A former inflation hawk just got tapped to run the Fed. Here's why that might be exactly what growth investors need.

KEY TAKEAWAYS

-

Warsh's "practical monetarism" seeks lower rates through tighter money first - shrinking the Fed's $6.5 trillion balance sheet to create conditions for cuts without sparking inflation.

-

This nomination hijacks earnings season just as Q4 results were gaining momentum and companies like Apple were demonstrating real execution over hype.

-

Tighter liquidity will accelerate the filtering process in AI and tech, exposing which companies have real unit economics versus those just riding the hype wave.

-

A credible, well-run Fed lowers risk premiums over time and forces capital allocation based on fundamentals rather than macro speculation.

MY HOT TAKES

-

The traditional "hawkish Fed = buy value" playbook is dead - we're hunting for value WITHIN growth opportunities, not rotating into utilities and consumer staples.

-

Warsh's tight money policy could pop the AI bubble before it fully inflates, weeding out pretenders now instead of suffering a catastrophic crash later.

-

Apple delivered 38% China growth and gets overshadowed by Fed noise, proving markets are still addicted to macro narratives over actual business fundamentals.

-

The overnight carnage was amplified because Warsh's nomination killed multiple crowded consensus trades simultaneously - gold, crypto, weak dollar, and dovish Fed bets all unwound at once.

-

A strong Fed that prices capital honestly is the best thing for serious long-term investors who want to be rewarded for discipline instead of just trading the next FOMC meeting.

-

You can quote me: “A Fed with a monetarist at the helm will clamp down the filter on even the most spend-happy AI players, leaving us only with the ones who can afford it. Was a bubble just avoided?”

Plot thickener. So here we are, a few days past an FOMC meeting which yielded us neither a rate cut nor any tradable information. It was pretty much as expected with some very minor surprises. Namely the fact that the Fed thinks the labor market is “stable.” I won’t get into that now, but my regular followers know my thoughts on that.

Yesterday was a busy day for me. Aside from my regular duties as a Chief Investment Officer, I had 2 scheduled press interviews and fielded at least 2 impromptu press inquiries. I love those–they pop up on my Bloomberg messenger or my mobile phone right in the middle of a critical trade or minutes before a deadline. All joking aside, I do love those, because they usually give me an indicator on what is buzzing around newsrooms that have not yet made it to the tape.

Most of yesterday’s discussions were around earnings and what to expect next in the markets. I often joke about how markets are addicted to the potential for rate cuts. Can a 25 basis-point rate cut on the overnight rate between banks better-justify the super-high forward PE of your favorite growth stock? You don’t have to answer that question, I will: hell no. I know about the math behind theoretical stock valuations and their sensitivity to interest rates, but I also know that theoretical value is just that, theoretical, and that the market ultimately decides the value of a stock. That is why I would much rather base my investment thesis on company fundamentals than what a group of insular bankers/economists do in their poorly-lit, grey meeting room in Washington DC. To be clear, interest rate policy is extremely important and it definitely impacts the economy and that certainly affects stocks. To make too-long a story short, I quipped yesterday that the Fed is likely to be on hold until summer, so now we can finally focus on what is important: earnings season.

That’s right. Q3 earnings season back in 2025 was a mess. Not the earnings–they were great–but rather the market’s reaction to those great earnings. That response set a really high bar for Q4 earnings season which started a few weeks back and just hit its stride this week. Perhaps investors would be able to view this earnings season with a clear head. A perfect setup for 2026. We kind-of know the impacts of tariffs, we have a good idea about where the Fed is at, we have an inkling about administration policy, and stocks that were really expensive last year are… er, a bit less expensive now. A perfect opportunity to re-form our investment theses. When I said that we have a good idea about where the Fed is, I meant that we expect policy to ease–not tighten–and we will have to be patient.

We had some interesting results in earnings so far, and this week we got the first wave of Mag-7 earnings and a bunch of fresh info on the state of artificial intelligence. We know that we are now in an era of “show me the margins.” As one journalist said yesterday “are you saying, Mark, that we need to look at EBITDA multiples now instead of revenue multiples?” Quite right, we are. Last night, we heard from Apple, which reminded us that execution is everything, and that they are the pros. Consumers remain strong–especially in China. Chip supply may become a problem and have broader implications beyond Apple. You don’t need AI in every other sentence of your announcement to be successful in the tech sector. That’s it. I was prepared to write an entire blogpost on Apple.

