A deep dive into how the economy dodged the tariff apocalypse and kept growing.

KEY TAKEAWAYS

-

Tariffs were expected to crush growth but the impact has been delayed due to inventory timing and exemptions

-

The OECD revised US GDP upward three times, now projecting 2% growth

-

Tech investment and AI driven trade flows kept global activity resilient

-

Consumers kept spending as incomes and employment held up better than expected

-

The real tariff drag may still arrive later but the economy has been far more adaptive than models assumed

MY HOT TAKES

-

Markets overreacted to the Rose Garden tariff theatrics

-

Economists underestimated real world adaptability and decision lags

-

Tech is quietly acting as the stabilizing force in global trade

-

The consumer continues to defy sentiment driven narratives

-

Reacting emotionally to political shocks destroys long term wealth

-

You can quote me: “The OECD just quietly cancelled the doom narrative.”

Never mind. Going back to 2018, you can easily find me on record bashing tariffs. I even considered ordering t-shirts with the graphic economic analysis of the utter madness of tariffs. I think most economists would agree with me that tariffs–in principle–are not a good thing. We prefer to let the economy usher resources efficiently with as little outside prodding as possible. Any time you mess with a machine that is designed to seek equilibrium and systematically self-right, you risk causing damage. Now, there are lots of models that explain how tariffs can hinder GDP growth.

Tariffs, you see, raise input costs for companies, which either eat the hit in margins or pass it on to consumers–neither of which is particularly growth-friendly. Higher prices slow demand, lower imports disrupt supply chains, and companies inevitably pull back on investment because uncertainty is poison for planning. And once trading partners retaliate, the damage compounds: fewer exports, weaker confidence, and a global game of chicken– “who blinks first.” In theory, tariffs sound like an easy lever for domestic strength; in reality, they tend to tax your own economy before anyone else’s. It’s that simple. But I would be remiss if I didn’t relay the nerd economists’ view (being a nerd myself 🤓).

