Three Separate Risks Are Pushing Treasury Yields Higher--None Of Them Good

KEY TAKEAWAYS

-

DOJ subpoenas of Powell raise questions about Fed independence

-

Labor market is stable but weakening–Fed policy timing matters

-

SCOTUS tariff ruling delay adds rate uncertainty

-

Defense spending implies higher deficits and higher yields

-

Volatility is rising, but not yet at panic levels

MY HOT TAKES

-

Political pressure on the Fed is a market risk–not a sideshow

-

Bond markets are signaling concern early

-

Higher yields pose a real challenge for growth stocks

-

This is a market that rewards patience and flexibility

-

Headlines matter–but structure matters more

-

You can quote me: “You can ignore politics--but your portfolio can’t for too much longer."

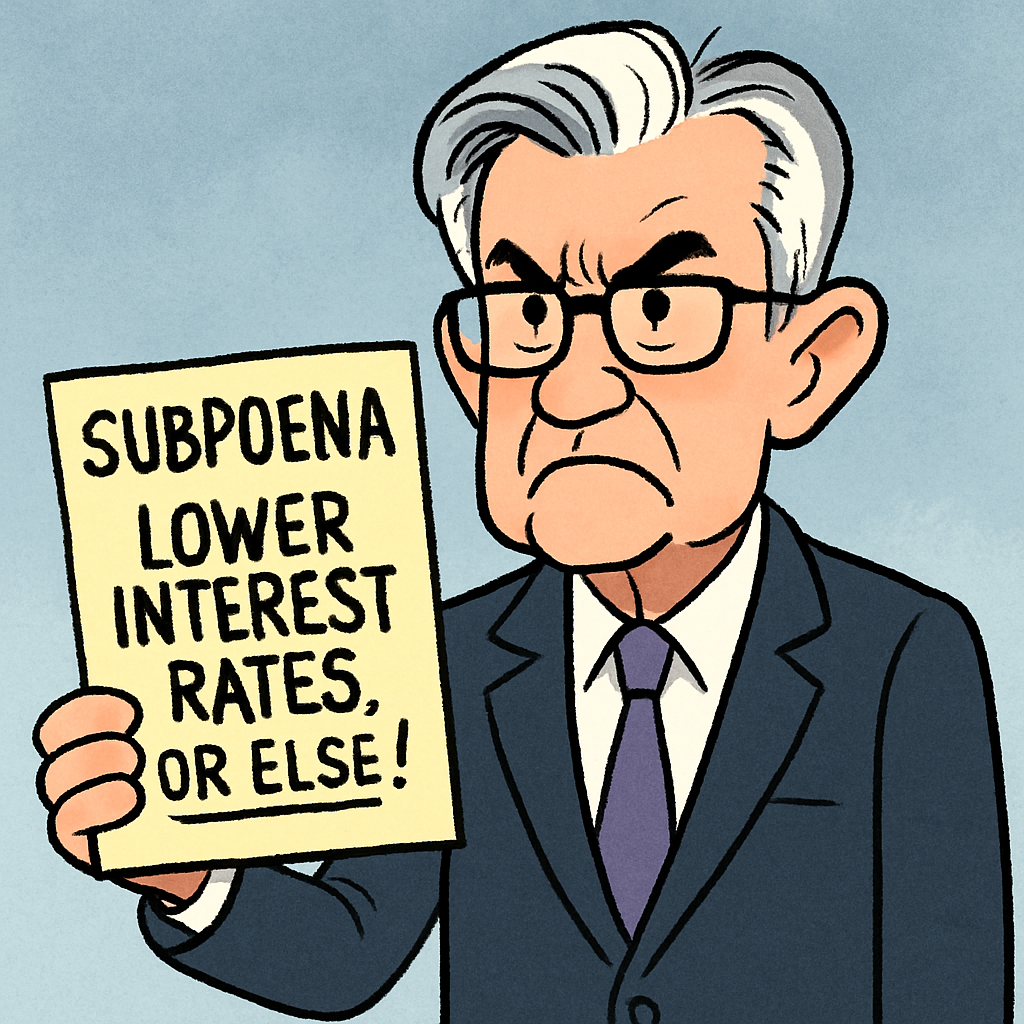

Happy Monday. Perhaps you are reading this as you sip your morning tea. Or maybe on your mobile phone on your way to work. Well, if you are seeing it here first, great. Regardless, let’s just dive straight into the news cycle. Jerome Powell’s weekend vibe was disrupted with–of all things–some subpoenas from the DOJ. That’s right, the Chairman of the Federal Reserve–the most powerful bank on the planet–received a pile of subpoenas from the Department of Justice.

On the surface that certainly sounds menacing. You might imagine a bunch of photographers in Powell’s office snapping late night photos of a taped outline of a body on the floor. Or perhaps a tearful Bud Fox being escorted out of the building by Federal Agents with his hands wire-tied behind his back (BTW, that was a reference to the iconic movie Wall Street 😉). Well, folks it’s not really any of that.

