Why Bitcoin’s recent weakness matters more for stocks than crypto

KEY TAKEAWAYS

-

Bitcoin is difficult to analyze using traditional investment frameworks, which makes it more useful as a behavioral signal than a valuation tool

-

Crypto markets often react faster to shifts in confidence and liquidity than traditional equity markets

-

Over the past six months, Bitcoin diverged from the S&P 500, signaling a cooling of speculative appetite beneath calm headline indices

-

Bitcoin tends to peak and roll over before broader risk assets feel pressure

-

Risk appetite is shifting toward rotation and selectivity rather than leverage and moonshots

MY HOT TAKES

-

Bitcoin is not a macro oracle–it’s a confidence barometer

-

Weakness in Bitcoin does not predict a crash, but it does warn that risk tolerance is thinning

-

AI and tech returns require renewed willingness to absorb volatility

-

Markets move on the margin, and Bitcoin reflects marginal risk behavior better than even equities

-

Speculation doesn’t disappear–it relocates, and Bitcoin shows you where it’s headed first

-

You can quote me: “Bitcoin is where speculation shows up first and leaves first.”

Chained to the block. My longtime followers know that I don’t write about the crypto market often, but that is not to say that I don’t watch it carefully–very carefully. And that is not to say that I am for or against crypto assets as much as any financial security that raises funds in the public markets. I am–right as we speak–completing hours and hours… and what seems like hours of annual continuing education required for everyone in the financial services industry. This continuing education ensures that regulated professionals are well-versed in the large-and-getting larger regulations “books” to make sure that investors are protected and that their best interests are put first. And I have to say–though it is not fun–I believe it is necessary if not highly important. That said, in recent years there has been more and more guidance on crypto assets as the asset class becomes more of a “mainstream” investment.

Ok, so now that we got that out of the way. How does one even analyze a crypto asset? Can we look at fundamentals? Balance sheets? Compare multiples? How about earnings–can we listen to management describe the state of the business? How about customers, sales… anything? I am not going to answer those questions. Let’s just leave it at “it’s tough, and one really has to know what they are doing.” Before I go on, it is important to recognize that it is not fair to lump all crypto assets into one bucket; they are all very different–unique, and special attention is required to avoid loss. This morning, I want to focus on Bitcoin, and talk a bit about one of the ways that I watch it.

First, let me just tell you how crypto experts describe the price action in Bitcoin. You see, crypto true believers will tell you Bitcoin isn’t trading on vibes and leverage, but on the invisible hand of central bank liquidity, real rates, and the slow-motion erosion of fiat currencies. According to common wisdom, every rally is a referendum on money printing, every drawdown a response to tightening financial conditions, and every chart a proxy for the Fed’s balance sheet rather than human behavior. Indeed, it’s a tidy framework, and I understand the appeal–nothing legitimizes a volatile asset quite like wrapping it in macro language normally reserved for sovereign debt markets. The problem, of course, is that Bitcoin still trades less like digital gold and more like the most honest expression of speculative appetite on Earth, with central banks often serving as the excuse rather than the cause. And before you beg to differ, let me say that I think that it is a good thing.

