Stocks snapped an 8-day winning streak as bulls took a well-deserved day off to check their maps applications and figure out just where they were at, having travelled so far, so fast. Traders are just passing time searching for market triggers ahead of what could be the big one on Friday with Powell’s remarks at Jackson Hole.

Look both ways. Can you just imagine the first person that threw a boomerang? Early boomerangs have been dated from over 10,000 years ago, well before you were able to watch boomerang fail videos on TikTok. That said the first person probably threw a stick, turned around to find another one only to get wrapped in the back of the head with the one just thrown. Thank you, whoever you were, we are grateful for your sacrifice. Seriously, have you ever thrown one? They hardly look like they could fly, let alone make a wide, slowww arc, only to come straight back at you.

I have been thinking a lot about wide, slowww arcs lately. I have cast many analogies about the economy over the years, but my go-to is always the overloaded cargo ship one. The point is, that nothing happens in an instant when it comes to the largest economy in the world. You can’t just slam on the brakes or mash down on the accelerator. Nor can you turn on a dime. No, things take time to be realized.

As of today, the Fed is largely expected to cut interest rates in September. There is lots of speculation about whether it will be a front-loaded -50 basis-point move, or a standard -25 bp cut. But really, what’s the difference? Do you think that a ¼ percentage-point move in overnight, interbank lending rates is going to affect your life positively? No, it really won’t. Mortgage rates and some auto loans are more closely tied to longer maturity yields that are largely controlled by bond traders. Even credit card rates, which are tied to the Prime Rate, will not materially impact monthly payments with only a -25 basis-point move. In fact, a big cut in rates will most likely have an unwanted negative effect as highly popular money market yields will fall. Sorry cash lovers, your time in the sun is coming to an end.

Right now, the Fed Funds target rate is 5.5% which is considered to be restrictive. There is a lot of debate amongst economists on what the neutral rate is, but the general consensus is around 3 – 3.5%. [Chuckling] it used to be around 2%. So, the Fed is slowly going to get there, and Fed Funds futures are expecting that to happen sometime in the second half of next year.

Now here is the funny thing. The last Fed hike was in July of last year, and its impact probably hasn’t even taken effect yet. Loans tied to those short-maturity interest rates are typically variable and they reset after a lock-in period. So those loans that are exiting over the next year are going to likely experience significant payment increases. Surely some have already reset in the past 6 months leaving borrowers to scramble and seek other funding sources, renegotiating terms, and learning to live with lower profit margins. All this even though we are cautiously celebrating the Fed pulling back by a ¼ percentage point next month. To be clear, some companies have and will continue to default and go bankrupt, but there are still many more that may be edging toward that point. Those companies don’t exactly advertise their stress. We rely on credit ratings agencies to keep an eye on companies’ abilities to service their debt, and according to them many more are on the verge of downgrades than say, a year ago. What am I saying here? The second shoe has probably not dropped yet.

Ok, but there is something else, and it’s a bit more positive. On the fiscal side of things, there are many stimulus programs that were launched and deployed that have yet to take full effect. Much of the early Biden Administration stimulus money has not yet even gotten into the hands of its intended beneficiaries. For example, money was distributed to states which were then tasked with distributing it to businesses for infrastructure and manufacturing expansion. Those checks are just in the process of being distributed. So, there is a lagged effect on the economy. A lagged POSITIVE affect. You probably don’t even remember the market celebrating all those giving, giving, giving programs from a few years ago. Sure, we were happy after coming out of the pandemic with the economy not yet even back on both feet. Stocks celebrated! Inflation and aggressive rate-hiking has since clouded the rearview mirror.

Alas, we look forward. Starting with this Friday when Jerome Powell will make opening remarks at the Fed’s annual Jackson Hole Symposium for central bankers, geeks, and the press. All we need to hear is something like, “based on the numbers, it will probably be appropriate to start cutting interest rates soon,” a statement similar to Powell’s comments from the last post-FOMC meeting presser. Anything other than that can mean big swings up or down for stocks and bonds. Despite that, it is clear that those cuts are coming soon. It would be nice to know exactly when and how much, but if you took anything away from this morning’s note, you would know that any positive effects of those cuts won’t be felt until well into the next president’s administration. But not before that boomerang of the last hike from 2023 hits us… hopefully not in the back of the head.

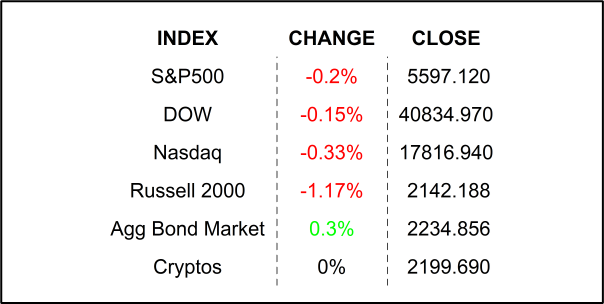

YESTERDAY’S MARKETS

NEXT UP

- The Fed will release minutes from last month’s FOMC meeting this afternoon at 14:00 Wall Street time. While it did not appear in the policy statement, we know that rate cuts were discussed at the meeting. Fed watchers will be eager to gauge the level of interest in a rate cut and hope to extrapolate the magnitude of a September cut. Pay attention, this can be a market mover.

- This morning, the Bureau of Labor Statistics will quietly revise payroll numbers. It is normal, and there may be none, but considering the impact of the last release, any significant revisions are not likely to be overlooked by the market.

- This morning, Target, Analog Devices, and TJX Cos all beat on EPS and Revenues while Macy’s missed Sales projections. After the closing bell, we expect results from Snowflake, Agilent, Synopsys, Urban Outfitters, and Zoom.

.png)