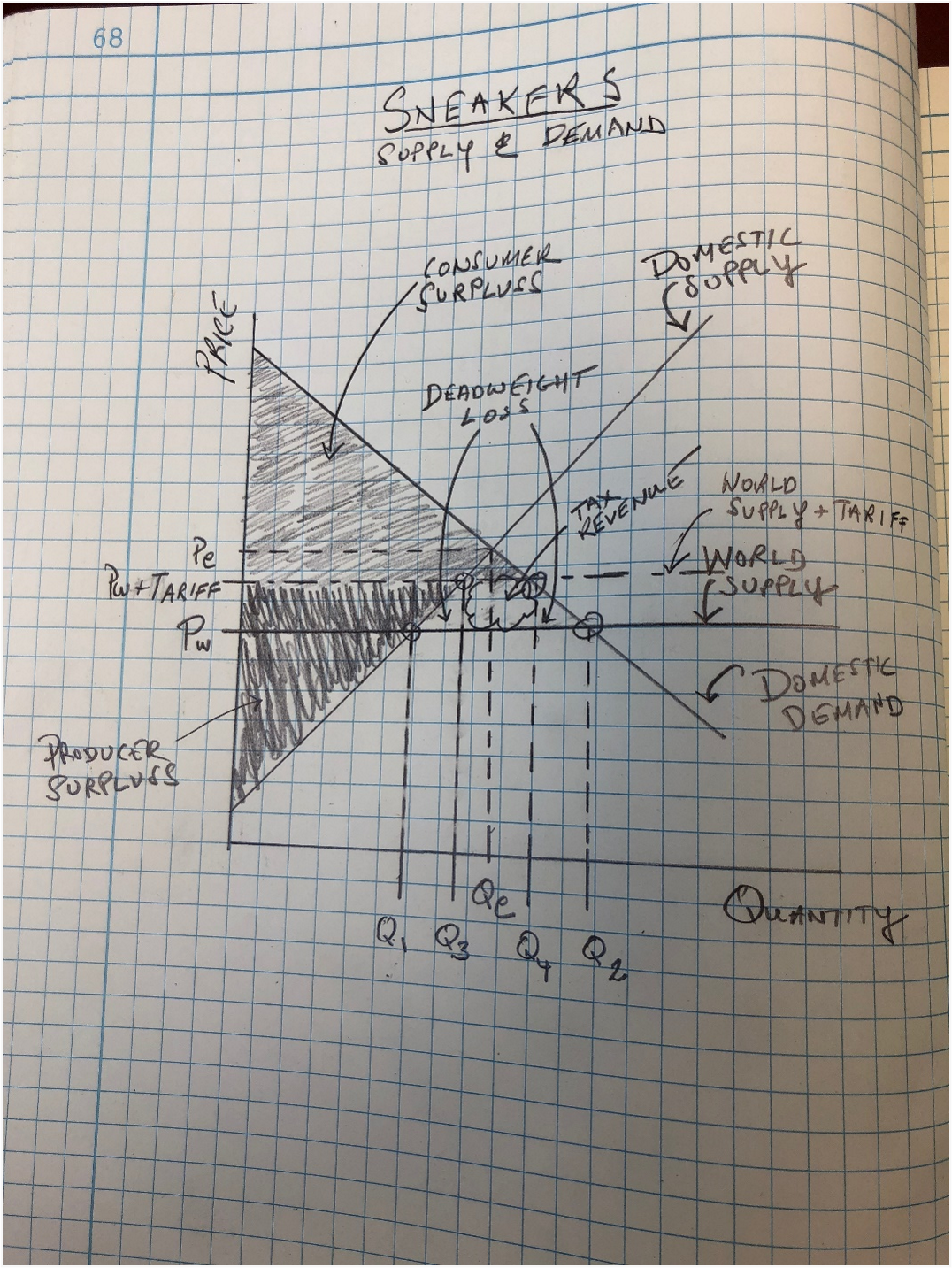

Tariffs distort relative prices and impose a deadweight loss by forcing consumption and production away from their welfare-maximizing, competitive-equilibrium allocations. You know what, I think that I will just show you the drawing I made in my notebook back in 2018 to illustrate tariff impact. Check it out–chuckle a bit and keep reading.

Yes, that's really my notebook and really my drawing. Anyway, I think that by now most of us understand that tariffs should–in theory–cause domestic prices to go up or margins to decline. This causes declines in demand or investment, both bad for GDP. I want to add that in my initial lambasting, I did carve out a justification clause for tariffs. If they are used as a negotiating tool to advantage the country economically in the long run or if they are used for national security, they are acceptable.

Fast forward to April of this year–2018 was a lifetime ago, and this year's tariff noise is far noisier than 2018’s. Back in April of this–Liberation Day–in the Rose Garden, it looked like the world was coming to an end from an economist's standpoint. Many stared at their televisions speechless as the President held up posters with numbers that were unfathomable. Markets were roiled. Pain begat more pain. Math needed to be re-mathed, pencils sharpened, slide-rules, abacuses, and HP-12C calculators were brought to the ready. The end of days were nye.

But alas, the President had other plans. Soon deals began to be struck. Business and political leaders from around the world came around to reshuffle capital flows. Investments were committed to and checks were put into the mail. It was uncomfortable, but a plan soon became evident. Not every economist was on board. Many slashed their GDP estimates and some predicted inflation rising into the teens.

The OECD, the Organization for Economic Cooperation and Development, is a consortium of 38 mostly advanced economies that coordinate on economic policy, data standards, and research. It’s like a global think tank with government members: it publishes closely-followed forecasts, sets statistical benchmarks, and analyzes everything from taxation to trade. When the OECD weighs in on growth or tariffs, markets listen because it's one of the most data-dense, model-heavy institutions in the world. Basically, a think tank that thinks…um, a lot. In June of this year the OECD warned that the US GDP would slow to 1.6% for the year. By September, the OECD revised its forecast upward to 1.8%, and this morning it raised its forecast once again to 2%. It got me thinking. Where are those “end of days” hallmarks? Just looked out my window down into the square and I saw some joggers (it’s early), a lone dog walker, some pigeons, but not a sign of those Four Horseman. My neighbor in the suburbs has not buried any cans of beans in his backyard in months. What gives?

