The 10-year yield has a new problem, and it’s coming from Silicon Valley’s AI ambitions.

KEY TAKEAWAYS

-

The deficit is keeping yields elevated and limiting bond price recovery

-

BlackRock argues AI will drive a new wave of corporate bond issuance

-

Even cash-rich megacaps will borrow to fund massive AI capex

-

Bond supply–Treasuries + corporates–will pressure long-term yields

-

Higher yields directly threaten growth stock valuations

MY HOT TAKES

-

Bonds finally have a compelling story

-

AI may be the unexpected driver of higher yields

-

Corporate credit isn’t the risk–bond supply is

-

Investors underestimate bond-market impacts on tech valuations

-

The 10-year yield is now a key AI narrative variable

-

You can quote me: “Growth stocks should pray the 10-year doesn’t start reacting to AI bond supply.”

Rocked. You think about bonds, but not too much. You know that they are important because your favorite financial blogger / content creator Mark Malek 👍 is kind of obsessed with them–amongst other things. He got his start on a bond trading desk over a quarter of a century ago where he learned that bonds offer the most direct reflection of the economy and global markets. He learned that bonds trade very rationally. We like rational. 😉 He also learned that it is really difficult to keep a crowd entertained by talking about bonds. Everyone wants to know about stocks. Everyone likes a good story. There are no really great stories when it comes to bonds. Sure, there are corporate bonds that come with stories about the companies that issue them.

When you see NVIDIA’s Jenson Huang in his leather jacket–calm, collected, focused–you pay attention. When you watch Palantir’s Alex Karp with his unkempt curls and quirky mannerisms wax philosophical and simplify the complexities of data and AI with absolute resolve, you pay attention. You don’t immediately run to your Bloomberg terminal and look up NVIDIA’s or Palantir’s bonds. No, you go straight to their stocks. Of course there are almost unlimited upsides of stocks versus the very definite returns on bonds (though bonds can get capital gains if sold before maturity). Despite all this, you probably own lots of cool stocks that come with some good stories along with some eye-watering capital gains. You probably own some bonds as well because you know that diversification is important. If you are my age, you probably own, or certainly have owned individual bonds. If you are a Millennial or younger, your exposure to bonds is most likely through a bond ETF–Ok, we’ll take that because some exposure is better than none.

Ok, enough of this. Are you tired of seeing bonds go nowhere for the past 3 years or so? Let me clarify that sweeping generalization. 10-year yields spiked from less than 1% in 2020 (all-time lows) to north of 4% starting in late 2022 when the Fed was on its rate-ratcheting, inflation-busting crusade. Since then, despite inflation receding AND the Fed easing, rates have pretty much remained range bound around 4 - 4.5%. Shouldn’t rates be coming down–prices up for you non-bond types?

