Job data looks stable on paper, but workers feel something different–and the Fed should pay attention.

KEY TAKEAWAYS

-

The labor market is weakening gradually, but confidence is deteriorating faster than official data reflects

-

Consumption depends on employment confidence, not just payroll growth

-

Job openings and hiring momentum have cooled meaningfully

-

The Fed is relying on backward-looking indicators despite rising household anxiety

-

Inflation has eased enough to give policymakers flexibility

MY HOT TAKES

-

Confidence is the real leading indicator, and it is flashing yellow

-

The labor market can be technically stable and emotionally fragile at the same time

-

Waiting for perfect data is a policy mistake

-

Small, early adjustments beat aggressive late reactions

-

The Fed is underestimating perception risk

-

You can quote me: “The biggest risk isn’t bad jobs data–it’s waiting until everyone agrees it’s bad.”

Can’t help help wanted? Thomas Jefferson famously wrote, “I’m a great believer in luck, and I find the harder I work, the more I have of it.” For those of you that know me well, you know that I am a big subscriber to this. I think we all recognize that, actually. Most of us are happy to work hard–it’s in our nature. Well, maybe not the interest in the hard work part, as much as the rewards of hard work. Those rewards include food and a roof over our heads. You know, the basics. But what if you want to work and you can’t find a job? What if you are working and you lose your job? Neither of those are good for you nor are they good for the economy as a whole.

Let’s start off with some of my basic tenets. My long-time followers know that I am laser focused on consumption–the stuff you and I buy. That’s because the health of consumption is vital to the strength of the economy. Consumption makes up more than ⅔ of GDP, so it’s really just math, stupid. Strong consumption ➡️ strong economy. Going further upstream, we get to the labor market. Having a job and income is required for consumption to thrive. It takes money! So, strong labor market ➡️ strong consumption. By using the transitive property of equality, we can confidently state that strong labor market ➡️ strong economy. We can even derive this further. If we are confident in our ability to retain our jobs and get new ones to further our careers or to replace a loss, we are more likely to consume. And…vice versa, of course. This leads to my famous quote:

“Confident consumers consume; employed consumers are confident!”

You have heard me say that time and time again. I say it to make sure that you understand it and you never forget it. Yeah, it’s that important. Ok, the labor market right now is in an unstable emotional state. Confidence in the labor market is waning. The actual numbers suggest a slowly weakening labor situation. The Fed’s FOMC members–depending on which one you ask on which day–think that the labor market is sluggish but stable. Help wanted ads are declining according to the latest BLS JOLTS Job openings. Weekly first-time applications for unemployment insurance are elevated but stable–we’ll get a fresh read on that later this morning.

The unemployment rate has risen to levels not seen since 2021. Tomorrow, we will get the first official, on-time employment assessment from the Bureau of Labor Statistics (BLS) in some time. BLS has been playing catch-up since being iced during last year’s record government shutdown. Economists are expecting a small but positive gain in jobs and a minor decrease in the unemployment rate. None of this sounds great, does it? Wait, there is more.