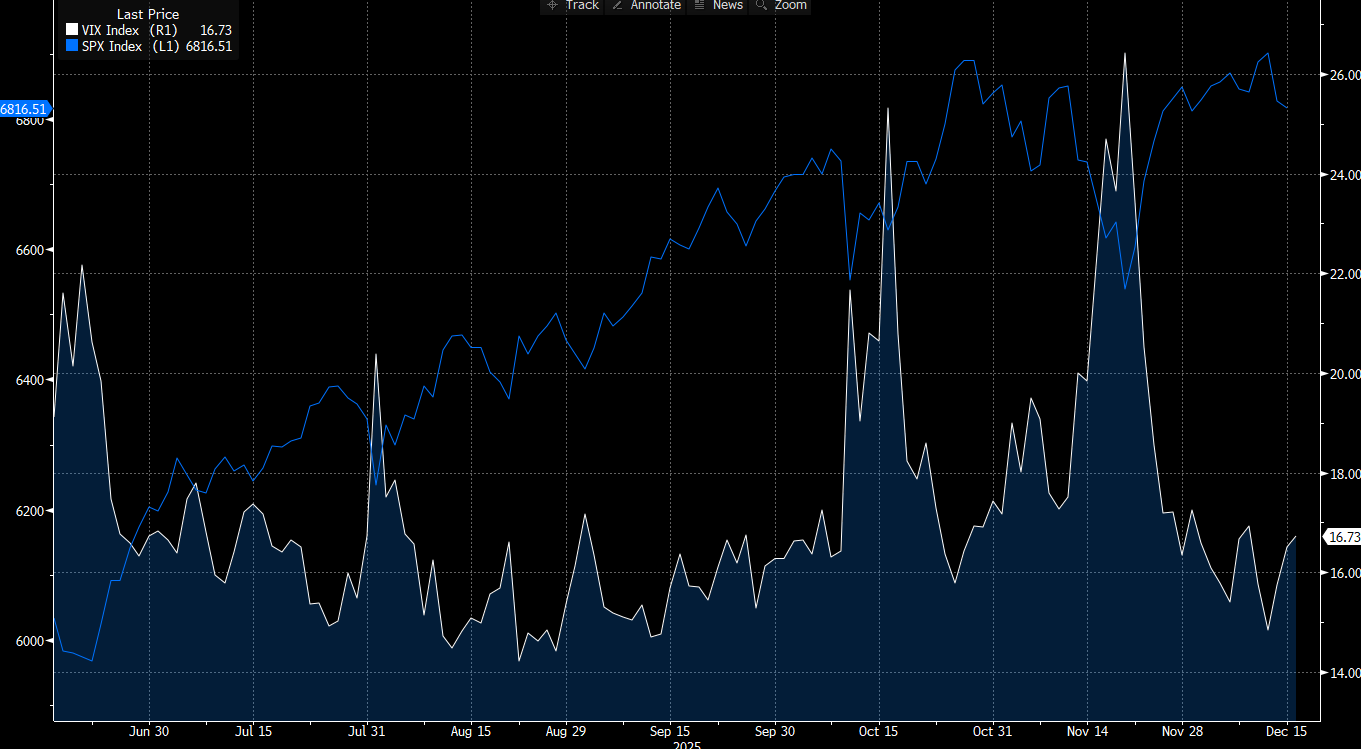

Let’s take a step back and think about the broader risk markets. You have read my newsletters, my blogs, and watched my videos. You know that there is an unbreakable relationship between risk and expected return. You can’t get a lot of one without a lot of the other. Full stop. For investment, let’s call risk volatility, though there are plenty of other risks investors accept when investing. The most conventional way to assess volatility in the markets is by watching the VIX Index. The VIX is Wall Street’s fear gauge–not because it predicts disasters, but because it measures how much investors are willing to pay for protection when they start to feel uneasy. It rises when uncertainty replaces confidence and falls when complacency takes over, often quietly at first and violently at the end. Think of it not as a forecast, but as the market’s emotional pulse, spiking when reality overtakes optimism. That is why most quants watch the VIX Index, even if they don’t trade it or use it as a hedge–its original intention. But how good is it really, as a proxy for investor risk appetite? Have a look at this chart.

This chart shows the VIX (white line) and the S&P 500 (blue line) over the past 6 months. I think that it is fair to argue that the past 6 months has been an interesting time for risk assets, specifically stocks… specifically our favorite, shiny, megacap, tech/AI stocks. Naturally, we all want to know what is next for tech. To be clear, I am referring to the immediate future, though my long-time followers know that I am more interested in the long-term prognosis. For now, I think we would all like to know how the rest of 2025 will end up and how ‘26 will roll in. Can you tell by looking at this chart? Not really. We certainly note a lot of bouncing around in the VIX, but the S&P, while it may trade inversely to the VIX during spikes, it in no way indicated that the S&P would climb by some 13% through that period. Now have a look at the following chart and follow me to the finish.

