The average new car now costs over $50K. Consumers are choking–companies aren’t. That gap is the whole story.

KEY TAKEAWAYS

-

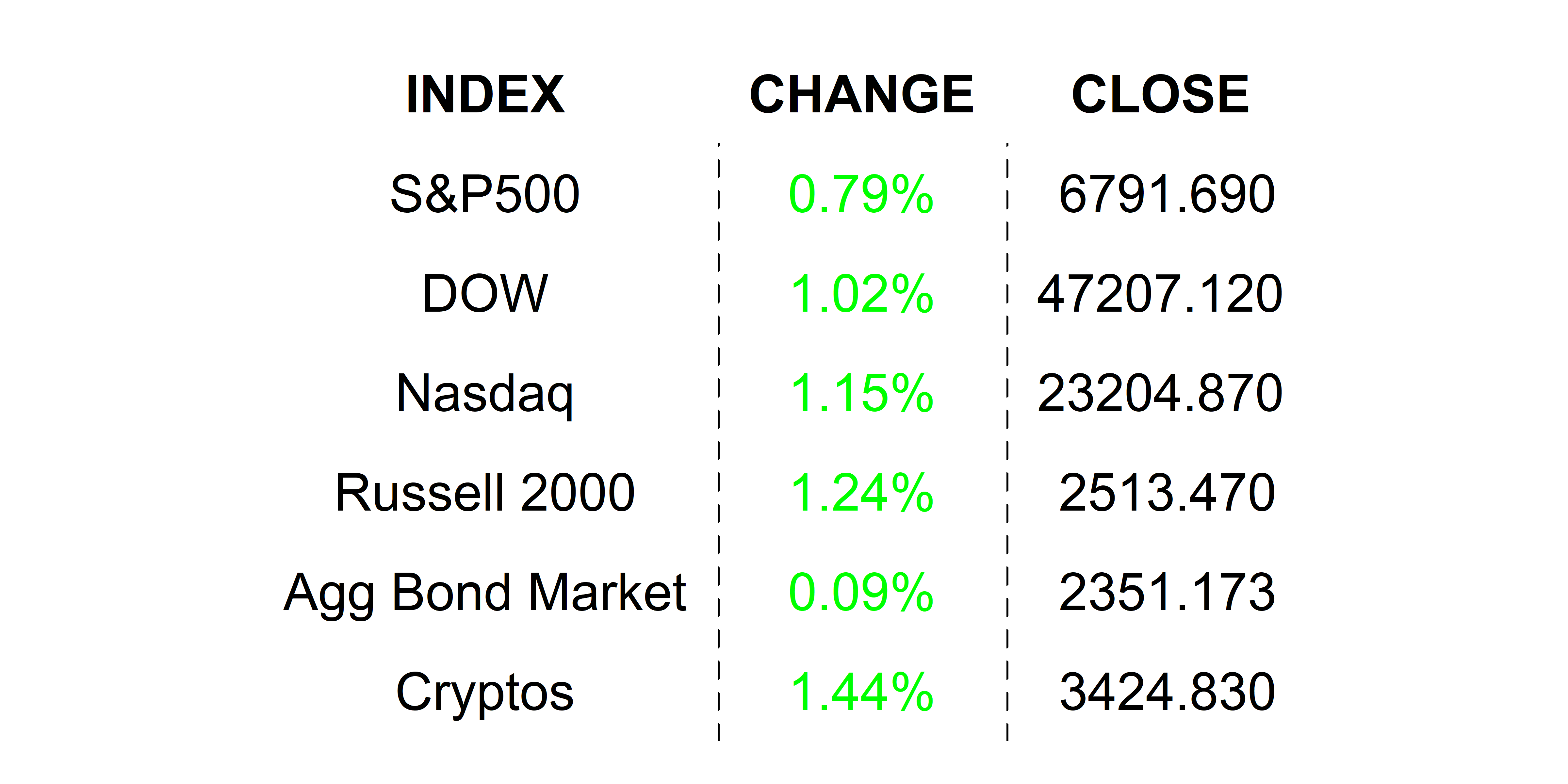

CPI came in at 3.0% year over year–a shade cooler than expected–and Wall Street celebrated like it’s rate-cut season.