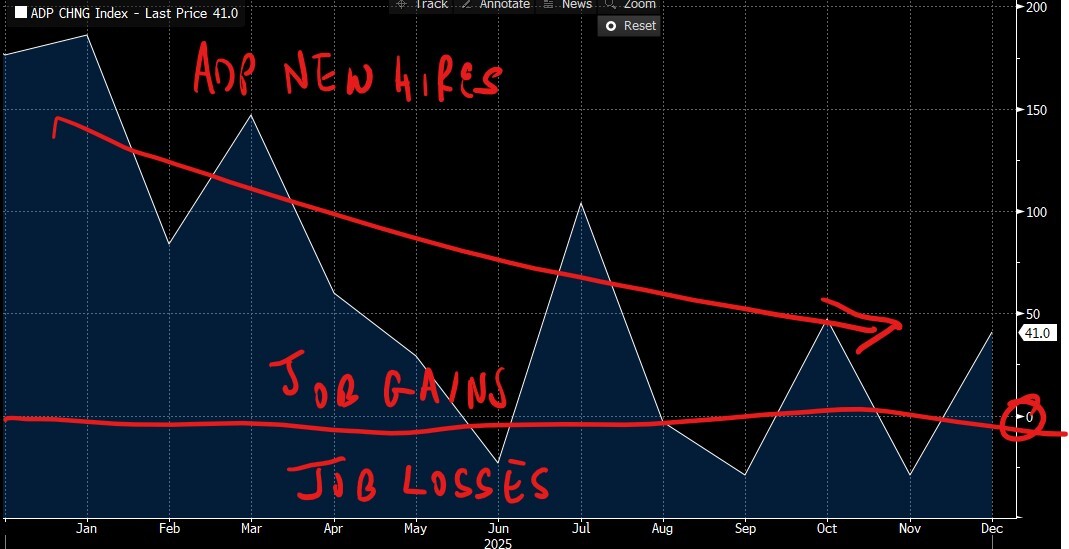

ADP, which stepped in for BLS while it was on government-mandated time off, reported yesterday that 41k new jobs were added last month. This after ADP reported a loss of jobs in its prior release. Yesterday’s print was below economists’ projections and, to be clear, 41k new jobs is not exactly healthy.

Let’s be clear, this is not an “end of days scenario,” but the trend is unarguably worrisome. Just this morning we got another private employment number from Challenger, Gray, and Christmas, which tracks announced corporate layoffs, and the data showed that US companies announced fewer layoffs in December (35,553) while they planned to add an additional 10,400. Ok, there is finally a minor positive. 😉

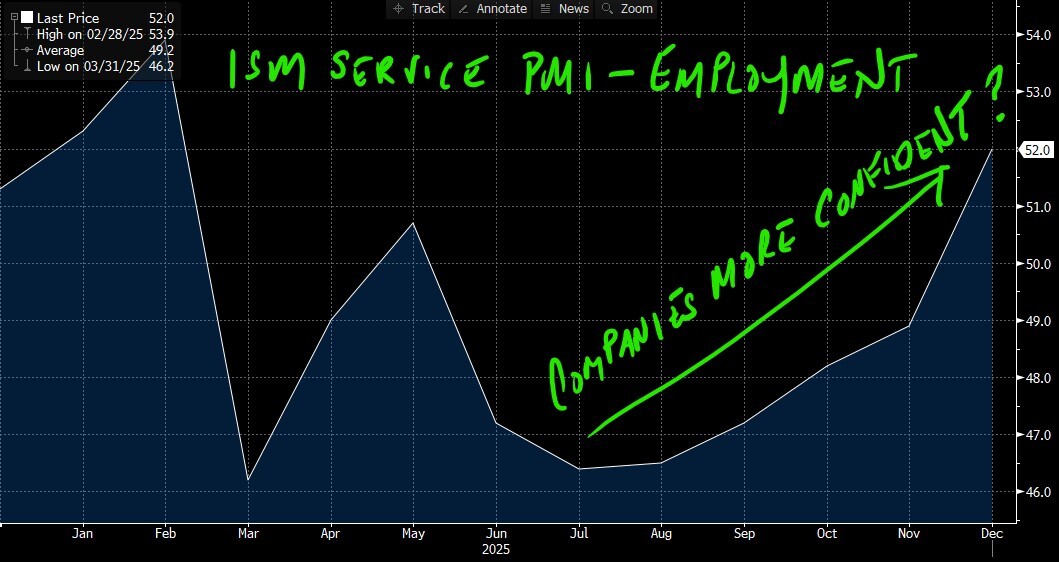

Yesterday, we got the ISM services PMI. Within that release, the company tracks employment expectations. In the latest release, the employment index climbed to a better-than-expected reading of 52. Looking at the chart that follows, you can see a recently improving trend since it dipped earlier in the year–likely in response to tariff announcements. This latest print leaves a question: are companies less fearful about the negative impacts of tariffs? Will companies continue to have this positive outlook and pick up hiring later this year? That would certainly be a positive for employment in a sea of choppiness.

