History doesn’t repeat, but it rhymes loudly. The fiber bubble of 2001 offers a warning for AI investors today.

KEY TAKEAWAYS

-

The AI ecosystem is real but showing early signs of speculative excess

-

The current buildout in AI-related power infrastructure mirrors the 1990s telecom overbuild

-

History shows that overcapacity, not failure, ends cycles

-

Oklo’s decline yesterday and Fermi’s IPO reveal how fragile investor faith has become

-

Endurance, not panic, determines who survives market overbuilds

MY HOT TAKES

-

This isn’t a dot-com repeat–it’s a CLEC redux

-

AI’s power rush will eventually create overcapacity before it creates opportunity

-

Not all hype is irrational–but a lot of it is lazy

-

Investors are confusing technological truth with investable timing

-

We’ll get our next infrastructure boom from today’s excess–but it will come after the shakeout

-

You can quote me: “Overcapacity always builds the next era—but it wipes out the investors who paid for it.”

Nuclear implosion. I used to swim in open ocean races. 🏊 Imagine being in the midst of hundreds of swimmers–most of them terrified about what might be below them 👀 –waves smashing into you, and currents pushing you. You are oxygen-deprived because you are swimming to win, or, at least, to get away from the dangerous pack. You pop up for a breath, but it is cut short when a wave fills your mouth with cold saltwater. You put your head down. Stroke, stroke, stroke, stroke… time for another breath, but before you can even turn your head, some panicked swimmer next to you grabs your goggles and pulls them off your eyes. You try not to panic; you turn onto your back and adjust. You turn back on your stomach and start to swim. But wait. Where are you? There is supposed to be a buoy that you round before heading to the finish line. You can’t see it and you pop your head out as far as you can, but still, you can’t make it out–all the while continuing to swim. Stroke, stroke, stroke, stroke. Well, it has been a while since I have done that, but the memories are still fresh in my mind.

Yesterday was a day where I felt like I was in one of those races. Swimming hard and as steady as possible, trying as hard as I could to stay on course, and hopefully not end up on the wrong beach. It had nothing to do with the market, but rather, more to do with what I had to get done during market hours. I won’t bore you with the details, but at one point one of my favorite writers at Bloomberg messaged me asking me to comment on Oklo’s sharp intraday decline. The message sat open, but unanswered on my Bloomberg terminal for some time because… well, I was swimming. But I did see it, and it worried me.

My regular followers know that I am a big fan of the AI ecosystem. I am referring to AI as an investment. I know that I am not alone. Everyone wants to be involved in the unfolding of the once-in-a-lifetime sea change in productivity and technology. It’s old news–really old. These days, though, I spend most of my time refuting notions that we are in the midst of a bubble, like the dot-com bubble. You have read my notes on this and watched my videos, and you may have even seen me on TV saying that we are not in a bubble. Is there exuberance? Yes! Is it irrational? Mostly, no.

Let me clarify, “mostly.” The AI ecosystem is wide, covering everything from security, to semiconductors, to power generation, to servers, to software, to service providers… well, you get the picture, and you know the players. We are now in a stage in AI evolution where wide is starting to get deep, meaning more players are entering the fringe. Some come with novel ideas, most are copycats, and still some more come with wild ideas that have no chance of succeeding. The latter type can slip into the mix because of the massive support from investors looking for the next big thing. So eager are some investors to get into the trade that they simply forget basic investment principals. Can you say “pets.com?” In hindsight, it was obvious, but the problem with bubbles is that you don’t know you are in one until they pop.

