AI is still under construction. Here’s how to stay focused when the dust flies.

KEY TAKEAWAYS

-

AI buildout is still in its early, infrastructure-heavy stage

-

Investors must distinguish patience from passivity

-

Valuations may be high, but the long-term thesis remains intact

-

Traders chase volatility; investors endure it

-

True conviction requires research, not reaction

MY HOT TAKES

-

Investing is construction–it’s slow, noisy, and messy, but essential

-

Valuation worries are healthy, panic is not

-

AI’s capital cycle mirrors past industrial revolutions

-

Patience is a competitive advantage, not a weakness

-

Conviction without diligence is just hope

-

You can quote me: “The problem with most investors isn’t that they buy the wrong building — it’s that they sell the right one too early.”

Investor? Are you an investor or are you a trader? They are not one in the same, at least in my book, though I do sometimes mistakenly use the two nouns interchangeably. Traders, in my book, look to profit on micro movements in the markets. Their interest is less about company health and fundamentals and more about intraday price action. I want to be clear that I have nothing against traders and trading. It is a complex world where rewards can be quite satisfying, but it takes a different kind of discipline than I typically discuss in my notes and videos. At a very–VERY high level, the principal difference is time horizon. While traders typically get in and out of stocks and bonds many times in one secession, investors seek longer-term rewards through capital gains and dividends. I am sure that you know this well, and that you are scratching your head as to why I would even waste a whole passage on this. 😕 The reason is quite simple. In my experience, even the smartest, savviest, and seasoned investors sometimes get confused about their missions. Are you an investor? If yes, hear me out. If you are a trader, stay with me, I will cover you in another series of posts.

Many years ago, I sat down with a seasoned investor whom I respected a great deal. He managed a tremendously large portfolio–trust me it’s big. But he was not a hedge fund hotshot. He was not the captain of his Ivy League b-school rowing team. He wasn’t a master spreadsheet creator. No, his investment prowess came from the streets of New York, and by streets I am not talking about the narrow, cobblestoned roads of lower Manhattan’s financial district. He amassed his wealth through real estate investing that started in Brooklyn and came to stock markets later in life, almost as a hobby.

Before our meeting, I prepped, as I often do, by running intense quantitative analysis and simulations on his portfolio. I came packed with a list of recommendations on what he could do to squeeze more alpha out of his portfolio along with a list of companies that I thought he should add to his holdings. Behind these recommendations was a book of numbers and graphs that would rival the thickness of the most expensive porterhouse steak at New York’s iconic Peter Luger Steak House, which was, by the way, established in 1887! 🥩 We met for lunch at his country club and came in hot and ready for action. He had other plans.

He spent an inordinately long time describing the hot dogs, deli sandwiches, and desserts that the club offered. He was extremely gracious and insisted that we order multiple dishes so I could sample the quality of the food. He was extremely popular with the staff, whom he introduced to me one by one. Before we go any further, you must understand that this nonagenarian gentleman was not flashy in any way. In other words, you would not suspect him of managing billions of dollars. As you might guess I was eager to get to business. I was very curious. My curiosity was aimed primarily on his acumen for investing. His portfolio had amassed a tremendous amount of profit–he was a prolific investor. If I didn’t know any better, I would think that he simply aggressively cut his losses only to be left with big gainers. But no, his portfolio was chock-full of the who’s-who of great stocks from that last 20+ years–all of them purchased long ago. How did he find these stocks that are now household names but back then were complete unknowns.

As it became clear that my big book of numbers would remain in my backpack, I asked him outright how he picked stocks. He proceeded to remind me that he was a real estate man. He explained that when he bought a building or built one from scratch, he did so based on what he thought the property would be worth in the future. His investment thesis was based on many years of experience in understanding what features etc would contribute to the property’s growth in value. He knew where he could add value, which in some cases involved expensive additional improvements, or in others improvement in business processes. But here is the important part, he told me that once he signed the contracts, he had no clue what the investment was worth. He simply knew what he expected it to be worth in the future. He told me that even if he wanted to know, there was no way of really knowing, so he would resolve himself to employ patience and allow the investment to grow. With stocks, he added, we know the value of what we buy in milliseconds, at almost all hours of the day and night, and that is not always healthy. Sometimes, knowing too much clouds your judgement and causes you to veer off course.

