Stocks sprinted into Fridays close thrusting the Dow to just a nose ahead of 40,000 with very little news to backfill the jump. The Conference Board’s Leading Economic Index pulled back more than expected in May… it’s up to the Fed whether that is good or bad.

Nine lives. Did you know that the concept of a cat having multiple lives dates all the way back to ancient Egypt. Now, I am not a cat person so I can hardly say that I am an authority on the behaviors of cats, but I have seen some pretty interesting feats on social media. Lightning-fast reflexes and unparalleled athleticism has given the cat a leg… er, a paw up on the rest of the animal world and that is most likely the source of the long lived “nine lives” lore. By now, you have probably figured out that I just cannot get Roaring Kitty off my brain. I am right on the cusp of the baby boom generation and Generation X.

Though I am technically Gen X, I certainly have some tendencies which warrant the occasional “boomer” jeer from a later generation. For one thing, as you all know, I am a big fan of long-term investing. That is because IT WORKS, and I have the numbers AND THE EXPERIENCE to prove it. However, I know that short-term investing has a certain allure and that those generations after mine have a particular predilection for it… kind of like a feline’s attraction to catnip 😻. Did you know that there is a group known as Generation T? It’s true, it commonly refers to the more recent generations and there are many interpretations, such as Technology, due to the younger generations’ strong reliance on technology, or Telecommuting, due to the younger folks who embraced work-from-home in the wake of the pandemic. Another one, and my favorite is Trading, due to their appetite for trading and short-term rewards. I sometimes switch back and forth between the word “trader” and “investor”, but the true distinction in my mind at least is that traders are out for short-term gains while investors, long-term.

In any case, it is clear that while Roaring Kitty’s initial focus on Gamestop way back in 2019 had to do with the stock being undervalued, his followers were more likely traders, motivated by a completely different investment thesis. They were not looking for value as much as they were looking for some quick profits. By the way, there is nothing wrong with that, though many of the pile-on stock and crypto trades that happened from 2020 on were spurred by retail investors simply jumping on the latest trend. Though things may have evolved somewhat.

I was recently on a subway doing my best not to look anyone in the eye… it’s a New York thing. Looking down, I noticed a young man of Gen T age plying his smartphone and literally flipping between different online trading platforms and reddit blogs while placing orders on all sorts of stocks. I know that I am making a generalization when I say that he may not have even known what many of those companies even did, but I am pretty confident of my assertion, based on the stock tickers I saw him focused on. He was looking at small cap premarket movers with large volume spikes. I did notice that he was looking for some news of why those companies were on the move, so I will give him that, but I literally saw him enter half a dozen orders between Union Square and Brooklyn Bridge / City Hall, carefully waiting for stops because that is where cellular service is best. It was a local train, so there were enough stops to get quite a few in. I will admit that when I got to my office and turned on all my screens that I did check some of the tickers I remembered from my unsuspecting business partner’s phone. And what I discovered confirmed by suspicions.

Indeed, all the stocks had spiked in the overnight/early morning pre-market with large volume surges. Interestingly some didn’t even have notable news. What concerned me most was that there was no discernible pattern beyond the extreme price moves and volume spikes. They were all from different industries and none of them had anything notable with respect to fundamental anomalies. Some did have interesting but vague technical patterns. I will admit, at that point I stopped short of checking Wall Street Bets on Reddit, but I did notice that some of them had increased social media activity, which is tracked by Bloomberg, so I am confident that the source of my friends flurry of orders was born in the Reddit-sphere. I followed those stocks throughout the day, and some moved noticeably higher while others fell. I could have ended the story there, but my curiosity persisted through the next day. I mean, after all, that young man on the subway seemed like a successful chap, I wondered if these trades were the source of his success… and his expensive watch.

AND THIS IS WHAT I FOUND. There were 5 dead-cat bounces; that is a Wall Street term that was born well before Roaring Kitty 😉. If I invested in every stock that I remembered from my Brooklyn-bound 6 train ride, I would have lost money on every trade except one. Wouldn’t you know it, that stock was the only one with noteworthy news and stable fundamentals. All the others had charts that looked exactly like the one that follows. What is the moral of this story? Indeed, stocks can make big moves simply through rumor and social media hype, and there is the potential to make money for some, but most are likely to be stuck holding the bag. Short-term trading requires specific skills, tools, and experience. It is not for everyone and takes a lot of focus. Are you a long-term investor? Good, please carry on.

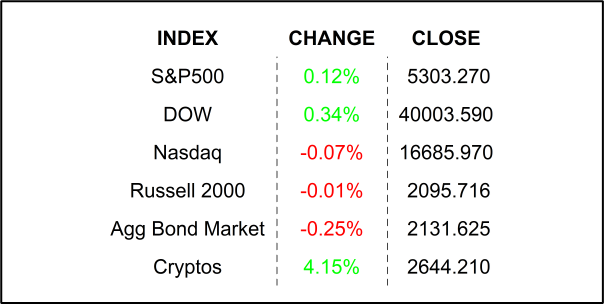

FRIDAY’S MARKETS

NEXT UP

- No economic releases today. Later this week we will get more housing numbers, flash PMIs, regional Fed reports, Durable Goods Orders, University of Michigan Sentiment, and FOMC meeting minutes. While earnings season is winding down, there are still quite a few important announcements in the next few days. Download the attached economic and earnings calendars for details.

- Today’s Fed speakers include Bostic, Barr, Waller, Jefferson, and Mester.

- Earnings after the closing bell: Zoom Video Communications and Palo Alto Networks.

.png)