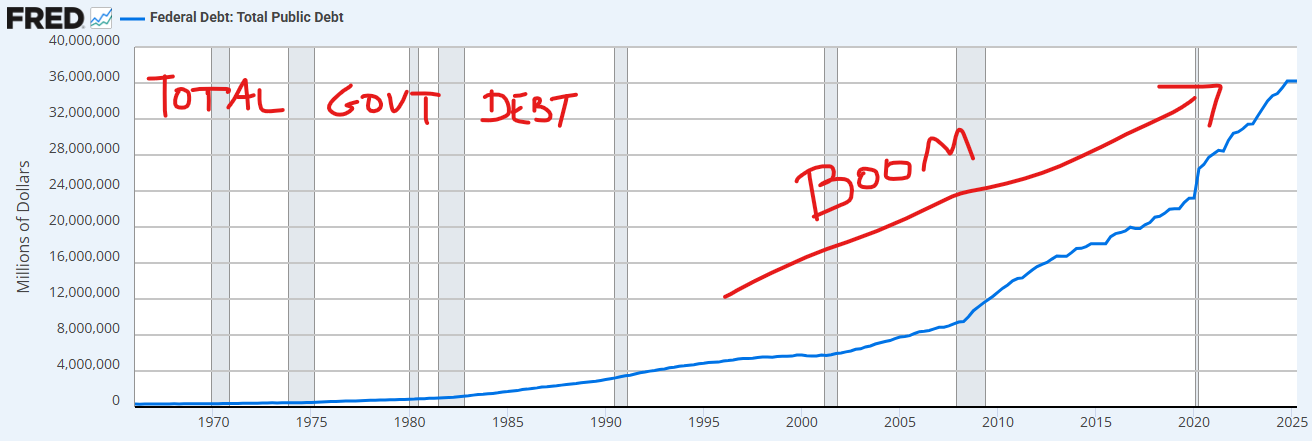

One of the principal reasons that longer-maturity yields is the deficit. Yep, you heard me correctly. I am sure that you heard that the Federal Deficit is a problem. To clarify, its existence is not a problem, but its size and the rate at which it is growing is. When I say problem, I am not referring to the anecdotal criticisms of high deficits. I am referring to the very practical problem of how the Government pays its bills. Not unlike most of us, if the Government wants to spend more money than it has, it must borrow money. It borrows that money by issuing bonds through the Treasury. If the deficit is rising, the Government must borrow more–issue more Treasury bills, notes, and bonds. When that happens basic economics takes over. You know, supply and demand. When supply is swelling, prices go down. When bond prices go down, yields go up! The Government is borrowing more and expected to borrow more yet to continue to fund the deficit. That is perhaps THE principal reason for yields being stuck.

Now I don’t want to get into all the negative effects of higher mid-to-long-term yields remaining elevated, but usual suspects are mortgage rates, HELOCs, auto loans, etc. These are all tied to those Treasury yields, and while they have eased somewhat, they seem to be stuck in suspended animation. But that may all change, according to a report issued by BlackRock, and it may not change for the better.

But the BlackRock report doesn’t point the finger at the usual suspects. It’s not about inflation refusing to die, or the Fed being too slow on the rate-cut trigger, or even the deficit itself, at least not exclusively. Instead, BlackRock raised a new wrinkle that feels almost counterintuitive at first: AI. Yes, the same AI that has launched trillion-dollar market caps into orbit and powered one of the most powerful equity rallies in history is quietly messing with bond markets in a far less glamorous way. AI infrastructure, they argue, is so capital-intensive, so electricity-hungry, and so compute-expensive that it’s about to unleash a wave of new borrowing, and not by distressed companies or by overlevered zombies, but by some of the healthiest balance sheets on the planet.

That sounds like a strange risk to highlight. After all, companies like NVIDIA, Microsoft, Amazon, Alphabet, and Meta have cash piles that could make a sovereign wealth fund blush. These are not shaky borrowers. They don’t need to clutch their hats and go begging to the bond market for survival. Their debt metrics look nothing like the bad old days of covenant-lite loans or overextended industrials. So why would their AI ambitions matter for the 10-year yield? Why would ultra-profitable megacaps–even those minting cash quarter after quarter– 😉 move the needle in the world’s largest, deepest bond market? Well, the answer is beautifully unsexy: supply.