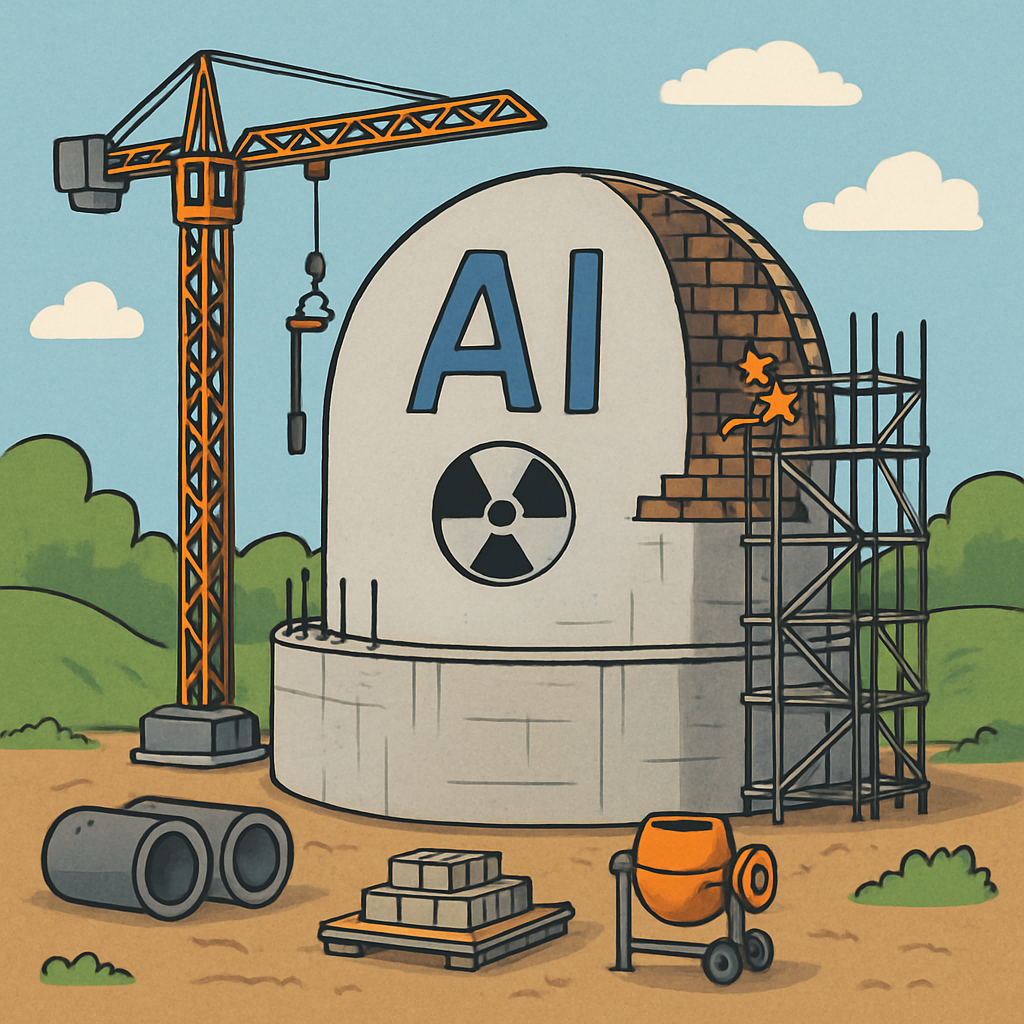

In today’s media world there are many, many folks vying for that top spot. The one where they can claim to have identified the bubble before anyone else. Hence the constant questions from everyone. To be clear, it’s my job to ask that very question of myself… every day. And I do. We are not in a dot-com-like bubble. HOWEVER, I have had a growing concern about a different bubble that no one really talks about anymore. The CLEC bubble. What? You don’t know what a CLEC is? Don’t worry, I’ll explain. I am talking about the Competitive Local Exchange Carrier (CLEC) boom of the late 1990s. I know, it sounds like ancient history, but the similarities are uncanny. Back then, the internet was the AI of its day–transformative, disruptive, and overflowing with promise. Every telecom executive in America was telling investors that bandwidth demand would grow exponentially forever. The story was irresistible. Fiber was the new oil. Remember that?

Companies raised billions to lay cable beneath city streets, across rural America, and under oceans. Every new entrant promised to capture a share of the massive digital future, and the more fiber they planned to install, the higher their stock prices went. The result was predictable: an arms race to build out capacity before anyone could even prove the demand existed. By 2001, the US had more dark fiber (unused network cable) than it could ever need. It was a gold rush that left behind a field of abandoned mines.

I remember the psychology vividly! No one wanted to miss the next big thing. Analysts justified wild valuations using total addressable market models, discounted cash flows that stretched decades, and phrases like “brave new economy.” 😂 Venture capital poured in, banks underwrote deals as fast as they could print pitch books, and retail investors followed the momentum right off a cliff. Sound familiar?

That is what I see flickering in some corners of today’s market. The AI-power trade feels eerily similar. The narrative is perfect: AI will reshape everything, but it needs power–LOTS OF POWER, and power is scarce, so whoever builds it wins. To be clear, there is truth in that, but not all truth is investable at any price. Building power capacity is capital-intensive, slow, and politically complicated. Just like fiber, you can’t spin up a new data center overnight. You need permits, transmission infrastructure, water access, and even possibly technology that doesn’t exist yet. The timelines stretch for years.

