Why momentum, the Fed, and seasonal optimism may carry markets forward – with no guarantees attached.

KEY TAKEAWAYS

-

The Santa Rally is a seasonal tendency–not a promise

-

Recent Fed action reduced a major market headwind

-

AI CAPEX fears disrupted tech leadership despite strong earnings

-

Momentum may carry markets into early Q1

-

Discipline matters more than optimism

MY HOT TAKES

-

Momentum deserves respect even when fundamentals lag

-

The Fed doesn’t need to ease aggressively to help markets

-

AI demand is real–fear distorted the narrative

-

Markets are cautiously optimistic–not euphoric

-

Complacency is the real late-cycle risk

-

You can quote me: “The Fed doesn’t need to cheer for markets–it just needs to stop fighting them.”

Forces of nature. Sitting on the corner of my desk is a tattered notebook. On its jacket are the words: “Wall Street Sayings–not to be ignored.” My long-time followers know that I love to quote this book. First, let’s get something out of the way. It’s not actually a book that resides on my desk, but it exists in the memories of those of us Wall Streeters who have been around for a while. The allegorical sayings within “the book” were passed down by mentors and picked up on the road–along the way–usually the result of painful and costly mistakes. 😉

Today is the last full trading day before the Christmas Holiday, so you know what that means. That’s right. It’s not just children looking up in the northern skies for Santa’s sleigh. Traders too are hoping–counting on–Santa Claus to ride in and bring with him a Santa Rally. I have been hinting at this in my notes and videos since the Fed’s cut several weeks back. Have you heard of the Santa Rally? If you've been following me for long enough, you should, but if not, a Santa Rally refers to the tendency for US equity markets to rise during the final five trading days of December and the first two trading days of January. The effect is often attributed to seasonal optimism, year-end portfolio rebalancing, tax-related trading, and lighter holiday trading volumes. Historically, this period has delivered above-average returns more often than not (how’s that for sketchy probabilities 🤣), though the effect is neither guaranteed nor consistent. It can get complicated too, because if it fails to appear, it has sometimes been viewed as a warning sign for market sentiment in the year ahead. So Santa, you see, is an important fellow to Wall Streeters–it’s not just a kid thing. 🧑🎄

Market action over the past few sessions has been somewhat positive after a spate of rocky trade. Earlier in the month the Fed delivered its holiday gift early to the markets. I viewed it as the last big hurdle for markets in 2025. It was more than just a rate cut. Sure, markets were hoping for it, and sure, there are many technical benefits to it, but the big message was that the Fed was concerned about the declining labor market and taking action despite its reservation that inflation was still too high. If you were worried about economic health, the Fed’s focus is positive. If you were hoping for rate cuts without any concern about economic health, this was also a positive development. With the Fed’s next meeting more than a month away, markets should be content with this development for the moment. Well, at least through the next few weeks. Of course, there were some caveats. There were still three big AI earnings announcements to toy with investor sentiment.

Markets leading up to the last Fed meeting have been weighted down by AI-CAPEX-bubble fears since October. That is when the leaders in the AI ecosystem announced their Q3 earnings and knocked the ball out of the park but warned of increasing CAPEX requirements. Fear of a CAPEX bubble turned the tide for tech investing as investors rushed out of the tech trade, which almost single handedly brought equity indexes to high after high these past few years, and into a broader value-oriented investment style. The gnawing concern turned into fear when Oracle announced its earnings earlier this month. Oracle is attempting to compete with the hyperscalers with stronger balance sheets. In other words, Oracle would have to borrow more to finance its CAPEX-heavy plan. Days later, Broadcom, another AI crown jewel, would announce its earnings which were near perfect–a sign of strength and stability. It would be punished–caught up in the AI fear tsunami that was overshadowing tech and the broader indexes.

One last hope for tech remained: Micron. Yes, Micron, the memory company. Micron indeed does produce memory chips which are largely commoditized products found in… um, everything from your refrigerator to your smartphone to even your grandkids’ electronic plush toys. But Micron also produces high-end memory solutions for companies like NVIDIA, and other AI ecosystem hardware providers. Micron’s earnings were anything short of solid, exceeding estimates by healthy margins. This would help to turn-around the tarnished narrative about tech.