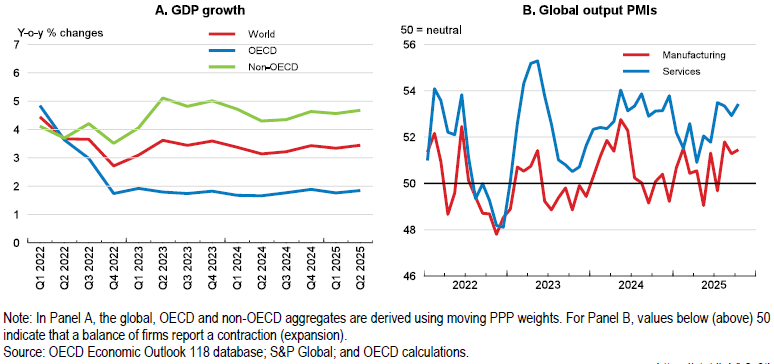

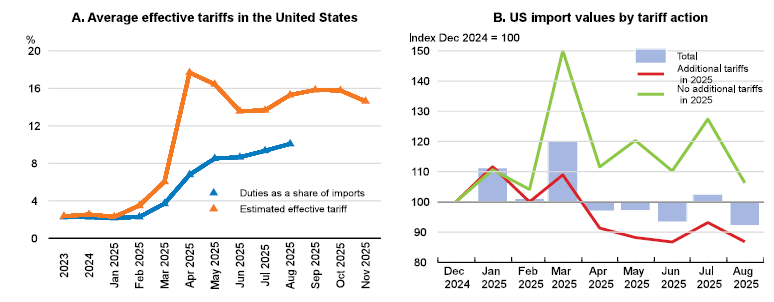

What gives, indeed. According to the OECD, quite a lot–and almost all of it runs counter to the doom-and-gloom narrative we all expected back in April. Despite the shock-and-awe tariff barrage, the economy has been doing something deeply inconvenient for the apocalypse set: it has been refusing to die. And the OECD spells out why. The first reason is almost embarrassingly simple. The full force of the tariffs hasn’t actually hit the economy yet. The report notes that while the legislated effective tariff rate shot up from 2.5% to 14%, the observed tariff rate–you know, what’s really being collected at the border–was only 10.1% through August. The difference, as the OECD explains, comes down to logistics, timing, and some corporate ingenuity. Firms front-loaded imports early in the year, filling warehouses before the new tariffs kicked in. They also had enough margin cushion to absorb some of the higher costs instead of passing them fully on to consumers. And because of how customs law works, anything already in transit when the tariffs were announced got exempted. In other words, some of the tariff “bombs” were duds on impact, not because the policy wasn’t real, but because reality doesn’t move as quickly as… well, political theater.

But even more interesting, at least to card-carrying econ nerds like me, is that the OECD finds the economy didn’t just dodge a bullet; it actually accelerated in some important places. Indicators of economic activity through August showed “more robust growth” and, critically, growth that was less reliant on AI investment than earlier in the year. For months we’d been told that the economy was essentially NVIDIA and friends dragging the corpse of the US consumer along for the ride. But that narrative is breaking down. Retail sales, personal income, and broader business output have strengthened. 🎉 Corporate earnings call transcripts, a treasure trove of sentiment data the OECD mines like gold (just like we do 😉), show no signs of companies pulling back on investment intentions. Even with tariff shockwaves ricocheting around the world, firms are still planning, spending, and hiring for the future. Now we know that there have been some recent signs of exhaustion, but it's not exactly what you’d expect in an “end of days” macro backdrop.

And then there’s the tech story–one the OECD leans heavily into. AI-enabling goods now make up 15.5% of total world merchandise trade, with two-thirds of that coming from Asia. The US is at the center of this demand wave. ICT investment (aka tech gear, for the non-nerds) is still growing at rates that would make even 1990s Cisco jealous. The OECD singles out rapid ICT equipment investment in the US as a key global growth driver. It boosted Asian exports, bolstered supply-chain resilience, and offset weakness elsewhere. In other words, even if tariffs were throwing rocks into the global pond, tech was generating enough ripples to keep the water moving.