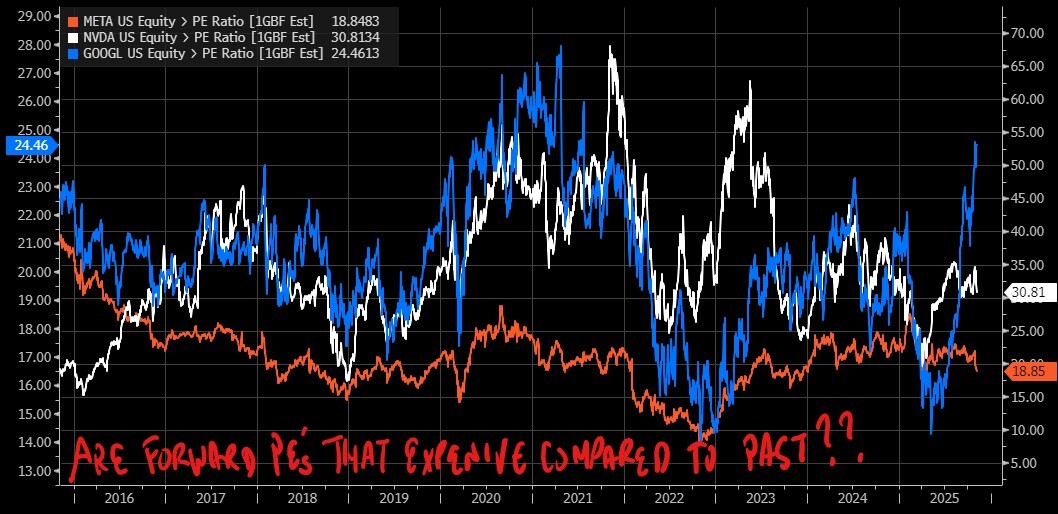

His words have stuck in my head for the many years since our first meeting. Fast forward to today where markets are struggling to find footing at these lofty valuation levels. My longtime followers know that I am a big fanboy of the AI ecosystem investment. I won’t repeat all my theses here. You also know that I feel that some companies and areas of the ecosystem look bubbly–that is to say they are bad investments based on hype. 😉Adding to that, there is a growing amount of outstanding private finance that may be on shaky legs. What this all means, is that you can’t just throw a dart at a list of tech companies and expect to find a winner. It takes work, research, and understanding–a lot of it. That is the basis for informed conviction. As with all emerging technologies, those convictions are tested daily–or quarterly, literally.

There is no hiding the fact that AI has been at the sharp end of the spear, leading equity indexes to new heights over the past couple of years. It has so many implications far beyond the innovative companies themselves. The S&P 500 gained 23.3% and 24.23% in 2023 and 2024 with restrictive interest rate policy! Talk about fighting the Fed. 🤣 This year saw markets falter a bit in response to the administration's rollout of draconian tariffs. It has since recovered, led by… wait for it… wait for it… AI tech.

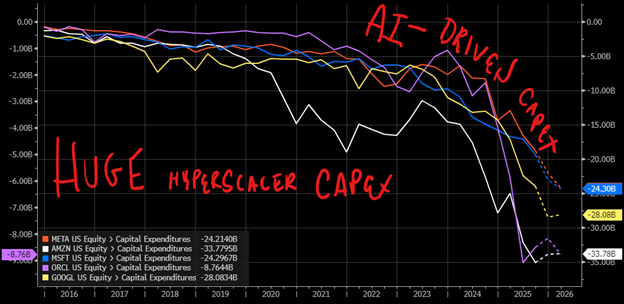

Earlier this week, something interesting happened. Big bank bosses David Solomon (Goldman Sachs) and Ted Pick (Morgan Stanley) warned of stretched valuations. AI darling, and high PE darling Palantir announced a stunning earnings beat on Monday, adding to what has been a stronger than expected earnings season for tech. Instead of celebrating, markets faltered. Michael Burry, only famous with his landscapers prior to Michael Louis’ The Big Short Book and the 2015 movie that followed, came out noting that he was buying put options on highly valued Palantir and NVIDIA. This set off a flurry of media coverage all with the word CAPEX in the description. CAPEX is Wall Street short for capital expenditures. We have been tracking CAPEX quite closely for the past few years as hyperscalers build capacity to handle the expected compute requirements for AI to continue to realize its full potential. There is no secret that it takes chips, servers, software, data centers, electricity–lots and lots of it. But how much is too much? What dollar amount is too much? Do you know? Does anyone know?

