Stocks climbed yesterday as traders awaited some key earnings and tomorrow’s Fed minutes for some direction. Fed officials are determined to get a summer off, choosing to be reactive rather than proactive, forgetting how that worked for them a few years ago.

Just nod if you can hear me. FOMC members are out front and center these days and boy are they talking up a storm. In a few weeks, the group of big bankers will meet to discuss interest rate policy and if you listen to the wild things they are saying (AND I DO, SO YOU DON’T HAVE TO), there would be absolutely no misinterpreting their intentions on near-term policy. These missives have not escaped swaps traders who give a June rate cut a 3.5% chance of happening. May as well make it zero. Any safer bets don’t come until September where there is now a 75% chance of a -25 basis-point cut. If you have been watching the stock market recently, it appears that traders have lost interest in the Fed as the Nasdaq hit a fresh high yesterday and even the dull Dow (which should, in theory, be very sensitive to high interest rates) closed above 40k last Friday. However, rates DO matter, and at some point, if the Fed continues to ride the brakes, the probability of recession will increase. AND I don’t care what anyone else thinks, I can tell you that a weak or contracting economy is not good for any company.

Yesterday, Atlanta Fed President Raphael Bostic admitted that he thought that rates will ultimately stabilize at a higher level than they were in the past decade. Ok, Raphael, rates were like 0% in the last decade, so, thanks for that bold view. The question is at what rates and when will they… um, stabilize. Bostic’s colleague Michael Bar, Fed Vice Chair, said yesterday that he was “disappointed” in recent CPI numbers which do not support immediate rate cutting. Ya, Michael, we are all disappointed in the numbers as well, but why, again, should rates remain restrictive? Is it because higher interest rates are going to force consumers to demand less due to higher financing costs?

Can I please remind you, AGAIN, that goods prices dis-inflated in the last CPI release and, in fact, have been quite tame over the past year. Food price inflation has also receded markedly since Q3 of last year. The big problem still remains in services, most specifically, RENT. If the Fed can figure out how to keep rent from growing north of +3%, then we would have this inflation thing licked, once and for all. However, that is a tall order.

Prices of homes are still too high for many folks. That has a lot to do with low supply which is driven by changing demographics and… um, high interest rates. Boomers are not selling their homes and migrating to retirement zones. There are lots of reasons for that, chief among them is that retirement homes which were typically cheaper allowing a downsize, are… MORE expensive, and also in short supply. Non-retiring homeowners too are reluctant to sell because of sticker shock and high mortgage rates. Ah, there it is, we finally got to rates. Lower mortgage rates would serve to free up some supply and would likely, help lower inflation. But wait, we are not talking about home prices, we are talking about rent. That’s right, because of all this craziness, demand for rentals is high. Higher demand is keeping rent inflation high. But there is something else. High borrowing costs for landlords is ALSO keeping rent inflation high.

So, my friends, it would seem that the last sticky area of inflation may be sticky due to the very high interest rates maintained by the Fed to fight inflation. So, if Mr. Barr is disappointed, perhaps he should have his staff economists look into the extremely well-known relationship interest rates and borrowing costs have with real estate. For that matter, so should all of his colleagues. In closing, I will admit that if these high rates drive the US into a recession, it is likely that rent inflation may be finally extinguished… along with everything else.

STOCKS ON THE MOVE BEFORE YOUR FIRST COFFEE

Lam Research Corp (LRCX)

Is higher by +4.67% in the premarket after announcing a stock buy back and 10 for 1 stock split. The semiconductor production equipment company has enjoyed a +61% gain over the past 12 months as the industry continues to expand rapidly, and with a share price of $942, a stock split will be welcomed by investors who like to buy stocks at lower absolute prices, though the absolute price has absolutely nothing to do with value… but it is a thing. One cannot however argue that a stock buyback is positive for shareholders. Dividend yield: +0.84%. Potential average analyst target price upside: +5.4%.

Palo Alto Networks (PANW) shares are lower by -7.88% in the premarket after the company announced that it beat EPS and Revenue estimates by +4.94% and +0.84% respectively. Results represent a notable decline in sales growth but is consistent with its competitors as IT managers curb spending. This despite a rise in cyber-attacks, indicating that the slowdown in bookings may have more to do with overall economic conditions than the company’s products. Even so, a slowdown in revenue growth is a slowdown in revenue growth, no matter what the cause. The company also lowered its current quarter guidance with revenues on the low end of analysts’ estimates and billings below analysts’ estimates. In the past month 14 analysts have increased their price targets while 3 have lowered them. Potential average analyst target price upside: +5.4%.

Also, this morning: Macys and Lowe’s both beat on EPS and Sales while AutoZone came up short.

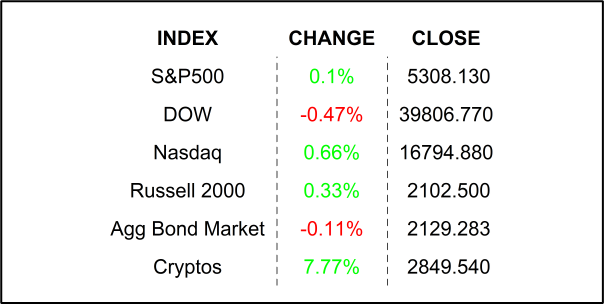

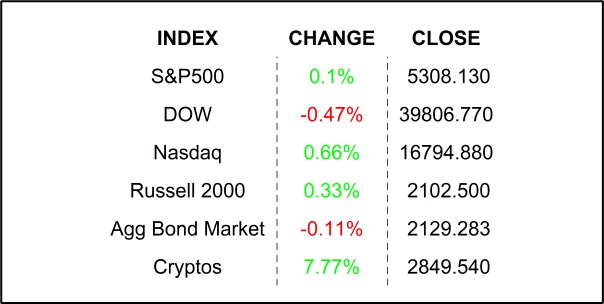

YESTERDAY’S MARKETS

NEXT UP

- No Major economic numbers today, but many Fed speakers, including: Barkin, Waller, Williams, Bostic, and Barr.

- After the closing bell earnings: Modine Manufacturing and Toll Brothers.

.png)