Stocks slid on Friday because bad economic numbers are bad, no matter how you look at it. Employment numbers missed their mark, which is bad, but perhaps not bad enough for the concession prize of a -50 basis-point cut.

Runway approaching fast, winds picking up. What, really, were you expecting? When the Fed raises interest rates, it does so in order to slow the economy. In theory, a burgeoning economy causes inflation. Nobody likes inflation… especially consumers, who power the economy. We end up the losers, but believe it or not, there are no winners. No, companies don’t win – all evens out when their costs go higher because employees require higher wages to cover gains in prices. Ok, so we got that out of the way. But inflation did pick up in 2021 and something had to be done before all chaos broke loose.

The Fed’s job number 1 is to fight inflation. It sprang into action with the most aggressive rate hikes in as long as most of us could even remember. It did so knowing, full well, that the move could result in a recession. No rocket scientists or Ivy League MBAs were required to forecast that likely outcome. No, a simple look at the Fed’s past results would be enough to know that recession was a high probability. Though it would not be politically correct to state it like this, the reality is that the best cure for a case of bad inflation is a recession. Now, if you can figure out how to throttle the economy to the brink of passing out and then ease your grip just in time, you may walk away with a gold star… or a few mentions in academic publications. That is this Fed’s intention. Will they get the star?

There are many signs that the economy is slowing down. There are some magical tools that supposedly predict recession, like the inverted yield curve or the old, newly discovered Sahm rule, but really a slowing economy is the best early indicator. And an early indicator of a slowing economy is surely labor market strength and consumer sentiment. Jobs are generally required to keep one’s financial standing in good order. If that is challenged, sentiment sours and consumers stop spending money. Must I remind you that a pullback in consumption has a sizable impact on GDP? For every $1.00 less you spend, GDP decreases by some $0.66. Go on read that again. Are you worried you may lose your job? Maybe your child is a recent college graduate searching for a job, who may need your continued support if the job market seizes up. As a result, you may conclude that this may not be the right time to buy that new car. You decide to save those $40,000 just in case. Guess what, GDP just decreased by $26,400 as result of that decision, WHICH CAME AS A RESULT OF YOUR DECREASING SENTIMENT IN A WEAK JOBS MARKET. The chart below IS the jobs market 👇.

Don’t get obsessed with the actual numbers, but please DO recognize that the number of new hires per month is going down. The green line is the monthly Nonfarm Payrolls numbers, and the red-dashed line is a moving average which smooths the spikes so you can more clearly see the trend… which is decidedly downward. This, my friends, is why the market has a bit of digestive discomfort.

These numbers are early indicators of a weaker economy. Wall Street is looking at this chart RIGHT NOW. The Fed is getting ready for its next FOMC meeting RIGHT NOW… also looking at a more complicated version of this very chart. Fed members have acknowledged the weakening labor market. Fed members have acknowledged that the inflation situation has improved. Fed members have talked about cutting rates to avoid what is inevitable if rates remain restrictive. Friday was just another data point that confirmed a weakening economy.

Will the Fed cut rates next week? Based on what we know today, yes. By how much? Based on what we know today, probably by -25 basis points. Will a -50 basis-point move lower the chance of a recession? Most likely not. BUT it would give the market confidence that the Fed is on the case and trying to be proactive. Can the Fed accomplish that without the big cut? Yes, with soothing words “don’t worry we are going to continue cutting and we will do whatever is necessary to avoid a calamitous recession.” OK, maybe they won’t use the word “calamitous,” but you get the point. Will the market accept word alone, calm down, and continue on its secular, upward trajectory? Possibly, but with nerves as exposed as they are at the moment, it is hard to tell. Not so hard to tell is how traders will react if the Fed tries to quell the market by saying “we see no signs of trouble.” They have tried that before, and we know how that ended up.