The “picks and shovels” trade became very popular in the past year. In other words, don’t worry about the end product, make money selling the things necessary to get there. This refers back to the gold rush of the 1840s where sellers of picks and shovels made money selling tools to prospectors, making money even if their customers never found a grain of gold. It was a great strategy, but even the gold rush didn’t last forever (which oddly still has something to do with gold today). Are there now too many picks and shovels out there? Is the gold rush in AI over? Well, based on the market's behavior in these past few days, it appears that some investors think so.

Let’s get back to real estate. It takes a lot of money to build a building. It takes a lot of patience as well. You have to buy the land, get permits, dig holes, make lots of noise, get more permits, buy bricks, buy steel, negotiate with unions, get more permits, weld, wire, duct, drywall, sheath, get more permits, buy more bricks, pay lots of legal fees… and so on, and so on. All this without even getting a single dollar of return from tenants. Seems risky, doesn’t it?

My friends, we are still in the building stage when it comes to AI and we are far from near capacity. It takes capital for CAPEX. It’s build or die. I would be concerned about any of my investments NOT aggressively building infrastructure. Will it ever peak? No, but growth will certainly slow. Did the PC market just end once everyone got a PC? Did the smartphone market evaporate once everyone got an iPhone 1, or 2, or 10, or 15? Do you see my point?

Patience is the hardest part of investing. Nobody likes to wait while the world seems to be sprinting ahead. But real investing, the kind that builds wealth, not just fleeting gains, is less like a sprint and more like constructing that skyscraper we just talked about. You can’t skip floors. You can’t decide halfway through that maybe the view from the fourth story is “good enough.” You keep building. You add steel and glass, you pour more concrete and you do it knowing the payoff doesn’t come until the building opens and tenants move in. Markets are no different. Everyone wants the penthouse suite, but few have the stomach for the scaffolding stage.

The temptation to trade, to chase, to react is the devil on the investor’s shoulder. It whispers things like “look at what’s running” or “you could have doubled your money in that one.” But I’ve been around long enough to know that impatience is the silent killer of returns. Acting like a trader when you meant to be an investor is like selling the blueprints before the building is done because the construction noise got irritating.

AI is still under construction. 👷 We’ve seen the cranes go up, we’ve seen some flashy renderings of what it might look like, but the structure itself–data infrastructure, chips, models, and yes, regulations–is still going vertical. The ecosystem is messy, capital-intensive, and uneven. Some firms will overspend, others will underbuild. Some investors will call the top every three months and others will quietly keep accumulating exposure to the companies that are actually doing the building.

Now, let me be clear: being patient doesn’t mean being passive. Patience without diligence is just waiting around. My wise, old friend, the one who made a fortune starting with Brooklyn real estate, didn’t sit around staring at bricks. He inspected every site, knew every cost, and made sure the foundation was solid before he put his name on the loan. He didn’t guess. He researched. He looked for signs of strength, location advantages, traffic flow, tenant demand. That’s what diligence looks like.

For investors in AI, diligence means watching not just who is shouting the loudest about AI, but who is actually spending smartly on infrastructure. We track CAPEX because that’s where conviction shows up. Microsoft and Alphabet aren’t throwing billions into the void, they’re laying down the digital equivalent of highways, water lines, and power grids. Those things don’t pay off overnight, but when they do, they create the foundation for decades of cash flow.

Still, it’s messy work. Building the future always looks chaotic when you’re standing in the middle of the construction site. Dust everywhere. Noise. Delays. Permits. Political risk. Inflation risk. Valuation risk. Yet, beneath the noise, real progress happens one brick at a time.

