Tenacity Has A Limit--And We’re Getting Closer To It

KEY TAKEAWAYS

-

The economy is still expanding but may be losing momentum

-

Confidence among businesses is declining

-

Job growth remains positive but fragile

-

Unemployment is rising and trending the wrong way

-

Consumption is cooling rather than collapsing

MY HOT TAKES

-

This latest data does not justify immediate rate cuts

-

The Fed is STILL trapped in wait and see mode

-

Labor market softening is the key risk to watch

-

Consumption trends matter more than headlines

-

Policy error risk is rising as the runway clearly shortens

-

You can quote me: “Recessions don’t start on Wall Street—they start in boardrooms.”

Tenacious. I am traveling this week and had an opportunity to sit down with a few cherished clients. At the moment, my body is completely unaware of what time it actually is and I am off to a 6-hour flight quite literally the second I am done penning this note. I contemplated skipping today’s note to avoid the possibility of missing my flight, but, based on some of my dinner conversations last night, I thought it important to review some of the torrent of economic data we got yesterday. Let’s get right to it.

My regular followers know of my obsession with consumption–I even declared myself a consumption zealot over my bronzino last night. Consumption makes up ⅔ of GDP, so it’s important. 👉 Employed consumers consume! 👉 Confident companies employ! Those are just two of the handful of Mark’s missives that often repeat. So, you should deduce that high unemployment leads to economic slowdown, and if the economy slows down enough, it could stall and cause a recession. And, based on the second missive above, we know, therefore, that recessions technically start in the corporate boardroom where decisions of cost cutting and layoffs are born.

Yesterday’s Government-sponsored data dump featured some telling signs. But before we get into those, let’s start with the private data, because there were some important nuggets of info there.

Let’s begin with the S&P Global flash PMI’s (Purchasing Managers Indexes). A quick reminder of what those are. S&P Global Flash PMIs are early, preliminary snapshots of economic activity in the manufacturing and services sectors. They are based on survey responses from corporate purchasing managers and are designed to give markets a fast read on whether business conditions are expanding or contracting. According to yesterday’s release, managers are less confident than analysts were expecting and less than they were when polled a month earlier. The manufacturing PMI came in at 51.8 and services at 52.9. The two important takeaways–both slipped indicating a decline in confidence, and both are above 50, which means that things are still expanding (below 50 means contracting). This one can be summed up as alarming but not bad.

On to one of my new favorite economic numbers, the ADP NER Pulse, which comes out once a week leading up to ADP’s monthly employment figure. So, with this number, you get to track the progress of the important monthly leading up to its release. Kind of like packing a suitcase for weekend travel starting on Monday and watching the weather each day as Friday approaches. And this week’s Pulse number came in with a gain for the second straight week, after 4 weeks of decline. The actual number is not as important as the trend that, if it continues, may lead to a monthly job gain figure for December, which is unequivocally positive.

Now, on to the Government numbers. Let’s start with BLS (Bureau of Labor Statistics) numbers. We got November’s monthly employment situation–finally. It should have been released on the first Friday of this month, but we are thankfully getting closer to normal, whatever that is. Yesterday’s number showed a gain of 64k jobs in November. It’s positive, so that’s good, but it is not exactly strong. We also got the long-delayed number from October which showed a loss of 105k jobs. That’s not good no matter how you slice it, but it is technically old data, and it shouldn’t surprise us given the private data that we collected during that period. These numbers on their own tell a story of a limping, but still walking labor market. We also got the November Unemployment Rate, which came in at a worse-than-expected 4.6%. It was the highest print since 2021. Remember 2021? I thought so. Anyway, while this number is weak, it is still not devastating as much as its trend is worrisome. There is no doubt that this number is written in the margin of each FOMC member's notebooks. If we dig into this number, it was strongly impacted by an increase in job seekers, which may be the result of folks getting off the couch after a pause and starting to look for a job. That doesn’t mean the number should be taken with a grain of salt, no. Here the trend is decidedly negative for the economy.

Finally, we got October’s Retail Sales figure from the US Census Bureau. It showed that Retail Sales were flat for the month, worse than economists were expecting, and lower than the prior month’s downward revised 0.1% increase. Digging into the number, we observe a notable decline in Auto purchases, which was offset by a notable increase in online shopping. The latter is likely the result of holiday shopping, but the former… well, the former could be the result of rising prices for new autos. Let’s not jump to conclusions until we see tomorrow's Consumer Price Index / CPI release. We know that used and new car prices have been on the climb. A logical conclusion may be that tariffs are to blame, but that is a tough statement to make without lots of footnotes, the least of which is that US car companies don’t have as big a tariff bill as might be advertised. Foreign sellers–let’s just say, the tariff conclusion is a strong possibility. Going back to the Retail Sales Figure, there is a clear trend that began in early summer which is decidedly negative. Retail Sales dovetails into…you guessed it…consumption. Is it a red-alert print? No, but it is a number which should also make it into the FOMC member notebook margin.

Now, apologies for the relentless data dump this morning as my creative brain–usually quite active at this hour–is currently working out how I am going to get from my hotel room at this ungodly hour where even the crickets are sleeping and back to my home in time for supper–many hours hence. So, what does the data tell us? Taken together, this data paints a picture that is far more nuanced than the headline skimmers would have you believe. This is not an economy falling off a cliff, but it is also not one sprinting confidently into the future. Growth is still there, employment is still expanding at the margin, and consumption has not collapsed–but the cracks are starting to show. Confidence is slipping, hiring is slowing, and consumers are becoming more selective about where and how they spend. That combination rarely produces fireworks, but it does tend to get policymakers’ attention.

