Stocks had a mixed close on Friday as investors were unsure about whether to let their AI gains ride or to walk away – with massive profits. Markets’ no-worries attitude has some investors worried.

Let it be. I spent a great deal of time with some extraordinarily bright folks this past weekend. One of the hot topics discussed was The Global Financial Crisis. Remember that? Of course, you do, your 401k lost like -56% in 2008! Ah, now you remember. You were seriously considering adding instant ramen back to your weekly menu with Spam as your plan B. You were cool and you didn’t overreact right away because you were confused about what was really happening. I mean, you survived the Dotcom bubble burst, you thought “how bad could this really be?” Then you saw once-pompous bankers walking out of Lehman Brothers carrying boxes filled with deal trophies (also known as “deal toys” in Wall Street Speak). “Wait,” you thought, “Lehman, Bear Stearns, possibly Merryl Lynch!” Well, if you were smart, you stuck with it, you remained cool, and you did… well, OK. If you were really smart… um, lucky, you bought at the lows and made a wild fortune, assuming you stuck with it through the next rough patch. Of course, it was not that simple, and many were financially ruined.

In the aftermath of the crisis, it appeared as if “the system” had completely broken down. Nearly every aspect of the financial industry had a hand in the disaster, from the banks to the ratings agencies to the Government regulators. Did the system really break down? Could the crisis have been averted? Shouldn’t there be more regulation and Government control to ensure that another GFC could never happen again? Tough questions, all, but I am going to have a go at answering them. Yes, maybe, NO.

That’s it. Have a nice day 😊.

Just kidding. Here you go, strap in, and pay attention. The system did, indeed break down. In a nutshell, ratings agencies fell asleep at the wheel, incorrectly labeling securities as investment grade without realizing that those securities were composed of sub-prime loans. This allowed bankers to make HUGE profits in creating the securities. Everyone seemed to get what they wanted… until they didn’t. Sub-prime borrowers got easy loans, bankers made huge profits, insurance companies got fat premiums, ratings agencies got more fees, and investors received great yields. However, a failure at the loan level caused the entire house of cards to collapse. The collapse caught regulators by surprise, it caused major insurers to fall into receivership, and decades-old, venerated Wall Street institutions closed their doors for good.

Unfortunately, the crisis could not have been averted, because, if you haven’t noticed by now, when it comes to money and wealth, someone always seems to find a way to get more of it… at all costs. Whether we like to hear it or not, greed is a big driver of success in investing. Now, I am not going to give you Gordon Gecko’s iconic “Greed is Good” speech, but I just want to acknowledge that it is a real factor, and only bad when it drives people to cheat and break the rules. The problem is that, at the time, nobody thought they were cheating and breaking the rules.

On the question of more regulation, that is, perhaps the toughest question to answer. You see, markets operate most efficiently when they are allowed to do what they do best, which is to clear all the available information and discover true values, and unfortunately, overregulation prevents that system from doing its job with accuracy. The Chinese stock markets have had a bit of a rough patch recently and regulators there have attempted to fix things up by imposing all sorts of… well, regulations. The heavy-handed approach may have served to stave off selling temporarily, but the actions could possibly have damaged the markets’ long-term viability. How can you know what a stock is really worth if a government regulator is either artificially propping up values or overregulating a company’s ability to conduct business freely (within the law, of course). In the wake of the financial crisis, US regulators imposed lots of tough regulations in order to avert another GFC. Those regulations had good intentions but were onerous on financial institutions for many years. Years later those rules were relaxed… which unfortunately paved the way for some more trouble to bubble up. The message here is that there is a delicate balance that must be struck in order to allow the markets to be successful and to prevent companies from behaving badly.

Markets are more efficient than at any time in history. Free markets are imperfect and will always be subject to bad actors behaving badly, but their ability to get the job done, freely, is critical for future growth. The burden, my friends, ultimately falls on us as investors to do our diligence, remain focused, and stay ever vigilant. Do those, please.

WHAT’S BEHAVING BADLY, OR NOT IN THE PREMARKET

Berkshire Hathaway Inc (BRK.A / BRK.B) shares are higher by +1.98% in the premarket after it announced earnings over the weekend. The company beat revenue estimates citing strong insurance underwriting earnings. This shouldn’t shock you if you have checked out insurance costs recently 😉. The company appears to be closing in on the $trillion market capitalization mark. Potential average analyst target upside: +4.4%.

Moderna Inc (MRNA) shares are lower by -1.51% in the premarket after HSBC lowered the company’s rating from HOLD to SELL on concerns of future revenues. In the past month 3 analysts have lowered their price targets while 2 have raised them. Potential average analyst target upside: +36.0%.

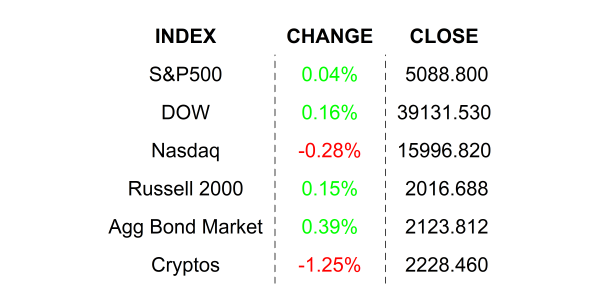

FRIDAY’S MARKETS

NEXT UP

- New Home Sales (Jan) is expected to have climbed by +3.0% after gaining +8.0% in December.

- Dallas Fed Manufacturing Activity (Feb) is expected to come in at -15.0, an improvement over the prior month’s -27.4 print.

- Kansas City Fed President Jeff Schmid will speak today.

- Earnings after the closing bell: Trex, SBA Communications, Zoom, Workday, and iRobot.

- Later this week: more earnings along with Durable Goods Orders, more housing numbers, Consumer Confidence, GDP, Personal Income, Personal Spending, PCE Deflator, ISM Manufacturing, and University of Michigan Sentiment. Download the attached economic and earnings calendars for details.

.png)