AI panic has crushed software stocks—but are investors throwing out high-growth “babies” with the bathwater? A valuation-driven reality check.

KEY TAKEAWAYS

-

Markets are cyclical, and valuation extremes tend to correct over time. Avoid assuming every period of elevated multiples automatically signals an extended winter ahead.

-

Recent selling in AI-linked software names has been driven more by narrative than deterioration in fundamentals. Distinguish between multiple compression and business decline before making portfolio decisions.

-

Companies like ServiceNow, Salesforce, Intuit, and Thomson Reuters continue to grow revenues and embed AI into their platforms. Evaluate whether AI is a threat to their model—or an enhancement to it.

-

Market overshoots can create opportunities when durable franchises are mispriced alongside weaker peers. Separate fragile models from companies with embedded data, workflow control, and institutional trust.

-

Capitalism clears excess, but it often does so indiscriminately in the short run. Apply disciplined analysis rather than reacting to fear-driven price action.

MY HOT TAKES

-

AI is a tectonic shift, but tectonic shifts create volatility before value. Patience is required to benefit from structural change rather than being shaken out by it.

-

Multiple compression alone is not evidence of structural disruption. Strong growth combined with AI integration suggests evolution, not extinction.

-

Data ownership and workflow integration are strategic moats in the AI era. Companies that control structured, longitudinal data have an embedded advantage.

-

Narrative velocity is distorting price discovery in parts of the software ecosystem. Investors must slow the story down and speed the analysis up.

-

Market purges are healthy, but indiscriminate selling creates mispricings. The disciplined investor’s edge lies in distinguishing babies from bathwater.

-

You can quote me: “AI without trusted data is noise–AI layered onto proprietary data is durable value.”

Babies in the streets. Now, I know that tagline evokes all sorts of uncomfortable images in your mind, but–I suppose–that is kind of the idea. I want you to focus carefully on this and I want to ensure that you remember this note. My regular readers know that I am a big fan of Economist Milton Friedman’s work, particularly as it relates to allowing markets to do their handywork; human intervention–while best intentioned–often causes painful inefficiencies which hampers progress. In other words–be patient and let the magical forces of the economy and markets do their thing! “Be patient,” in case you didn’t know, instant-gratification junkies, means that course corrections take time. If a stock is incorrectly overpriced, markets will eventually correct it–or the stock will rise to the occasion by backfilling into its value.

In case you haven’t noticed stocks are considered expensive right now. Actually, they were quite a bit more expensive at the start of Q4 last year as the forward PE of the S&P 500 topped out at around 23x. Heuristically speaking, investors believe anything over 20x is expensive. That is because the multiple spent much of the QE years trading in the high teens. But if you look farther back to the Global Financial Crisis, you would find stocks cheaper yet in the low teens. Going back to the Dotcom bubble era, you would find a forward PE in the high 20s. Wait, why not just show you a chart? Have a quick look, then let's talk babies.

On this chart you can clearly see how valuations swelled in the period leading up to 2000 only to fall back to earth in the 8 years that followed, culminating in the GFC which actually caused values to become cheap–it went in the OTHER direction. So, we had overvalue ➡ ️ ️correction ➡ ️ undervalue ➡ ️ correction ➡ ️ overvalue. Using this same logic you can see how values rose again leading up the pandemic and corrected in 2020 only to swell once again and find a correction in 2022 at the hands of the Fed. Ignoring last year’s early spring swoon, stocks have remained in that “expensive” zone for the better part of the past 12 months begging many to call it bubble 2.0. If one casually follows these cycles and is a bubble believer, we can expect an 8-year winter where markets correct valuation similar to the post-Dotcom era. That fear has certainly stoked some of the recent selling as investors, like a roving mob, swarmed through the markets beating down anything that had to do with artificial intelligence, the spark that started this last wave of value growth. From a Friedman standpoint, this is the market doing its handywork, however the pace and intensity–which surprised many of us Wall Street insiders–has possibly provided some hidden opportunities, where babies have been thrown out with the bathwater. Hence, that graphic image.

The most recent wave of selling started in software and it even has been coined “software-mageddon” or “SaaS-pocalypse”--or any permutation of those. The filter: any company that provides a service that can be replaced by AI gets the hammer. That incorrectly formulated condition is the reason why so many babies have taken flight. Let’s take to the street and find some potential baby examples.

