Why today’s rate cut is a mixed bag depending on whether you invest for growth or income.

KEY TAKEAWAYS

-

Lower yields feel like a pay cut for fixed income investors

-

Rate cuts boost stock valuations but reduce income for retirees

-

Corporate bond spreads are extremely tight heading into Fed easing

-

Real yields are pressured as inflation stays sticky

-

Your reaction to the Fed cut reveals whether you rely on growth or income

MY HOT TAKES

-

Rate cuts are a silent wealth transfer from income investors to growth investors

-

The bond market is pricing perfection in an imperfect world

-

Real yields are the hidden stress point no one is talking about

-

Credit spreads this tight make zero sense in a world full of macro risk 👊

-

Investors celebrating rate cuts may not understand what they just lost

-

You can quote me: ““Lower rates are not stimulus–they are a forced salary reduction for income investors.”

Spread the love. It’s Fed day, and because of that, you are thinking about interest rates, aren’t you? What? You’re not? Do you know what the Fed Funds rate target is? Do you know what 2-Year Treasury Note yields are right now? It’s ok, I am pretty sure that you don’t, but you DO know that the Fed Funds rate is likely to be cut by 25 basis points by the FOMC today. So, know that by the time you sit down for your supper, the most watched number in the world today will be lower by ¼ of a percentage point to… er… um… wait, what was it again? It’s 4% and likely going to 3.75%. Yep.

Will it affect your stock portfolio? Yes, probably, but not directly. Will it affect your financial quality of life? Probably not, unless you owe billions of dollars and your interest payments are somehow tied to SOFR, which moves in lockstep with Fed Funds. If you do owe billions, congratulations. If you are like the rest of us, the Fed move is not likely to have a material impact on your day-to-day life. However, if you are on a fixed income and you rely on bonds or bond funds to provide you with monthly income to live, your story may be quite different. Perhaps you started putting your 401k in one of those snazzy target date funds years ago and you are about to retire. Congratulations, you now have more fixed income exposure than you have ever had.

Where am I going with this? Most investors' initial thoughts on bond yields is that they would like to see them lower. I won’t get into the whys–you are just going to have to ride with me on that. But if you buy bonds for income, that return on your investment, or your yield is going down. It is equivalent to your boss cutting your salary rather than raising it. How does that make you feel? Not good, eh?

Let’s jump in with both feet and see if we can make some sense out of all this.

Because while everyone will be cheering this afternoon–stocks up, yields down, confetti falling from the rafters–the folks who depend on bonds for income will be silently crying into their lukewarm chamomile tea. 😿 Lower yields don’t feel like a party when those yields are your paycheck. And today’s expected cut is only the beginning, because Fed Funds Futures are already pricing another 50 basis points of cuts by the end of 2026. If you are a buy-and-hold fixed income investor, that is the equivalent of HR calling you into the office and gently informing you that they’re “right-sizing” your salary. Never a good sign.