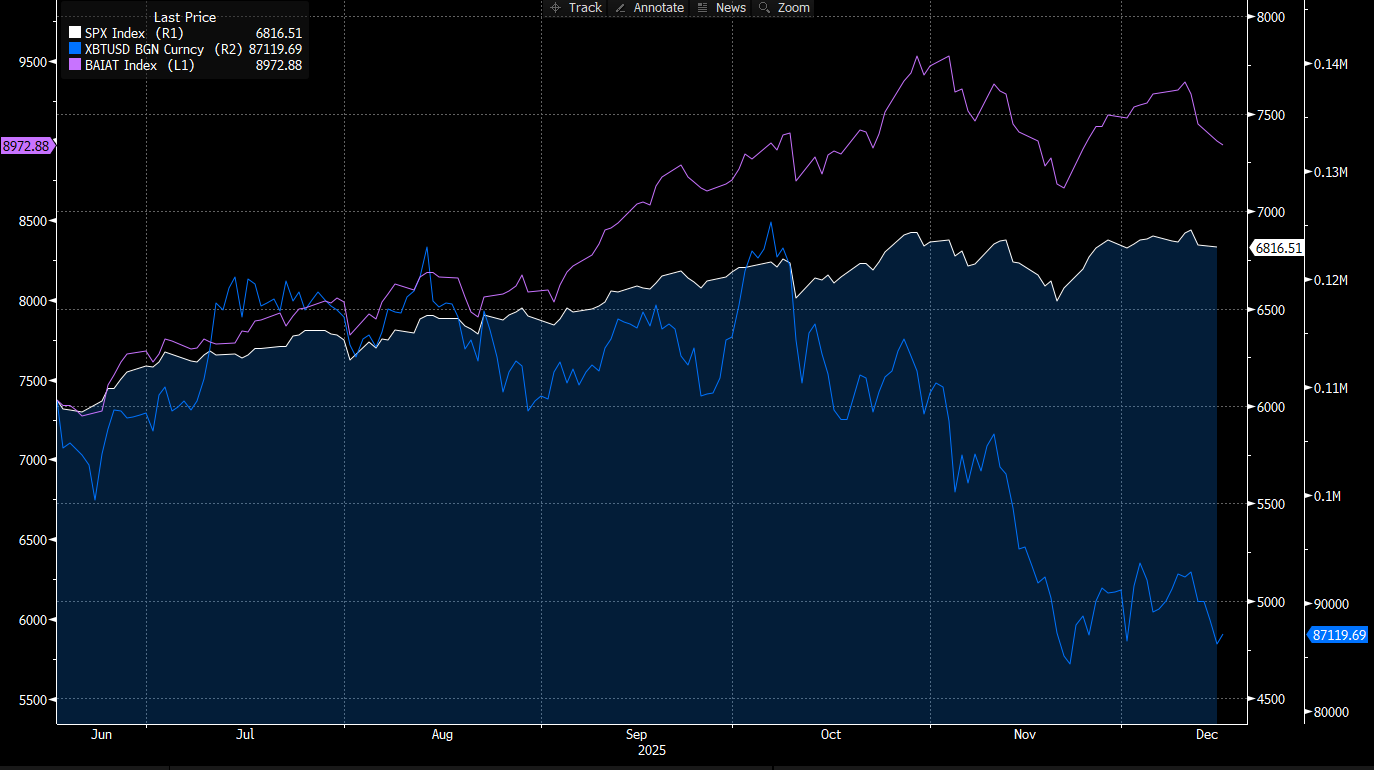

This is a chart of the S&P 500 (white line), Bitcoin (blue line), and the Bloomberg AI index (purple line) over the past 6 months. The S&P has had its moments–good and challenging ones–and it is just below its all-time highs. It grinded higher throughout that period, but it was helped along by a recent rotation out of our favorite AI/tech stocks. Those had a more extreme ride, and if you look carefully at the chart, you will notice that Bitcoin and AI Index kind of had a similar journey, and that probably doesn’t surprise you. So, the real question begs, does Bitcoin tell us something about market risk appetite or vice versa?

