Day 24 of the government shutdown leaves markets in a data blackout, but investors are still finding light through earnings.

KEY TAKEAWAYS

-

The government shutdown has caused a total data blackout, forcing markets to rely on private and corporate data

-

Fed policy decisions hinge on inflation and employment data–both partially unavailable

-

CPI expected at 3.1%, with potential implications for rate cuts

-

Target layoffs signal stress in retail margins from tariffs and reduced demand

-

Earnings season shows solid growth; investors are rewarding results, suggesting sentiment may be improving

MY HOT TAKES

-

Markets are proving they can function–and even thrive–without constant government data

-

The Fed is flying blind, but so is everyone else; expectations management is now the game

-

Retail margins may be the canary in the coal mine for tariff-driven inflation

-

Investors are rewarding “good enough” results, not perfection

-

The real economy is alive and humming–if you know where to listen

-

You can quote me: “If you need a data print to tell you what’s happening in the economy, you’re already late.”

Into the grinder. Washington DC pressrooms are sparkling clean and the lights are off. We are now in day 24 of the government shutdown and the market is dealing with a complete data blackout. That data blackout appears–barring a few exceptions–to be here to stay for a while as the Senate plays a game of chicken to see which side flinches from pain first; it has failed to pass 12 continuing resolution votes to turn the lights back on.

The Fed is still active, though they don’t deliver any data except for the hot air bestowed upon us by its FOMC members. Those members will be voting on interest rate policy next Tuesday and deliver one of the most important market data points–rate cuts now and the possibility of future ones. But today and this past week, the usually chatty Fed is in a press blackout leading up to next week’s FOMC meeting. We are still flying blind, and so is the Fed, for that matter.

Earlier this week I wrote about the importance of following earnings closely as a source of real and possibly even more important economic information. You can read that here and search social media for my videos. Well, we have had almost a full week of earnings with just around 30% of the S&P 500 reporting so far but near nothing from “official” government sources. So, where are we?

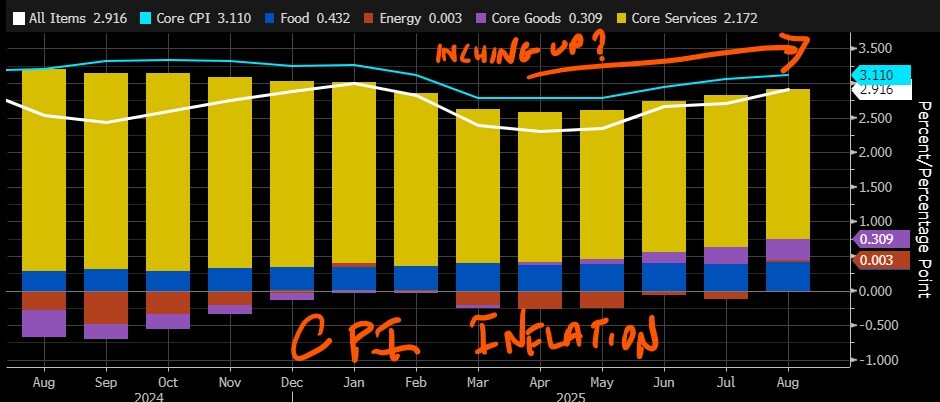

Let’s start with some of the important drivers of Fed policy–really there are only 2… literally. Inflation and unemployment–that’s it. This morning, we are going to get the delayed Consumer Price Index / CPI from the Bureau of Labor Statistics. The Fed prefers the BEA’s PCE Price Index, but something is better than nothing, so we’ll take it. The consensus of blue-chip economists expects both headline inflation to have ticked up to 3.1% from 2.9% due to rising energy and food prices, and core inflation to remain flat 3.1%. My friends at Bloomberg economics expect the number to be slightly cooler. If you are one who is desperately seeking a rate cut, you would hope for cooler numbers, or at least consensus. If it comes in hotter… well, all bets are off for a December cut (in addition to next week’s) which, according to futures, has about a 90% chance. It is not likely that the Fed will change what appears to be its apparent path in a data blackout, but December is a different story–lots can happen between now and then. The delayed CPI print will be this morning’s star of the show. The report, by the way, was prepared before the shutdown, so it is in no way lacking the “usual” attention in its preparation.