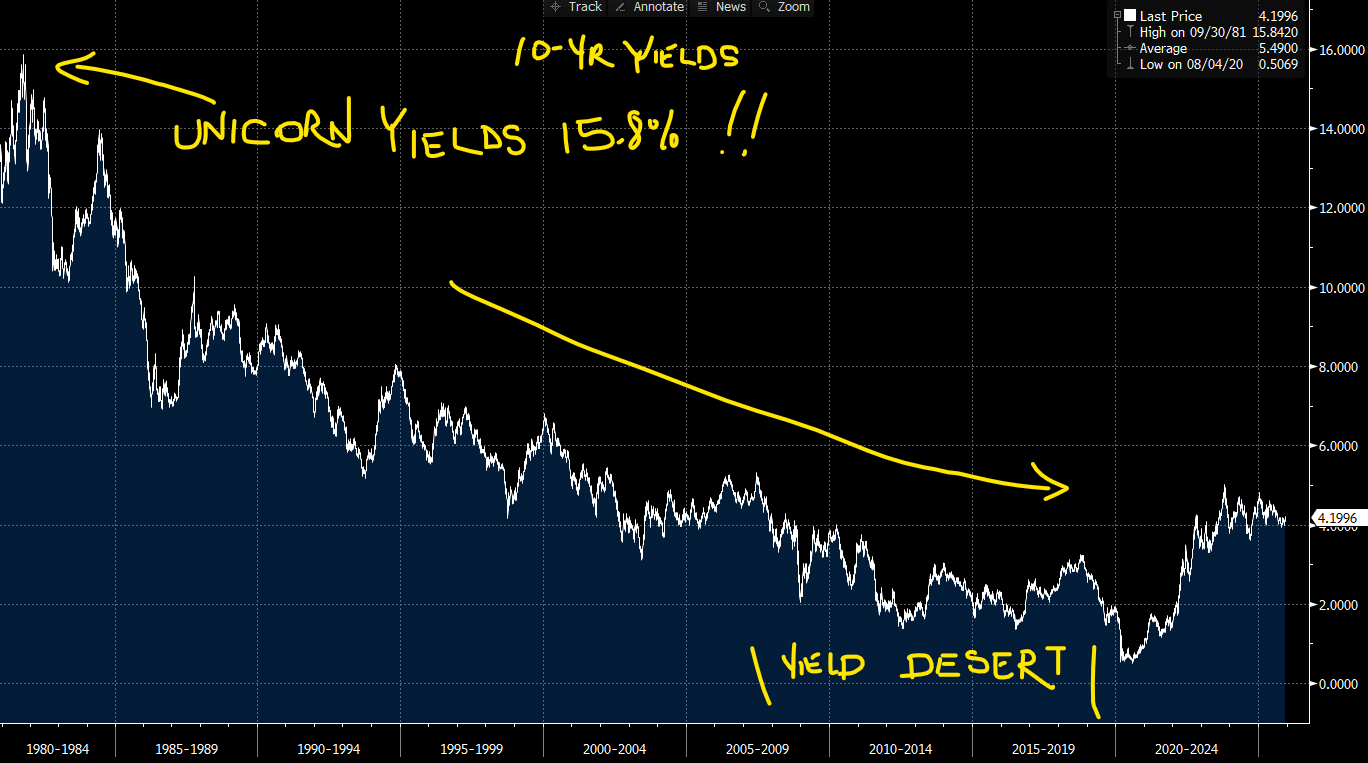

And before you let yourself get too swept up in the joy of lower yields, remember the strange arc of history that got us here. In the 1980s, bond yields were like unicorns–double-digit, towering mountains of income. People bought Treasuries at 12–15% like they were picking up $100 bills on the sidewalk. Then came the long, beautiful multi-decade glide downward. Yields drifted lower through the ‘90s and the early 2000s until the Global Financial Crisis smashed them down like a piano falling twelve stories and landing on Wile E. Coyote’s head (sorry for that hidden Warner Bros reference, I couldn’t help myself 😉). You know the story: markets broke, confidence evaporated, and investors fled to the safest harbor they could find. Treasuries plunged to levels that previously would have required a signed permission slip from a parent or legal guardian. The Fed certainly didn’t help by ZIRPing what was left of Fed Funds yield (ZIRP = Zero Interest Rate Policy).

But that wasn’t the end. Oh no. Post-pandemic, yields plumbed all-time lows. The kind of lows that made you wonder if the bond market was either incredibly optimistic or deeply depressed. (Spoiler: it was both.) For about five minutes, it felt like fixed income investors were doomed to wander the Earth earning 0.0000003% forever.

Then, suddenly, a miracle happened! The Fed threw income-starved investors a bone in 2022 and 2023. A big bone. A bone wrapped in barbed wire. The Fed ratcheted up rates at warp speed, and yields snapped back. For the first time in over a decade, retirees and ultra-conservative investors could buy a Treasury and actually earn something that looked and smelled like income. It was great—unless you owned duration, in which case, you needed a stiff drink, because your bond values got crushed!

But here we are again. Yields have come in dramatically from their 2023 peaks, and now they are promising to get even lower. And while that may be wonderful for equity valuations–and it really is–it’s significantly less wonderful for the investors who depend on coupon payments to survive.

