Inflation is creeping back and tariffs are officially arriving. Here’s what that means for stocks.

KEY TAKEAWAYS

-

S&P 500 is up 7.78% YTD but has rallied 27% from April lows

-

Tariffs officially start in 7 days—average rate of 15.2%

-

Durable goods inflation flipped from -1.2% in Dec to +0.93% in June

-

Companies are likely to pass tariff costs on to consumers or be faced with margin compression

-

Fed policy is paralyzed as inflation shows early signs of re-igniting

MY HOT TAKES

-

Tariffs are a tax—someone always pays

-

Durable goods inflation is the canary in the coal mine

-

The “pause” in inflation is likely over–trend matters more than level

-

Market strength has masked incoming economic pressure

-

The Fed’s hands are tied–trade policy is doing the tightening now

-

You can quote me: “The party ends in 7 days. If you are staying for the afterparty, you better have a pair of comfortable shoes.”

Welcome to the afterparty. Stocks have had a tremendous 2025! You wouldn’t know it by looking at the S&P 500’s year-to-date return of 7.78% though. But if you look more closely at the contours of its ascension path, you are likely to give the index a bit more credit. After all, the S&P recovered from a -15% deficit, piling on 27% of gains since its April low through yesterday. That recovery took place while the Trump Administration rushed to make trade deals with the world. The starting point for those negotiations was the Liberation Day announcement of stiff tariffs, which at the time seemed… well, almost comical because of their magnitude.

Trump’s willingness to negotiate became the catalyst that sparked that recovery rally. The recovery was also helped by a strong Q1 earnings season, stronger-than-expected economic numbers, and progress in some trade negotiations. Those negotiations earned everyone a temporary reprieve which was ultimately extended through today.

The economy, since Liberation day has held up rather remarkably, despite some doomsday predictions from many economists. At the core of worry was that inflation would be re-ignited by the new tariffs. The logic? Rational companies pass taxes on to consumers in the form of price increases. That’s Econ 101. Despite today’s deadline, there were many tariffs present throughout this negotiation period. Before every release of the Consumer Price Index / CPI and the PCE Price Index, Wall Street thought, “this is the one.” This is the one where inflation would finally show up. But it never did, really. Sure, core goods prices crept up a bit, but nothing on the magnitude of what we witnessed a few years ago. However, from a trend perspective, there was a clear upward trajectory for durable goods, and yesterday’s PCE Price Index release really underscored those price gains.

Folks, inflation is here. It is not nosebleed inflation, but the trend cannot be ignored. Durable goods inflation went from -1.2% last December to 0.93 in June. That’s right, at the start of the year durable goods were deflating, that is, their prices were decreasing year over year. And now they are rising once again. Will it get higher from here? Well, that depends on 2 things. The first is how much inventory companies have managed to pile up prior to the tariffs, and the second is, how much of the tax will companies absorb.

Regardless of the size of pre-tariff inventories, they will not last forever. They only put off the inevitable reality of biting cost increases for companies. How much those companies ultimately pass along to consumers will vary from industry to industry and company to company, but suffice it to say that each company WILL PASS ALONG AS MUCH AS IT CAN TO CONSUMERS. There is no such thing as a benevolent for-profit company. If a company decides to absorb the tax, it will only do so if it fears losing customers and not to make your day better.

This sword of Damocles has been hanging over the head of the equity markets ever since Trump announced his seriousness in the White House Rose Garden in early April. Some deals were cut in the interim. Those deals saw baselines rise from 10% to 15%. To be clear, there are additional tariffs which have not been negotiated. Namely, fentanyl tariffs, steel and aluminum tariffs, and auto tariffs, which have persisted throughout this period, and still exist today. Today, it seems that time is, officially, up for negotiations.

Yesterday, the White House published a list of tariffs that will go into effect in 7 days 1 minute after the strike of midnight. You are welcome to take a look at the official memo from the White House here, but I will simplify it and tell you that the average tariff rate is 15.2%. Remember, that is an average, which means some countries will be charged far more and some, possibly less, but for the most part those tariffs converge on, say, 15%. So what does that mean?

It quite simply means that, in general, companies will now pay 15% for all products they import from anywhere else but the US. Companies that rely more heavily on imports will pay more than companies that don’t. It really is that simple. Well, not really. There is a ton of fine print and some products and materials are exempted. But really at the end of the day the challenge is officially here. Companies that were holding out with the hopes that Trump would back down will now find themselves scrambling to figure out how to deal with the margin compression.

To be crystal clear. Someone is paying for it, either the importing company or you. If it’s the former, it will cost you in your retirement portfolio (stock values will reflect the compression), or if it's the latter, it will cost you at the check-out counter.

The potential for prices to rise as a result of these new tariffs is what is vexing the Fed, causing the policy paralysis we witnessed on Wednesday, and unfortunately, with yesterday’s PCE Price Index print, it is likely to continue through autumn, at the very least, and possibly through the end of the year. So, the final question that is as yet unanswered: what does this mean for stocks?

