AI’s trillion-dollar promise meets the inconvenient math of debt and CAPEX.

KEY TAKEAWAYS

-

Oracle beat earnings but the stock fell sharply in the premarket

-

AI infrastructure requires massive upfront investment

-

Debt levels and CAPEX intensity are now major investor concerns

-

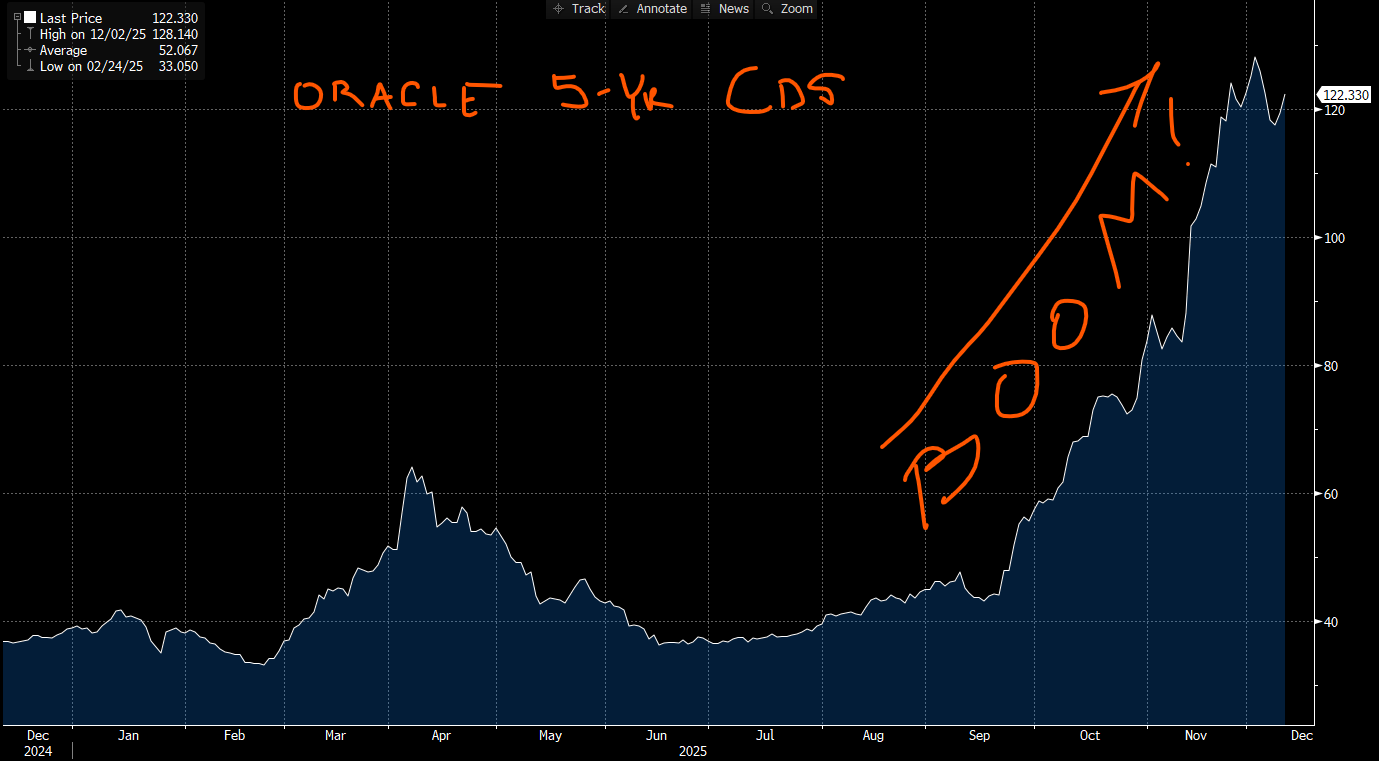

Credit markets are pricing higher risk for Oracle through CDS

-

Fundamentals and risk discipline are reasserting dominance in AI investing

MY HOT TAKES

-

The market is waking up to the true cost of AI expansion

-

Balance sheets are becoming more important than narratives

-

Oracle’s selloff is about fragility, not failure

-

This era will reward disciplined operators, not the fastest spenders

-

Growth is meaningless if financing risk overwhelms execution

-

You can quote me: “Some AI companies won’t just miss targets--they won’t make it out alive.”

