Your Post-it note of macro worries? Every box is getting checked—this week.

KEY TAKEAWAYS

-

Inflation, jobs, AI, tariffs, and the Fed–all seven market questions are being answered this week

-

Fed held rates steady with 2 rare dissents favoring cuts

-

GDP came in strong on paper but masked weakness in consumption and investment

-

Microsoft and Meta reported blowout earnings, boosting sentiment

-

Apple and Amazon earnings expected to be complex–especially with tariff exposure

MY HOT TAKES

-

GDP strength is skin-deep and driven by timing quirks from tariffs

-

The Fed is increasingly irrelevant and stuck in wait-and-see mode

-

AI leaders are widening the gap–MSFT, META, and NVDA are the new defensive plays

-

Tariffs are becoming more unpredictable and could hurt Apple’s margins

-

We're flying at altitude now, but the landing could be rough

-

You can quote me: “The Fed may be finding itself having less and less relevance in the markets by simply finding new ways to repeat its same message: ‘we don’t know what to do.’”

Don’t let go. I am not one of those nervous fliers, but I can understand why some folks get a bit uneasy. After all, taking 273 tons of metal, racing it down a runway at 200 miles an hour, lifting it off the ground, climbing to 7 miles above the earth, then flying at 500 miles an hour, is… well almost unthinkable when you think about it. But it happens. Most folks calm down once the plane is flying high and straight.

I told you that this would be a pivotal week–an inflection point. If you could put a market to-do list on a little yellow Post-it note, what would it say?

? What are tariffs going to be?

? How is the economy doing?

? Is inflation picking up from tariffs?

? Will AI continue to drive markets?

? How are consumers feeling in these uneasy times?

? What is the employment situation like?

? What is up with that enigmatic Fed?

It’s less a to-do list and more of a things-I-need-to-know-in-order-to-make-investment-decisions list. I am sure that you can fill up half a notebook with that list, but we have only been allocated 1 single Post-it note, and, I think, that pretty much covers the main roadblocks en route to market nirvana. Well guess what? All these questions will be answered in this single week. It's Thursday morning and we are still in the thick of it. Let’s dive in.

Let’s quickly review yesterday’s answers. ADP says hiring came in weak but better than expected, and far better than last month, which saw a net loss of jobs. Jobs are kind-of required to pay for stuff, so it's important for the economy and folks that sell that “stuff,” the companies whose stocks we own. Also, a healthy jobs market is 1 of only 2 things that the Fed is responsible for. Construction management is only a side-hustle for Top Guy Powell.

The Fed decided yesterday to keep interest rates steady. No one was surprised by this. The FOMC met for two days, edited their policy statement, and voted. The edit noted the ongoing murkiness of trade data, moderating economic activity, and… well, that’s it. Because of tariffs, import activity is a bit out of sync, and companies have slowed their spending. Nothing important there. What was important was that 2 FOMC doves dissented, hoping for rate cuts. Any dissension is not normal, and 2 dissensions is rarer yet–the last time that happened was over 30 years ago. The super-soft press conference delivery left markets feeling under-appreciated as Powell did everything he could to justify the Fed’s inactivity, stopping just short of saying that we are lucky that the Fed is not raising interest rates to tackle tariff inflation. Net, net, the 2 dissensions are probably a positive, but unfortunately, the Fed may be finding itself having less and less relevance in the markets by simply finding new ways to repeat its same message: “we don’t know what to do, we are unsure, so, we are going to wait until something breaks to decide whether to lower or raise rates.”

On that “economic activity” the Fed was referring to, we got Q2 GDP which came in at a stronger-than-expected 3.0%. Though that looks great on the surface, it really wasn’t. Consumers and consumption did a bit better than in Q1, but nowhere near what it should be, and Business investment slowed to an almost complete halt. So how did the number get so large? Net exports! The same GDP component that caused Q1 GDP to come in at -0.5%. Imports surged in the first quarter as companies clamored to pre-order goods prior to new tariffs kicking in. Imports subtract from GDP because cash is going out. In Q2, those imports fell significantly because… well, all the imports that would normally happen already… happened… in Q1. That decline in imports ADDS to GDP because less dollars are going out. And that’s it. Looks good, but that beauty is only skin-deep, sorry.

After the market closed, tech giants Microsoft and Meta took center stage with HUGE beats. Microsoft beat every estimate! Its intelligent cloud business grew by 21% and its Azure data center business grew by 34%, both beating estimates. Overall, the company beat EPS and Revenue estimates by 8.23% and 3.45% respectively. That’s good for 15.5% and 15% annual growth rates!

Meta not only beat EPS and Sales estimates by 21.29% and 6%, but it also raised its full-year guidance to well above analyst’s expectations. 👏The company beat on all revenue targets but its very small reality labs business line. Its core ad business revenue beat estimates by 5.7%. On the spending side, the company ended the quarter with less employees than expected and underspent on CAPEX. This is a sign that, though the company has made boisterous announcements of data center builds and talent acquisitions, it is going about it in a… thoughtful way. This puts Meta in a good position to continue aggressively pursuing its “do or die” objective of being a leader in AI-led growth.