Look at ServiceNow. Down roughly -30% year-to-date, tagging 52-week lows as if something fundamentally broke. Yet in its most recent quarter, total revenue was $3.6 billion, up 20.5% year-over-year, beating consensus expectations, with non-GAAP diluted EPS up 25% year-over-year. That is not deterioration. That is growth. The company has embedded AI into its platform, not as a defensive patch, but as an offensive layer. It is no longer simply an IT ticketing system. It is the infrastructure layer upon which the autonomous enterprise is being constructed. Its AI-related annual contract value is tracking toward a $1 billion milestone in 2026. The sell-off here feels like sentiment running ahead of logic. The market is treating ServiceNow like a casualty when the numbers suggest it is a builder. It has baby-like features.

Then there is Salesforce, down roughly -30% year-to-date. Revenue grew 9% year-over-year in the third quarter, and the company raised its 2025 full-year sales forecast. That is not what disruption looks like in real time. Salesforce is not being ambushed by AI agents. It is deploying them. Agentforce is central to its go-to-market strategy entering 2026. The narrative suggests AI will eat CRM. The economic reality is that AI needs a system of record to be effective. Customer data, sales pipelines, marketing flows, service logs–that is Salesforce’s core competence. The market is pricing Salesforce as if it is about to be displaced by what it is actively commercializing. That disconnect is precisely why the right question matters.

Intuit has taken one of the sharper hits, recently falling nearly -11% in a single session and now down more than -43% year-to-date. The headline fear is simple: why pay for TurboTax if AI can file taxes for free? It is an attention-grabbing soundbite, but it ignores structure. Intuit has been embedding AI into TurboTax and QuickBooks for years. It serves roughly 100 million users. It possesses decades of proprietary tax data and deeply integrated financial workflows. The relevant question is not whether a general-purpose model can answer tax questions. The relevant question is whether a company sitting on structured, longitudinal financial data (that means same data, similar situations, over time, for you non-academic types 😉🤓) and a massive installed user base is better positioned to deliver AI-powered financial assistance than a model trained broadly on information scattered about the internet. The stock is being priced as if TurboTax is already obsolete. The business trajectory does not suggest that. That, too, looks like a baby.

Thomson Reuters offers perhaps the clearest example of narrative overshoot. The stock plunged roughly -16% after a new legal productivity tool from Anthropic hit the market. The immediate assumption was that legal AI makes legacy research platforms redundant. Yet when Thomson Reuters reported earnings, it projected organic revenue growth of around 8% in 2026 along with operating margin improvement of roughly 100 basis points. Westlaw sits atop one of the most comprehensive legal databases in existence. That proprietary corpus (the technical term for a large, organized collection of written information or documents) is not a liability in an AI world. It is precisely what makes AI outputs reliable in legal contexts. AI without trusted data is… um, noise. AI layered onto curated legal content is productivity. The market reaction treated the company as a victim. The forward guidance suggests something else. Another baby?

Now, none of this is an endorsement to blindly buy every dip. Some software companies were built on fragile models, aggressive assumptions, and easy-money multiples. Some deserve to be marked down. Markets clearing out fodder is healthy. Excess gets burned off. Weak hands are exposed. That is capitalism doing what capitalism does.

But in the process of clearing the system, markets often overshoot. They compress multiples indiscriminately. They trade narrative instead of numbers. They assume capability equals destruction. That is when homework becomes valuable.

Take a step back. Recognize that this is the market flushing out excess while simultaneously mislabeling strength as vulnerability. Separate the companies that merely rode the AI wave from those that are quietly laying its foundation. Ask the right question. Who owns the data? Who owns the workflow? Who owns the customer relationship. Who has institutional trust. Who is embedding AI into a durable model rather than being displaced by it.

There are certainly companies that deserve to be marked down. But there are still many babies. Go back and apply the right question. You have your homework. Now get to work.

