Stocks gained in a bumpety-bump session fraught with all sorts of “tape” noise. Powell gave us nothing new in his Capitol Hill testimony with more nothing new expected today.

Noise cancelling. I feel guilty. I have a beautiful office with a beautiful view. There is nice furniture, which is really just an accessory to the menagerie of screens that add a nice, orangey hue to the walls – even in stark sunlight. On my wall hangs a huge television which is supposed to have a financial news station playing 24 / 7. Walking down the hall of executive offices with their TVs full of talking heads and crawling tickers would make the casual visitor think, “hmm, these folks must really know what’s going on.” Here is where I am guilty. Not only do I keep my TV on mute, but I actually turn it off most days.

Do you ever flip to the financial channel to fill up on the latest news and hottest tips on Wall Street? Of course, you do, and I don’t blame you. You want to make greater returns, and that IS the name of the game. If you have the patience to watch for at least a ½ hour block, you will find that an equal number of guest “experts” will tell you that the market is going higher, and the other half will tell you it’s going down. Overall, you will notice that there is no lack of people willing to get gussied up, have their noses professionally powdered, get mic’ed up and voice their opinions on live TV. Don’t get me wrong, I have nothing against these folks, but be it known that they are the agents of the devil. “Wo, wo, wo, did he just evoke that biblical bad guy,” you chortle? Well, not the guy himself, but rather the concept that those folks could easily force the best of us to abandon our course.

Have you noticed that the markets have been bubbling higher? Sure, you have. Do you need an expert with an MBA to tell you that? Further, do you need the executive managing partner / director / co-head of some important group in some company named after a mythical hero to tell you that sometimes when markets go higher for a while, they tend to pull back? No, of course, you don’t. You understand that nothing gets anywhere in a straight line when it comes to the markets. You know that we are getting paid to take that risk and endure that volatility. You know about the risk / reward continuum, where you get more potential reward if you take higher risk.

The market has just had an incredible run, fueled by many things. Amongst them were the discovery of the potential positive impact of AI, a more relaxed Fed, and healthy economic conditions. That run has attracted some real “experts” to get the courage up to tell you that the market can pull back. That seems like a low-risk omission, doesn’t it? Joining that group of experts is another cohort who will only tell you about their lucky calls… after the fact. You surely have noticed that the “experts” rarely tell you of their wrong calls.

Have you done all the homework necessary to make an investment? Have you looked carefully at the details, fundamentals, market dynamics, news, public disclosures? Did you compare the investment to similar ones? Do you have a credible hypothesis on where you think that investment is going, why it’s going there, and the supporting data? If you answered yes to all these questions, then you are ok. If you listened to the talking heads on TV… well, you are on your own, kid. Do your homework, or find a trusted advisor, mentor, or whatever who will do all of those things for you and with you. And if you do find that person, make sure that the person you trust does not have a TV playing at full blast in their office. Stay focused, do your homework, and stick to your long-term plan!

WHAT’S NOT ON TV YET THIS MORNING

Micron Technology Inc (MU) shares are higher by +3.90% in the premarket after Stifel raised its rating to BUY from HOLD along with a target increase to $120. The analyst made the recommendation based on growing demand for electronic products which rely on microns memory chips that are in tight supply. Micron will announce earnings later this month. Dividend yield: +0.48%. Potential average analyst target upside: +4.1%.

General Electric (GE) shares are higher by +0.45% in the premarket after it announced a $15 billion stock repurchase program. The Aerospace division will be what’s left of the once-sprawling conglomerate after its energy division is spun off in April. That division re-affirmed its full-year guidance. In the past month, 12 analysts have raised their price target while none has lowered them. Dividend yield: +0.20%. Potential average analyst target upside: +1.2%.

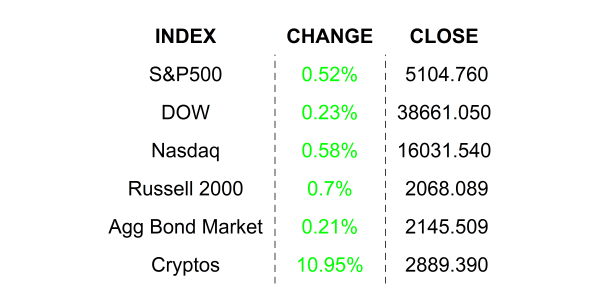

YESTERDAY’S MARKETS

NEXT UP

- Initial Jobless Claims (March 2) is expected to come in at 216k, slightly higher than last week’s 215k print.

- Jerome Powell will testify before the Senate Banking Committee today. This can be a market mover.

- Cleveland Fed President Loretta Mester will speak today.

- After the closing bell earnings: MongoDB, DocuSign, Marvell, Broadcom, Samsara, Costco, and Gap.

.png)