It would take just one more final push to get equities back on track. A cooler-than-expected CPI print would allay any fears of run-away inflation. We had not gotten a real CPI release in some time because of the Government shutdown. October data was completely missing! Anything above estimates would energize the Fed hawks to lay off the current cutting cycle. The number did quite the opposite, coming in far cooler than expected, sending a clear message: inflation is not out of control… for the moment… with a few minor-but-extremely important caveats. The release number itself was flawed because of missing data. The direction was good, and positive for markets, but confirmation will have to come from the next release in January.

All these more recent developments will certainly fuel hopes and positive probabilities of a Santa Claus rally that can help bring stocks over the finish line in style–and at least through the first few days of 2026. Turning the Santa Rally page in our book, I would like to bring you–briefly to two more worn pages. These pages may help explain what happens beyond January 5th, just as Santa covers his sleigh and prepares for a vacation to the Caribbean with Mrs. Claus.

The first of those pages reads simply: “the trend is your friend.” It is perhaps the most abused, misunderstood, and yet persistently correct saying in that imaginary book. Trends are not about prediction, bravado, or chest-thumping conviction. They are about humility. They acknowledge that price itself is information, and that markets often move further and faster than fundamentals alone might justify in the short run. Momentum has a way of feeding on itself, particularly when uncertainty begins to clear, liquidity improves at the margins, and positioning is still cautious. That is precisely the kind of setup we may be walking into as we turn the calendar. If stocks can carry positive momentum out of late December and into January, history suggests that it does not stop politely on January 5th. Q1 has a habit of rewarding markets that enter it with confidence, improving breadth, and investors who are still under-invested rather than euphoric. That does not mean straight lines, and it certainly does not mean immunity from drawdowns, but it does mean that dismissing momentum outright has been a costly mistake far more often than respecting it.

The next page is even more dog-eared: “don’t fight the Fed.” This saying has survived cycles, chairs, political pressure, and more than a few bruised egos for a reason. Monetary policy does not dictate markets, but it absolutely sets the wind conditions. When the Fed is tightening, even the strongest swimmers eventually tire. When the Fed is easing, even mediocre swimmers can stay afloat longer than expected. Today’s Fed is not enthusiastic, celebratory, or reckless. It is cautious, data-dependent, and openly conflicted. Inflation is not yet vanquished, but it is moderating. The labor market is not collapsing, but it is clearly softening. That combination matters. While cuts may not come quickly, and certainly not on demand, it is increasingly likely that two or three cuts arrive in the latter half of 2026 as those trends continue to evolve. That is not a promise, and it is not a forecast etched in stone, but it is a meaningful tailwind relative to where we have been. Markets do not need aggressive easing to move higher; they simply need reassurance that policy is no longer actively working against them.

Put those pages together and the message becomes clearer. Momentum can carry markets further in the near term, particularly into Q1, while monetary policy provides a longer runway rather than a looming wall. Add in seasonal psychology, improving narratives around tech, and a market that has already digested a great deal of bad news, and it is not hard to see why optimism is creeping back into the conversation. Not reckless optimism. Not blind optimism. But cautious, disciplined optimism–the kind that keeps one eye on opportunity and the other firmly on risk.

And that brings us to page one of my little book. “There are no guarantees!” Not from Santa. Not from trends. Not from the Fed. Markets have a cruel habit of humbling those who confuse favorable winds with destiny. Staying vigilant matters. Position sizing matters. Risk management matters. Complacency is always the real enemy, especially when conditions begin to feel more comfortable. Winds may be shifting in our favor, but storms do not announce themselves in advance. Respect the trends, respect the Fed, enjoy the tailwinds when they arrive, but never forget what book you’re reading, and never assume the ending has already been written. You will notice several hastily torn out pages at the end of my book–those were all expected endings that never materialized–all hard-learned realities from my earlier days on the Street. Happy Holidays!