Well, this morning, it means that stocks are down in the premarket, but is this the start of something way worse, like the March / April selloff magnitude? Well let’s start by recognizing that August is not a strong month historically, and September is the worst. So, there is the potential for that pressure. Earnings season for Q2 is past the midpoint and it has been solid for beats and growth so far. The strong showing in tech stocks could be helpful in propping up markets, but how much longer can it last? Looking forward to the next 2 quarters, analysts expect earnings growth to continue to slow; tariffs certainly have a hand in that. Stock indexes, right now, are near or just below their record highs, and it is going to take a lot to punch back through with a sustained follow through, but that doesn’t mean it can’t happen.

While tariffs are not going to go back to the 2.3% average rate (2024), it is likely that the administration will continue to negotiate, resulting in minor downward adjustments. It is a lot to get done in the small time window set by the President. That said, the details that will have to be ironed out in the months ahead may yield some positive market catalysts, but until then, this will be a test to see just how much fortitude US stocks have.

These next few months will indeed be challenging as the effects from this unprecedented tariff regime shift work their way through the economy and the markets. The party, so far, has been quite pleasant with many unexpected surprises. The party ends in 7 days. If you are staying for the afterparty, you better have a pair of comfortable shoes, because you are going to have to stay for the whole thing to see how that plays out.

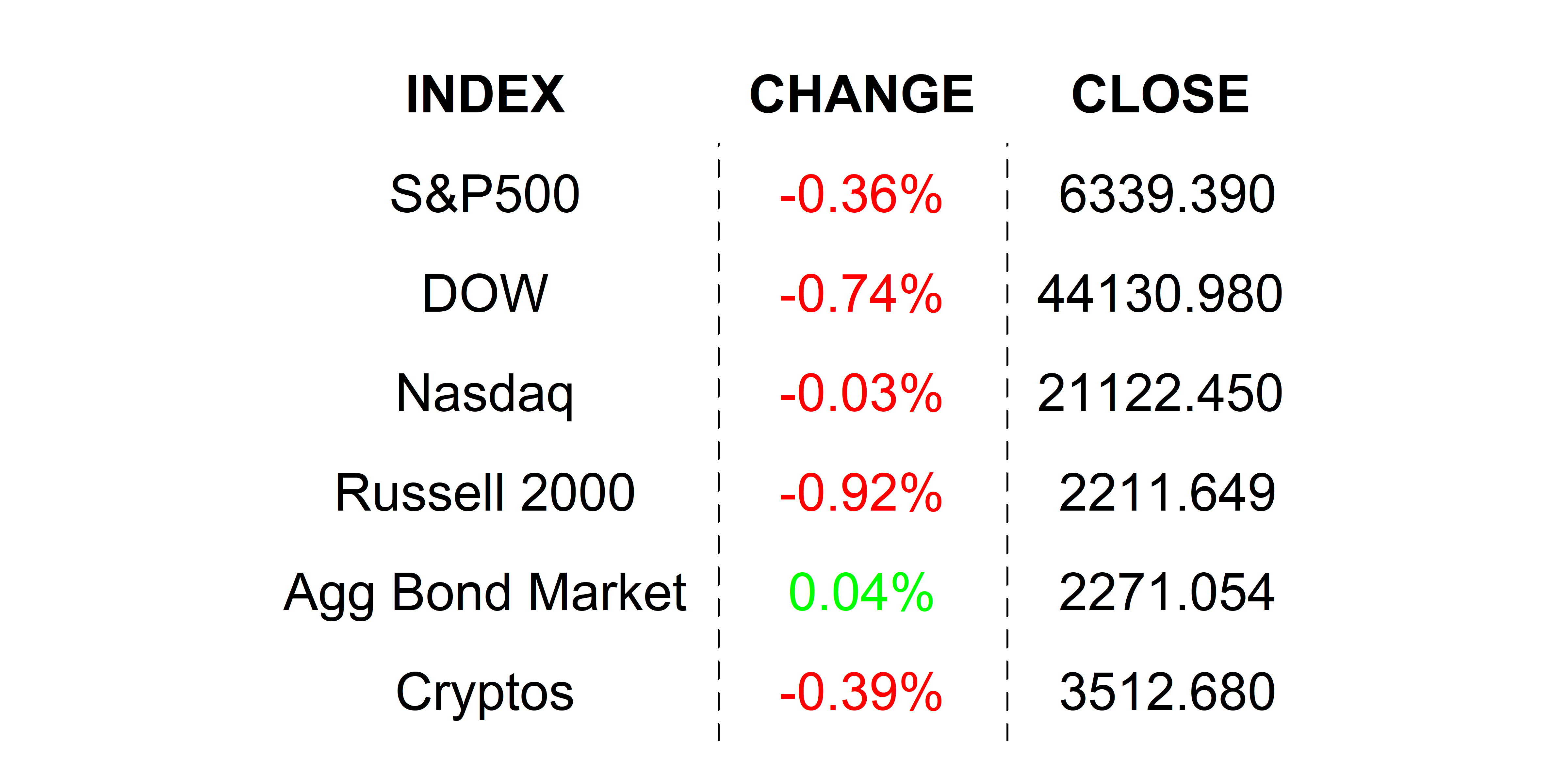

YESTERDAY’S MARKETS

Stocks declined yesterday in response to hotter than expected inflation numbers and some Presidential tariff curveballs. Rate cut bets through the end of the year were cut back in the wake of the Chair’s comments and the latest inflation figures. Bond yields were little changed after Wednesday’s larger gains.

.png)