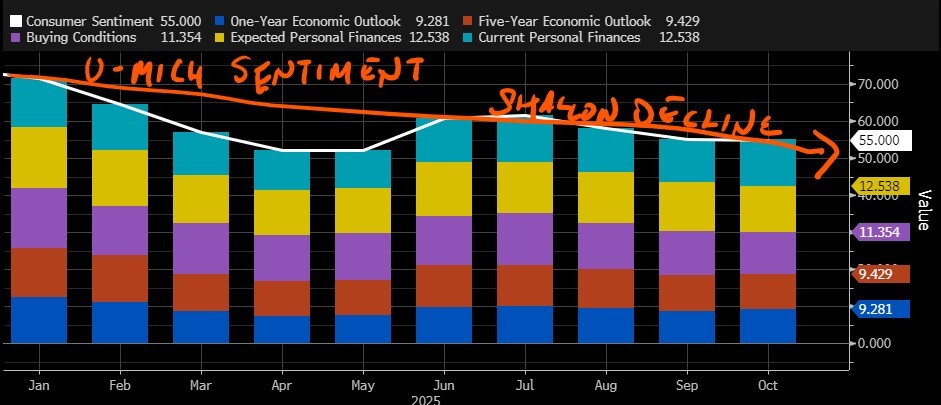

Also, this morning, we will get some important private economic data that is likely to be more-than-typically scrutinized because… well, it’s all we've got at the moment. University of Michigan will release its final monthly revision of its Sentiment indicator which is expected to be revised down from its earlier-in-the-month estimate. It has been on a shallow decline year to date and further declines could indicate future economic stress. Consumers control ⅔ of economic growth and confident consumers… consume.

S&P Global's US Purchasing Managers Indexes (PMIs) are expected to show a slight drop in services with no changes in manufacturing. PMIs are like sentiment indicators for companies. Don’t forget companies, because they make investments in big things (like plant and equipment) and they–even more importantly–hire and fire workers who rely on jobs to pay for stuff. Ah, there it is employment, that other important driver of Fed policy. Let’s check in on that data, or lack thereof.

First, a reminder that the only released data we have includes monthly job additions/losses through August, as September’s tally was not released earlier this month. The four prior prints were sub 100k and in a clearly declining trend–not good. We also got a private employment report from ADP, and it showed a loss of jobs for the month, a second month in a row.

We usually rely on weekly jobless claims data to get a more granular look at the health of the labor market, but alas, those numbers too have been missed due to the shutdown. Well, it pays to have friends in high places 🤣 and my friends at Bloomberg Economics have collected whatever weekly state unemployment data they can get their hands on to come up with a weekly estimate of their own, and they expect that the number for last week was around 227k, which is kind of in line with where it was before the shutdown and slightly below the 4-week moving average of 237k that existed… back when we took data for granted, in September.

According to other research I have dredged up, an increasing number of companies are discussing layoffs or reductions in force. I didn't give you an exact number because I couldn’t independently confirm the source, but I know this to be factual, because I have witnessed it–so I agree, heuristically, at least. Most notable was last night’s bombshell from Target that it will be laying off ~1000 corporate roles and eliminating an additional 800 vacant positions. Now 1000 newly unemployed execs are not going to break the labor market, but this is a signal that can’t be ignored. Target has struggled in recent quarters for a number of reasons. In addition to bad management decisions, the company, like all other retailers in its peer group, is under margin compression pressure from reduced demand and increased input costs (possibly tariffs–ya think). It is likely that at a systematic level, all retailers will be under increased margin pressure. I have been quite vocal about this. I think many companies may not be able to pass tariff cost increases on to end consumers due to the fact that prices are already so high–they simply won’t tolerate it. Once their pre-tariff inventories begin to sell through, we are likely to see margin declines appear more broadly. We haven’t seen it yet, though. Target is expected to announce its earnings along with its retail peers next month. It is expected to show annual declines in earnings and revenue growth.

That brings us to earnings season. With 144 S&P 500 companies reporting so far, earnings have beaten by 7.8% on average while sales have exceeded estimates by 2.4% on average. Not bad, but not as good as last season’s 12.8% and 6.3% respective beats. We closely watch earnings and revenue growth, and so far, those numbers look pretty good. To date, reported earnings growth has been 15.5% and revenue growth 7.8%. Though we are not nearly through it all yet, I was looking for EPS growth to be closer to 8%, so we can say that so far, at least, we are doing better than expected. EPS growth to date is also slightly ahead of last quarter's 12.8%. Finally, I want to point out that so far in this earnings season, the market is more positively responsive to earnings beats than last season. Check out the following two charts for comparison then follow me to the close.

These two scatter plots show earnings surprises by sector (x-axis, each sector is a different dot) and their coinciding 1-day price moves (y-axis). Don’t get into the minutia of the charts. Just note that beats (dots to the right of center) received a muted performance response, as evidenced by all the dots on or around the 0 line. In contrast, so far this season, the 1-day prices changes are clearly positive. This can be interpreted as investors’ being more excited for weaker results, which leads us to assume that expectations were low–the bar is low.

So where does that leave us? Probably somewhere between cautious and confident. The numbers we have are enough to say things aren’t falling apart, but not enough to claim victory over inflation or uncertainty. The real story of this shutdown won’t be how long it lasts, but how investors learned to navigate through it. Every earnings call, every PMI print, every sentiment index is a pixel in the bigger picture–a picture that’s still coming into focus.

All these data points are now in the grinder. But grinders don’t just crush, they refine. The next few weeks will separate more signal from noise, the companies with real earnings power from those running on narrative alone. If you’ve been following along, you already know the drill: stay curious, stay skeptical, and don’t let the silence from Washington fool you into thinking nothing’s happening. The data may be missing, but the story is still being written, but in quarterly reports, in consumer checkout lines, in factory orders, and in every whisper that makes up the hum of the economy.