Such a deal. I have a good opportunity. Actually, I am going to let you pick from two. You can pick only one investment out of two. Company A and Company B both have great growth prospects. They both sell into a rapidly growing ecosystem which is expected to be the cornerstone of explosive growth for the next decade. In fact they have lucrative multi-year sales contracts, so we have a good idea of what to expect as a baseline. Both have many years of experience and have revenues and are profitable. Both have well-known brands. Let’s take one of my famous “step backs” to zoom out and get a lay of the land. The ecosystem which these companies sell into requires a very, very large upfront investment to service those long-term revenue-generating contracts. That is big challenge #1.

Now, let’s be clear. Cash does not just fall out of the sky. 🙃 Nope, it takes investment. It takes money to get… well, more money. No arguments yet, I hope–this is basic stuff. Some companies invest in people to develop intellectual property. Think tech or pharmaceuticals. Other companies invest in capital-intensive plant. Think industrials, mining, energy, utilities. The former is R&D intensive and latter is CAPEX (Capital Expenditures) intensive.

Getting back to this fine opportunity I am presenting to you. Both of these companies are a hybrid. That’s right, they rely on intellectual property AND capital-intensive plant and equipment. On the surface both companies look quite similar, but scratching the surface and looking just one layer deep, differences emerge immediately. Company A has a lot of debt while Company B has significantly less debt. Having debt is not a problem. In fact, debt and the ability to deploy it is a good thing, especially when it comes to capital-intensive projects where ROI (return on investment) is relatively straight forward to calculate.

I will take it one step further. More debt may not necessarily be bad either. More debt may mean more capital available to build infrastructure more quickly, increasing the chances of beating a competitor by capturing market share first. So, Company A with all its debt may actually win in the long run by building capacity first, leaving Company B in the dust. Company B will always be playing catch-up. Which company would you prefer to own?

Ya, I know, I know, it’s not that simple. If everything goes as planned Company B has much better prospects than Company A–assuming everything goes as planned. Will it? Company B is so levered up that a slight hiccup may cause it to miss a debt payment. It has some cash on hand, but being cash flow negative, means that it will burn through that cash pretty quickly. You still want Company B? Maybe, because the growth prospects are huge. It already has earnings growth of over 50%. That's fast growth! But that fast growth DOES NOT COME FOR FREE. Sorry, in finance there is just death and taxes… and risk. You have to increase risk if you want to increase your expected returns. Sorry, it’s a law of nature, like gravity. I will ask you once again, would you rather invest in Company A or Company B?

This must all sound very familiar to you and I know that you have already correctly identified these companies as being ones in the AI ecosystem. AI is in its early stages, so those great returns have not yet rolled in. I take that back, many have rolled in, but the big, big, big ones are still far on the horizon. We are still in the development stage where we are investing in the infrastructure that will support those big, big, big returns. No one is denying the size of the opportunity and everyone at this point (I hope) is denying that it takes investment and patience to get there. But–and this is a really big BUT–not everyone is going to make it out alive. Big opportunities come with big risks, and those risks will include defaults and maybe even bankruptcies. And that is very much on the mind of investors recently.

Last night, we got an earnings announcement from Company O–Oracle! Great company, great prospects, great top and bottom line growth. Oracle announced that it beat EPS projections by nearly 40%! The company’s stock is down by -12% this morning. In fact, even at yesterday’s close, the stock is off its September highs by some -32%. How can that be? Company O, like companies A and B has great prospects!

Yet here we are. Oracle delivered what most companies would call a victory lap: revenue up solidly year-over-year (14% growth), cloud services and license support growing in the mid-teens, infrastructure-as-a-service revenue continuing its rapid climb, and–oh yes–a nearly 40% beat on EPS. On paper, that is the kind of earnings report that earns a CEO an early tee time and a standing ovation on CNBC. But markets aren’t reacting to the paper. They’re reacting to the pressure points beneath it. Oracle’s stock, down double digits overnight and down more than thirty percent from its September highs, is telling you that this company, great as it is, innovative as it is, carries some structural challenges that make investors twitchy in a way most tech giants haven’t felt in years.

For starters, Oracle is a company in transition. It is simultaneously trying to stay relevant in cloud infrastructure, catch up to hyperscalers, power generative AI workloads, and keep its massive installed base happy. All of that requires… er, you guessed it–investment. Ginormous investment! Oracle has been leaning into CAPEX like someone trying to sprint uphill carrying a bag full of rocks, 🏃 and with that investment comes leverage, execution risk, and the uncomfortable reality that their cloud buildout must succeed at hyperscaler speed even though Oracle has historically moved at enterprise-software speed. That mismatch alone is enough to leave most traders sitting in a pool of sweat.