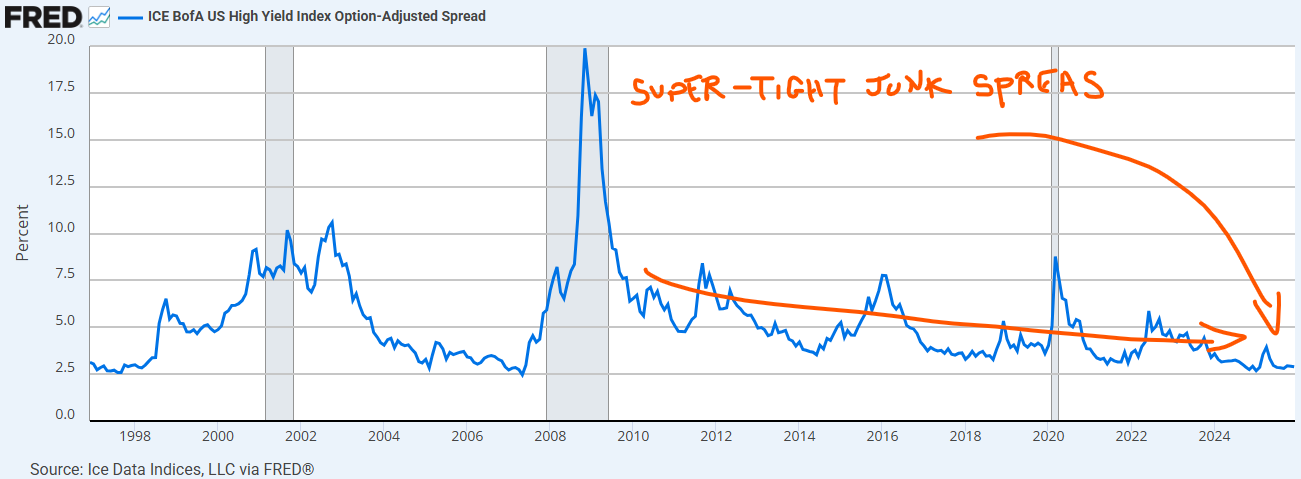

Corporate bond buyers are in a tough spot, too. You would think with all this talk of recession risks and geopolitical mayhem that spreads would be blowing out. But no. Corporate spreads are as tight as your jeans after Thanksgiving. 🍗 Check out the following chart of High-yield spreads. Note how they are virtually hugging the bottom of the page. They are pricing a world where default risk is apparently a myth told to frighten MBA students. And AAA spreads–highest rated? Practically invisible–38 basis points, actually. A rounding error. This is the bond market equivalent of “Nothing to see here, folks.”

And yet, there IS something to see here. When spreads are this tight heading into expected Fed cuts, you are not being compensated much for credit risk. If you’re a bond investor, that matters. If you’re a stock investor, though? That’s a stiff cup of espresso. Tight spreads, strong demand for credit, and falling yields are valuations’ best friends. Especially in growth stocks, where every basis point pumps up discounted cash flow models everywhere.

But the picture grows even more complicated when you consider real yields. That’s right, tthe inflation-adjusted return on your money. Real yields have been the quiet superhero of the fixed income universe these past two years, offering something rarely seen: positive inflation-adjusted income. The problem? Inflation remains sticky. Not crazy-bad, but certainly not dead. And if inflation is sticky while nominal yields are falling, guess what happens to real yields? They get squeezed. The bond investor loses again. Your purchasing power erodes. Your effective income shrinks. [Cue the sad violin music here.]

Which brings us to the twist. While today’s rate cut will be celebrated by stock investors like a late-night pizza delivery, for buy-and-hold bond investors, it is a mixed bag at best. Lower yields mean higher bond prices today, sure, but lower income tomorrow. Stocks may soar because lower yields turbocharge equity valuations, but fixed income investors will be staring at a future defined by skinnier coupons, tighter spreads, and real yields under pressure.

In other words, your reaction to today’s Fed announcement will reveal something very personal about you–not your age, not your political affiliation, but whether you prefer your returns in growth or in income. Because one of those groups will be cheering tonight. And the other will be quietly calculating how many fewer dinners out those shrinking coupons will pay for.

Disclaimer: sorry I didn’t write about how important Jerome Powell’s press conference will be today–everyone else is, and I have worn out my Powell pencil.

YESTERDAY’S MARKETS

Stocks slipped into a mixed close as traders await this afternoon’s Fed decision. Tech shares were the shining light–propped up by the Trump Administration’s willingness to allow NVIDIA to sell its more-advanced H-200 chip to China.

NEXT UP

-

The FOMC will announce its rate decision at 2:00 PM Wall Street Time along with its SEP report and Dotplot! 👀

-

At 2:30 PM Wall Street time, Jerome Powell will take to the podium for his customary presser where he is highly likely to rile up the markets with some hawkish rhetoric. It should all be enough to get your heart pumping–pay attention.

-

Important earnings today: Chewy, Synapsys, Adobe, Vail Resorts, and Oracle.

.png)