When too much capital chases the same bottleneck, the result isn’t shortage–it’s glut. And gluts are what end cycles. The CLEC bubble didn’t burst because the internet failed. It burst because too many people tried to monetize the same opportunity at once! The survivors weren’t the dreamers–they were the scavengers who bought the bankrupt networks for pennies and repurposed them when the demand finally caught up.

That is why the recent Fermi America IPO got my hackles up. Not because the company itself lacks vision, but because of what it represents. The appetite for anything tied to “AI infrastructure” has reached a point where investors are suspending disbelief. A pre-revenue power company with a multi-billion-dollar valuation doesn’t make sense unless we are collectively assuming that demand will be infinite and that execution risk doesn’t exist. That’s not investment–that’s faith.

When my Bloomberg friend pinged me asking about Oklo’s decline, it felt like deja vu. The sudden selling wasn’t about one stock. It was about a crack in confidence. A single TV comment from Cramer questioning Oklo’s fundamentals triggered a chain reaction across the clean-energy sector. That tells you just how fragile this trade is. When stories, not cash flow, drive valuation, it doesn’t take much to knock things over.

This doesn’t mean the AI revolution isn’t real. It is. Just as the internet was real in 1999. The question is one of timing. Fiber eventually became the backbone of the digital economy, but not before an entire generation of investors got wiped out financing it. The parallel, my friends, is hard to ignore. The internet really did change everything–but not before a lot of people got crushed building it. AI will, too, but that doesn’t mean everyone racing to power it will make it to the other side. The AI economy will absolutely need more power, more servers, more grids–but maybe not this much, and certainly not this soon.

The capital buildout we’re seeing with microreactors, new REITs, massive data-center complexes, is happening at a pace that markets historically can’t sustain. Infrastructure doesn’t grow linearly; it lurches forward in bursts, then pauses while demand catches up. Right now, we are sprinting into the unknown, assuming that AI’s appetite will never level off. Unfortunately, that’s what the fiber crowd thought, too.

I’m not saying this is a bubble, but some of the symptoms are appearing. Pre-revenue companies trading like established utilities. Speculative SPACs dressed up as infrastructure. Retail traders buying “AI power” tickers the way they bought “dot-com” tickers. Even the language feels recycled–“capacity” “explosive demand,” “bandwidth.” Replace “fiber” with “megawatts” and you have… well, the same pitch deck.

Yet, I’ll end this on an optimistic note, because not all fiber builds were bad. The overcapacity of the early 2000s eventually became the foundation for modern broadband, streaming, and cloud computing. The pain of that bubble financed the pipes that made the next era possible. And in that sense, even an overbuild in energy infrastructure might not be a total loss. The world will always need more power, even if it’s not immediately for AI. The winners may not be the speculators chasing headlines today, but the patient operators who buy the leftovers when the frenzy fades.

So, while I’m not calling this a bubble, I am saying this: be selective. There are companies with real earnings, real cash flow, and real prospects, and then there are those floating on narratives. The difference isn’t always clear at the moment, but history has a way of drawing sharp lines when the music stops.

We’ve seen this movie before. It doesn’t end in catastrophe for everyone, but it does humble those who forget that markets, like ocean races, don’t reward panic. They reward endurance, discipline, and the ability to keep your bearings when visibility fades. Stroke, stroke, stroke, stroke… keep swimming toward the buoy. Even if you can’t see it yet, it’s there. 😉

YESTERDAY’S MARKETS

Indexes fell yesterday, led lower by volatile growth stocks. More saber rattling between China and the US left earnings-rattled bulls on edge. Treasury yields declined and gold stabilized.

NEXT UP

-

No jobless claims today–the government is STILL shut down.

-

Existing Home Sales (Sept) may have picked up by 1.5% after slipping by -0.2% in August.

-

Important earnings announcements today: Dow Inc. Honeywell, Hasbro, American Airlines, Tractor Supply, Freeport McMoRan, Valero Energy, Blackstone, PG&E, T-Mobile, Ford, VeriSign, Norfolk Southern, Intel, Newmont, Digital Realty Trust, Deckers Outdoors, and Baker Hughes.

.png)