Both stocks are trading significantly higher in the pre-market with Meta on tap to attain a new record and Microsoft in striking distance of joining NVIDIA in the $4 trillion club. Speaking of NVIDIA, we won’t hear from them for some time, but those positive reports from, to date, Alphabet, Microsoft, and Meta can only be positive for the single dominant player at the nexus of all AI today. Two more of their Mag-7 siblings will announce their earnings after tonight's close: Apple and Amazon are on deck, and the bar is super-high.

Amazon which, on one level, competes with Microsoft and Alphabet as a hyperscaler. It also competes with Walmart as a mass online retailer. Finally, Amazon competes with the likes of Netflix, Disney, etc in streaming services and content. With Amazon, it will be all about their AWS offering and how its performance stacked up to the outstanding metrics from MSFT and GOOG. But it won’t be that easy to impress investors. The company still earns some 43% of its revenues from retail selling. On that, investors are hoping to learn what impacts tariffs will have on profitability. That is likely to be the wildcard for tonight's release. Analysts are looking for a much-trimmed-down 3% EPS growth on a 9.6% increase in revenues.

Apple will be playing defense in its Q2 earnings announcement tonight. Even if we ignore the company’s obviously slow AI takeup, the company has lots to answer for. To be clear, the company is projected to have a record revenue Q3. It’s when we get below the top-top line that questions arise. The company’s flagship product iPhone is manufactured abroad. The bulk of that manufacturing is China and India, leaning heavier to the former but rapidly pushing production to the latter. Both will end up with higher tariffs, and until last night, Apple’s aggressively moving production out of China and into India, seemed like a solid strategy. Trump’s announcement that imports from India will be taxed at 25% certainly throws into question the company’s gross margins. Chinese negotiations are nowhere near complete, so there is no telling what its final tariff will be, and India–I suppose–still has a few hours to whip up a deal with the administration and avoid the 25% levy. It’s amazing how now 15% would be considered a win! That all said, Apple is under tremendous pressure to navigate the highly complex trade environment that has resulted in the President’s trade strategy. That pressure only adds to the existing pressure to show continued growth in its other revenue sources. Analysts are expecting an EPS growth of 2.4%, lower than last quarter's 7.84% growth. Revenues may have grown by 4% after increasing by 5% in the prior quarter. This will be a tough release to interpret. Stay tuned.

This morning, we will get inflation numbers from the Bureau of Economic Analysis. The PCE Price Index is the Fed’s preferred inflation metric, and it is expected to come in slightly hotter than May’s figure. Annual inflation may have ticked up to 2.5%, but it’s really the monthly increase that is important now. The monthly increase is expected to be 0.3%, which is slightly higher than the prior month’s 0.2% gain. Monthly is important because it allows us to better assess the impacts of tariffs, if any. If the monthly numbers continue to rise, it can be worrisome, because it implies accelerating, persistent inflation. In contrast, big, one-time monthly increases are possibly the result of tariffs, but considered transitory. With this number, we will look closely at its durable goods category.

You probably dozed off a few times while over states you want to visit but may never. Your ears are clogged, but it's smooth sailing. You look out the window and, thankfully, the wings are still attached. You would like to visit the washroom but you don’t want to rouse the snoring passenger next to you. The pilot gets on and announces that you are on your final descent to your destination. The airplane banks then drops thousands of feet. You feel it in your stomach and you realize that the ride is far from over. The large hunk of metal has to land back on the ground.

That landing will not come today for the markets. The President made it clear overnight that tomorrow’s Liberation day tariff deadline will hold. No deal… no dice. And there are plenty of countries that have no deal as of this morning. Added to countries with deals overnight was South Korea which emerged with a not-surprising 15% tariff along with promises to invest in the US–also not surprising. Countries that may end up with hefty tariffs still include Canada, Mexico, India, and Australia, three of which are in the US's top ten trading partners.

Tomorrow morning we will get monthly jobs numbers, but today, we will get weekly Initial Jobless Claims. They are expected to have ticked up slightly for the week. This will be another data point in the crumb-trail that started earlier this week with weaker than expected JOLTS Job Openings and as a stronger than expected ADP Employment number. Tomorrow’s release will be the deciding number and the final check on the list. Remember the list? ☝️

That’s right, by tomorrow’s close we will know about tariffs, the health of the economy, if inflation is picking up, if AI will continue to dominate, that consumers are gaining confidence, the employment situation, and that the Fed is still frozen on the same page in its playbook. I think that covers the entire Post-it note.

Landings can be rough, but you are not stressed because statistics are in your favor. The bright side is that you are one step closer to where you were heading. Oh, and for all that stress, you also got a can of warm diet Coke and a free bag of peanuts–how nice. Just make sure to keep your seatbelts fastened, because unexpected turbulence can cause injury. I am expecting a bumpy return flight.