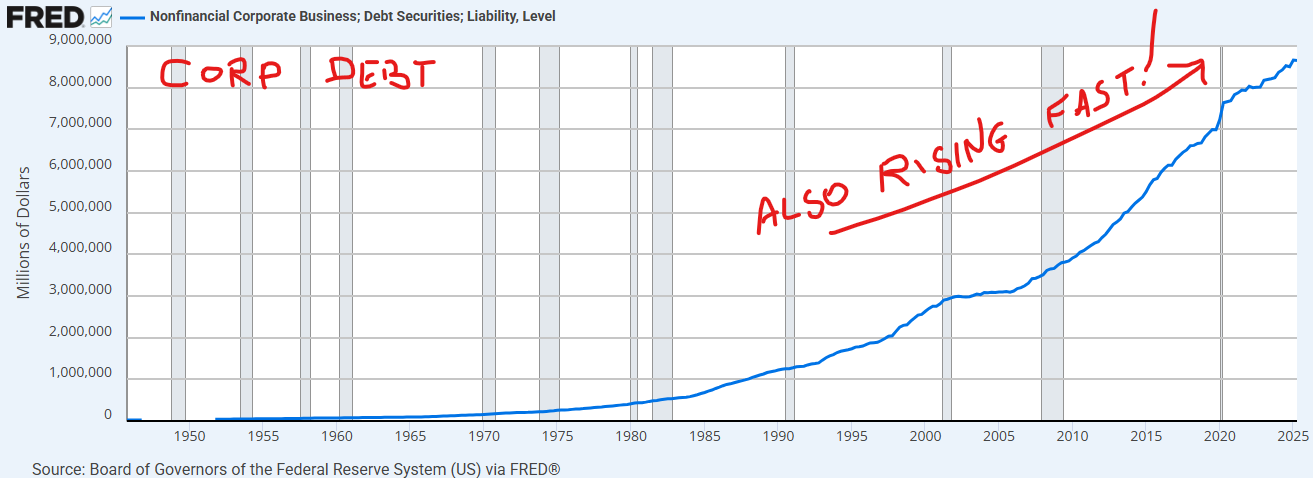

This is where the bond story actually becomes interesting, because BlackRock is effectively saying the quiet thing out loud. Even if the borrowers are pristine, even if the credit risk is minimal, and even if the interest coverage ratios look like they came from a fairy tale, issuing more bonds still increases the total supply of debt sloshing around in the system. And when supply rises–just as we discussed with the deficit–🙃 prices fall, and yields rise. It doesn’t matter that the issuers are AI heavyweights. The market only cares about how much paper is hitting the street. And in BlackRock’s view, we are on the cusp of a secular surge in corporate bond issuance tied directly to the AI build-out.

Think about it. AI is not a “product” in the traditional sense. It’s not a software service that costs pennies to run once it is built. AI requires enormous upfront capex–data centers, chips, thousands of miles of fiber, new power infrastructure, cooling systems, real estate, and cloud capacity that makes prior generations of computing look like child’s play. Capital for that infrastructure must come from somewhere. For many firms, it will come from retained earnings. But for almost all of them, it will also come from the bond market because debt is still the cheapest and most efficient capital source for long-duration projects.

So now you have two forces pressing on the same pressure point. On one side is the Government, floating trillions of dollars in new Treasury issuance. On the other is Big Tech, about to join the party with record corporate issuance to fuel an AI supercycle. Both feed into the same marketplace. Both swell the supply of bonds. And both, according to BlackRock, are likely to keep upward pressure on long-term yields even if the Fed cuts rates and even if inflation continues to drift lower. The Fed controls the front end. But the back end? That belongs to deficits, issuance, and global demand. Right now, the issuance side is winning.

Now, let me be very clear about something, because this is crucial: the problem is not the companies. There is no crisis brewing in Silicon Valley’s credit departments. No CFO is sweating bullets about being unable to service their debt. These are some of the most profitable enterprises in human history. The fundamentals are fine. The risk is not credit. The risk is simply… math. Once again, it’s just math, stupid. When you flood a market with more bonds–Treasuries, investment-grade corporates, utilities, data-center REIT debt, everything–the price of money rises. The bond market does not ask “why” you are borrowing. It only reacts to how much paper exists relative to demand.

And that’s where this gets fascinating for a bond nerd like me. Suddenly, bonds do have a story. Not a melodramatic one like “company X missed earnings” or “CEO Y said something weird on CNBC,” but a macro story. A structural story. A supply-demand story. A story about how one of the biggest technological revolutions of our lifetime is quietly shaping the cost of capital, the yield curve, and the valuation mechanics that ultimately determine stock prices.

It is, dare I say, a cool bond story. An AI-related bond story. A story where the plumbing matters just as much as the glitzy consumer-facing tech that everyone else is obsessed with. You won’t hear this on TikTok, and it probably won’t go viral, but it might just turn out to be one of the most important market dynamics of the next decade. Because if the AI capex boom is as large and persistent as many expect, the supply of long-dated corporate paper is going to rise in tandem, and that means yields may not fall in the clean, linear way everyone hopes as the Fed continues its easing cycle.

And here’s the kicker. The part equity-only investors often ignore. Higher long-term yields don’t just make mortgages more expensive. They also raise the discount rate that determines the present value of future cash flows. And which stocks rely most heavily on far-in-the-future cash flows? Growth stocks. Tech stocks. AI stocks. Exactly the companies driving today’s rally. So before you shrug off the 10-year or assume that it’s stuck in a range forever, remember that yield moves have a direct line into equity valuations. When the market starts paying attention to that, things can get interesting fast.

So yes, bonds have stories. You just have to know where to look. And right now, if you look closely enough, the bond market is whispering something important about AI, about supply, and about how the next leg of this market may depend on which side of the balance–stocks or yields–wins the battle. Pay attention.

