Powell’s waiting, the Senate’s stuck, and the President’s deadline looms. The war may be over, but the market’s stress isn’t.

KEY TAKEAWAYS

-

Oil has returned to pre-strike levels--markets priced in a best-case outcome

-

Equities are up year-to-date, showing resilience post-conflict

-

July 9th marks the end of the tariff delay period--key risk ahead

-

Senate faces pressure to pass a tax reconciliation bill before July 4th

-

Powell signals “wait and see,” but July cut still unlikely at 20% odds

MY HOT TAKES

-

Markets don't fear conflict--they fear uncertainty--and that fog just cleared

-

Rely on data-driven probabilities--not political messaging--to guide calls

-

The oil drop and equity rally validate conservative, Bayesian expectations

-

Wall Street may be still too complacent about the risks stacking up in July

-

JPMorgan’s earnings is the first domino--what it says could tip the whole market

-

You can quote me: “From the market’s perspective, the mission was a direct hit—14 direct hits.”

Mission: accomplished. You know what I was doing in my spare time during the 12 days of the… well, “12-Day War?” Of course, you do, I was calculating and recalculating the price of crude oil in all possible scenarios. My Google Earth Map was frozen on the Strait of Hormuz and the four shipping lanes that run through it. I was monitoring ship traffic on Bloomberg like a proper, old salt! Taking the analysis further, I was calculating upsides and downsides for each sector in worst, expected, and best case scenarios. I shared the results of those analyses with you in a few of my newsletters, blogs, and videos. What I didn’t share were my estimates for probabilities of those outcomes as well as the bayesian trees I used to calculate the expected outcome.

I used the most conservative methodologies I could and still came up with a positive expected outcome, which is why I did not hesitate to go on record with the press. But here is the thing, the weekend mission actually yielded a best case scenario which even my models deemed as possible but highly improbable. Limited scope mission, limited collateral damage, direct hits, minimal response by Iran, and a ceasefire between Israel and Iran. Now, yesterday, it was reported that a leak showed that the strike did not completely “obliterate” Iran’s nuclear program, but in fact, only set it back. Even if Iran has some enriched Uranium hidden somewhere, it is not likely going to be in a hurry to get back to the bomb-building business any time soon. Remember, its airspace is still vulnerable to Israel, the US, or anyone else for that matter.

What about the Strait of Hormuz? I just checked: all clear. Wait, shall we check the pudding for proof? Crude oil dropped back down to its pre-war level. Equities? Now up for the year and just below highs. From the market’s perspective, the mission was a direct hit–14 direct hits. 💥

Now, why did I spill so much ink on what you probably already know. Well, I wanted to send this one out with applause and make it clear that it is now time to put that behind us and focus on the plateful of other risks still vexing markets.

July 9th, the last day of the President’s delay period for the “Liberation Day” tariffs, is fast approaching. We are told that we should expect some deals in the coming days, but we know that some of the US’s biggest trade-partner-negotiation-opponents have openly continued preparations for counter-measures. The administration is therefore hard-pressed to get some bigger deals complete before the deadline, OR, a plan B for the bevy already announced and soon-to-be-enacted tariffs. Will the President extend the delay?

On July 4th, I will be savoring my once-a-year-extravagance: a foot long grill-frank (aka a big overpriced hot dog), complete with spicy mustard and sauerkraut. Lawmakers will not be so lucky. Members of the Senate will be locked away in their chambers if they cannot find a way to agree on a tax reconciliation bill and send it to Pennsylvania Ave for a signature. The market has this factored in, but a miss could cause pain.

Then there is the Fed–ahhh, the Fed–the sit-and-wait Fed. In yesterday’s piece, I highlighted all the ways big Bankers can make things better for the economy, the government, and our stocks. The Chairman told Reps that he is going to continue waiting until he sees. Expected, for now. He will most likely tell Senators something along those lines today in his second day of testimony. Powell did not rule out a cut in July, the FOMC’s next meeting, but the admission wasn’t enough to move futures markets, which put the probability of a July cut at 20%--bad odds by Wall Street’s standards. But that can change in the interim as it is still more than a month away.

And by the way, stuff is happening. The housing market is still in shambles according to the latest collection of data. Consumer Confidence dropped last month, according to the Conference Board’s latest survey. Additionally, in case you missed it, companies are starting to announce layoffs more frequently. That is just anecdotal for now–we will know more tomorrow, next Thursday… and well, all Thursday’s forever about weekly initial unemployment claim filings. In a few week’s the BEA numbers will give us a more comprehensive view, but that will be a Friday, the first Friday of next month–but no, this time it will be on a Thursday, because July 4th (of Big Beautiful Bill due date-fame) is on that Friday. Oh, and on the Tuesday after the Friday after that Thursday, earnings season will kick off with the Financials. JPMorgan Chase will head the parade. Its stock is trading well above the average analyst target for the stock and EPS estimates are climbing. Will the results justify it? If not, it might portend pain for the sector and possibly cast a shadow over the entire earnings season.

