Stocks posted gains yesterday supported by tech heavyweights amongst confusion around what the controversial Supreme Court decision and a possible Trump presidency 2.0 would mean for the markets. US manufacturing falls further into contraction territory according to latest ISM figures.

The A team. In the largest economy in the world, in the biggest stock exchange on the globe, there resides a very exclusive club. To be in that club a company must be in the top 500 market capitalization rankings. Because market cap, at its simplest level, is calculated by multiplying a company’s outstanding shares by its share price, it is a reflection of strength. Either a company’s stock price has appreciated a lot, or its shares are so highly demanded that even doubling or tripling its float, its share price has support. Those are kind of the same thing, but the point is that a company has to be doing something right in order to get into that club. Of course, I am referring to none other than the S&P 500 Index. It is such a valuable distinction to be in that club, that many times when I use the noun “stocks” with no other description, I am actually referring to the S&P 500.

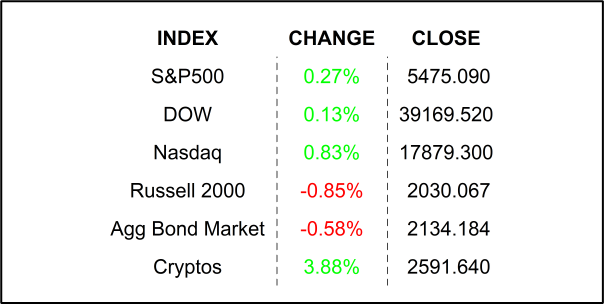

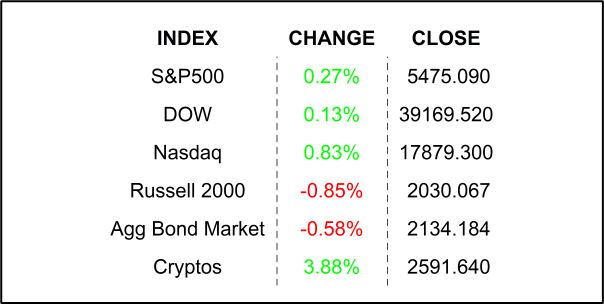

Once a stock has made it into that club, a bunch of analysts create an index by weighting each club member by its relative market capitalization. That number is compared to a similar number from 1941 (or thereabouts) at which time the index was set to 10. That is how those pocket-protector-wearing computer jocks come up with the 5475 or so, which is where we are today… er, yesterday afternoon at 16:00 Wall Street Time. You see the S&P itself is not traded but all its constituent stocks are, and as they go up and down, the index follows, a representation of the stocks’ performances.

You have to admit that it’s a nifty way to monitor the state of the stock market. But wait, that’s not completely accurate. There are over 3000 stocks that traded on the NASDAQ and more than 2000 on the NYSE. What about the also-rans who didn’t make it into the exclusive club? If one of those had a great day, doubling its share, or more pessimistically, a terrible day, halving its share price, the S&P 500 would not reflect it. No, only the stocks in the club.

So, now we have to qualify the description; technically, I can’t simply make a statement like “stocks are higher in the session.” I have to say something more like “the largest 500 stocks are higher in the session.” Do you think I am done? Of course I am not 🤣. Remember that stuff about the cap weighting? Yeah, that’s a thing. Because of the cap weighting, the largest of those large stocks have the most impact on the index. Guess who those are. Microsoft, NVIDIA, Apple, Amazon, Meta, Alphabet A and C, Berkshire Hathaway, Eli Lilly, and Broadcom. Those top 10 largest stocks make up almost 36% of the entire index! In fact, the top 3 make up 20% of the index. Number 500, Bio-Rad has a weight of only 0.01%. It may be a great company, and if it has a great day, it will have very little impact on the performance of the overall index. Back on the top, if Microsoft has a great day, its large weighting (7.25%) will have a noticeable impact on the index.

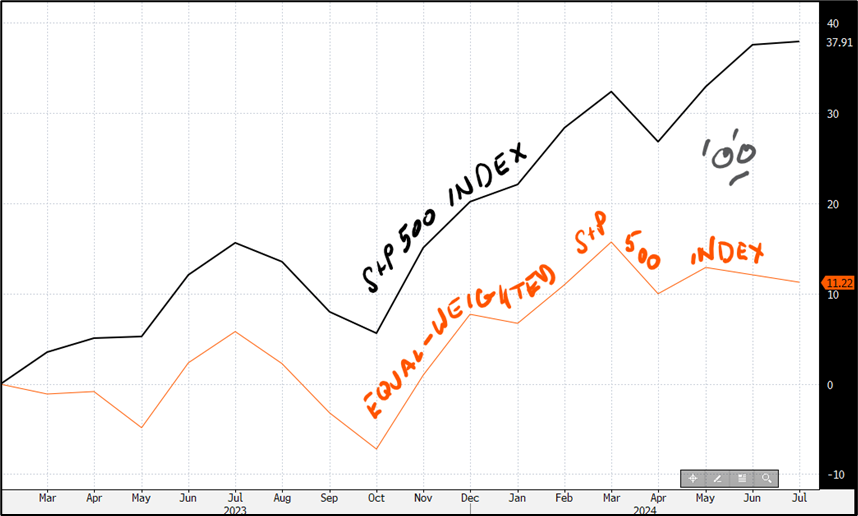

Looking back at those top 10, can you see a pattern? Sure, you can. Except for Berkshire and Lilly, they are all tech stocks. Apple makes up close to half of Berkshire Hathaway’s portfolio, so we can almost call it a tech stock. The only non-tech stock in the bunch, therefore, is Eli Lilly. The pharma company’s top 3 products, Mounjaro, Zepbound, and Trulicy, are all GLP-1 inhibitors… aka weight-loss shots, so we know how Lilly got into the top 10 of the elite group. Is it clear that the S&P 500 is not necessarily a realistic representation of “stocks?” Perhaps a better way to see how the large caps are doing is to look at an “equal-weighted” index, in which all stocks are treated equally. In other words, an index where Bio-Rad has the same impact as Microsoft. Check out the chart below of the traditional S&P 500 versus the equal-weighted S&P to see the stark difference between the two since March of 2023.

Knowing all this, it should be clear that I need to update my nomenclature. I clearly cannot say “stocks are higher.” It is still not even accurate to say, “the biggest stocks are higher.” Indeed, I should probably say something like “AI is booming and there is high demand for weight-loss drugs.” I can’t tell you, for sure how, the other 490 stocks are doing… I would have to look into it for you.

YESTERDAY’S SESSION

NEXT UP

- JOLTS Job Openings (May) is expected to have fallen to 7.950 million vacancies from 8.059 million.

- Wards Vehicle Sales (June) may have slipped to 15.8 million units from 15.9 million units.

- Watch out for a Fed-speak blizzard today with comments from Chair Powell and Austan Goolsbee.

.png)