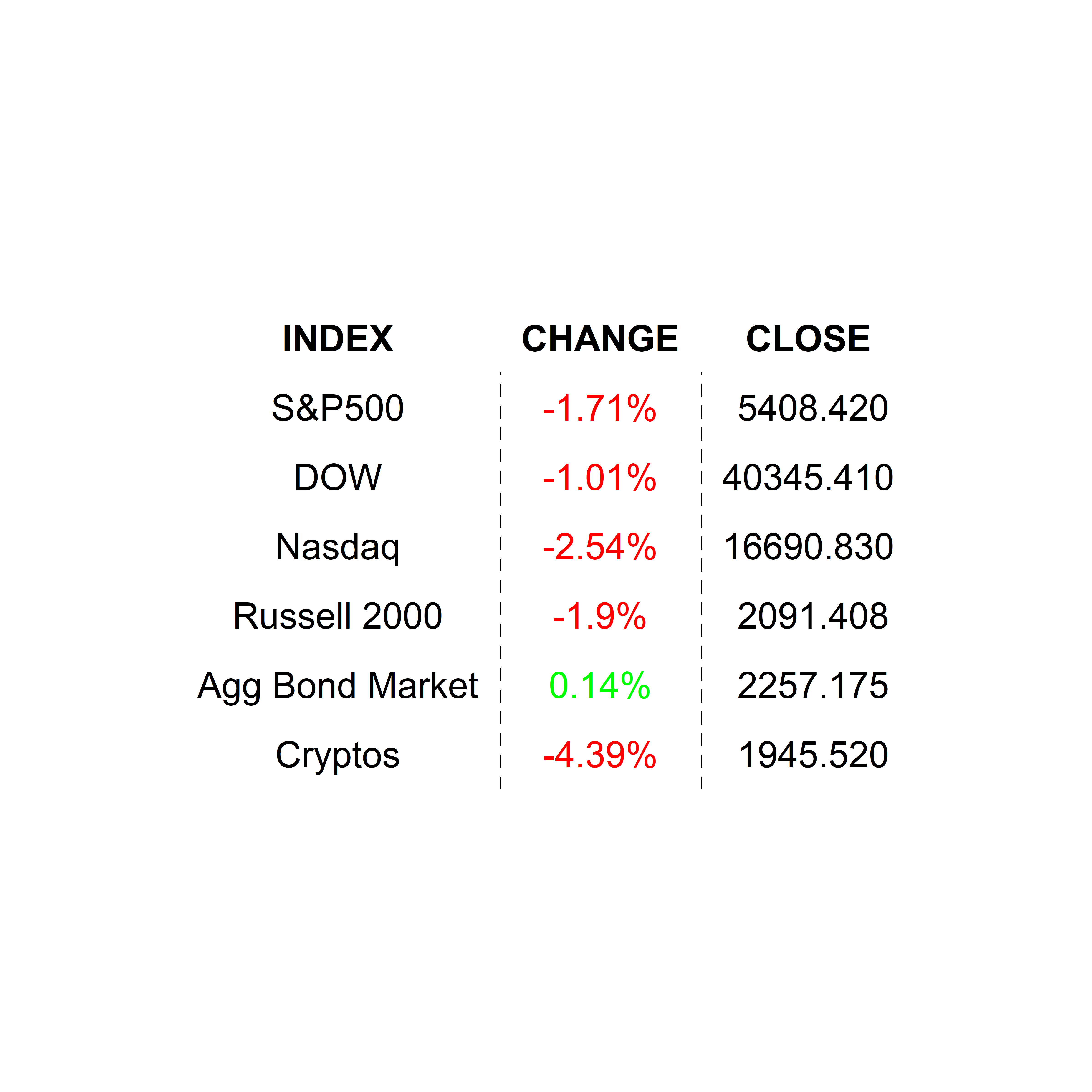

FRIDAY’S MARKETS

NEXT UP

- Consumer Credit (July) may have increased by $11.2 billion after it climbed by +$8.934 billion in June.

- Oracle and Rubrik will announce earnings after the closing bell.

- Late this week we will get Consumer Price Index / CPI, Producer Price Index / PPI, and a first look at University of Michigan sentiment. That is not a lot, but it will have a lot of impact on market sentiment. Download the attached calendars so you don’t miss them.

.png)