The report is also blunt about one other thing: the US consumer–beleaguered as we all like to portray them–is still spending. WOOHOO–regular followers, you know this makes me happy. Yes, sentiment is soft. Yes, food prices have been annoying. But real incomes have been rising for a large enough share of households to support ongoing consumption. The job market has cooled at the edges, but it hasn’t cracked. Wage growth has eased without collapsing. And longer-term inflation expectations remain stuck at a very normal 2.2%. None of that fits the doom narrative. Consumers act on reality, not vibes–and the reality is still decent enough for them to keep those wallets open.

Then we arrive at tariffs again, but this time in a more nuanced form. The OECD is crystal clear that while the eventual impact of the tariff increases will weigh on activity, the early effects have been smaller than almost anyone expected. Why? Because models make assumptions and businesses make choices. Companies have used inventories. They’ve adjusted supply chains. They’ve rerouted trade flows. They’ve taken advantage of new trade agreements that lowered some tariffs even as others went up. The OECD even points out that recent deals with Japan and the EU reduced tariff rates on key categories like cars, parts, and civil aircraft, actually offsetting some of the broader tariff shock. That’s the thing about global economic systems: push here, pull there, and the whole machine tries to find a new equilibrium. It’s messy, but it’s also resilient.

The other big surprise in the report is that global trade didn’t collapse. It actually held up far better than economists assumed. Global trade volumes grew at an annualized pace of 8.1% in the first quarter due to front-loading, and while US import volumes fell sharply thereafter, this drop was offset by strength in Asia-Pacific. What looked like a fatal blow to the system turned out to be a massive global reshuffling of who sends what to whom.

And here’s where it all comes together: the OECD upgrade to 2% U.S. GDP isn’t a feel-good story about policymakers sticking the landing. It’s a cold, data-driven confession that the economy has been more flexible, more adaptive, and… well, more stubborn than expected. It’s a recognition that businesses didn’t panic, they adjusted. Consumers didn’t fold, they kept spending. Tech didn’t cool off, it went supernova! 💥 And tariffs, while undoubtedly distortive and painful and inflationary, didn’t detonate on impact. They’re spreading, slowly, unevenly, with lags and buffers and backdoors. A punch in slow motion is still a punch, but it hurts a lot less on day one.

Does that mean we’re in the clear? Not at all. The OECD is very open about the risks. Once those tariff lags unwind, once inventories are depleted, once margins shrink, and once the tariff revenue numbers converge with effective rates, the drag will grow. Inflation could re-accelerate. Consumption could soften. Investment could wobble. Nobody gets out of a global tariff war without bruises. But here’s the twist: there is also a real chance that all this stress–the deals, the buildup, the forced supply-chain rewiring–actually pays off in the long run. Economic pain isn’t always wasted pain. Sometimes it rearranges incentives in a way that produces more resilient structures. Sometimes it spurs investment in the right places. Sometimes it forces clarity. The OECD hints at this in the upside scenario: stronger tech investment, new AI advances, and onshoring could all create upside surprises that offset the tariff drag.

And that brings me to a final point: being reactive is a wealth destroyer. If you dumped stocks the moment those Rose Garden posters went up, you missed the part where the economy said, “Not today.” You missed the rally, the tech boom, the data turning, and the revisions climbing. React to noise and you’re guaranteed to whipsaw your own portfolio. Stay calm, stay analytical, and stay focused on how the machine actually works–not how loudly someone is hammering on it–and you give yourself a chance to capture the upside that follows the fear.

The end of days may come someday. But according to the OECD–and according to the joggers, pigeons, and unburied backyard bean cans–it sure wasn’t this year.

