Oil and rare earths are optionality--defense is control.

KEY TAKEAWAYS

-

The world now resembles a crowded Risk board entering the fortification phase

-

Resources offer optionality but not control

-

Venezuela and Greenland matter only if they can be defended

-

Security and defense define the real perimeter of power

-

Capital should follow protection--not speculation

MY HOT TAKES

-

Commodities are crowded trades chasing headlines

-

Defense has shifted from cyclical to structural

-

Geography now dictates capital allocation

-

Holding territory matters more than acquiring it

-

The market is underpricing fortification risk

Roll the dice. I can remember when my best childhood friend got the game Risk as a gift. We were probably too young to realize what the game was all about. It didn’t take us too long to understand that having more red or blue pieces all over the map was a… good thing. We had no idea that we were practicing global domination. Risk, in case you don’t know, is a classic strategic board game where players compete for world domination by deploying armies and conquering territories across a map of the continents. Each turn involves reinforcing your front lines, attacking adjacent enemy regions via dice rolls, and moving troops to fortify your borders. The game ends when one player successfully eliminates all opponents, securing total control over every territory on the board. I miss those simple childhood days of the late ‘60s / early ‘70s. Everything seemed so much clearer back then.

Imagine if you plucked young-versions of me and my friend David from his messy toy room and dropped us in the White House situation room. There is a large map on the table. The US is at the center. Lots of blue pieces scattered within its borders. There are others across the map, but they are scant. Now, imagine that there are a bunch of red pieces centered on Russia and China. Those are moving steadily West and North, encroaching on the grey pieces that dominate Europe. The red pieces from China are rapidly encroaching East, South, and North. Our mission would be clear. Defend our borders and push outward.

Our 8-year-old minds could have easily come up with a strategy to accomplish that. My 58-year-old mind would take that a step further. I would have to figure out a way to benefit financially for my efforts. What if we could find adjacent lands that were being encroached upon that had resource optionality? Resources as in crude oil and rare earth elements. Now, that is the stuff of greatness!

When you scan the board today, your eyes naturally drift toward the high-value territories that haven't been fully claimed by the red pieces. Venezuela sits there at the bottom of our home continent, essentially a massive stockpile of oil reinforcements waiting for the right player to make a move. For decades, it’s been a dead zone on the map, but the optionality is undeniable. If we can secure that flank, we aren't just gaining an ally; we are securing a fuel supply that keeps our cavalry moving and our economy insulated. Then you look North, way past the familiar borders to Greenland. It’s the ultimate long game territory. Beneath that ice lies the rare earth elements like lithium and neodymium, which is the stuff that builds the high-tech sensors on our modern-day military machine. It is tempting to think that the winning move is to go all-in on the mining and drilling rights for these territories. We want to believe that by owning the resources, we own the game.

But the 58-year-old CIO in me knows that the game of Risk isn't actually won by the person who discovers the most gold. No, it’s won by the person who can hold the territory they just took. In the old days, David and I would fight over South America because it had that nice continent bonus, but we’d lose it two turns later because we didn't have enough infantry to guard the borders. The resource optionality of Venezuela and Greenland is a siren song that masks a much harsher reality. Oil and rare earths are just cards you hold in your hand. They don't do you any good if the opponent has more pieces on the board and the tactical superiority to simply take them from you.

