History shows markets can stay “too expensive” for years before breaking. Are we there now?

KEY TAKEAWAYS

-

Greenspan’s “irrational exuberance” speech in 1996 did not pop the bubble

-

The Dotcom bubble actually burst in 2000, after four years of further expansion

-

Tech stocks like Microsoft and Cisco traded at extreme PEs, echoing today’s Magnificent 7

-

The Fed’s 1999–2000 rate hikes–not speeches–triggered the crash

-

Today’s valuations are high, but policy still matters more than punditry

MY HOT TAKES

-

Markets can stay irrationally exuberant for a long time

-

People misremember Greenspan’s speech as the bubble pop–it wasn’t

-

Today’s AI hype echoes the late-90s tech frenzy

-

Valuations are rich, but Fed policy is the real catalyst

-

Selling too early can be as dangerous as staying too long

-

You can quote me: “You can call it a bubble, but you might be waiting years for it to pop.”

Abundance of joy. Can you ever get enough of a good thing? You know how it goes. You open your pantry door for some random reason, and just as you are closing it, IT catches your eye. It was just a brief encounter, but it is now stuck in your mind. It was that package of chocolate chip cookies you forgot you had. You get on with your day, but the yearning only gets stronger. You finally break down, and you name your terms as you give in and head back to the pantry: only 2 cookies! The rest is a blur. You stopped counting after 5 but you are positive you didn’t eat more than 10–well, mostly positive.

Do you remember Alan Greenspan’s “irrational exuberance?” It is often credited with popping the Dotcom bubble, however the assertion is historically incorrect. First of all, a little background may help. The iconic term was first uttered by Greenspan during a dinner speech at the American Enterprise Institution on December 5th, 1996.

“But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions…?”

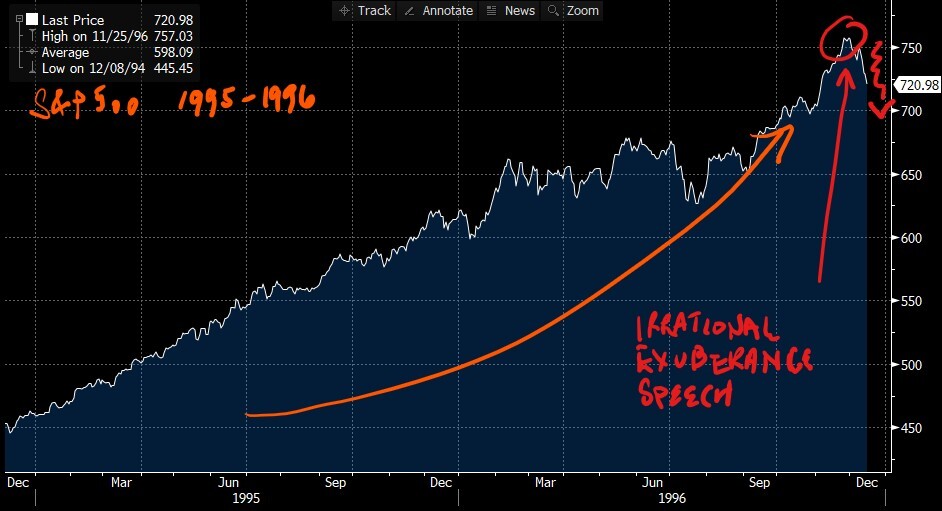

That’s it. The shot heard ‘round the world, literally. Because it was a dinner speech, it hit during trading hours in Tokyo, and markets there tanked in response, prompting a selloff in the US. Now, for some context. Check out this chart.

This is a chart of the S&P 500 in 1995 and 1996 (white line). You can see how the index rose from the start of 1995 through Greenspan's “irrational exuberance” speech in late 1996–some 61%. You can also see the market’s response to the speech all the way on the right-hand side of the chart. Greenspan was not necessarily focusing on the great gains on the S&P, but rather on asset pricing. “Asset pricing,” if you didn’t know, is the Fed’s codeword for stock prices. You see, at the time, many FOMC governors were worried about bloated asset pricing–they were worried that a bubble was developing. Have a look at the following chart and keep reading.

