Political noise, trade tensions, and earnings collide in a high-stakes market week.

KEY TAKEAWAYS

-

Headline risk has returned as a defining feature of markets

-

Volatility has begun a slow upward trend

-

Political and trade tensions are resurfacing simultaneously

-

Markets remain sensitive to tariff rhetoric

-

Earnings arrive in a less forgiving environment

MY HOT TAKES

-

Markets underestimated the persistence of uncertainty

-

Complacency was rational but is now being challenged

-

Shutdown risk matters more for sentiment than pricing

-

Tariffs reintroduce volatility faster than fundamentals change

-

This is an environment where discipline matters

-

You can quote me: “If you add climbing and elevated volatility to the equation, you end up with ripe conditions for wildfires–the equivalent of dry conditions in late summer.”

Tease the senses. Ice cream goes with whipped cream, chocolate, and everything sweet and gooey. I was brought up on that norm. The idea of adding salt to a sweet food is simply mind-blowing to me. These days, juxtaposing tastes seems to be the new norm and, for the record, I am a big fan. I started to see famous chefs adding a dash of acid–like vinegar or citrus–to almost every dish starting in the early oughts, and it seems to have taken. To be clear, chefs have always used wine–a more subtle acid alternative–to add complexity to a dish, and that too appears to have become the norm. Ok, it’s 4:00 AM on an arctic Monday, and I can finally just make out the New York City skyline from my window after seeing nothing but opaque white for the past 24 hours. Maybe that is why I find myself talking about food, but it’s time to move from the kitchen to the trading floor, because the markets are already in full swing globally, and the week ahead is chock-full of very important data.

I have been joking with all of my media and journalist friends that for the past 6 months we have all been on the “weekend beat.” That’s inside journalist-talk for the small handful of reporters that pick the small straw and become responsible for reporting about events that take place over the weekend. This past weekend was, unfortunately, another one of those weekends. Financial markets are closed on the weekends–for the most part–but the news that can affect the markets clearly is not.

If you have been paying attention to musings these past several weeks, you may have noticed my increased use of the term “headline risk.” I have been highlighting this challenge facing markets in this first quarter. Headline risk is quite literally, as its name implies, the risk associated with as yet unknown, market-impacting news hits the tape causing potentially severe market reactions. I have argued that the administration is likely to dig deeper into its playbook this year, attempting to use untried tactics. The objectives are not nefarious, but the results could be extreme, as the markets are not accustomed to these new plays. And you know well–regular followers–that markets don’t like to be surprised. To be clear, some of those tactics may produce very positive results, but the outcomes in most cases will be less impactful than the sense of “not knowing” that has the potential to roil markets.

Last week was jam packed with all sorts of geopolitical gyrating, and it culminated with sad news on the domestic front with the shooting death of a protester in Minneapolis. The details of the shooting are still unclear, but what is clear is that it has sparked a heated political debate. Heated political debates are not nothing new to US markets. In fact, political strife has become a fixture in Washington DC and markets have, for the most part, chosen to turn the other way and tune out the noise. A perfect example of that was last year’s record government shutdown which was largely ignored by the markets despite the very real costs that resulted from it. In fact, we are still feeling impacts from it on Wall Street as we continue to get stale data as agencies catch up from the long-term furlough. The S&P 500 through the 2025 shutdown, for the most part, broke even, but that doesn’t mean that markets were completely unaffected. In fact, one could argue that investor sentiment was muted in-part because of the shutdown, which ultimately led to the 2.4% Q4 gain in the index despite outstanding earnings.