-

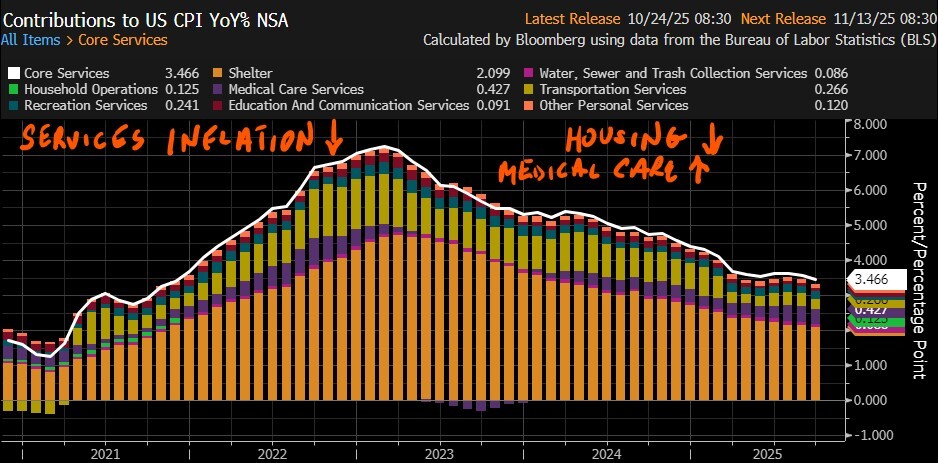

Services inflation is still sticky because of housing and medical costs, even as housing pressure slowly eases.

-

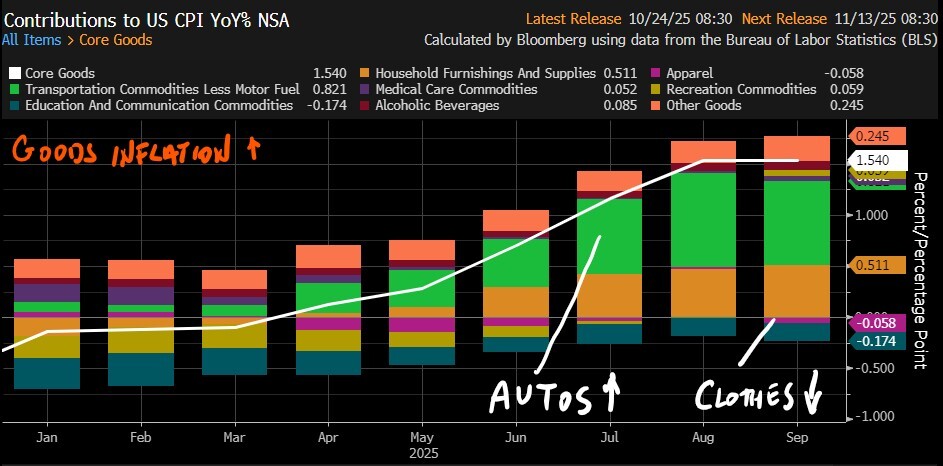

Goods inflation should be mostly quiet—except for vehicles—which remain a major contributor.

-

Ford and GM both delivered strong earnings, raised or held guidance, and thanked the White House for tariff policy.

-

Detroit is adding shifts, investing locally, and turning tariffs into a competitive advantage–not a cost burden.

-

Consumers are absorbing the costs while corporate margins stay healthy.

MY HOT TAKES

-

Tariffs were supposed to be a handcuff–Detroit just turned them into a tool.

-

The Fed can cheer a cooler CPI print, but if companies keep their pricing power, inflation is still alive.

-

Detroit’s guidance tells you something the CPI can’t: the corporate engine is still running hot.

-

The average new car price is over $50k–that’s not a demand problem, that’s a transfer of burden from company to consumer.