Layer in the growth expectations. Oracle’s cloud infrastructure business is growing fast, but not nearly fast enough to justify perfection pricing. Investors want to see hypergrowth; Oracle is delivering growth, but not hypergrowth. They want to see AI-related revenue explode; Oracle is showing AI-related demand, but AI-related demand does not yet translate to the revenue reacceleration that analysts had built into their models. In this market, as we have learned recently, “good” is not good enough. “Great” is only sometimes not good enough. Only “absurdly flawless” seems to satisfy the crowd, and Oracle did not clear that super-high bar last night.

But perhaps the most important element, one most everyday investors don’t watch but professionals obsess over, is credit risk. Oracle’s credit default swaps are priced like the company is jogging barefoot across a field of Legos. 🤣 They are expensive–far more expensive than what you would normally see for a company this profitable, this entrenched, this operationally competent. That tells you something simple but critical: investors are worried about the balance sheet. They are worried about debt loads, about the cost of maintaining them in a world where the front end of the curve is slowly drifting lower but long-term yields remain sticky, and about the sheer size of the capital required to catch up in the AI arms race. Widening CDS spreads are like smoke alarms. They don’t tell you the house is on fire, they tell you the wiring needs attention. Markets heard that alarm and did what markets do: price in the possibility, not the probability, of trouble.

And this is why Oracle is so sensitive. It is not a pure-play AI company where investors expect volatility. It is not a startup where losses and growing pains are priced in. It is one of the bedrock names of enterprise software. When a company like Oracle leans this hard into CAPEX, takes on this much debt, and tries to pivot into an ultra-competitive cloud world dominated by trillion-dollar hyperscalers with near-infinite resources, investors get uneasy. Not panicked, but uneasy. The earnings were solid. The story is solid. The execution must be perfect, and perfect is a high bar when every market conversation these days includes the phrase “AI infrastructure capacity.”

Now here is where we step back again–my favorite thing to do, lol. We are living in a high-tech, high-octane AI investment cycle that would make prior tech booms blush. Everything is moving too fast. Everything is priced for perfection. Everything carries both promise and danger. And yet, in moments like Oracle’s earnings reaction, I can’t help but feel that we’re being gently reminded of a very old truth: fundamentals matter. Not vibes, not narratives, not whatever new acronym showed up on a slide deck. Fundamentals. Debt levels. Cash flow. Profit margins. Managerial discipline. The boring stuff. The Graham and Dodd stuff.

Speaking of which, if you haven’t dusted off your dog-eared copy of “Security Analysis”, now would be a pretty good time. Benjamin Graham and David Dodd–professors at Columbia Business School in the 1930s–taught generations of investors how to value companies based on what they are, not what they might become in a perfect future. Graham, the father of value investing, mentored Warren Buffett, the Oracle (👀) of Omaha himself. Dodd co-authored the textbooks that built modern fundamental analysis. Their work was born out of the rubble of the Great Depression. an era not entirely unlike today’s volatility, where investors desperately needed a framework to separate durable businesses from thrilling-but-fragile stories. They argued for margin of safety, for skepticism, for discipline. For understanding the difference between a good business model and a business model priced as if failure were impossible. In other words, the exact mindset investors seem to have forgotten anytime someone whispers the letters ‘A’ and ‘I’ in the same sentence.

We don’t need to go backwards. But we do need to go back to basics. We need to remember that risk is not the villain here. Risk is the price of admission. You want high returns? Fine. You must accept high risk. You want transformative growth? Wonderful. You must accept hiccups, disappointments, tightened financing conditions, and yes, the occasional earnings report that looks great and still punches the stock in the nose. That is how real investing works. Even in AI. Especially in AI.

Oracle’s earnings didn’t reveal a broken company. They revealed a company pushing aggressively into a capital-intensive frontier where even slight deviations from investor expectations can create wild reactions. They revealed that leverage matters. They revealed that CDS spreads matter. They revealed that fundamentals matter more now than at any point in the past decade. And they revealed that in the coming years, the market will reward those who understand the timeless lessons of Graham and Dodd just as much as it rewards those who can utter the phrase “large language models” without stumbling.

So we come back to the question. Company A or Company B? Growth or discipline? CAPEX courage or balance-sheet conservatism? The safe choice or the one that might rocket higher if everything goes right?

Or maybe… just maybe… the real question is this: is it going to be Company A, Company B… or Company O?