So where does this all leave us? The labor market is clearly not where it was just a few years ago when it was going strong. There are, of course, many macro factors that have impacted it. There is adoption of AI which allows companies to squeeze more productivity out of the same number of workers, there are deportations of illegal workers, and of course, the margin pressures from tariffs. Then, I have to mention, market pressure to grow earnings. For non-growth companies whose revenue growth is stable–nothing close to the double and even triple digit growth of growth companies–the only way to keep showing bottom-line growth, cost cutting is the only option, and labor is the easiest overhead to cut.

All of that brings us back to the core problem, which is not that any single data point is screaming “recession,” but that taken together they paint a picture that feels increasingly disconnected from the official narrative. Some industries are booming. You hear about AI-driven productivity, record profits in pockets of the market, and service-sector resilience. At the same time, help wanted signs are coming down, job switching has slowed, and households are telling survey takers that they are more worried about employment than they have been in years. Both of these things can be true at the same time. That is precisely why the moment feels so confusing.

The Fed, for its part, is looking at the labor market through a backward-looking lens. Payroll growth is still positive. The unemployment rate, while rising, is not yet flashing red. Wage growth has cooled enough to keep inflation from reaccelerating. From a purely technical standpoint, that gives policymakers cover to sit still. But sitting still is not the same thing as being right. Monetary policy does not work on impact. It works with long and variable lags. By the time the data confirms a problem beyond any reasonable doubt, the damage is usually already done.

This is where the driving metaphor matters. Imagine barreling down the highway at a good clip. The road behind you is clear, which is comforting, but irrelevant. Ahead, traffic is beginning to bunch up. Brake lights flicker in the distance. You do not slam on the brakes. You do not swerve wildly. You simply ease off the accelerator and make a small adjustment early. That is how you avoid a pileup. That is how you arrive safely. The Fed is in exactly that position right now. It can see the traffic ahead. It cannot credibly claim otherwise.

Inflation, the great villain of the past few years, has calmed down materially. It is still sticky in places, especially services, but it is no longer the runaway force it once was. This gives the Fed something it did not have eighteen months ago: optionality. The ability to be proactive rather than reactive. The ability to make a modest adjustment now, when the system can absorb it, rather than being forced into aggressive moves later when confidence has already cracked.

And confidence is the key word here. People do not experience the economy as a spreadsheet. They experience it as a feeling. Do I feel secure in my job? Do I feel confident taking on a big purchase? Do I feel like I have leverage if something goes wrong? Consumer confidence surveys are telling us that many households are answering those questions with increasing hesitation. That matters. As I have said a thousand times, confident consumers consume. When confidence erodes, consumption eventually follows, even if the official data are slow to acknowledge it.

Tomorrow’s employment report will be important, no doubt about it. Markets will react. Headlines will be written. Talking heads will declare victory or defeat based on a few tenths of a percentage point. But one print does not resolve the underlying tension. The broader message of the data we have been discussing is that the labor market is cooling unevenly, that perceptions are deteriorating faster than topline numbers, and that risks are skewing in one direction. That is not panic worthy. It is caution-worthy.

Based on those confusing signals, it is likely that the Fed will choose patience over action in the near term. That has been its instinct throughout this cycle. Wait for confirmation. Wait for clarity. Wait until the fog lifts. The risk, of course, is that by the time the view is perfectly clear, traffic has already stopped and the braking distance is gone.

This is not a call for emergency measures. It is a reminder that good drivers adjust early. They do not wait for the screech of tires to tell them something is wrong. The Fed has a chance, right now, to make a small course correction while inflation gives it the room to do so. Whether it takes that chance remains to be seen. What is clear is that the road ahead is more crowded than it appears in the rearview mirror, and pretending otherwise has never been a particularly safe strategy.