This is where investors separate from speculators. Traders see noise and volatility as opportunity–catching a move, shorting a spike, playing momentum. That’s fine. But investors must view volatility as background music. When markets wobble after headlines like “Solomon and Pick warn of stretched valuations,” it’s not the time to rip up your investment plan. It’s the time to ask: Has my thesis changed?

Has AI’s potential suddenly evaporated because the multiple on NVIDIA looks rich? Has the world’s hunger for compute power, automation, or intelligent systems suddenly vanished? Of course not. The thesis remains. What changes, week to week, is sentiment. And sentiment, as my seasoned friend reminded me once over those country club hot dogs, is a poor substitute for valuation discipline. He told me something that still echoes today: “Mark, the problem with most investors isn’t that they buy the wrong building, it’s that they sell the right one too early.” That sagely advice still rings strong in my psyche.

He wasn’t talking about greed. He was talking about endurance. About staying power. He reminded me that buildings take time to mature. Tenants move in, rents rise, neighborhoods change, and value compounds quietly. Stocks, he said, are no different. “If you know why you bought it,” he said, “then stop watching the ticker and start watching the thesis.”

And that’s the message I want to leave with you today. We are in the middle of the AI buildout. The scaffolding is up. The rebar is visible. The big spenders like Microsoft, Amazon, Google, Meta, and Oracle, are pouring billions into concrete. That’s the digital concrete of data centers, chipsets, and energy contracts. There will be cost overruns. There will be temporary labor shortages (literal and digital). There will be a few ugly quarters of earnings compression. But if you believe in the structural shift this technology represents, you have to let the foundation set. And when it comes to investing, foundations take time.

Does this mean close your eyes and hold everything forever? Absolutely not. Patience doesn’t mean blindness. It means judgment. It means re-evaluating your positions not every day, but every few months, and asking that same question: Has the thesis changed? If the answer is no, then don’t let volatility talk you out of conviction. The noise is temporary; the structure is permanent.

I know, it’s easy to preach patience when markets are calm. It’s harder when your portfolio is down 5% in a week and the headlines are blaring “AI bubble bursts.” But every transformative era looks like this in the middle. In the 1990s, the internet buildout looked overdone too. Remember when people said Cisco and Microsoft were “too expensive”? They were right for a while. Then the world caught up. The infrastructure they built became the backbone of global commerce.

The same principle applies here. You don’t stop pouring concrete on the fourth floor because you think steel prices might drop. You keep building the tower you set out to build. You inspect, you adjust, you stay focused–but you don’t walk away halfway through.

My friend is now in his mid-nineties, still sharp as ever. When I spoke with him recently, I asked whether he thought markets had gotten too expensive. He smiled. “Everything’s expensive when you’re watching the ticker,” he said. “Nothing’s expensive when you’re watching the decade.”

That’s wisdom you can’t buy with a CFA or a flashy doctorate in finance.

So, if you’re invested in the AI ecosystem, remember: we’re not done building. The future of this technology–and the companies driving it–is still under construction. Expect dust. Expect noise. Expect critics. But don’t confuse construction chaos with collapse. Be patient but not passive. Patience keeps you from panic; diligence keeps you from ignorance. Combine the two, and you’ll do more than survive this market–you will own the building when the lights finally come on.

When the building finally opens–when the tenants move in and the revenue starts flowing–the traders will be long gone. And the investors, the real investors, will be standing at the ribbon-cutting.