YESTERDAY’S MARKETS

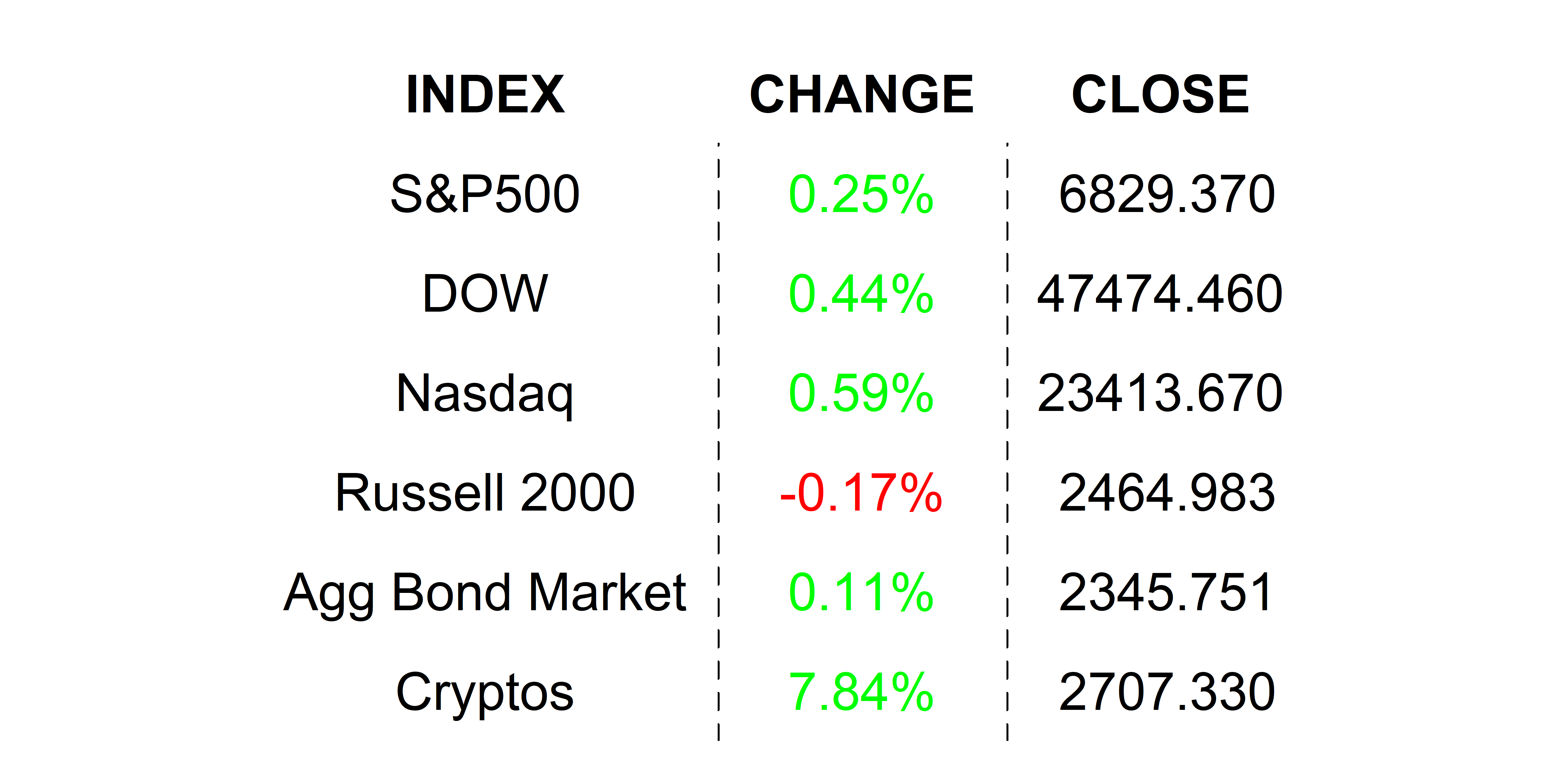

Stocks rallied yesterday led by growthy stocks. A crypto rebound sparked the speculative flame which ignited already rearing-to-go tech shares after solid earnings outlooks. No real macro catalysts helped to push stocks higher–the direction of least resistance.

NEXT UP

-

ADP Employment Change (November) showed that -32k jobs were lost for the month. Analysts were expecting a gain after last month’s 47k increase.

-

ISM Services PMI (November) may have slipped to 52.0 from 52.4.

-

Important earnings today: Dollar Tree, Macy’s, Snowflake, UiPath, Salesforce, C3.ai, Five Below, and Guidewire.

DOWNLOAD MY DAILY CHARTBOOK HERE 📈

.png)