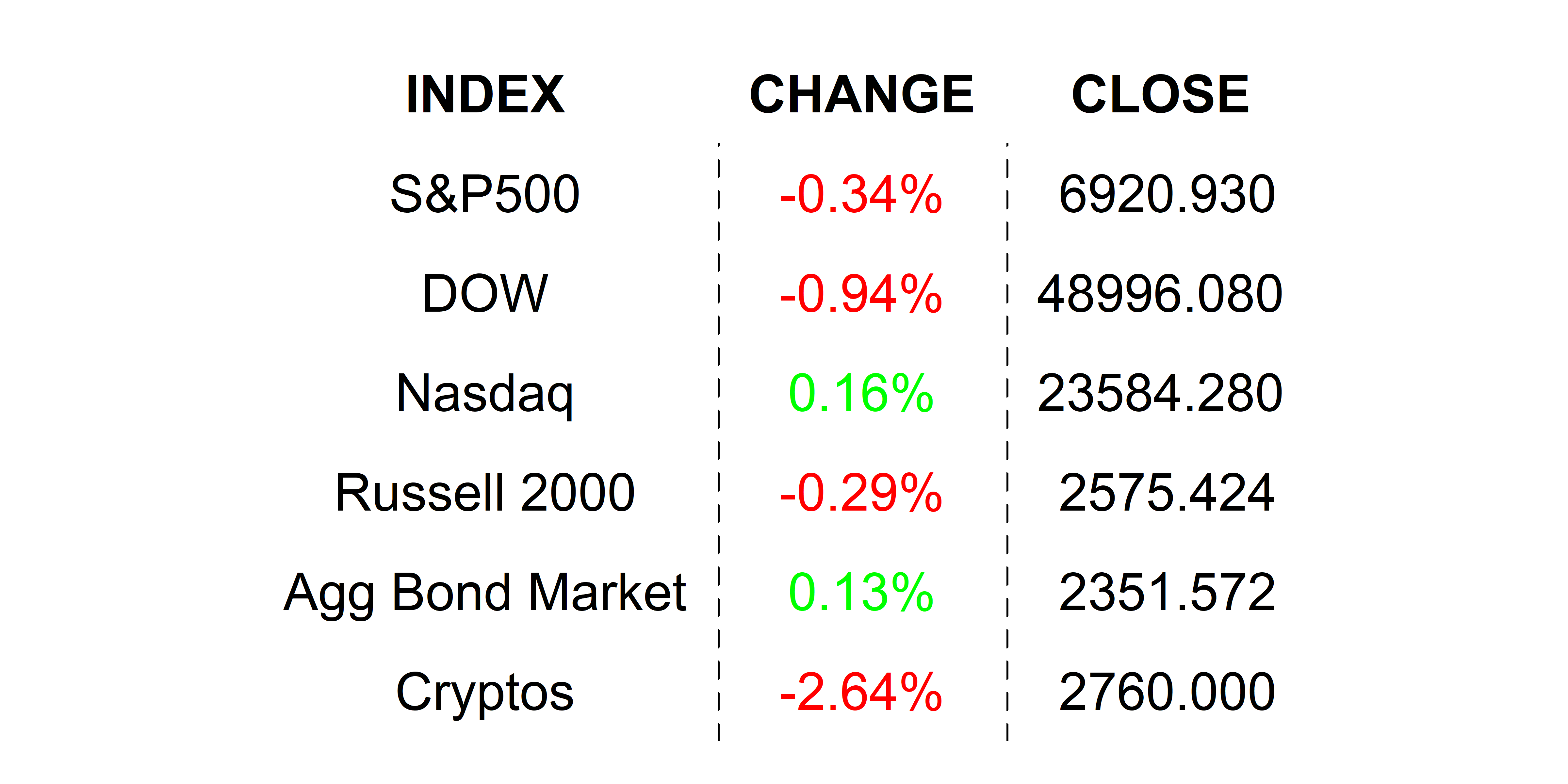

YESTERDAY’S MARKETS

Stocks closed lower yesterday. What looked like a continuation of the Santa Rally was cut short by comments by President Trump of the defense and real estate sectors. Banks were under pressure ahead of earnings, which will be kicked off by banks next week. Mixed economic signals clouded the markets and bonds struggled for direction.

NEXT UP

-

Initial Jobless Claims (January 3) came in lighter than expected at 208k, slightly above last week's 200k claims.

.png)