Why Venezuela’s oil matters--and who really benefits downstream.

KEY TAKEAWAYS

-

Energy supply shocks shaped the 1970s and permanently changed US energy policy

-

The US now holds structural advantages in heavy sour crude processing

-

Gulf Coast refiners benefit from discounted heavy barrels

-

Oilfield service firms gain during long rebuilding cycles

-

Long-term supply growth supports price stability not chaos

MY HOT TAKES

-

Energy dominance matters more than price control

-

Infrastructure is the real source of leverage

-

Volatility hurts producers more than lower prices

-

Heavy crude is misunderstood and underappreciated

-

Regional control beats global dependence

-

You can quote me: “The seventies taught the US what happens when other people control your energy.”

It’s a cruel, crude world. I was there! I remember the long lines at gas stations. I sat in the back of my family’s gas-guzzling Oldsmobile for what seemed like hours on end. No air conditioning, no seatbelts–just Roberta Flack on the AM radio singing “Killing Me Softly.” Riding up the local highways, you could see the flags flying–red meant no gas, yellow meant low gas, and green meant “good to go,” depending on whether it was an odd or even calendar day and your license plate number. It was bad. It was a direct result of the oil embargo imposed by OPEC. It unarguably lit the fuse to what would become the runaway inflation regime in the 1970s and 1980s, which would include at least 2 recessions. Yeah, it was that bad.

It was a huge eye-opener for the US. Everyone knew the importance of energy as a natural resource, but that event marked a turning point of sorts. The US could literally be brought to its knees by foreign governments with their own political agendas. How could we let something like that occur?

Fast forward to today, the US is the top producer of crude oil, globally. No longer a price taker at the mercy of foreign governments. Though the US cannot control the global price of crude, it certainly can influence it, avoiding 1970s-style supply shocks. A great part of this dominance actually emerged recently with the advent of horizontal drilling and fracking.

To be clear, the US is not the only big player. Saudi Arabia remains the second largest producer, and Russia is the dominant force as well. The two of them–under non-war conditions–control what is today referred to as OPEC+. Venezuela is part of OPEC, and while it is considered to be oil rich with the world's largest reserve, it is a minor producer. But that doesn’t mean that its position is not highly coveted by global super powers.

My longtime followers know one of my favorite quotes: “OIL is the oil of all industry!” It’s a take on the quote “money is the oil of all industry.” The motivation for my bastardized version is that crude as a resource has far more usefulness beyond fuel. Don’t get me wrong, fuel is a big one. Without it you would freeze to death, get to work late, and wait days–if not–weeks for your Amazon package… or your food delivery. Anyway, I am sure that I don’t have to tell you how important oil is to just about everything. Because of that, supply and price can have a big impact on SO much. It is certainly not something you want bad actors to control.

This morning, Wall Street is waking up to a brave new world after the US staged a precision strike against Venezuela, plucking its President Nicolas Maduro out of his safe house and awarding him with a New York City vacation–behind bars. He has been indicted on Narco-terrorism charges, amongst some other ghastly crimes. I won’t get into all that, but I do want to talk about the implications on your investments.

Let’s just get Gold out of the way for a second. It’s high, it’s getting higher yet. Justified? Who knows, but it should be no shock to you. My advice? If you have it, give yourself a pat on the back, if you don’t, be aware that chasing it may lead to some pain at some point as there is not real math behind its price. It’s pure supply and demand. Supply is obviously limited and demand has gone up because of central bank buying and doomsday preppers… and of course speculation. Is the world a less stable place this morning? Yes. Will that instability affect your investments in technology and healthcare? Probably not. Let’s move on.

Obviously, the largest impact will be in the energy sector. But to understand what the impacts may be, you have to understand a bit more about the industry, because oil is not oil, and barrels are not interchangeable widgets. This is where heavy sour crude steps onto the stage, quietly, awkwardly, and with far more influence than most investors appreciate.

Venezuelan crude is heavy and sour. Thick, sulfur-rich, and, for lack of a better description, difficult. It is not the light, sweet shale oil that gushes out of West Texas and makes for clean soundbites (I am guilty of those, mostly referring to WTI when I talk about crude). Heavy crude is work. It requires sophisticated refining capacity, massive capital investment, and years of operational trial and error. This is precisely where US Gulf Coast refiners have a structural advantage that has been decades in the making. Companies like Valero, Phillips 66, Marathon Petroleum, and Chevron have spent years building and optimizing refineries designed to process Canadian heavy crude. Western Canadian Select is not chemically identical to Venezuelan crude, but it rhymes. The equipment overlaps. The expertise transfers. The margin opportunity is familiar.