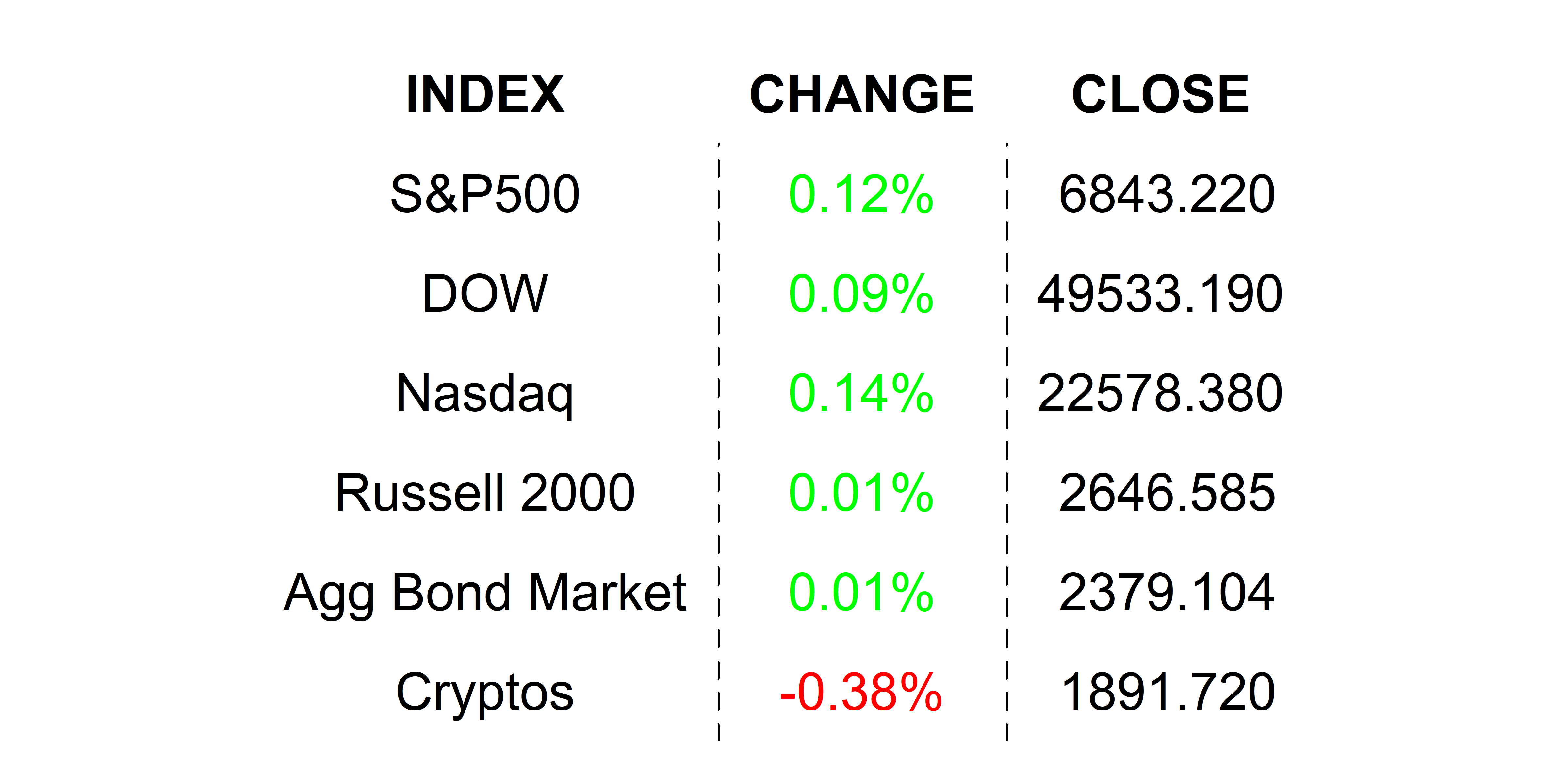

YESTERDAY’S MARKETS

Stocks spent most of yesterday’s session clawing back early losses sparked by continued AI-valuation themes. Gold and Bitcoin gave up ground and the Dollar caught a bit extending recent gains.

NEXT UP

-

Durable Goods Orders (December) slipped by -1.4% bettering estimates and markedly weaker than the prior month’s 5.4% gain.

-

Housing Starts and Building Permits (December) both came in above estimates, climbing by 6.2% and 4.3% respectively.

-

Industrial Production (January) may have gained 0.4% after climbing as much in December.

-

At 2:00 PM Wall Street Time, the Fed will release the minutes from its January 28th FOMC meeting giving traders a chance to see just how broad the consensus was to keep rates unchanged–and maybe a few other market-moving tidbits.

-

Important earnings today: Wingstop, Global Payments, Charles River Labs, Analog Devices, Verisk, Molson Coors, Booking Holdings, Blue Owl Capital, Occidental Petroleum, DoorDash, Figma, eBay, American Water Works, Carvana, Texas Pacific Land, and Omnicom.

.png)