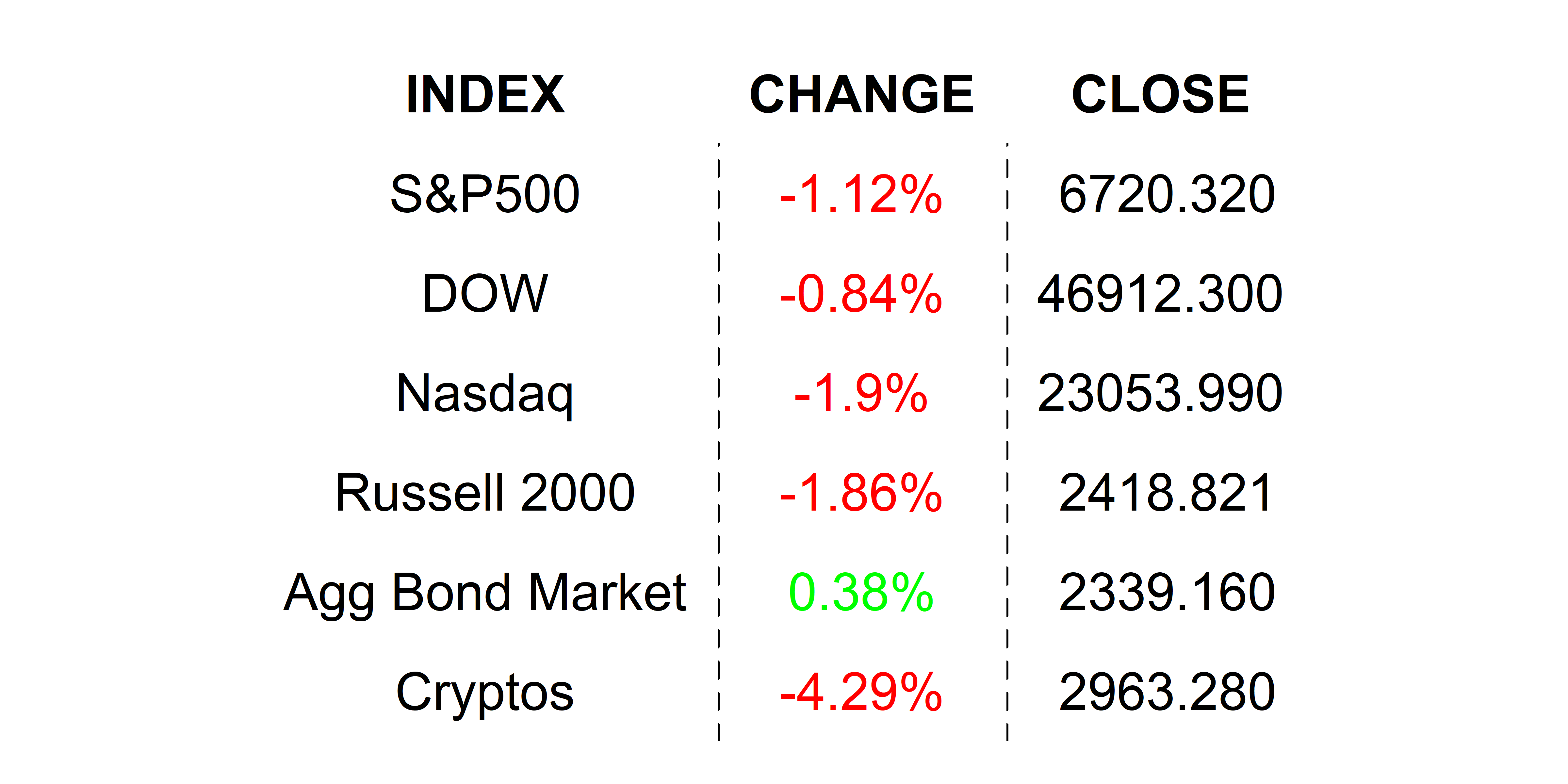

YESTERDAY’S MARKETS

Stocks had a tough day yesterday, closing in the red, unable to get much air as two obscure, but very telling, private employment numbers painted a grim picture of the US labor market. No government data leaves investors in the lurch, relying on private data with nerves on edge. Bond yields declined as investors rushed into treasuries as a safe haven.

NEXT UP

-

University of Michigan Sentiment (November) is expected to have slipped to 53.0 from 53.6. This is an important number always, but increasingly so in the data blackout.

-

Next week, we are due to get important inflation and retail sales numbers, but the shutdown, if it continues, is likely to delay the releases. We will get a number of important earnings announcements and plenty of Fed talk. Check back in on Monday to download calendars so you can be in control of your financial future.

.png)