YESTERDAY’S MARKETS

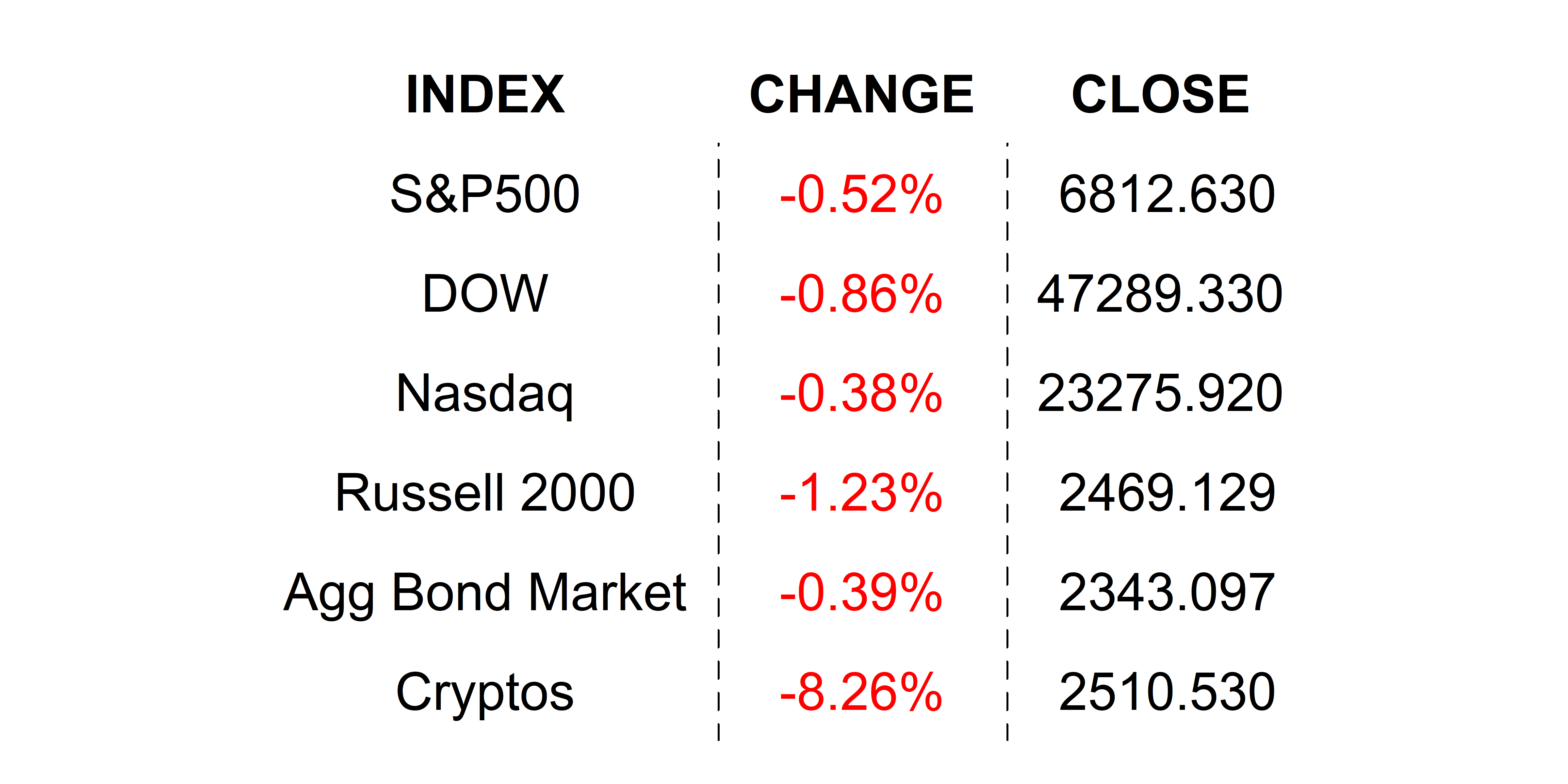

Stocks declined yesterday as traders had second thoughts on last week’s surge. NVIDIA’s investment in Synopsis was scrutinized and deemed “OK” helping the Mag-7 hold its ground. Bitcoin slipped back into the pain zone, while silver made new highs.

NEXT UP

-

Today, we will get a truckload of delayed September economic data including housing data, Leading Index, Durable Goods Orders, Factory Orders, and Producer Price Index / PPI. These can move the markets, but it is important to note that they are stale. Fed speculation will continue to dominate trade.

-

Important earnings today: Okta, Marvell, Crowdstrike, American Eagle Outfitters, and Pure Storage.

.png)