The image you need to place in your mind was that silly one to which I referred several times this past year. It’s the one of Powell and the President wearing hardhats at what appears to be a construction site. That construction site is the Federal Reserve’s HQ which is undergoing a bit of a glow-up. You may recall earlier this year as part of the President’s public jawboning, pressure campaign to get the Fed to lower rates, that he threatened to fire Powell over construction budget overruns. That spilled over to congressional testimony, for some strange reason. And for a stranger reason yet, it appears that Powell may face “criminal” charges for lying to Congress about the renovations.

Wow. Let’s take a step back. Lying to Congress? Not good. My advice? Don’t do it. But saying anything truthful or otherwise when the President wants you to lower interest rates and you flat out refuse–there is sadly only one way to avoid trouble. Let’s unpack all of this.

First, it is perfectly normal for Presidents to publicly and privately pressure the central bank to keep rates lower. It is nothing new and most Presidents in the past have done it. President Trump has clearly taken it to a new level.

I just want to say outright–and my longtime followers know this–that I believe that the Fed needs to be proactive with policy to stave off a potential collapse in the labor market. It is stable but weakening, and last Friday’s number supports that conclusion. Companies are not firing but they are also not hiring. That no-fire / no-hire chapter typically precedes a chapter which includes layoffs. Layoffs beget declines in consumption which almost always results in economic decline.

The labor market is not burning down, but it is heating up, so now is a good time to act. A major decline in the labor market cannot be turned around overnight, so it is safer to be proactive and err on the side of caution. “Err” in this case could mean further inflation. Considering that inflation is above target at the moment, the Fed is in a tricky position. I suppose the Fed can just do nothing and let the labor market collapse and cause a recession. That is certainly a proven method to fight inflation, but I don’t think anyone wants to be remembered for that.

Ok, back to the news cycle. Are the subpoenas and threat of criminal prosecution simply a ploy to manipulate the Fed? I can’t say, but I can say that I hope not. The Fed must remain independent in order for the central bank to remain effective and–and this is important–for the integrity of the US Dollar and the all-important Treasury markets to remain the world’s benchmarks. Full stop. Earlier this year bond and currency traders expressed concerns of a manipulated Fed by pushing yields higher and weakening the dollar. This latest move is looking like we will get a repeat.

Turning the page back to Friday on a different matter, we have the Supreme Court. SCOTUS was expected to rule on the legality of the Administration’s tariffs. I covered the impact of those tariffs being ruled illegal in Friday’s notes and videos. In a nutshell though, the ruling can result in a rise in Treasury yields.

So, now we have two news cycle items putting upward pressure on Treasury yields. Whether they play out causing those yields to remain elevated or not remains to be seen, but higher bond yields are likely to cause pain to your growth portfolios, due to the interest rate sensitivity of growth stocks.

Last weekend’s headline news included the invasion of Venezuela which was taken in stride by markets. Possibly because Maduro’s removal went off without any major hitches and the fact that markets entered the first full week of trading for the year with some pent-up momentum. My initial response was to recommend having a closer look at the defense sector, which today seems prescient given the President’s announcement a few days later promising a major increase in defense spending. Gains there however come at a cost. Additional spending has to come from somewhere which really means that the additional spending is likely to cause the deficit to swell yet further. What results if that happens? Bond yields rise. Ok, so we now have three bona fide drivers of higher bond yields, none of them good.

Equities are currently trading lower in the pre-market. Gold, Treasury yields, and the VIX are all trading higher this morning. The 2year-10year yield curve is steeper and the dollar is weaker. But the real question is: will these changes continue and will they ultimately cause stocks to reprice (that is a polite, academic way of saying that your stocks are going to sell off)? Unfortunately, the answer is not a clean one, or at least, it is hard to say at the moment. What this really means is that volatility is likely to dominate markets in the near term. The VIX is up but not at intolerable levels, which tells me–at least this morning–that investors expect all this to blow over, or that they simply don’t want to focus on this as we enter Q4 earnings season later this week.

How do you trade this market? Carefully–very carefully. Longer term and secular trends are expected to continue, but it is likely that we will encounter some risk and discomfort along the way. Approach it from a neutral stance so you can lean in when more information arises. The next bit of information will come later this week–possibly Wednesday–if and when the Supreme Court rules on the administration's tariffs. We will get some inflation prints this week that should impact Fed policy, but markets are not expecting any rate cuts until late spring / early summer. Earnings season will kick off later this week with the banks, but there may be some headline risk to contend with there as well. The President has hinted that he may force credit card issuers to place a ceiling on interest rates it charges customers. That can have a negative impact on those banks that we are all hoping will come through this earnings season. I guess I am telling you to stay vigilant and stay focused–maybe dress comfortably, this is going to be a long, bumpy flight.

FRIDAY’S MARKETS

Stocks traded up to fresh highs on Friday as a neutral employment print felt good for the economy without risking the Fed losing focus.

NEXT UP

-

No economic number releases today, but late this week we will get Consumer Price Index / CPI, Producer Price Index / PPI, more housing numbers, Retail Sales, regional Fed reports, and Industrial Production. This week also marks the start of Q4 earnings season–finally. Do your portfolio a favor and download the attached calendars and keep coming back to read my posts and watch my videos–they will tell you how to react to the numbers.

.png)