For the Federal Reserve, this batch of data offers neither absolution nor urgency. There was nothing here that screamed “cut rates now,” but there was also nothing that justifies complacency. The labor market is softening, not breaking. Consumption is cooling, not freezing. That puts the Fed squarely in its least favorite position: waiting. Watching. Hoping that the economy continues to decelerate just enough to relieve pressure without tipping into something far more uncomfortable.

And that, perhaps, is the most important takeaway. This economy remains… tenacious, even as it shows signs of fatigue. The runway is still there, but it is getting shorter, and the margin for policy error is narrowing. As we head into year-end, the question is no longer whether the economy can withstand higher rates–it has,somehow–but how long it can do so before caution turns into constraint. That answer won’t come from any single data point, but yesterday’s numbers made it clear that the clock is ticking, even if it isn’t yet blaring. Last night’s branzino was perfectly baked and the panzanella was super-tasty, the conversation with clients was memorable. I am already planning my next trip. Now, which gate is my flight at? 🛫

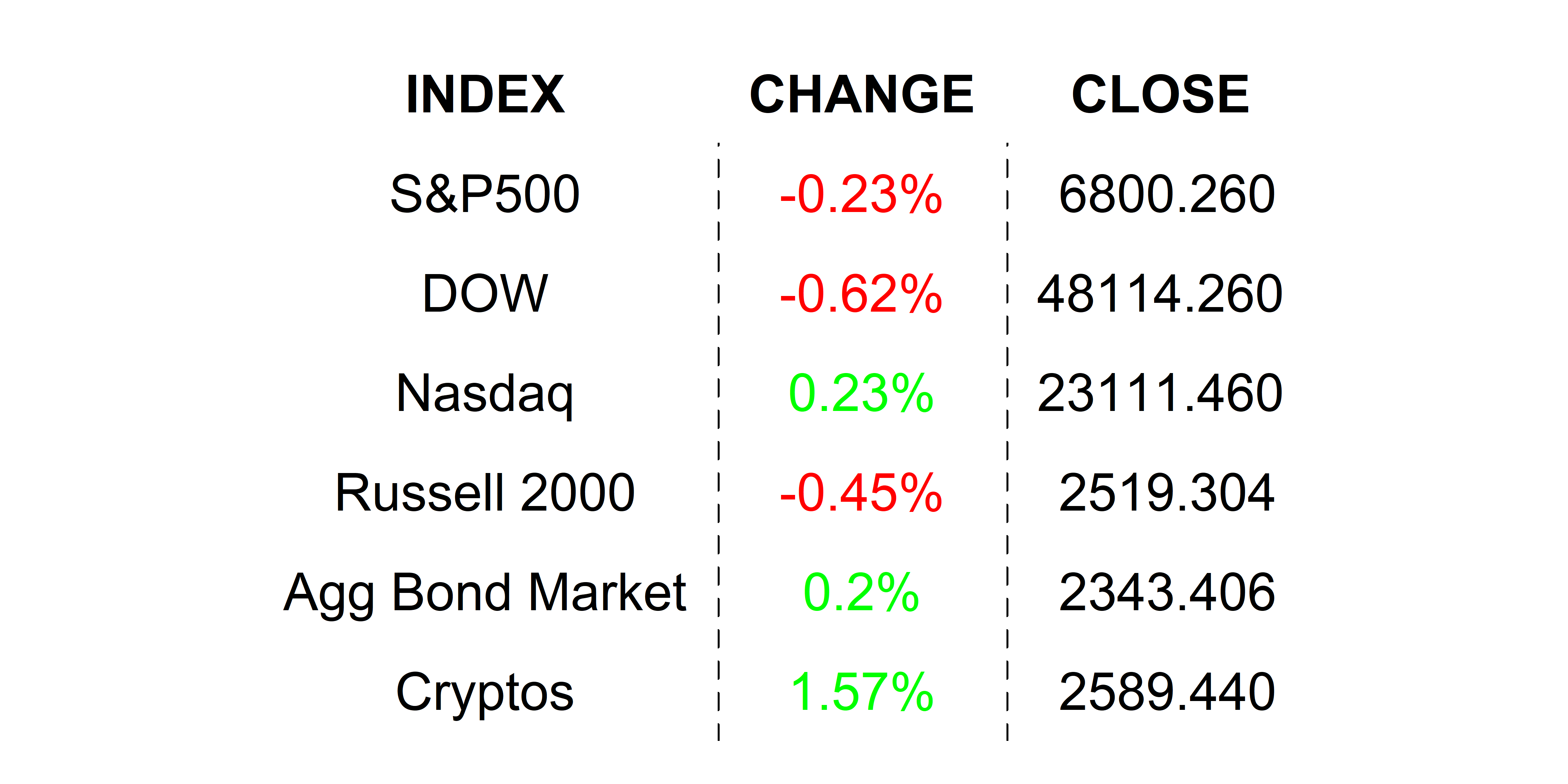

YESTERDAY’S MARKET

Stocks had a mixed-ish close yesterday in response to the complicated blend of economic data that gave no clear signals on the economy or what the Fed’s next move might be, other than to sit tight and wait for December’s data. 10-year Treasury Note yields slipped by 2 basis points and Bitcoin managed a small bounce, though it could not get back above 90k.

NEXT UP

-

Housing Starts (September) are expected to have increased by 1.6%.

-

Building Permits (September) may have risen by 1.5%.

-

New Home Sales (September) probably fell by -10.8% after booming higher by 20.5% in August.

-

Fed speakers today include Waller, Williams, and Bostic. Waller is still a contender for the corner office job at the Fed, so pay attention. 😉

DOWNLOAD MY DAILY CHARTBOOK HERE 📈

.png)