-

This is a new economic model: protect the producer, test the consumer, hope the Fed looks away.

-

You can quote me: “Ford and GM just thanked the White House for tariffs–and Wall Street still thinks this is a tax.”

Merrily we roll. Ok, I am sure that by now you have already heard that Friday’s long-delayed Consumer Price Index / CPI delivered a huge kiss to equity markets, coming in lighter than expected. 🎉 Recall that the usually-monthly inflation number from the beleaguered Bureau of Labor Statistics (BLS) was put on ice due to the government shutdown. That’s a problem for markets and even the Fed (though it is not the Fed’s favorite inflation report) who need to know if inflation will continue to eat into consumers’ budgets and–perhaps even more importantly–allow the Fed to get on with its rate-cutting plans.

Before you go on feeling all important like BLS gives a hoot about your portfolio, I have to inform you that the agency only released the report for the Social Security COLA–Cost of Living Adjustment. Social Security is adjusted to keep up with the cost of living, and the folks that make those adjustments rely on CPI. There! Sorry to burst your bubble bigshot, but, honestly, who cares why the BLS bureaucrats released the already-prepared report, as long as we have it. And like a cup of warm water in the middle of the dessert it was as sweet as sweet can be–the only “official” government economic release this month, and it is possibly, besides labor data, the only one the market needs at the moment. Consumer prices rose by 3.0% since last year, slightly more than the prior reading of 2.9%, and slightly lower than the 3.1% consensus estimate. That is still a full percentage point higher than the Fed’s target, but the better-than-expected print was enough to propel equity markets higher. Let’s dig into it a bit more.

I want to start with the old news. Sticky inflation from the pandemic inflation wave is still…um, sticky. That sticky inflation is from services. Have a quick look at my favorite Bloomberg ECAN chart and keep reading.

This chart shows services inflation (white line) along with its components (stacked bars). The big gold bars which make up almost 60% of services inflation is housing. If you have been paying attention for the past 5 years you shouldn’t be surprised. However you should see by eyeballing the chart that it has been steadily declining, albeit slowly as molasses. This has contributed to an overall, shallow decline in services inflation. However, I want you to note the expanding purple bar, medical care services, which is kind of working against the trend, pressuring service higher. The inflation comes from the hospital care costs which are inflating at 5.8%. For some context, that is above a long-run average of around 4.25%. Ok, enough about sticky inflation, it’s getting better, but it's not there yet. Let’s move on to goods inflation. That is where we would observe the Fed’s monster under the bed, tariff inflation. Have a look at this ECAN chart and keep reading.

This is a chart of goods inflation (white line) and its constituents (stacked bars). You don’t have to squint to notice that transportation commodities–AKA cars and trucks–make up the bulk of goods inflation–32.3% to be more accurate. Next in line household furnishings, which contribute 18.5% and then apparel 14.25%. These three categories would be the most likely place where tariff inflation would appear. Now, to be CRYSTAL clear, all of these are running way below the 2% target, but we are hyperfocused on them because of tariffs and their overall impact on inflation, so we are looking for trends that might suggest trouble ahead. You have heard about steel and aluminum taxes, both of which are big input commodities for vehicles. You have also probably heard that passenger vehicles may be subject to a 25% tariff. You may have also heard that even vehicles manufactured in the US used many foreign-manufactured parts and subassemblies, also, possibly tariffed at 25%. That should concern you, based on this chart and the fact that you probably need a car to get around. You know what else might concern you? According to Kelly Blue Book, the average sales price of a vehicle in the US was just over $50,000 for the first time ever! Wow! 🚗