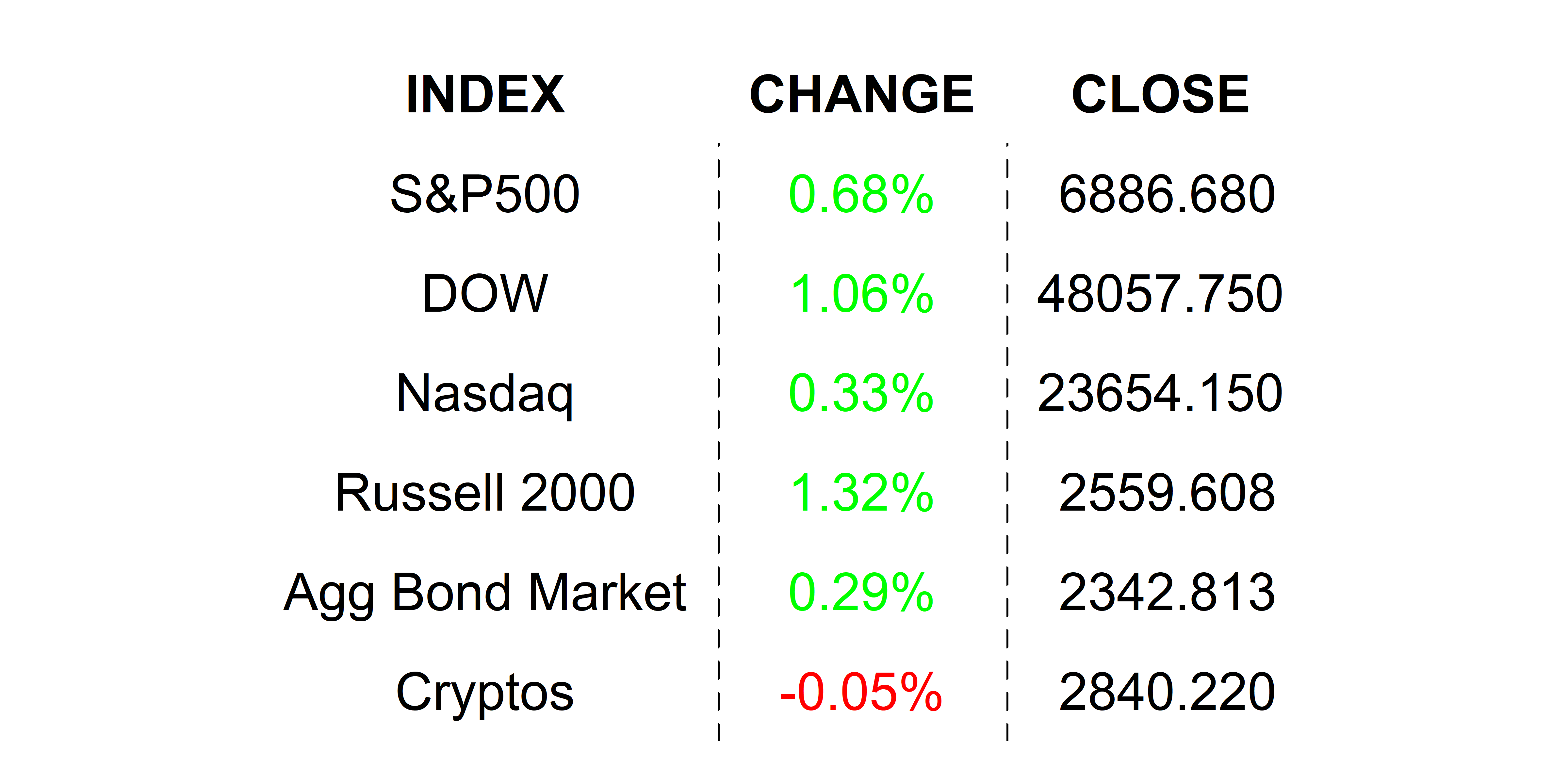

YESTERDAY’S MARKETS

Stocks rocketed higher in response to the FOMC rate cut. It was expected to be a “hawkish” cut, but turned out to be less hawkish than expected. Oh yeah, we still got the cut. No one cheered harder than small caps which are highly correlated to lower interest rates. Bond yields slipped despite an unchanged dotplot.

NEXT UP

-

Initial Jobless Claims (December 6th) is expected to come in at 220k after last week’s surprisingly low 191k claims.

-

Important earnings today: Ciena, Costco, Broadcom, and RH.

.png)