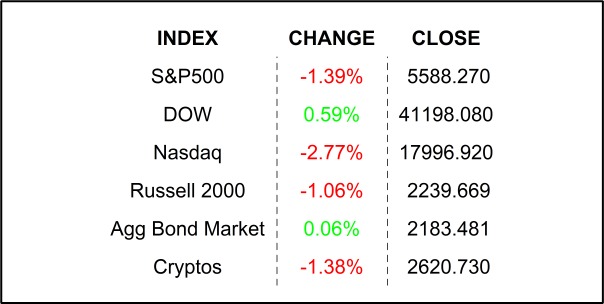

YESTERDAY’S MARKETS

NEXT UP

- Initial Jobless Claims (July 13) is expected to come in at 229k, slightly higher than last week’s 222k claims.

- Leading Economic Index (June) may have declined by -0.3% after sliding by -0.5% in May.

- Philadelphia Fed Business Outlook (July) may have improved to 2.9 from 1.3.

- Fed speakers today include Goolsbee, Logan, Daly, and Bowman.

- This morning, DR Horton came up a winner on EPS and Revenues, while Domino’s Pizza, KeyCorp, Marsh & McLennan, Blackstone, and Abbott all missed the mark. After the closing, we will get releases from Netflix, Intuitive Surgical, and PPG Industries.

.png)