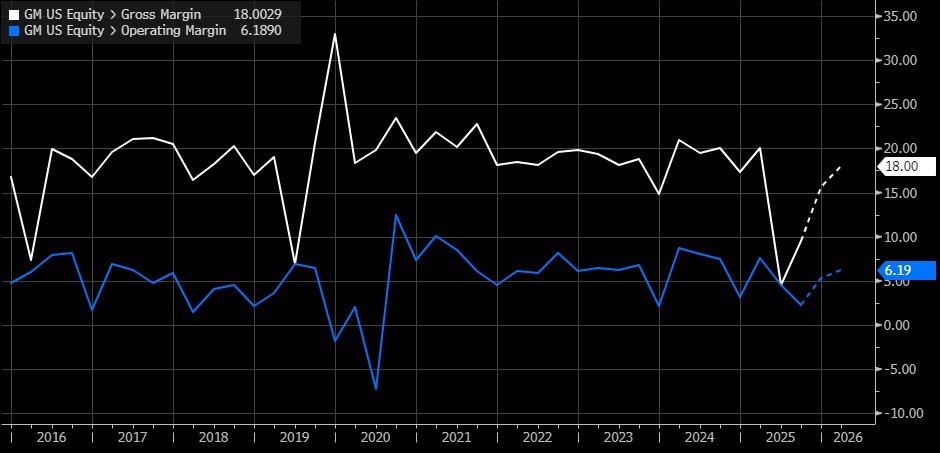

So now let’s put those threads together and bring in last week’s auto earnings, because this is where the narrative starts to bend in a way that markets might not be fully pricing. If you just look at CPI, you’d say, “Goods inflation is being propped up by vehicles, and vehicles are getting more expensive. Tariffs, parts shortages, aluminum incidents, chip drama–all of this should be choking off margins and crushing Detroit.” 🔥🔥 I get it–my heart is racing as well. But that is also not what Ford and GM just told us. Both companies came out last week and gave what was, in tone and in content, one of the most unexpectedly upbeat sets of calls from a sector that is supposedly under siege from input costs, regulation, and shifting consumer demand. Inflation is still hanging around, consumers are being told to suffer the pain of $50K vehicles, and meanwhile Ford and GM are sounding like they’re settling into BETTER positions, not worse ones.

Let’s start with the big emotional read. I ran sentiment screens across the prepared remarks and Q&A from both Ford’s and GM’s Q3 calls from last week. Across roughly 28,000 total words of management commentary, the positive/constructive language was far greater than the cautionary language. Ford’s tone in particular was confident and pragmatic. Jim Farley opened by saying, “We not only solidly beat expectations, but our underlying performance has us on track to raise our full year 2025 EBIT guidance if it weren’t for the impact of the Novelis fire in Oswego, New York.” That is not a CEO crawling onto the call begging for patience or attempting a slight-of-hand tactic by mentioning humanoid robots (Tesla 😂). That is a CEO more or less saying: operationally, we’re humming. He then pivots immediately into thanking suppliers and dealers and even thanks the administration for tariff policy “which is favorable to Ford as the most American auto manufacturer.” WAIT, WHAT? That subtext is unmistakable. Tariffs, which were supposed to be a crippling 25% tax, are instead being absorbed, and in some cases even turned into a relative advantage for domestic-leaning manufacturers.

GM had the same general energy. Mary Barra hit investors early with “we delivered another very strong quarter of earnings and free cash flow,” and then, crucially, “we are raising our full-year guidance.” She also explicitly thanked “the President and his team for the important tariff updates,” saying that the updated offset structure “will help make US-produced vehicles more competitive over the next five years.” Again, this is not the language of an industry pleading for tariff relief. This is the language of an industry that has already internalized tariffs, possibly already rerouted supply, and is now treating policy as a tailwind to localized, higher-margin production. The whole thing feels almost upside down relative to the consensus doom loop we’ve all been trained to expect: tariffs → higher input costs → margin compression → lower capex → layoffs. What we heard instead was tariffs → national-content credits → plant retooling in Kansas, New York, Kentucky → “we’re hiring” and “we’re adding shifts!!”

