Stocks gained yesterday as dip buyers search for bargains in the wake of Wednesday’s dip. All eyes will be on the tape this morning (the Fed’s included) for monthly employment figures.

Why, oh why? A portfolio manager and I had a quick discussion about how unemployment has been so low and what its impacts may be on GDP performance. His assertion was correct, but what is the cost, or the tradeoff, for low unemployment and strong GDP growth? Wouldn’t you know it, the Fed is pondering this very question. It’s employment Friday… perfect time for a quick lesson on economics. I will start with a long quote (just try to read it, if you can’t don’t worry, I will explain):

“When the demand for a commodity or service is high relatively to the supply of it we expect the price to rise, the rate of rise being greater the greater the excess demand. Conversely when the demand is low relatively to the supply we expect the price to fall, the rate of fall being greater the greater the deficiency of demand. It seems plausible that this principle should operate as one of the factors determining the rate of change of money wage rates, which are the price of labour services.”

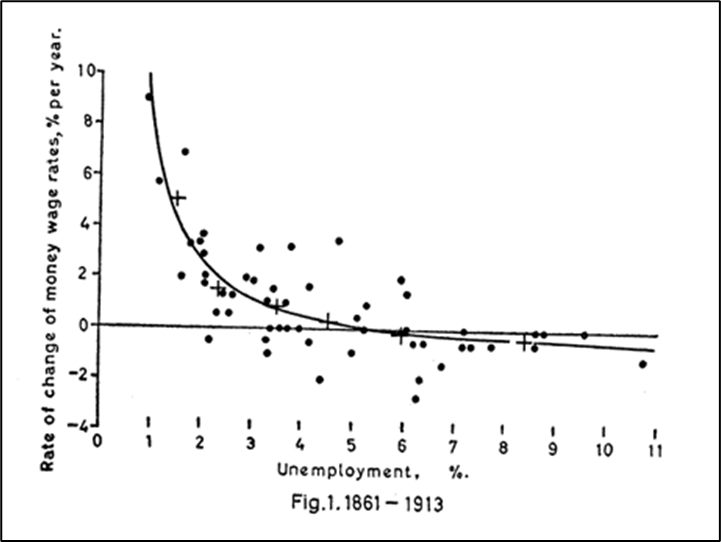

We have economist Bill Phillips to thank for that nugget. My regular readers should be familiar with Phillips and his infamous Phillips Curve. It all started with this very quote as he developed his hypothesis in 1958. Here is the citation if you are so inclined to read further: Phillips, A. W. (1958). The relation between unemployment and the rate of change of money wage rates in the United Kingdom, 1861-1957. economica, 25(100), 283-299.

What it all comes down to is this. If unemployment is low, the labor supply is low. When labor supply is low, companies must pay higher wages to fill vacant seats in the “factory”. Faced with higher costs, companies will increase prices to maintain profit margins. You know what that is? Of course, you do, it is called… wait for it… INFLATION. If you just deleted all the text between “unemployment is low” and “INFLATION,” you have everything you need… er, mostly. Got it? And here is a screenshot of the Phillips Curve, drawn by his very own hands (more likely, one of his grad students 😉).

This is far from the first time that I posted this picture for you, and it is far from the last time. This exact picture is on Jerome Powell’s desk, next to the ones of his family, Adam Smith, Thomas Malthus, and his dog. I can’t confirm that he has a dog, but if you Google deep enough, you find he and his wife are near the center of a dog park controversy in his posh DC suburban neighborhood. I think they were on the “against” side 🐶. Enough of that, the point is that the Fed does very much tie the unemployment rate to inflation. Not only that, maintaining a strong labor market is part II of the Fed’s dual mandate… the other being… um, inflation. Get it now? Now there have been a few notable riffs on Phillips’ assertion, but most of them show that a strong labor market, marked by a low unemployment rate and lots of hiring, is bad for inflation.

I will only mention one famous Phillips Curve derivative from the very recognizable economist Milton Friedman, who earned the same undergraduate degree as me from the very same, and close to my heart, Rutgers. Friedman and fellow economist Edmund Phelps developed the “expectations-augmented Phillips Curve.” I won’t show you the crazy maths, but I will simply say that they assert the same thing as Phillips, but they add in inflation expectation. Friedman, as you may know, had the ear of some very powerful and noteworthy Fed bosses back in the day, and his views on monetary policy are still in the institutional psyche of today’s Fed. That is precisely why the Fed is so highly focused on seeing the labor market slacken a bit before it starts slashing interest rates, and that, friends, is precisely why YOU should pay close attention to this morning’s release. With regard to inflation expectations, there are many places where we can find readings on that. The Fed itself releases those from time to time and the St. Louis Fed will give you a read on that with high frequency. We can also find inflation expectations in the monthly confidence/sentiment indicators as well as the monthly PMI figures. I can tell you, that those, thankfully, have been declining. Employment on the other hand… well, you are just going to have to wait and see later this morning. That ends this class on economics. Beyond reviewing this morning’s release, you have no homework. Enjoy your weekend.

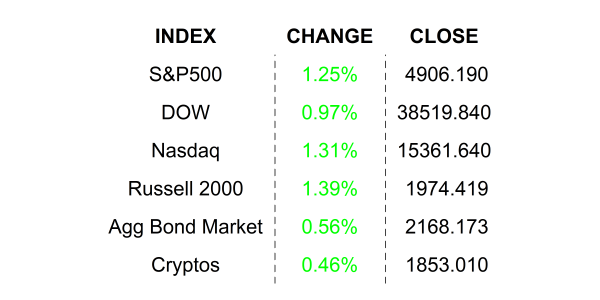

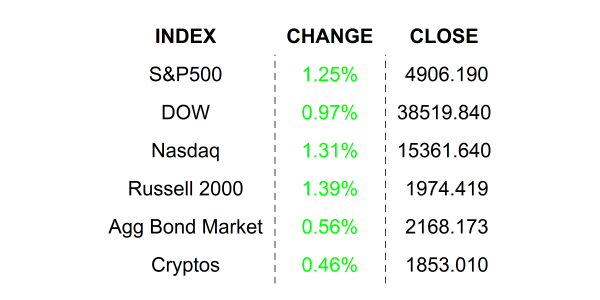

WHAT’S CURVING UP OR DOWN IN THE PREMARKET

Meta Platforms Inc (META) shares are higher by +17.69% in the premarket. The celebration is about Meta beating EPS and Revenue estimates. AND, AND the company announced a dividend ($0.50 / share), a rare thing for a growth company. Current quarter and full-year guidance was strong as well. Dividend yield: coming soon. Potential average analyst target upside: +24.5%.

Amazon.com Inc (AMZN) shares are higher by +7.17% in the premarket after it announced strong results, operating income, guidance, and cloud performance. In the past month 35 analysts have increased their price targets while none have lowered them. Potential average analyst target upside: +26.4%.

Apple Inc (AAPL) shares are lower by -2.67% in the premarket after it announced that it beat EPS and Revenues last quarter. A weakness in Chinese demand disappointed analysts… and traders. Dividend yield: 0.51%. Potential average analyst target upside: +7.1%.

YESTERDAY’S MARKETS

NEXT UP

- Change in Nonfarm Payrolls (Jan) is expected to come in with a 185k gain, lower than the prior month’s 216k additions.

- Unemployment Rate (Jan) may have inched higher to 3.8% from 3.7%.

- Factory Orders (Dec) are expected to have increased by +0.2% after rising by +0.1% in November.

- Next week, we will have a lull in economic releases, but there will be plenty of earnings to ponder. Check back in on Monday for release and earnings calendars so you can be ready to tackle the week ahead.

.png)