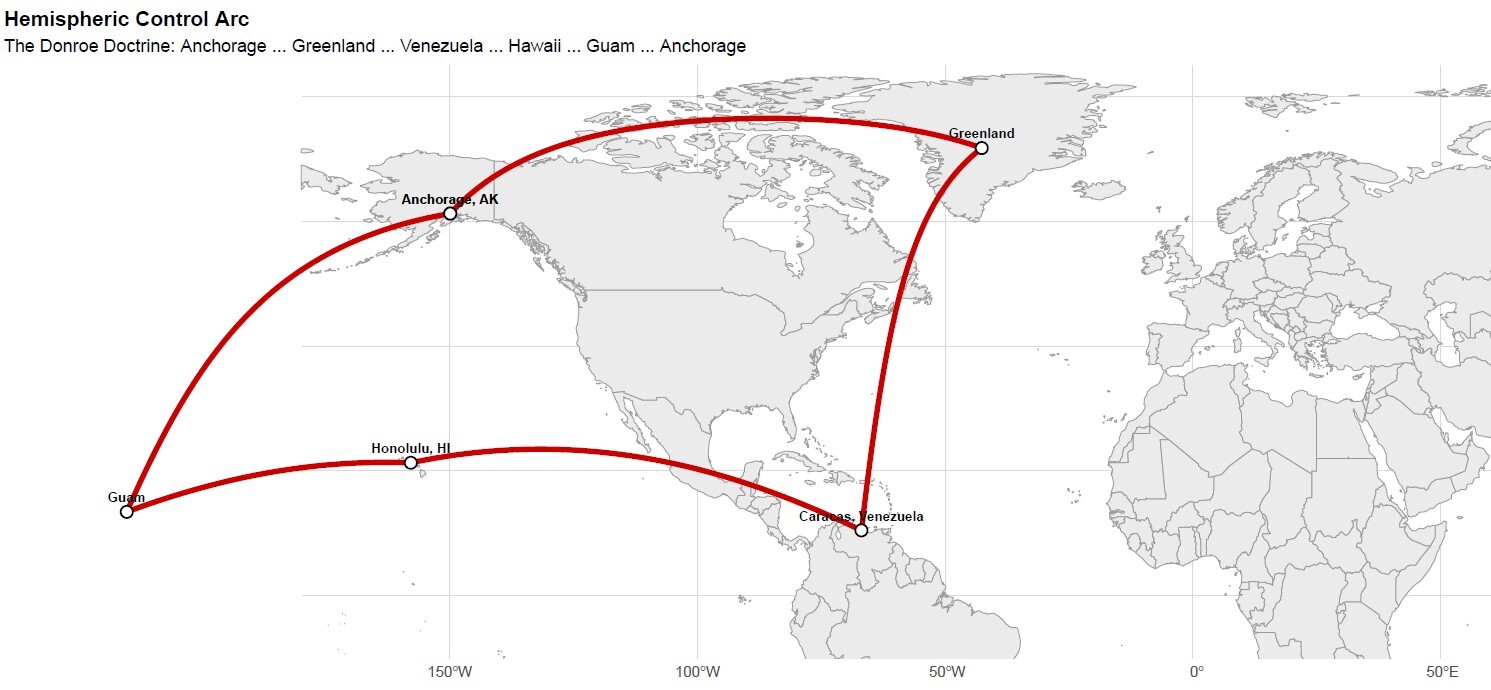

The lens I am looking through this morning isn't one of commodities–we have overthought that for the past few days and quite frankly, everyone else is crowded into that same trade. This morning, I am thinking of security. I sat down and actually drew it out on a map, and that’s when the "ah-ha" moment hit me. When you look at the globe not as a collection of countries, but as a game board that needs to be secured, a pattern emerges. Check out this map I plotted using R-code.

If you draw a line from Anchorage across to Greenland, down through Venezuela, and back around through Hawaii and Guam to Anchorage, something incredible happens. You aren't just looking at dots on a map anymore. You are looking at a complete ring fence. This Hemispheric Control Arc of the newly minted “Donroe Doctrine” (which pays homage to the Monroe Doctrine) isn't just about where the oil is or where the minerals are buried; it is the definitive perimeter of our home territory. By securing Greenland and Venezuela, we aren't just grabbing resources, we are closing the loop. We are completing the "fortification" phase of the turn. Without those two specific anchors, the fence has holes. With them, the blue pieces have a contiguous, defensible shield that locks down the entire hemisphere.

In this environment, the most valuable territory on the board isn't a patch of ground with oil under it–it’s the industrial base that builds the defense systems required to hold that ring fence together. Perhaps we shouldn't be chasing the next big mining strike in a frozen wasteland or a drill site in a volatile jungle. Instead, we should be looking at the companies that provide the artillery and the infantry for the modern age. Defense is the true backbone of the board right now. While the world gets distracted by the fluctuating price of crude or the theoretical value of a rare earth mine, the real power is shifting toward those who build the shields and the swords that maintain that arc. It is a matter of pure geographic necessity. If you control the defense technology, you control the outcome of every conflict. You can have all the oil in the world, but if your adversary has better missile defense and superior drone tech, your oil stays in the ground or, worse, becomes theirs. Security is the ultimate hedge against a map that is increasingly turning red.

Focusing on a place like Venezuela might give us a temporary boost in reinforcements, but it doesn't change the fundamental physics of the game. We are in a period of fortification. In the late '60s, it felt like the game would go on forever with everyone just trading cards and moving slowly. Today, it feels like someone is looking for a total wipeout. When the board gets this crowded and the moves get this aggressive, you don't bet on the resources; you bet on the security of the supply chain. You bet on the entities that make it impossible for the red pieces to cross the line.

I look at the defense sector, and I see its importance to this map. These companies aren't just business ventures. They represent the literal fortification phase of the turn. They are the pieces we move to the border to make sure my old friend David–or whoever is sitting across the table–thinks twice before picking up the dice. The resource optionality of Greenland is a nice story for a rainy afternoon, but the reality of a carrier strike group or a sophisticated cyber-defense network is what actually keeps the blue pieces on the table. We need to stop thinking like explorers and start thinking like generals.

The greatness I’m looking for isn't found in a speculative hole in the ground. It’s found in the certainty of protection. As the red pieces continue their steady march West and North, the value of a well-placed defense contract far outweighs the potential of an untapped oil field. We are transitioning from a world of what can we find to what can we keep. That shift changes everything about how we allocate capital. It moves us away from the periphery and back to the core of the American industrial machine. It is about the hardware that ensures the map stays the color we want it to be.