Let’s zoom in on the quantifiable part of that optimism, because this matters for the inflation conversation. Both companies addressed tariffs head-on and both gave numbers. GM said that earlier in the year it was bracing for a gross tariff impact of four to $5 billion for 2025. That’s the scary headline number that sounds like the end of civilization. By the time of last week’s call, GM had already walked that down to three and a half to four and a half billion in gross exposure, and then Paul Jacobson, GM’s CFO, explained that they expect to offset about 35% of that through pricing discipline, cost work, and footprint shifts. In other words–English words: we’re not just sitting here paying it and crying, we’re moving production and recapturing price. After all those self-help initiatives, GM’s net tariff is closer to the $2-3B range, and even with that baked in, GM guided full-year 2025 EBIT-adjusted to $12-13 billion. They also said, and this part should make your eyebrows go up, that 2026 should be even better than 2025. That is a direct margin story. That is GM telling you that under all the noise– chip supply, EV adoption slowing, tariff ratcheting–the structure of their P&L is getting sturdier, not shakier.

Ford told a very similar story, but with Ford you also get a look at classic “blocking-and-tackling manufacturing nerd stuff,” and I mean that in the most complimentary way. Ford said tariffs would be a roughly $1 billion headwind for 2025, down from $2 billion in earlier expectations, thanks largely to the administration’s expansion of an MSRP-based offset program that lets them credit their high domestic content against the parts they still have to import. They explicitly said they absorbed a roughly $700 million tariff headwind in the quarter and still generated $2.6 billion of adjusted EBIT. They emphasized that warranty costs came down by $450 million year-over-year, that quality scores improved, that AI-enabled plant upgrades are reducing defects in real time (AI in practice 💥), and that they are tracking at the high end of their pre-fire guidance. Ford’s CFO, Sherry House, basically walked investors through the math: excluding the aluminum supply shock from the Novelis fire, Ford would have been guiding $8 billion plus in EBIT this year, and that was after already digesting the tariff.

Let’s take a step back and underline that: GM, the supposedly tariff-vulnerable one, is telling you it can still hit something like $12-$13 billion in EBIT-adjusted this year and improve next year. Ford, the supposedly supply-constrained one, is telling you it would have been above $8 billion in EBIT if not for one plant fire at a supplier, and that even after that event, after tariffs, after whatever chip anxiety is still floating around, it is still guiding $6-$6.5 billion. Gross margins at Ford’s Blue unit held up because pricing on high-value trucks and SUVs stayed solid, and Ford’s commercial arm is still running double-digit margins with software subscriptions adding more. GM is seeing North America margins that would have been 9% without tariffs in the quarter, and is openly talking about getting the overall North America business back to its pre-shock 8-10% EBIT margin range. That, for autos in 2025 with rates still elevated and CPI still at 3.0%, is not too shabby. In fact, it’s actually kind of outrageous.

Let’s also address the elephant in the inflation room: the cost of the average new car. Yes, with the average transaction price of a new vehicle in the U.S. topping the $50,000 mark for the first time, affordability is clearly stretched. That should, theoretically, show up as demand destruction. It should show up as dealers choking on inventory. It should show up as incentive wars that crush gross margin. It should absolutely show up as management tone going a few shades darker with terms like “challenging environment,” “value-conscious consumer,” “we remain cautious,” etc. Instead, what we heard was GM bragging (their word was “disciplined,” but bragging is the vibe) that their incentives are still below the industry average for the 10th consecutive quarter, and Ford pointing out that full-size truck pricing remains strong and that they continue to dominate the hybrid truck segment, which is where they are steering buyers who still want a truck but want to minimize fuel cost.

Another piece that jumped out to me from both calls, and this is where the “tariffs might actually be doing what they were advertised to do” argument creeps in, is the onshoring theme. GM said bluntly that it is doubling planned Chevrolet Equinox output at Fairfax Assembly in Kansas, investing another $1 billion in a next-generation V8 engine program in New York. Ford said it is adding up to a thousand new jobs to increase F-Series production and adding shifts at Dearborn and Kentucky Truck to make up lost aluminum-bodied truck volume after the Novelis fire. Both companies are saying, in plain English, “we are going to build more of our high-margin stuff here in the US.”