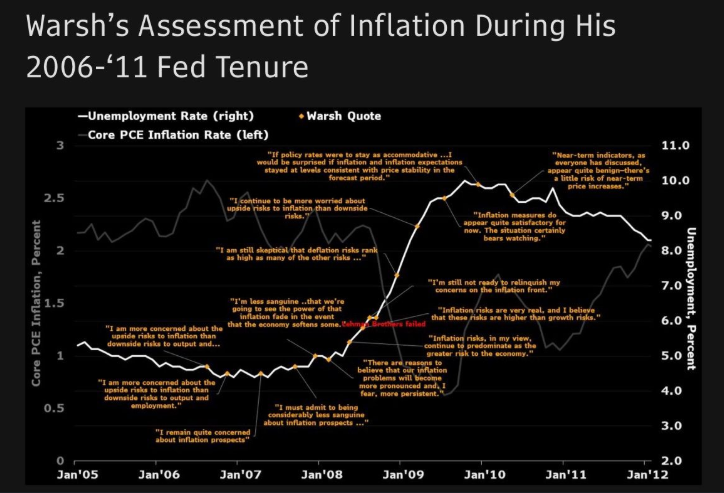

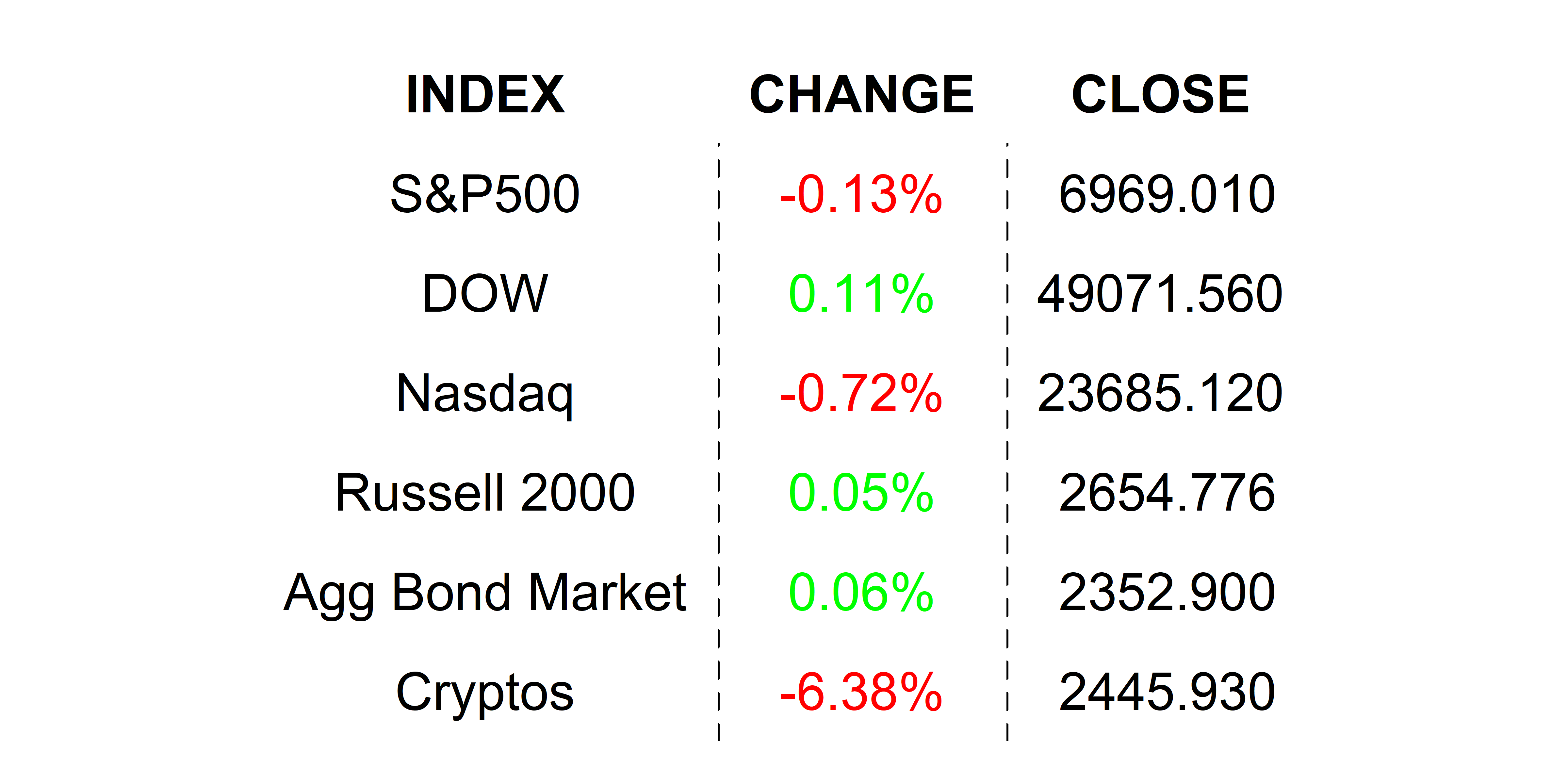

But, alas, it wasn’t meant to be. My phone was blowing up all night after, first one, then many of my favorite news sources reported that the President was going to nominate Kevin Warsh to be the next Fed Chair today. And it appears that he has, quite literally as I was writing this post. By the time I started my research for my daily note markets already weighed in. You were still sleeping. 😴🤣 Gold was getting slammed–even trading below $5000 for a moment. 10-year Treasury yields were higher. The Dollar caught a bid. Bitcoin was falling–a newfound proxy for risk appetite. Oh, and stocks–those other risk assets–were trading off. The first thing I thought of, weirdly enough, was a LinkedIn post that I liked a week ago posted by Anna Wong, Bloomberg’s Chief Economist. I am a huge fan of hers. She posted a timeline of Kevin Warsh’s comments on inflation and rate policy through his tenure as a Fed Governor. He quit in 2011 because he was opposed to QE–he thought it was inflationary. That should tell you everything you need to know about his bird preference–he WAS a hawk. He was also very vocal about his feelings about how the Fed operates–he was not a fan. Anyway, I got on LinkedIn this morning and took a screenshot so you can see what I was talking about. Thanks Anna. Check it out and follow me to the close.

Don’t bother squinting to try and read all the quotes. He is–or was at least–a huge hawk. This information is not news, but I love how it is displayed visually. Because of this, I, along with many of my colleagues, believed way back in 2025 when the whole Trump-Powell clash began that a Warsh nomination was a long-shot. Why would the president nominate a known hawk when he clearly would like to see lower