So, which one is leading whom? Is Bitcoin merely reacting to the same forces that push and pull equities, or is it quietly whispering something about investor psychology before the rest of the market bothers to listen? I would argue the latter, and not because Bitcoin has suddenly become some macro oracle or monetary indicator, but because of what it represents in practice rather than in theory. Bitcoin is where speculation shows up first and leaves first. It trades around the clock, it is heavily levered, it has no earnings calls to soothe investors, no balance sheet to point to, and no management team to promise that next quarter will be better. What it does have is a participant base that is overwhelmingly sensitive to changes in confidence, liquidity, and the willingness to take risk for the sake of return. That makes it uniquely useful, maybe not as an investment thesis, but as a behavioral signal.

When risk appetite is expanding, Bitcoin doesn’t ask many questions. It rises quickly, often enthusiastically, fueled by narratives, leverage, and the comforting belief that liquidity will always be there when needed. When that appetite begins to fade, however, Bitcoin doesn’t wait for confirmation from economic data or earnings revisions. It reacts immediately. That is exactly what we have seen over the past six months. While the S&P 500 continued its steady grind higher, supported by rotation, diversification, and the comforting ballast of profits and buybacks, Bitcoin rolled over hard. That divergence matters. It tells us that something was changing beneath the surface, even as headline indices appeared calm and resilient.

This is not the first time we have seen this movie. Bitcoin has a history of acting as a canary in the coal mine for speculative excess. In prior cycles, it has often peaked before high-multiple growth stocks rolled over and sold off violently once broader risk markets finally caught on. That does not mean Bitcoin predicts earnings recessions or economic downturns. It does not. What it does predict, or at least reflect, is the willingness of investors to consume risk without demanding much in return. When that willingness wanes, the most speculative corners feel it first.

And that brings us back to tech and AI, the undisputed darlings of this market cycle. There is no question that these companies have real businesses, real revenues, and in many cases, real earnings power. This is not 2000. But it is also true that the extraordinary returns investors have enjoyed in this space over the past few years required an extraordinary appetite for risk. High valuations, long-duration cash flows, and aggressive capital spending only work when investors are comfortable stretching, and when volatility is tolerated rather than feared.

That is why watching Bitcoin right now is so instructive. Its weakness is not an indictment of blockchain technology, nor is it a forecast of imminent doom for equities. It is a signal that risk appetite, at least at the margin, has cooled. Investors are still willing to own stocks, but they are becoming more selective about how much volatility they are willing to absorb in pursuit of returns. They are rotating rather than levering up. They are choosing grind over moonshot.

So, what’s in store for us in the weeks and months ahead? Will this be an AI winter? For tech to truly regain its wings, for those eye-popping returns to reassert themselves, that appetite for risk will need to return. You simply cannot achieve outsized gains without consuming outsized risk. That is not an opinion; it is a law of markets. The open question, and the one worth watching closely as we head into year-end and beyond, is whether Bitcoin turns higher first, signaling a renewed hunger for speculation, or whether tech leads the way and drags risk appetite back with it. Either way, the answer will tell us far more than any press release or earnings call ever could.

