AI stocks stumbled in Q4, but the long-term infrastructure thesis remains intact.

KEY TAKEAWAYS

-

AI wealth is being created in infrastructure, not applications

-

Semiconductors are not discretionary in the AI economy

-

Micron’s memory scarcity is creating durable pricing power

-

TSMC’s full capacity gives it monopoly-like leverage

-

Broadcom’s networking and custom silicon are essential at scale

MY HOT TAKES

-

Market discomfort doesn’t equal a broken thesis

-

Q4 weakness likely created better long-term entry points

-

AI demand is survival-driven, not optional spending

-

Pricing power matters more than unit growth

-

Infrastructure moats widen before they crack

-

You can quote me: “Focus on the plumbing, not the paint job.”

Chips and dips. Can we talk? It’s time to chat about the less glamorous side of artificial intelligence. While it is true that Jenson Huang certainly rocks his leather jackets like a Hollywood megastar of sorts, announcements from companies higher up in the tech food chain tend to out-sizzle. We don't typically get the slick demos or the breathless headlines, but the reality is that this group of companies–the AI semiconductors–captures most of the economic value in the AI ecosystem. While markets chase the next shiny AI application, the real money continues to be made in the infrastructure moats. That hasn’t changed. What has changed is the market’s mood. AI semiconductor stocks had a challenging Q4 despite their outstanding showing in Q3 earnings season, and that certainly tested investor conviction. Pro tip: that’s usually when the best opportunities start to form. 😉

The AI revolution isn’t a feature cycle like the new, new, newest iPhone. It’s not discretionary–there are some people who still prefer flip phones. It’s a structural rewiring of the global economy. And you cannot build that economy without silicon. Full stop. Semiconductors aren’t a supporting actor here–they are the keys to the castle. No chips, no models. No memory, no scale. No networks, no speed. Everything flows downhill from compute.

Let’s start with Micron Technology, because memory has quietly crossed a line that many investors still haven’t fully processed. For decades, memory was treated like a commodity–cyclical, brutal, and prone to price wars. It was like wheat with wafers. 🤣 That framing no longer works in an AI-driven world. Memory is no longer optional. It’s quite literally the fuel. If NVIDIA is the engine, Micron is the gas tank. High-bandwidth memory isn’t just another SKU, it’s physically stacked on processors to remove the bottlenecks that slow computation. We often talk about NVIDIA selling an AI chip, but it's actually a chip solution which includes…wait for it… specialized high-bandwidth memory. The simple fact that Micron is effectively sold out of high-bandwidth memory through the end of 2026 isn’t a narrative. It’s math. They aren’t just selling chips, they’re managing scarcity. That creates pricing power we haven’t seen before, and as the mix shifts from standard DDR5 toward high-margin AI stacks, the profitability profile of the business is being structurally upgraded. Did you miss that? Let me break it down into plain language. Micron has something that everyone wants. That high demand gives Micron pricing power! Pricing power means that margins are not likely to contract, but possibly even expand. More basic economics–just saying.

Then there’s TSMC, the ultimate toll booth of the modern economy. Every road to the future runs through Taiwan. Their latest earnings didn’t surprise anyone who has been paying attention. Its earnings simply confirmed it. Demand isn’t cooling. It’s accelerating. They are the only manufacturer on earth capable of producing at the leading 3-nanometer and 2-nanometer nodes at scale. When Apple, Nvidia, and Broadcom are all competing for space on your lines, you don’t negotiate pricing–you dictate terms. More pricing power! Full capacity changes everything. OH, and a guidance raise toward roughly 20% revenue growth isn’t subtle. It’s a flare shot into the night sky that the hardware cycle is heating up, not rolling over.

That capacity crunch is exactly why we have to talk about Intel. The company is in the midst of one of the most ambitious corporate turnarounds in modern American industrial history. The strategic logic is sound. A domestic alternative to Taiwan matters, economically and geopolitically. And if TSMC is full, there is a vacuum. Intel is the only other player with the pedigree to plausibly fill it. But potential and performance aren’t the same thing. The enemy here is time. Retooling fabs, hitting leading-edge yields, and meeting the standards demanded by AI hyperscalers takes years, not quarters. Intel’s direction is encouraging, and the long-term outcome may well be positive, but timing matters in this market. While Intel rebuilds, Micron and TSMC are cashing checks. In semiconductors, being a year late can mean being a decade behind. The company will deliver its Q4 earnings after the bell and all eyes will be on neophyte CEO Lip-Bu Tan. Will he show up in leather?

Which brings us to Broadcom, the quiet architect of the entire ecosystem. While most attention stays locked on processors, Broadcom focuses on how those processors talk to each other. As AI clusters grow to the size of city blocks, the constraint shifts. It’s no longer just raw compute–it’s networking. Broadcom’s Tomahawk and Jericho platforms sit at the heart of the world’s largest data centers. One is built for speed, letting GPUs communicate at blistering rates. The other is built for intelligence, preventing data loss and inefficiency at massive scale. And beyond networking, Broadcom has positioned itself as the custom silicon partner of choice for the biggest names in tech, supplying internal accelerators to hyperscale AI workloads. If you’re trying to compete at the frontier, Broadcom is increasingly part of the blueprint.