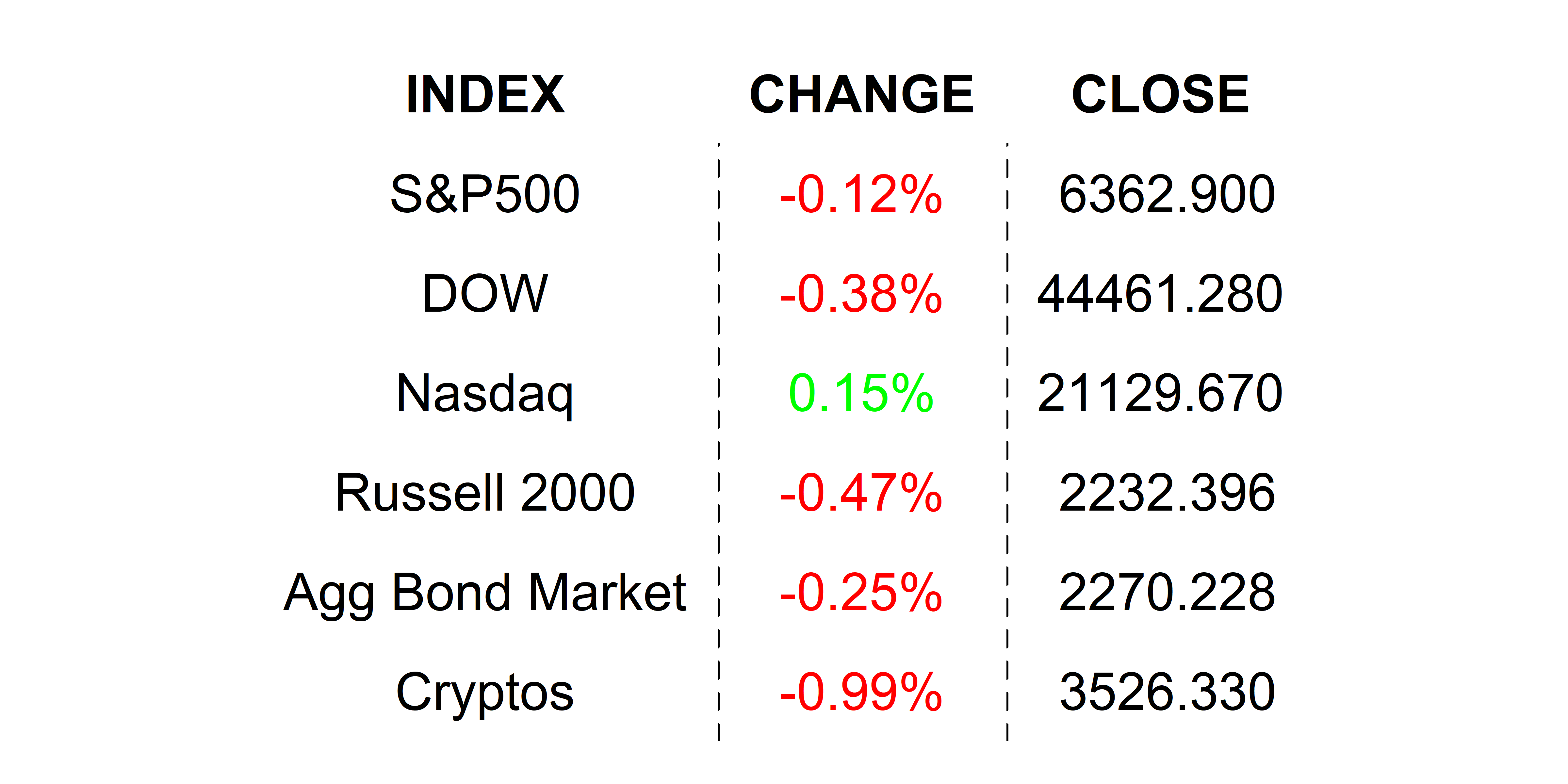

YESTERDAY’S MARKETS

Yesterday, stocks closed mixed but mostly lower as the wishy-washy Fed could not keep the narrative upbeat. Decent earnings, strong GDP, and better-than-expected job creation were not enough to keep disappointment in the Fed from pulling the indexes below water. Rate cut expectations were pushed further out and treasury yields climbed. Two Fed doves were not enough to pull rates down.

NEXT UP

-

PCE Price Index (June) is expected to have increased to 2.5% from 2.3%.

-

Initial Jobless Claims (July 26th) is expected to come in at 224k, up slightly from 217k claims.

-

MNI Chicago PMI (July) may have increased to 42.0 from 40.4.

-

Important earnings today: Bristol-Myers Squibb, CVS, Exelon, Comcast, Roblox, PG&E, AbbVie, Builder FirstSource, Shake Shack, Air Products, Medical Properties Trust, KKR, Mastercard, Biogen, Cigna, Norwegian Cruise Line, International Paper, Stryker, ResMed, Illumina, Reddit, Cloudflare, Coinbase, Rocket Cos, Amazon, Roku, First Solar, MicroStrategy, and Apple.

.png)