The lights will eventually come back on in Washington. They always do. When they do, we’ll get our deluge of pent-up reports, revisions, and charts. But until then, we’ll keep doing what we really always do anyway–read the tea leaves, follow the clues, and stay focused on what matters most: earnings, employment, and expectations. That’s the real economy. Stay diligent out there.

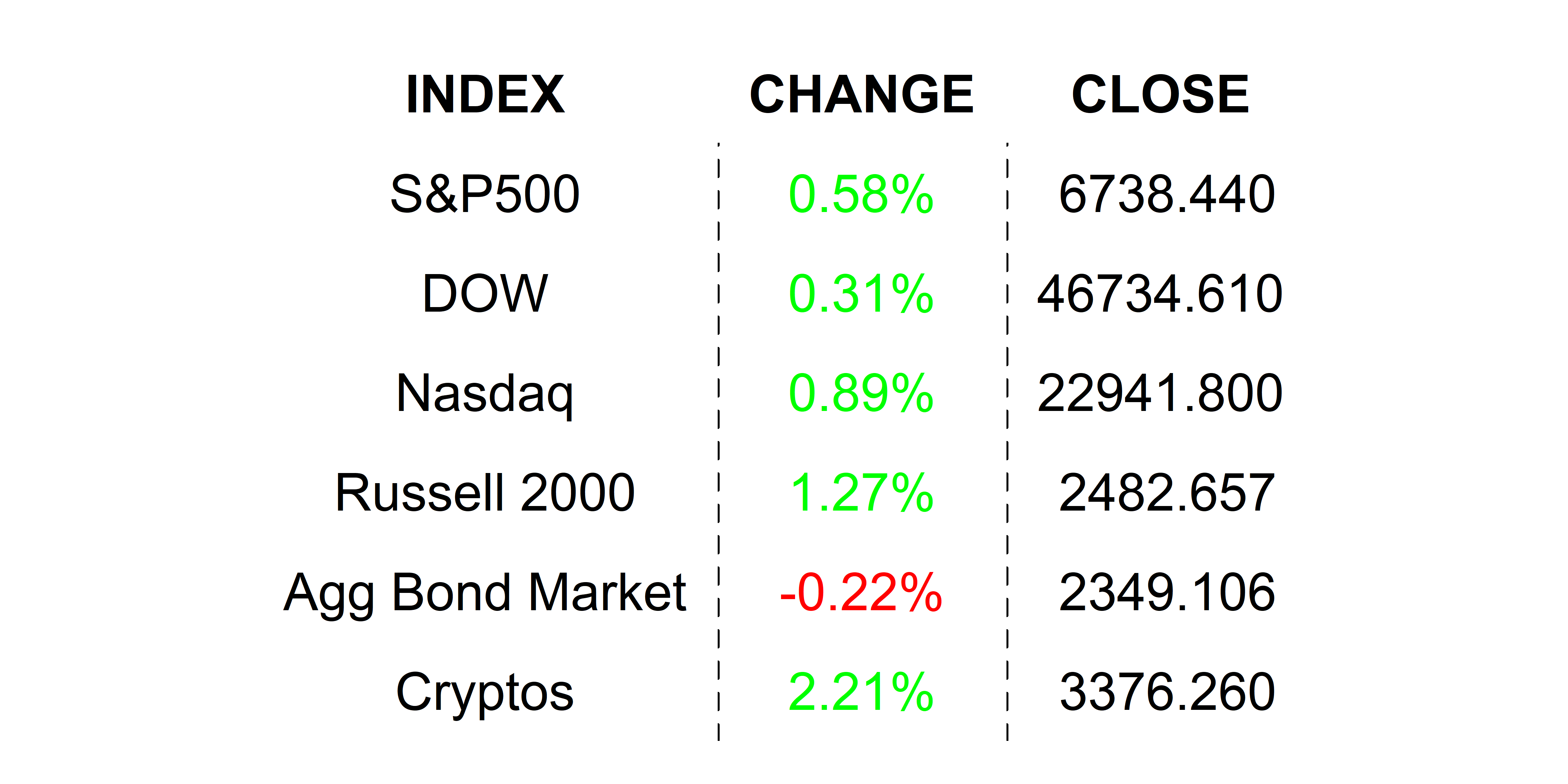

YESTERDAY’S MARKETS

Stocks rallied yesterday from general… er, happiness. I know that happiness doesn’t count as a quantitative indicator, but Tesla’s as yet explained rise yesterday–in the wake of a bad earnings call the night before–had a big hand in driving the indexes higher. So, self-driven happiness? 😄

NEXT UP

-

Consumer Price Index / CPI (September) is expected to have heated up to 3.1% from 2.9%.

-

Next week we have lots of earnings and possibly… lots of numbers if the government reopens by some bit of luck. The Fed’s FOMC meeting and its results will get the markets attention midweek. Check in on Monday for calendars so you can be the first on line for long-term financial success.

.png)