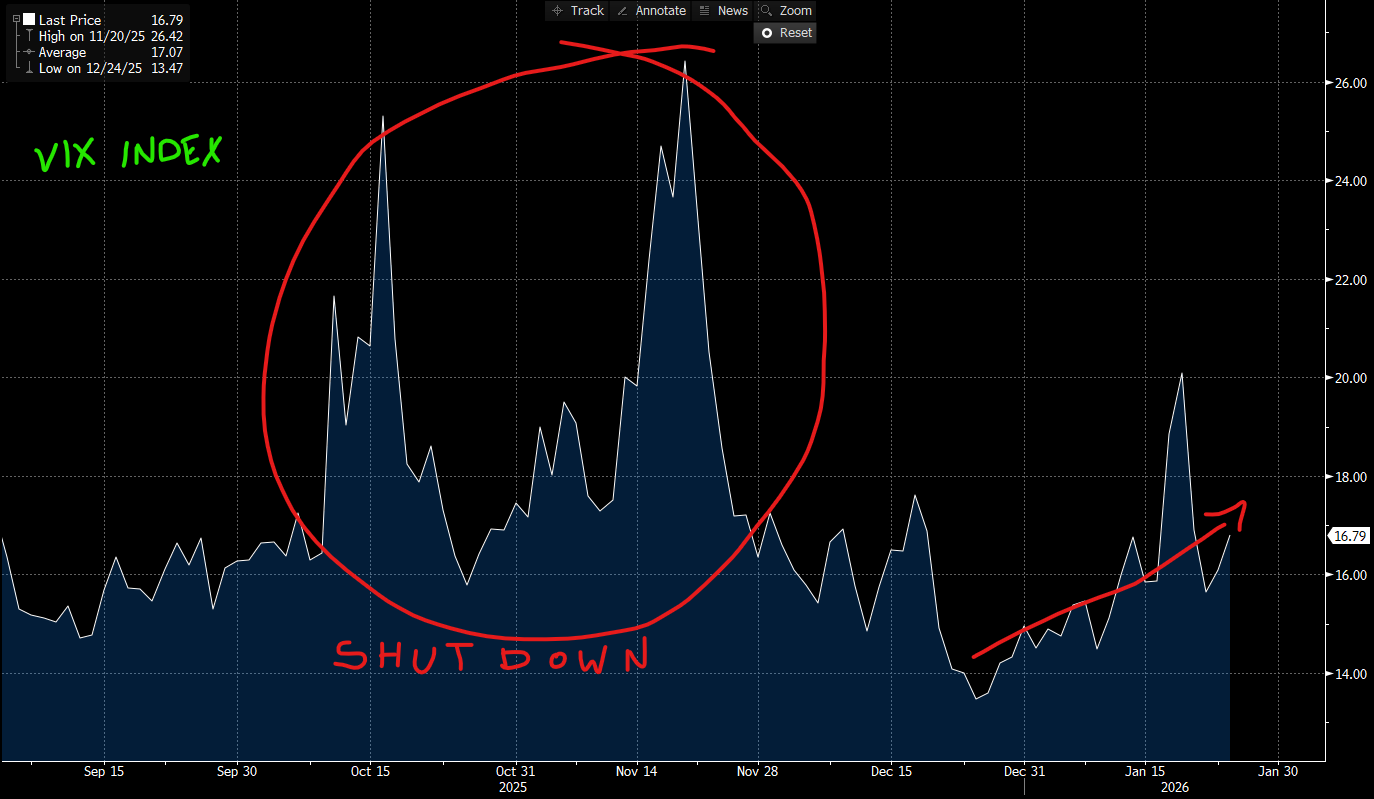

In fact if you look at the VIX Volatility Index through the shutdown period, you will notice that it was elevated and had two notable spikes in mid-October and mid-November. Now, those spikes were not necessarily directly related to the shutdown, but it certainly played a role in them. Check out the following chart of the VIX, which includes that period.