interest rates? There is a long list of perfectly qualified bureaucrats and even some industry heavyweights who are willing to publicly call for ZIRP now! I mean, who doesn’t want to add “Chairman of the Federal Reserve” to their resume. Really. Despite this, President Trump has apparently chosen this former Hawk and would-be shaker-upper as his pick for the corner office of the most powerful bank in the world.

That begs the most important question. WHAT DOES A WOULD-BE CHAIRMAN WARSH MEAN FOR YOUR PORTFOLIO?

The short answer is that it means uncertainty, at least initially, and markets hate uncertainty far more than they hate high rates, low rates, or even bad data. This isn’t about whether Kevin Warsh would hike or cut tomorrow, next month, or even this year. It’s about the market suddenly having to re-anchor its expectations around a Fed that might look, sound, and behave very differently from the one investors have grown used to over the past decade and a half. When regimes change, multiples wobble. When narratives change, positioning gets sloppy. That is exactly what we saw overnight.

The knee-jerk reaction made perfect sense. Gold sold off because a hawkish Fed chair nominee implies less tolerance for inflation and less appetite for financial repression. Yields moved higher because the bond market, always faster on the uptake than equities, immediately priced in a lower probability of aggressive easing. The dollar caught a bid for the same reason it always does when real rates are perceived to be headed higher. Crypto slipped because, for all the protestations that it is something else entirely, it still trades like the highest-beta expression of excess liquidity. And stocks faded because stocks, despite their long-term optimism, are not immune to sudden changes in discount rates.