And here’s where it all loops back into CPI and why markets should care. The goods inflation chart told us that transportation commodities are still a major contributor to core goods inflation. Vehicles cost more. Parts cost more. Repairs cost more. Tariffs theoretically should make all of that worse, not better. But we now have evidence from the people actually hammering the metal that the effective tariff burden for the big US automakers is meaningfully lower than the headline numbers imply, because of offset mechanisms tied to domestic production, because of mix management that keeps average selling prices elevated, and because of aggressive cost cutting initiatives in manufacturing and warranty. Ford said it was on track for a net $1 billion cost improvement this year excluding tariffs. GM walked through structural warranty fixes, dealer process changes, and software repairs that cut repair costs and limit future accruals. These are not abstract accounting magic tricks. This is “we found the money in the system and pulled it out,” which is what you do when you know tariffs are going to take a bite and you plan to keep earnings whole anyway.

There’s also a policy punchline that I think we should not ignore. Both CEOs went out of their way to thank the administration for tariff policy. That almost never happens in earnings calls unless management wants investors to understand that Washington is, for once, possibly working in their favor. Remember, tariffs were sold politically as a way to bring production back home and support domestic labor. If you take GM and Ford at their word, that’s more or less what is happening. The broadened MSRP offset program (which lets them apply a credit from US-built vehicles to offset tariffs on imported parts) is literally designed to reward domestic footprint. GM called it “the ability to designate parts” so that more inputs qualify, and said that’s already showing up as real cash reimbursements in the quarter. Ford said the program, plus its already-high US footprint, cut its expected tariff drag for 2025 in half, from $2 billion to $1billion, and allowed them to keep guidance intact. When your two largest legacy automakers are publicly praising tariffs for “leveling the playing field” and immediately announcing more shifts in Kansas, New York, Michigan, Kentucky, Dearborn…well, you have to at least consider the possibility that this is, in practice, industrial policy wearing a tariff mask. In other words, the tariffs may look like taxes on trade, but in practice they may be pushing companies like Ford and GM to build more in the US, hire more American workers, and invest in local plants.

So where does that leave us? With an economy in which CPI just printed a 3.0% year-over-year, which the market is cheering because “it means the Fed can keep cutting,” and at the same time an auto industry that is still pushing through higher ticket prices, still contributing more than its share to goods inflation, and still telling investors that margins are holding up just fine. The old textbook link between tariffs and instant margin death is not showing up in Detroit’s numbers… yet. Instead, we’re getting something subtler and, maybe for the Fed, more annoying. Tariffs and localization are keeping industry busy, moving more production onshore, and supporting corporate earnings, even as the cost of the final product (your car) drifts further out of reach. In other words, the pain of “car prices are insane” is not showing up as corporate weakness. It’s showing up as corporate strength. The machine is still running, it’s just asking the consumer to carry more of the load.

Services inflation is still sticky because of housing and medical care. Goods inflation, which had been fading, now shows a stubborn contribution from vehicles, which is exactly the area we were told to watch for tariff pass-through. Consumers are staring down a $50,000 average sticker. And yet, Detroit just got on two different earnings calls and basically said: margins look fine, cash flow looks strong, and next year might even be better.

LAST FRIDAY’S MARKETS

Stocks rallied hard after the delayed CPI came in lighter than expected. All eyes turn to the Fed this week for expected rate cuts as 10-year yields end the week flat at 4%. Earnings topped the week off on a strong note.

NEXT UP

-

No economic releases today because of the shutdown. Later this week, we will get private housing numbers, Conference Board Consumer Confidence, the FOMC meeting, and lots of important earnings (including Mag-7 and tech). Download the attached economic and earnings calendars, so you can be the fastest car in the race.

-

Important earnings today: Keurig Dr. Pepper, Whirlpool, Waste Management, Rambus, Welltower, Avis Budget, Cadence Design, Nucor, F5, and BioMarin.

DOWNLOAD MY DAILY CHARTBOOK HERE 📈

.png)