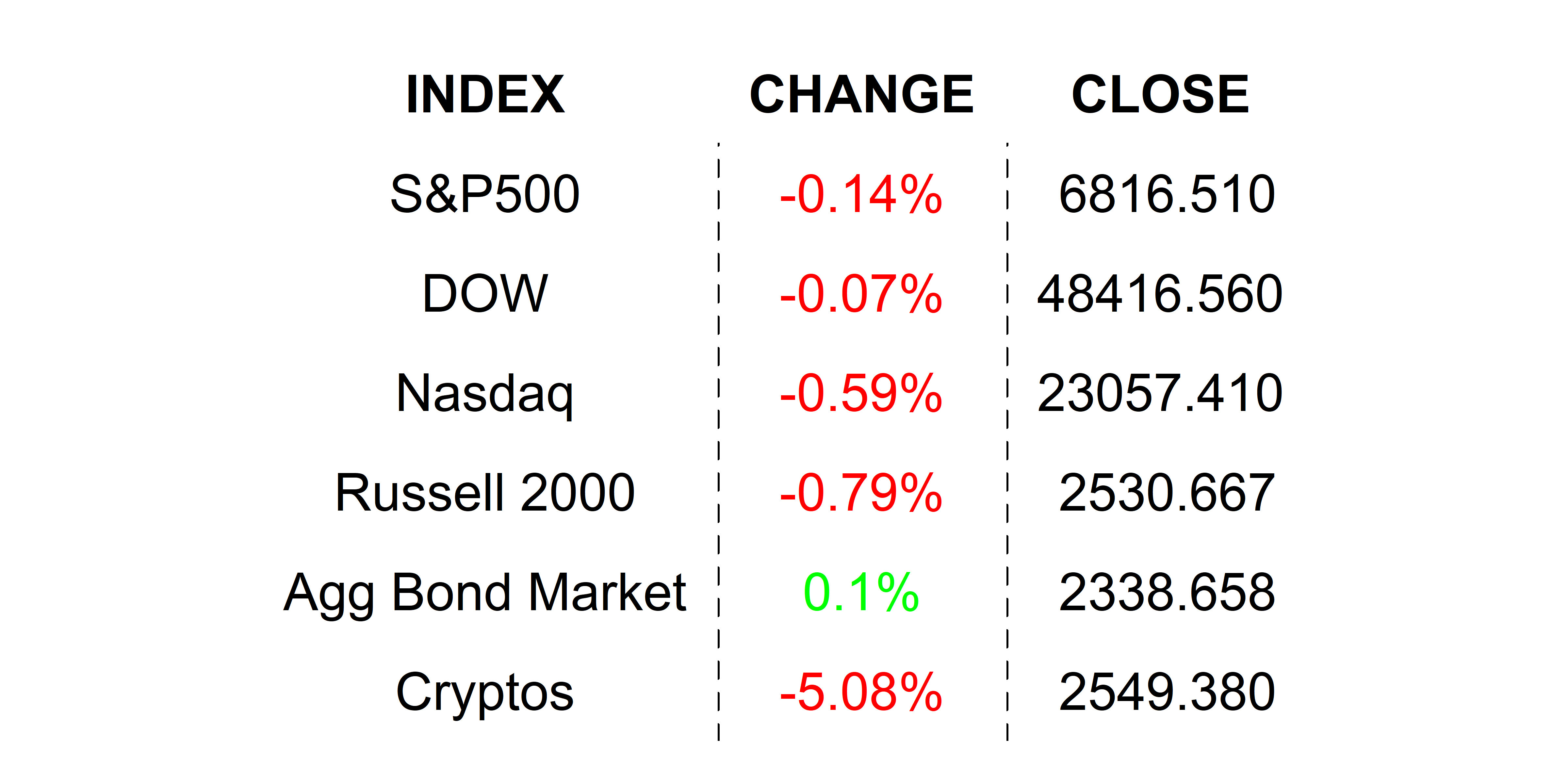

YESTERDAY’S MARKETS

Stocks declined yesterday as investors prepared for today’s onslaught of “official” –and some unofficial–employment data, wondering if it will disturb plans for the Fed in 2026. Bitcoin followed its Sunday swoon below 90,000 leaving investors wondering if it’s a sign. 😉☝️

NEXT UP

-

Change in Nonfarm Payrolls (November) is expected to show 50k new jobs created. The whisper number is bigger, so pay attention to this one–it will be a market mover today.

-

Unemployment Rate (November) may have ticked up to 4.5%.

-

Retail Sales (October) are expected to have inched up by 0.1% after gaining by 0.2% in the prior month.

-

S&P Global Flash Manufacturing PMI (December) may have slipped slightly to 52.1 from 52.2.

-

S&P Global Flash Services PMI (December) is expected to have slipped to 54.0 from 54.1.

.png)