That matters because heavy sour crude almost always trades at a discount. If you can process it efficiently, that discount turns into profit. Gulf Coast refiners have been doing this quietly for years, benefiting from Canada’s geology and limited export routes. Add Venezuelan barrels into that same ecosystem, but now under US operational and security influence, and the advantage compounds. This is not theoretical. This is refinery math, stupid.

This is where the newly minted “Donroe Doctrine” starts to feel less like a cheeky slogan and more like a strategy (“Don” after the President and the rest from Monroe Doctrine). The Monroe Doctrine was about hemispheric control and keeping hostile powers out of the backyard. The Donroe Doctrine is its energy-era cousin. Control the supply chain close to home. Control the chokepoints. Control the rules. Oil is not just fuel here. It is leverage. And leverage works best when it is regional.

On the upstream side, the winners are not hard to identify. US majors with experience in complex, politically sensitive environments stand to benefit the most. Chevron is the obvious example. It has longtime exposure to Venezuela, deep technical expertise in heavy oil, and the balance sheet to wait out the messy middle. ExxonMobil fits that profile as well, particularly if redevelopment becomes capital-intensive and long-dated. ConocoPhillips, with its heavy oil experience and operational discipline, also stands to benefit if production ramps become feasible under more stable conditions.

Then there are the oilfield service companies, which are often the quiet beneficiaries of chaos turning into order. Schlumberger / SLB and Halliburton are almost unavoidable characters in this story. Rehabilitating Venezuela’s oil sector is not about drilling a few new wells. It is about workovers, pressure management, reservoir modeling, pipeline integrity, and field-level project management–the nasty details. That is the bread and butter of these firms. If Venezuelan production ever moves meaningfully above its current sub-one-million-barrel-per-day level, it will not happen without them.

Downstream, as mentioned, the Gulf Coast refiners are in the sweet spot, even though they deal with sour crude. Valero, Phillips 66, and Marathon Petroleum are particularly well positioned because of their coking capacity and geographic proximity. Chevron also benefits here through vertical integration. These companies can buy discounted heavy barrels, process them efficiently, and sell refined products into global markets. That is how you turn geopolitics into earnings.

Now for the less comfortable part of the conversation. Canada–oh, Canada. Canadian oil companies have enjoyed a quiet but powerful advantage for years. Limited export routes have forced Canadian heavy crude south, often at steep discounts. US refiners built their systems around that reality. Companies like Canadian Natural Resources, Suncor, Cenovus, and Imperial Oil have benefited from stable, if imperfect, access to the US market. In the near term, they may still do well. Any disruption or quarantine effect that temporarily tightens heavy crude supply can lift prices and margins for Canadian producers. NEAR term.

But over the long run, increased Venezuelan supply erodes that advantage. More heavy crude options mean less pricing power. The monopoly-like conditions that Canadian producers have quietly enjoyed weaken. It doesn’t mean Canada becomes irrelevant. It means competition returns. And competition compresses margins.

This is why the long-term price outlook matters so much. Increased supply, over time, almost always leads to lower prices. That sounds bearish until you remember that volatility is the enemy of profitability. Stable, moderately lower prices allow producers to plan, invest, and optimize. The companies that survive and thrive are not the ones chasing spikes, but the ones with low costs, operational discipline, and scale. US producers tend to check those boxes more consistently than most. Most have literally spent the last two decades increasing their operational efficiency!

Consumers benefit too, though not in the way headlines suggest. This is not about cheap gas. It is about stable gas. Fewer shocks. Fewer lines. Fewer moments where energy suddenly dominates every conversation. Stability at the pump is an underappreciated economic tailwind.

The short term, however, will not be smooth. Supply quarantines, transitional control issues, legal uncertainty, and infrastructure decay guarantee noise. Venezuela once produced roughly three million barrels per day. Today it produces one million at best. You don’t triple output without years of work. Pipelines need repair. Ports need modernization. Refineries need parts. Skilled labor needs to return. Capital needs to feel safe. This will be uneven, frustrating, and politically noisy.

There are also broader implications. Other countries in the region are paying attention. Very close attention. Passwords are being changed. 😉 Assumptions are being stress-tested. The message is clear even if it is not stated outright. Energy security is still national security, and proximity matters.

And so, we circle back to the AM radio. Back to the gas lines. Back to that feeling of helplessness while Roberta Flack or the Carpenters filled the silence. “Top of the World” played while the country very much was not. The question now is whether the United States, armed with technology, regional dominance, and control over heavy crude supply chains, really is on top of the world this time…or whether this is just another verse in a very long song. History says dominance never lasts forever. But it also says that controlling supply beats waiting in line.