We’re in a familiar market moment. The winners are visible, but the entry points feel uncomfortable. Tech has been bruised, sentiment has softened, and volatility has returned. Don’t confuse that with a broken thesis. This demand isn’t optional. Companies aren’t buying compute because they want to, they are buying it because survival increasingly depends on it. We are sticking with the infrastructure moats. Pricing power at Micron. Monopoly-like positioning at TSMC. Architectural dominance at Broadcom. Intel remains the great American wildcard, one that warrants watching closely for signs that execution is catching up with ambition, but today, the real results are still being delivered by the companies already operating at full throttle.

Stay disciplined. Focus on the plumbing, not the paint job. And don’t let a few dips in the chips distract you from a multi-year opportunity that’s still very much intact. Oh, and in case you missed it, it’s not just about NVIDIA. 😉

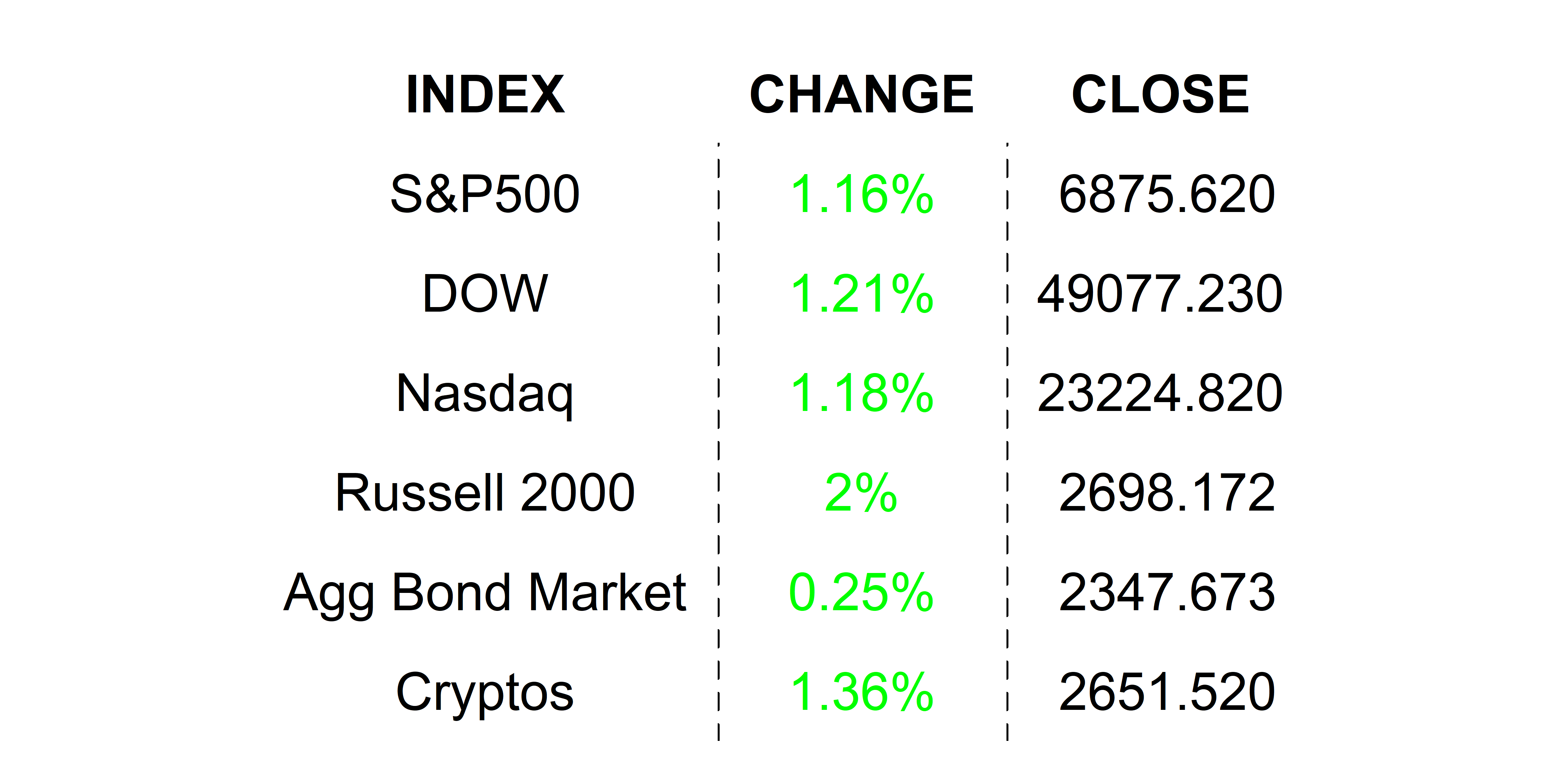

YESTERDAY’S MARKETS

Stocks rallied yesterday because it’s good to know that the US is not going to war with Europe over Greenland–full stop. Also, AI is still a thing.

NEXT UP

-

Annualized Quarterly GDP (Q3) final estimate nudged up to 4.4% from prior 4.3% estimates.

-

Initial Jobless Claims (Jan 17th) came in slightly less than estimate at 200k, but higher than last week’s 199k claims.

-

PCE Price Index (November) is expected to come in at 2.8%, both headline and core.

-

Important earnings today: GE Aerospace, Procter & Gamble, Freeport-McMoRan, McCormick, Huntington Bancshares, Abbott Labs, Capital One, Intuitive Surgical, Alcoa, CSX, Intel, and Alaska Air.

.png)