I think back to that messy room again. David and I eventually had to pack up the game because it was dinner time, and the world went back to being a place of schoolbooks and bicycles. But the real world doesn't have a dinner bell. The game is still going, and the board is more precarious than it’s been in our lifetime. My friend and I might have been practicing for global domination without knowing it, but now the stakes are high enough that we can't afford a bad roll.

Don't get distracted by the shiny objects on the map. Those are good, but you might miss the bigger picture. Don't get lured into the territories that look rich but are impossible to defend. The winning strategy this morning isn't about finding more oil; it’s about making sure you have the strength to keep the pieces you’ve already got. Focus on security, focus on defense, and let the others gamble on the resources. We’re playing for the whole board now. 😉

YESTERDAY’S MARKETS

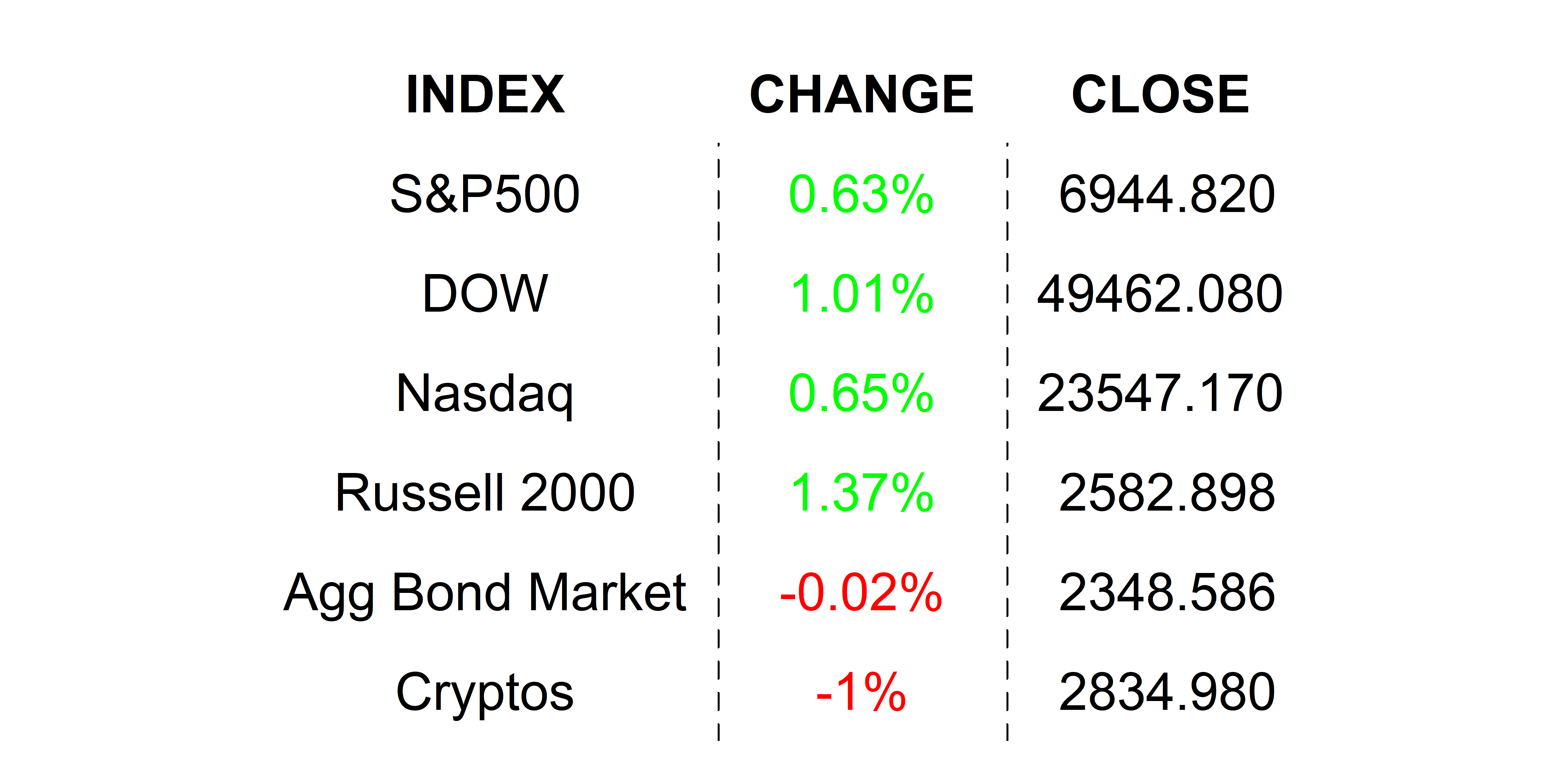

Stocks rallied yesterday because, apparently controlling more oil is good–the markets applauded. The Supreme Court will opine on tariffs later this week–no tariffs could be a windfall for consumer companies, thought investors.

NEXT UP

-

JOLTS Job Openings (November) is expected to show a slight decline in vacancies to 7.648 from 7.670 million.

-

ISM Services Index (December) may have slipped to 52.2 from 52.6.

-

Factory Orders (October) probably declined by 1.2% after inching higher by 0.2%.

.png)