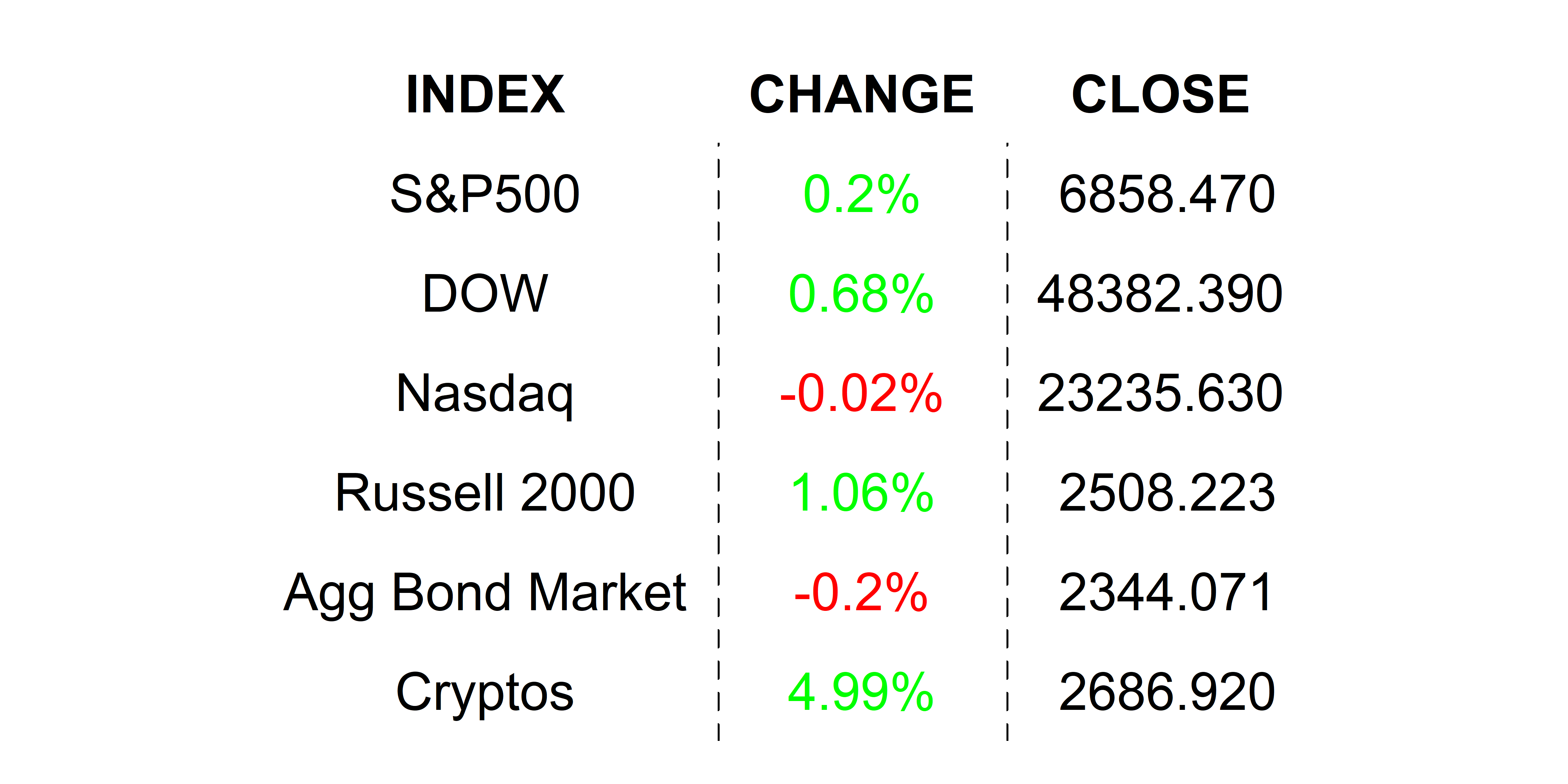

FRIDAY’S MARKETS

Stocks had mixed close on Friday as traders limped back to the office on Friday with renewed hope that 2025’s soft ending was a buying opportunity. The Santa Rally, strictly speaking, still has a few days to materialize and traders are ready for some relief after an extended sideways trade. Happy New Year.

NEXT UP

-

ISM Manufacturing (December) may have ticked up slightly to 48.4 from 48.2. Remember, below 50 is contraction and above 50 growth.

-

This weekend’s military operation will take center stage today. But don’t forget the calendar which includes ISM Services PMI, JOLTS Job Openings, Factory Orders, ADP Employments Change, Housing Starts, University of Michigan Sentiment, and the first official on-time employment report from BLS in a long time. Download the attached calendar so you can be on top of YOUR world.

.png)