Late last year and early this year I have been pointing out just how low the VIX index was considering what appeared to be rising probabilities of tail risk events. That implies that investors were somewhat complacent, and they have good reason to be. The buy-the-dip strategy has been quite a winner recently, and markets have an uncanny propensity to have acute short-term memory disorder. Complacency tends to result in market overreactions. If you stand back and look at the VIX chart, you will note that it has been trending higher. Additionally, last week’s chest-beating battle royal between the US and basically–all of NATO caused a hefty spike up in volatility as the word “tariff” found its way back into trending search terms. Really, last week’s events in Davos revealed just how sensitive markets remain to global trade tensions.

Yesterday’s blizzard blanketed much of the United States northeast in Snow and ice, including Washington DC and New York. That did not stop the politicians from hitting the Sunday talk shows toting sharp words and stiff threats. Being snow bound gave me an excuse to take them all in–a luxury I typically don’t get on a busy Sunday. I wondered what, if any, impact would last week’s Davos adventure and the events surrounding the Minneapolis shooting have on markets.

I am blessed to be in the rolodex of some very seasoned and highly esteemed financial journalists. There is one, in particular, who is really good at getting the facts straight on messy political situations, and I am always happy to see her name pop up on my iPhone, though it usually means that there is trouble brewing somewhere in the world. In fact, it was her call that I got while I was out celebrating my birthday last summer that confirmed that the US was, in fact, bombing Iran–mere seconds after Twitter lit up and the news had not yet hit the mainstream news tapes. She called to get my take on potential market impact–it was a Saturday–I think. An event which another of my favorite reporters at Bloomberg captured in a neat article about last year’s crazy trading environment. Well, wouldn’t you know, her name popped up on my iPhone just yesterday.

Is trouble brewing? Gold is over $5000, Silver is over $100, and the Dollar hit a 4-month low. The VIX is bubbling higher, though not nearly in the “pain zone” by any means. Democrats have threatened to shut down the government in response to the growing tensions around ICE. You may recall that a key vote on either a spending bill or continued resolution is coming up on January 30th–THIS WEEK. There are some rumblings on the Republican side of the aisle as well, which means the probability of another shutdown is not 0%. In other news, Canada has reached a preliminary trade deal with China which reduces tariffs between the two countries and deepens cooperation. Though it is not a full, free trade deal, the Trump Administration has already threatened a 100% tariff if Canada’s relationship with China expands. This after much heated rhetoric between Trump and Carney last week.

The implications? None immediately. Longer term however, there are certainly some. It is likely that the VIX will continue its slow, methodical climb. This week includes some very important earnings announcements which are likely to be market movers. If you add climbing and elevated volatility to the equation, you end up with ripe conditions for wildfires–the equivalent of dry conditions in late summer.

Now, here is an important takeaway–one which I talk about often. Volatility isn’t always bad–it works in both directions. It’s your best friend when markets are ripping and your worst enemy when they are dipping. If earnings come out on the strong side, we may experience some very positive results. But just like with food, it's a very delicate balance between the right amount of acid or salt which can either greatly enhance the experience or cause a wince and a pucker. Stay focused, because this week is sure to be one faced with lots of extremes.