YESTERDAY’S MARKETS

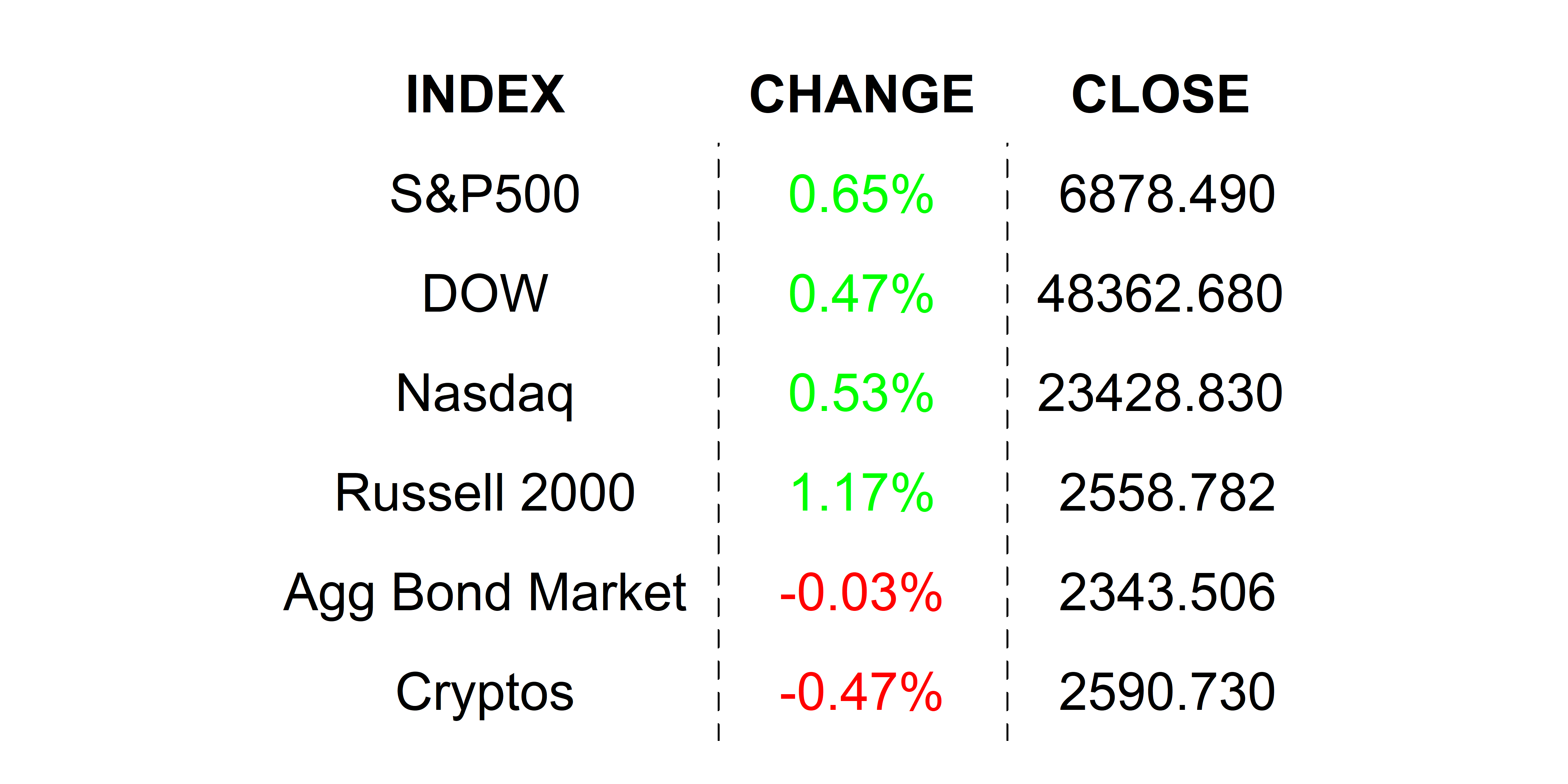

Stocks rallied yesterday, carried forward from continued optimism from last week’s positive ending. Bond yields edged higher as Gold and Silver touched the heavens. Bitcoin inched higher but could not stay above critical resistance at 90,000.

NEXT UP

-

Annualized Quarterly GDP Growth (Q3) the first release but second estimate of Q3 GDP is expected to show that the economy slowed moderately Q3 with a growth 3.3% after having grown at 3.8% in Q2.

-

Durable Goods Orders (October) may have declined by -1.5% after climbing by .5% in the prior period.

-

Conference Board Consumer Confidence (December) probably picked up slightly to 91.0 from 88.7.

-

ADP NER Pulse (December 6th) is due out this morning. The last reading was 16.25k.

-

Markets will close early tomorrow. I will be back on Friday!

.png)