This is a chart of Price to Earnings (PE) Ratios of Microsoft (white line), Cisco Systems (blue line), and the S&P 500 (red line) during that 1995 through 1996 period. First, I want you to notice the expanding trend. Stocks were getting richer! Second, I want you to notice the PEs themselves. The S&P 500’s PE (on the left axis) ran up from 15.5x to almost 20x leading up to Greenspan’s speech. Remember, even today, we consider a 20x PE for the S&P 500 to be rich. Microsoft and Cisco were the tech darlings of today. The former was the software leader driving the tech boom, and Cisco, the communications giant, was the pick & shovel needed to connect the rapidly expanding internet–almost like NVIDIA today. Both of them were extremely expensive–46x and 39x respectively. Those multiples are even high by today’s standards, and relative to the S&P at the time, those were considered nosebleed high. For some more context, some other popular stocks during that time (not pictured) were General Electric, Walmart, and Amazon. The former 2 had PEs of 14x and 18x respectively, and Amazon didn’t have a PE, because it was not profitable at the time.

So, you should be able to see why the FOMC governors were concerned that stocks were expensive and that a bubble might be developing. The big monetary question of the day was whether the Fed should deflate the bubble by raising interest rates or wait for the bubble to pop and respond to the results by lowering rates. To be clear, Greenspan did not advocate either path as he was simply hypothetically analyzing a bubble environment. In fact, contrary to market urban legend, Greenspan never said that a bubble existed. Despite this, the Nikkei fell hard in response to the televised speech and in the weeks that followed, the S&P 500 fell by almost 5% from its Thanksgiving highs.

Does all of this sound familiar to you? The Magnificent 7’s PE is around 37x and the S&P 500 is trading at all-time highs. Microsoft is trading at a PE of 37x, almost as expensive as it was on that December 1996 day, and NVIDIA is around 51x, for context. How many times have you heard the words AI Bubble, or Tech Bubble in the past year? A lot, right?

So, what do we do? Is there some handwriting on the wall that we are missing? Should we sell in fear that a bubble is about to pop? Is this market, trading at all-time highs irrationally exuberant? Markets are making new highs in what is historically the worst month of the year for the big index.

…OK, breathe…breathe. R’you good? OK, let’s get this wrapped up. Did you notice something peculiar with the dates above? Greenspan’s legendary speech took place in 1996. The Dotcom bubble didn’t really pop until 2000! Nearly 4 years after his speech. Wait what? 😮

That’s right. That exuberant market went on growing–expanding for almost 4 years beyond when Greenspan and his concerned Fed first became alarmed. Indeed, the S&P 500 quickly shook off the initial selloff (within weeks) and climbed another 100% through late 2000 when the bubble actually popped. Microsoft's and Cisco’s PEs would continue to expand, touching 78x and 133x respectively by the end of 1999. The S&P topped out at 30x!

The actual pop came late in 2000–it was September, incidentally–and the carnage that followed was painful. The S&P 500 declined almost -37% in the 12 months that followed. PE multiples came back down to earth with Microsoft and Cisco declining to 24x and 80x while the S&P 500 eased back to 23x.

Do you want to know what caused the bubble to burst? In the summer of 1999, the Fed had enough of expanding asset prices and began to hike interest rates. 6 successive rate hikes through May of 2000 would do the trick. The bubble would pop along with economic growth. By Q1 of 2001, the US would enter a recession, and the Fed would reverse course cutting rates from 6.5% to 1.75% throughout 2001. Why do you think that the Fed raised rates engineering a recession? Was it inflation? Wanna guess where CPI was in the summer of 1999? 2%--right on target.

OK, ok, why the history lesson? Well, it’s true that some companies do appear to be “rich” from a heuristic standpoint. And, it is true the S&P 500 is touching new highs despite the clear weakening of the labor market and some signs of a weakening economy. Monetary policy is still restrictive despite last week’s cut and promises of more. It would be easy to say that markets are irrationally exuberant. Does that mean that it's time to sell stock, hide in a bunker, and wait for the bubble to pop? Well, if you don’t mind waiting for a long time, go right ahead. Indeed, the bubble will pop at some point. Either the rapidly expanding earnings growth will reverse and start to decline, or the Fed will decide that it’s time to break out the pin and pop it. Neither has happened yet, so why not grab a cup of tea and a few of those chocolate chip cookies–there are still plenty left, even after you binged on them yesterday. 😉🍪

FRIDAY’S MARKETS

Stocks rose on Friday as good vibes from the Fed rate cut continued to provide fuel for the bulls. 10-year Treasury yields continued to climb, adding 2 basis points and the 2y-10y yield curve continued its steepening. Gold continued its ascent finding fresh highs.

NEXT UP

-

No major economic releases today, but later this week, we will get PMIs, more housing numbers, GDP, Personal Income, Personal Spending, PCE Deflator, and University of Michigan Sentiment. You don’t want to miss these, so download the attached calendar for details–it's calorie and gluten free, unlike those cookies.

-

Fed Speakers today include Williams, Musalem, Hammack, Barkin, and 50-basis point proponent Miran.

.png)