Goods deflation is over, and tariffs may be the culprit. Tomorrow’s CPI could confirm it.

KEY TAKEAWAYS

-

Inflation has cooled but may be resurging through core goods

-

Tariffs collected since inauguration may be starting to show up in prices

-

Core goods deflation has reversed—prices are rising again

-

Categories most affected for now include autos, apparel, and seafood

-

Tomorrow’s CPI release will be key to confirming tariff-driven inflation

MY HOT TAKES

-

Tariffs are an invisible tax with delayed inflationary impact

-

Headline CPI hides underlying risks in core goods inflation

-

The Fed’s in a holding pattern not because of where inflation is—but where it may be going

-

Core goods are the canary in the coal mine for tariff effects

-

Consumers will eventually bear the brunt—if they’re not already

-

You can quote me “Regardless of the strategic intentions of the tariffs, they are a tax. That tax is collected from US companies.”

No free lunch. I am sure that I have used this tagline many times. It is such a quintessential phrase on Wall Street and can be applied to just about anything to do with business, markets, risk, finance–you name it. Today, I want to focus on a sticky topic, inflation. You might ask, “is it still even a thing, Mark?” Well, it has certainly calmed down and has shown some real signs of improvement. It is heading in the right direction toward the Fed’s self-fashioned goal of 2%.

If not for all the noise and market gyrating associated with tariffs and the start-stop-start-stop Big Beautiful Bill, we might still be wondering “what’s up with tariffs?” Of course, a sure sign that inflation is still a thing are interest rates. The Fed hasn’t touched them since last December and it is not expected to change them when the FOMC meets next week.

If we observe headline inflation, we see that Consumer Price Index / CPI ended the year at 2.9%, while April’s read was at 2.3%, respectably lower, and, indeed closer to the 2.0% target. In golf-speak that would be a gimme. Maybe not so fast.

Tomorrow, we will get last month’s CPI, which is expected to come in at 2.5%, a bit higher than April’s but still lower than it was when the Fed last cut rates. Though there is some debate around this, the Fed has acknowledged that the current Fed Funds rate is still restrictive. So why then would the Fed not let up on the brakes if inflation appears under control? Well, of course, the answer is: tariffs.

Regardless of the strategic intentions of the tariffs, they are a tax. That tax is collected from US companies. If those companies chose to eat that tax and accept lower margins, there will be an impact on corporate performance, AKA your stock portfolio. If the companies pass some or all of the increased cost to the consumer–which they will–it means a bump in the inflation rate for at least one year. It's just math, silly. Now, this has been well-discussed these past few months, so you shouldn’t be surprised to hear that.

Today, while the picture is not completely clear, enforceable tariffs exist. There are steel and aluminum tariffs, autos and autoparts taxes, reciprocal baseline levies, etc. Granted there are lots of caveats. But according to Customs and Border Protection (CBP), some $21 billion in tariffs have been collected since the inauguration. Someone paid those bills. The question is was it you and me, or was it the importers… or both? Well if you and I paid them, it should show up in the CPI or PCE numbers. But I just said that the CPI has been lower since Trump won and since inauguration.

The Fed is concerned that the real inflationary effects have not yet shown up yet. In other words, either companies are eating the new cost or they simply, practically have not shown up yet. For these many past months, I have been encouraging everyone to focus on durable goods inflation, not headline inflation, when trying to determine tariff effects.

From early 2021 through mid-2022 goods inflation was in the driver seat, largely caused by supply chain problems and high consumer demand. By mid-2022 goods were disinflating (inflation was slowing) while services inflation took the lead expanding rapidly. Services have disinflated since peaking in February 2023 but not by much. This “sticky” inflation has been the primary focus of inflation watchers since. What has gotten little or no attention has been goods inflation which went negative, deflating (prices are actually going down). In fact, last summer, core goods prices were down by around -1.9% from a year early. Yeah, that minus sign is not a typo. That deflation actually helped bring down headline inflation, offsetting sticky services inflation. Since last July, however, the deflation of goods has been getting smaller, and in fact, last month, goods became inflationary again. In other words, prices of goods are growing again.

Is this just a natural cycle? Have goods input prices begun to rise? Have companies been raising prices due to higher consumer demand? It can be all of those, but what we really would like to know, is any of it caused by tariffs?

Based on the complex collection of tariffs in effect today, we would expect aggregates such as autos, apparel, and foods to show initial signs of tariff-driven inflation. In food, specifically, seafood is likely to be affected as most US seafood is imported (roughly 70%). Almost all apparel is imported and roughly ½ of auto / auto parts are imported. So, let’s have a look, shall we. Do, let’s then follow me to the close.

This is my favorite Bloomberg ECAN chart! This chart shows Core Goods Inflation and its primary inputs. The white line is overall group inflation, and you can see how it spiked in early 2022 and bottomed out last summer. But you will also note that it has since been climbing and actually went from negative to positive in April. Transportation Commodities are represented by the lime green bars and include new and used cars along with parts.