FRIDAY’S MARKETS

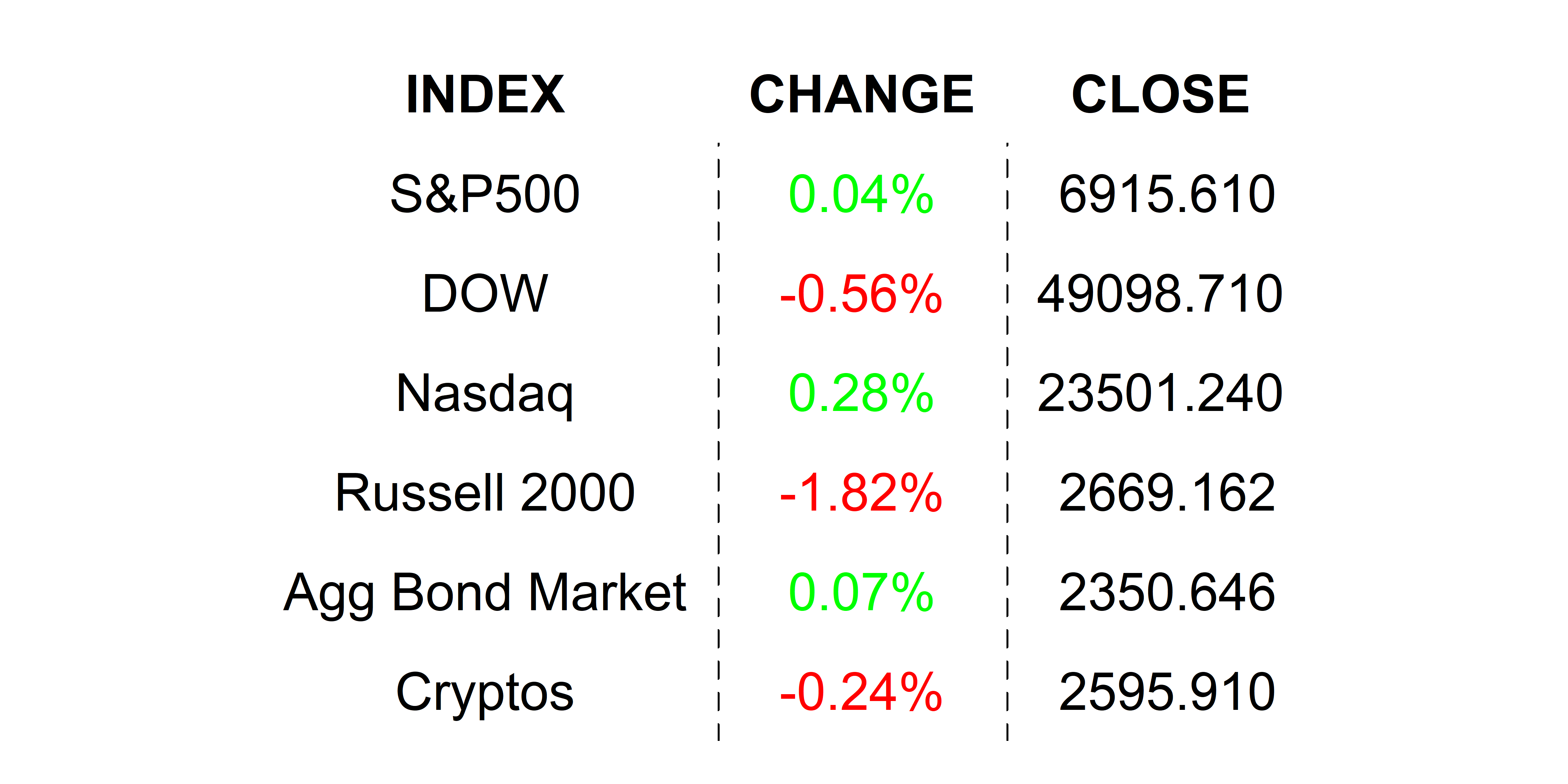

Stocks had a mixed close as traders digested the wild week of geopolitics and mixed earnings announcements. An FOMC meeting, key earnings announcements, and rising political tensions have traders on edge and precious metals at fresh highs.

NEXT UP

-

Durable Goods Orders (November) grew by 5.3% beating estimates and higher than the prior period’s -2.1% upward-revised decline.

-

Dallas Fed Manufacturing Activity (January) may have improved to -8.5% from -10.9.

-

Important earnings today: Steel Dynamics, Nucor, and AGNC.

-

The week ahead: lots of important, market-moving earnings along with an FOMC Meeting, more housing numbers, Producer Price Index / PPI, and much, much more. Download attached calendars so that you can be the best equipped chef in the kitchen.

DOWNLOAD ECONOMIC CALENDAR HERE 📆

DOWNLOAD EARNINGS CALENDAR HERE 📆

.png)