Happy summer! One mission was accomplished for now (that book may not be closed), we must now focus on the barrel full of others that are still in the way of clearing the path for equities to get back on their bullish way. Applause is over, sit back in your seat and get comfortable, because the show is far from over. Stay focused, stay calm, and keep cool. Your wealth is counting on you.

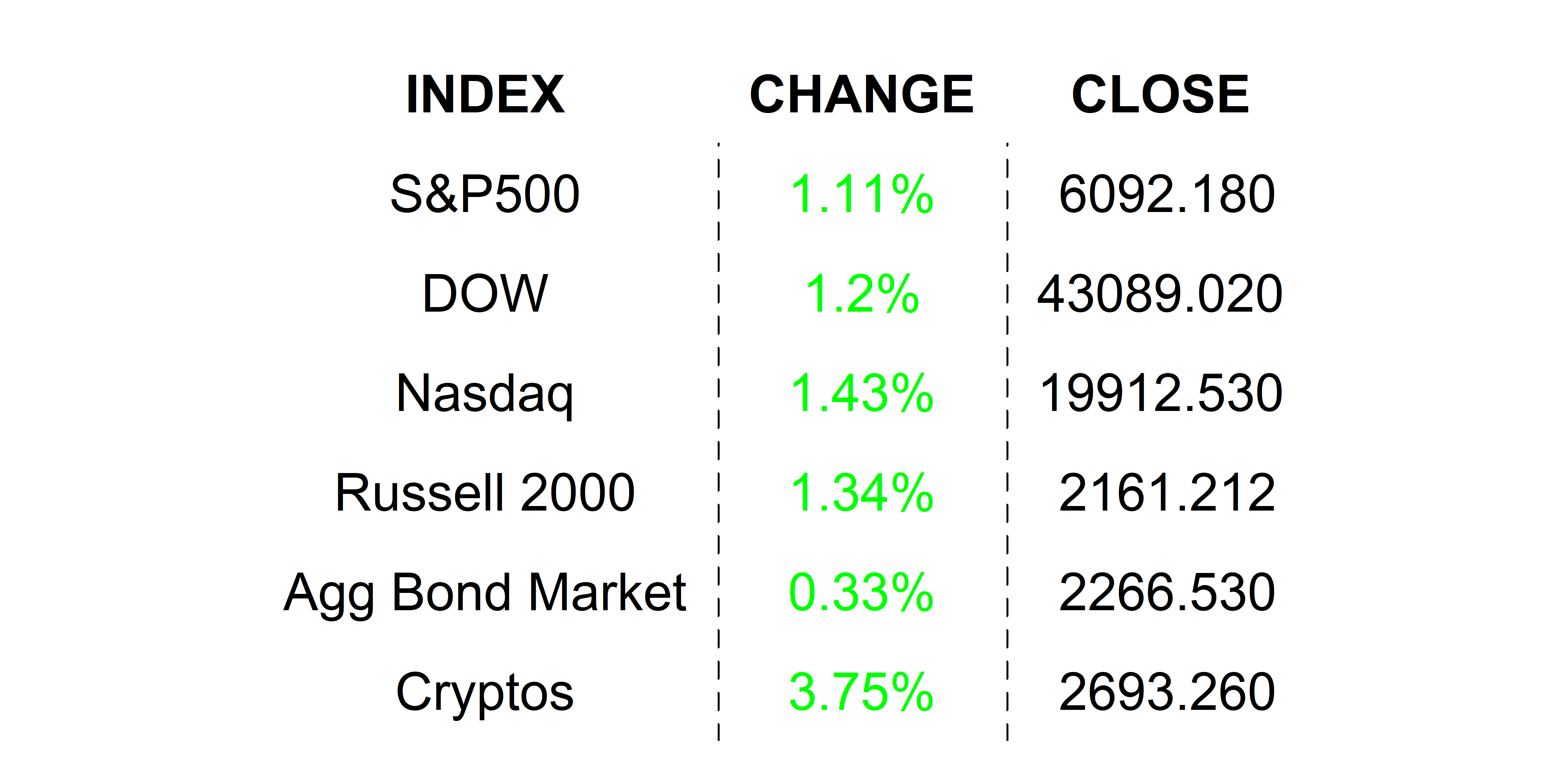

YESTERDAY’S MARKETS

Stocks rallied yesterday in response to an announced ceasefire between Israel and Iran–one that has mostly held after the President whipped an f-bomb at them. The President also whipped an ambiguous tweet about Iran selling oil again, causing crude to drop, bolstering the equity rally. Crude ended the day off by around 6%.

.png)