Stocks closed in the red yesterday after an early-session comeback faded, leaving the hopeful… with little hope. “Experts” point to a weak Treasury Note auction, not a surprise to the real experts, traders who are making money day-trading the volatility.

Pro ball. I am not much of a basketball player. I love the sport, but alas, when it comes to my skills, I luckily inherited better ball control with my feet, leaving much to be desired with my hands. That didn’t stop me from playing at the local playground with my friends, amongst whom, my skills on parquet… er, concrete were average at best. It was a public park, so occasionally, some stragglers would show up and ask to join our game, and every now and then we would end up playing with what was likely an unsigned pro baller. Inevitably, that straggler’s friends would begin to show up and they would start playing with us as well, and before you knew it, the court would be full of highly skilled players, while my friends and I would be watching from the sidelines.

Let’s get technical for a moment. Have you forgotten about last Friday, Monday, or yesterday? No, of course not, they have you nervous and wondering what is next. I am sure that you have forgotten Tuesday; the markets went up on that day. Yesterday, by the time you started thinking about lunch on the East Coast, your hopes of jumping back into the market, were thwarted as stocks threw you a curveball when the early-session rally began to fade, trading lower, unrelentingly. This morning you will wake up and find that stocks are pointing to a softer open, and you are likely to get uncomfortable, wondering further, what this all means. Folks, what we are witnessing is continued volatility from Monday’s session. To get a visual idea of what I am talking about, check out this chart of the VIX Index and continue reading for an explanation.

This chart shows the VIX Index, which is derived from options volatility of the S&P500. When it goes up, it means that volatility expectations over the next month are increasing. You can see that for the better part of March 2023 and last Friday, the VIX was below 20. In fact, more recently, it spent quite a bit of time below 15. That means low volatility, which in English, really means no curve balls for the S&P500. You can see how it picked up in mid-July but still remained quite subdued. And then came the spike. Take a step back and look at the shaded area on the chart. That shows +/- 3 standard deviations over the past trading month. For you non-statisticians out there, 3 standard deviations contain 99.7% of all potential data points expected to lie within this range. The bottom panel of the chart measures the width of that range. The bigger, or wider, the more likely we are to experience big swings. Now, you can see how the VIX trended downward from fall 2022 through mid-summer of this year. That index has gone from more volatile to less volatile. You can also see that the bandwidth of standard deviations has also been somewhat stable, even narrowing significantly this summer. That means less surprises on the index which predicts surprises. Go on, read that again. It is like being at the beach, seeing calm seas, and looking at your weather app only to find that the weather will be mild with no waves for the next month. That would seem like a good time to stretch out and take a nap. Now imagine as you are just starting to drift into dreamland, those first few snores bellowing out, the tiniest bit of drool forming at the corner of your mouth… … … … and BAMMM you get slammed by a huge wave that knocks you right out of your chair. That is what happened in the markets on Monday.

You pick up your belongings and run further up the beach and you stand and wait for the waves to calm so that you can get back to your favorite spot and stretch out once again, but now the water is looking a bit ominous. You look down at your sand-filled body and are reminded of the ordeal from 5 minutes ago and you decide to take your time. You are in no rush for a repeat. It will take time, but the waves will calm, and you will gain enough courage to return to water’s edge to resume your nap.

This odd and weirdly satisfying example is exactly what is happening with stocks right now. Many investors had been lulled into believing that stocks would just continue to climb in an orderly manner when that series of unfortunate events occurred late last week, over the weekend, and into Monday. Rightly so, those investors are now sitting on the sideline waiting for things to calm down. This vacuum of participation only accentuates market moves as there are less buyers and sellers. This increase in volatility is what day-traders dream of; super high, intraday volatility, where they can attempt to ride moves up and down repeatedly. Pro tip: don’t do that, you will lose money… trust me. Those day-traders’ getting in and out repeatedly only increases volatility yet more.

And here it comes for the umpteenth time this week: volatility works in both directions.

We would sit on the sidelines watching these would-be professional, local basketball players for a long time. Players became spectators; they were a dream to watch. At some point they began to tire, and one after another began to pick up their towels and head home. When there were less than 4 left, my friends and I would slowly make our way back onto the court.

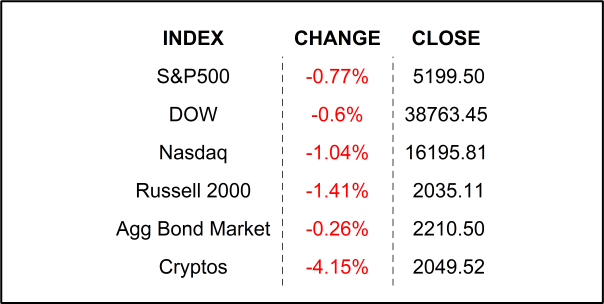

YESTERDAY’S MARKETS

NEXT UP

- Initial Jobless Claims (August 3rd) is expected to come in at 240k after coming in at a slightly higher 249k last week.

- Richmond Fed President Thomas Barkin will speak later today.

- This morning: Eli Lilly, Penn Entertainment, SharkNinja, Datadog, Americold Realty Trust, Shift4 Payments, and Parker-Hannifin all beat on EPS and Revenues while US Foods, Martin Marietta Materials, Chenier Energy, Plug Power, and Novavax all missed the mark.

- After the closing bell earnings: Gilead, elf Beauty, Insulet, Onto Innovation, Akamai, Sweetgreen, Expedia Group, and Paramount Global.

.png)