Can you remember back in 2022 when cars, specifically Used cars got out of control? New car manufacturing lines were shut down due to supply chain problems, and demand was through the roof, so buyers turned to the used market causing prices to skyrocket. That was one of the original overall drivers of inflation! As you can see, things calmed down by 2023 and auto prices actually have declined throughout the better part of the last 2 years… EXCEPT FOR THE PAST FEW MONTHS! Is this an early sign of things to come? Will we go back to big positive green bars of 2021 and 2022? I haven’t even talked in-depth about food inflation. That is still very much a problem which can be easily made worse if tariffs inflame it. Meat and poultry prices have been on the climb (3.15%), and seafood is on a steady rise as well.

Folks, if you really want to know if tariffs are affecting inflation? Well, tomorrow’s CPI may give us a clue. Not the headline number, but rather, the Core Goods component. The Fed will be watching that… and so, my friends, should you.

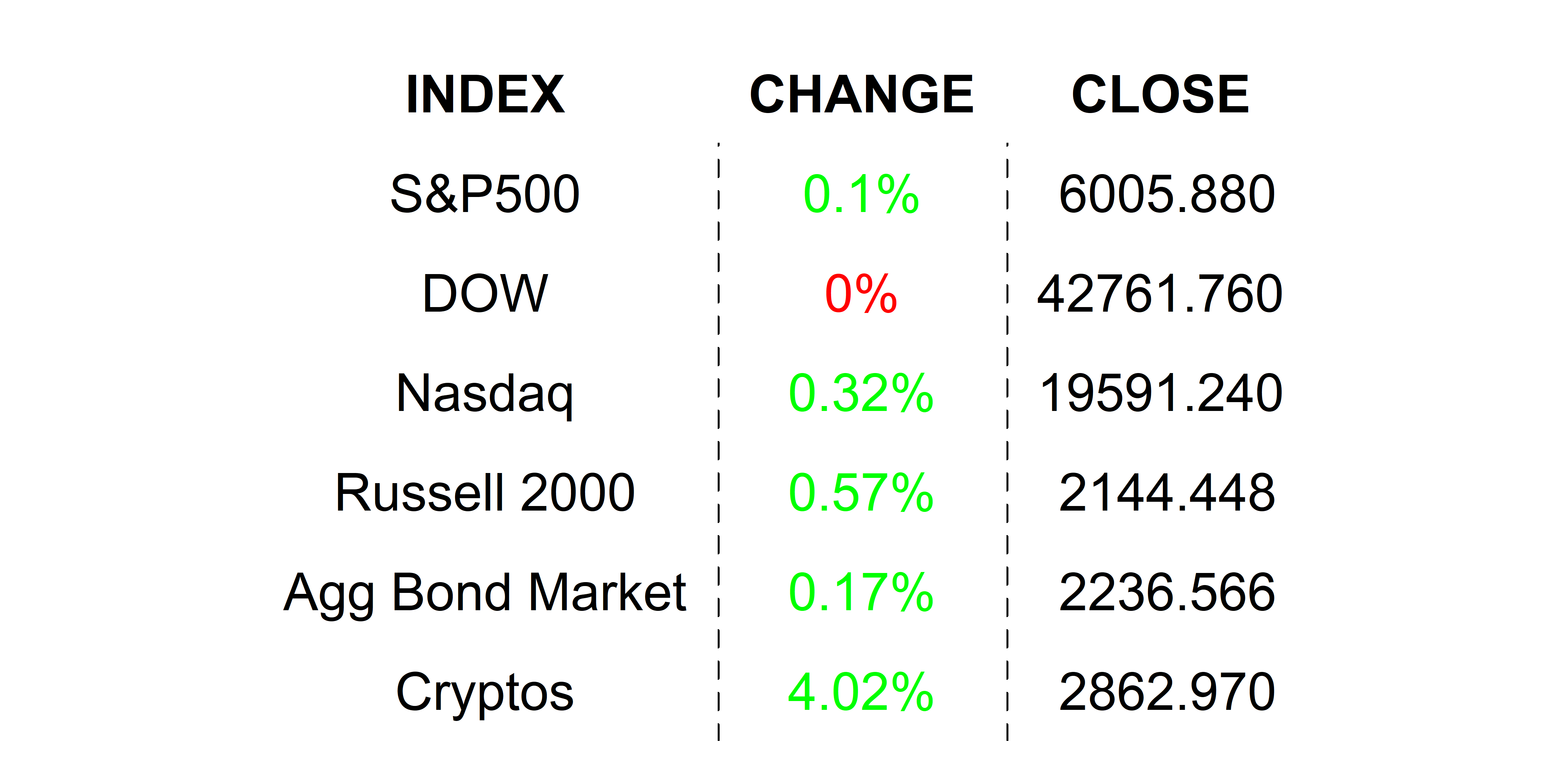

YESTERDAY’S MARKETS

Stocks inched higher yesterday on hopes that more progress would be made in Sino-US trade talks being held in London. Jensen Wong did his share to give tech stocks a boost in a keynote address while Apple underwhelmed at its WWDC with a noticeable lack of what we all want these days–AI.

NEXT UP

-

Small Business Optimism (May) improved to 98.8 from 95.8. The improved outlook did come with some caveats, namely the uncertainty index which rose due to tariff concerns.

-

Important earnings today: Core & Main, Academy Sports, Gitlab, Dave & Busters Entertainment, and Gamestop.

.png)