Here’s the part that matters, though, and it’s the part that tends to get lost in the first 12 hours of breathless commentary. A hawkish Fed chair does not automatically mean a hostile Fed. It does not mean policy error. And it certainly does not mean that earnings suddenly stop mattering. In fact, over time, it usually means the opposite.

A Fed that is perceived as disciplined, credible, and independent lowers the risk premium embedded in markets. That sounds counterintuitive in a world addicted to easy money, but history is pretty clear on this point. When investors trust the central bank to do its job, they spend less time trying to front-run it and more time doing what markets are supposed to do: allocating capital based on fundamentals. That is very good for long-term investors and very good for companies that execute well.

Which brings me back, reluctantly, to earnings season. I say reluctantly because, yes, this nomination will absolutely steal oxygen from what should be the main event. To my lament, we will now spend the next several weeks parsing Fed tea leaves, rehashing quotes from 2009, and debating bird metaphors instead of talking about margins, cash flows, pricing power, and demand. That’s a shame, because this earnings season is shaping up to be one of the more important ones in years.

Apple reminded us of that last night. Not because it said anything flashy or because it dropped a new buzzword, but because it did what great companies do. It executed. It showed that consumers are still spending, that China is not some lost cause, that services growth still matters, and that supply chains, while tight, can be managed. It showed that you don’t need to shout “AI” every other sentence to be relevant in tech, but you do need to show discipline, scale, and an ability to convert demand into profits. That message should have been the headline.

Instead, we are talking about the Fed again. 😖

To be really clear, a Fed with a monetarist at the helm could mean less liquidity. In the strictest sense, that could mean multiple pressures. But going back to my conversations with journalists yesterday, this macro thesis supports investing in strong companies that are adept at execution. It’s not just Apple–they are a winner in a tight environment. A tight Fed will clamp down the filter on even the most spend-happy AI players leaving us only with the ones who can afford it. It will possibly speed up the process of weeding out the weak ones who are just along for the AI ride. Was a bubble just avoided? 🤷

Stepping back, there is a constructive way to look at this. If the Fed is truly on hold for now, and if policy easing is more a matter of timing than direction, then a credible, well-run Fed actually clears the runway for earnings to matter more, not less, as we move through 2026. It forces investors to stop relying on macro hopium and start doing the harder work of differentiating between good companies and bad ones, between real growth and financial engineering.

Markets don’t need a friendly Fed. They need a competent one. They need a Fed that is predictable, transparent, and willing to take short-term heat to preserve long-term stability. A well-run Fed is a strong Fed, and a strong Fed ultimately supports stronger markets, even if the path there is occasionally uncomfortable.

So yes, today feels messy. Yes, the plot has thickened. And yes, my perfectly teed-up earnings season just got hijacked by central banking politics. But if this leads us toward a world where fundamentals reclaim the spotlight and capital is priced a little more honestly, that is not a bad trade-off at all. In fact, it might be exactly what the market needs.

YESTERDAY’S MARKETS

Stocks tripped over themselves yesterday, falling, as traders re-assessed… EVERYTHING in the wake of Microsoft’s worst pounding since 2020. And…that’s really it. 😉

NEXT UP

-

Producer Price Index / PPI (December) came in hot, Hot, HOT this morning growing by 3.0% since last year. That’s higher than expected and even with the November print. That leaves inflation watchers wondering if producer price pressure will find its way into consumer prices. Fed hawks will be hawking this morning… or is it squawking. 🦅

-

Fed speakers today: Miron, Musalem, and Bowman.

-

Important earnings announcements today: Colgate-Palmolive, WisdomTree, Air Products, Church & Dwight, Regeneron, Chevron, Verizon, Exxon Mobil, American Express, and Franklin Resources.

-

Next week we get a ton of important earnings announcements in addition to PPIs, JOLTS, ADP Employment Change, University of Michigan Preliminary Sentiment, and monthly jobs numbers. Check back in on Monday to get your weekly calendars so that you can be the smartest person at the dog park–assuming they shovel the snow. 😉

.png)