Carrier strike groups are moving. Oil could move next. A disciplined framework for positioning portfolios across three conflict outcomes.

KEY TAKEAWAYS

-

The market is overwhelmed with noise–AI fears, Fed indecision, inflation confusion, and mixed labor data–while a significant geopolitical risk quietly builds in the background. Two US carrier strike groups moving toward the Middle East and a 61% market-implied strike probability demand serious attention.

-

In a short strike, markets likely react sharply but briefly, with oil, gold, and defense stocks rallying before a relief trade emerges. Historical precedent suggests limited strikes often reverse quickly.

-

A multi-week conflict introduces sustained oil pressure, renewed inflation risk, and delayed rate cuts. Growth-heavy sectors and rate-sensitive equities could face meaningful corrections.

-

A multi-month regional conflict raises the specter of stagflation, with prolonged energy shocks and deeper equity drawdowns. In that environment, capital preservation overtakes return maximization.

MY HOT TAKES

-

Preparation consistently outperforms prediction. Modeling probabilities and outcomes in advance prevents emotional decision-making when headlines hit.

-

Markets are resilient, but portfolios are fragile when overexposed to a single narrative like AI optimism or imminent rate cuts. Diversification across geopolitical regimes is not optional.

-

Oil is not just a commodity; it is a macro transmission mechanism. When energy spikes, inflation expectations, bond yields, and equity multiples all shift in tandem.

-

The Fed’s flexibility shrinks when geopolitical shocks collide with sticky inflation. Monetary policy cannot easily offset a supply-driven oil shock.

-

Low-probability tail risks are often ignored precisely because they are uncomfortable to contemplate. Intelligent investors assign weight to them anyway.

-

You can quote me: “When carrier strike groups move, portfolios should at least pay attention.”

Shall we play a game? I know that you are trying to tune out all the noise in the market right now–don’t worry you’re not alone. I can’t remember the last day that I read a single market commentary that didn’t have the words “ongoing AI fears” in it. The flip-flopping, late-to-the-party Fed is flooding the market with conflicting opinions. Congress is focused on everything that means something to the extremes of each party. The VIX is at 20, which is considered the boundary of worried and not-so-worried. Employment numbers don’t look great but they are not terrible…yet, but you can feel that the labor market is not what it was a year or two ago. Inflation seems to be coming down according to the numbers, but your real-life experience tells you that prices are too damn high. Consumer confidence is weak but consumers seem to relentlessly consume. So much noise!! 🔊😧

In the midst of all this noise–which has most of us distracted–something important is happening. The Gerald R. Ford (CVN-78) and its strike group is right now transiting the Mediterranean Sea steaming to the Middle East to link up with the already present Abraham Lincoln (CVN-72). Ok, are you reading the room? According to modern-day-soothsayer Polymarket there is a 61% chance of a US strike on Iran by the end of March with a volume of 1 million contracts. Those odds are pretty good from a Wall Street perspective. If you scratch about the web enough you will find respected analysts placing the probability of a strike even higher.

The last time the US struck Iran was during my birthday celebration last summer, an event captured in a Bloomberg article recounting my experience of getting quoted by Reuters minutes after the strike. I had spent some time calibrating my response last June, so I was not completely caught off guard when my phone rang with a call from one of my favorite journalists. That said, this time around, I would like to get ahead of it–just in case–hopefully not–but just in case. You can’t ignore 61%.

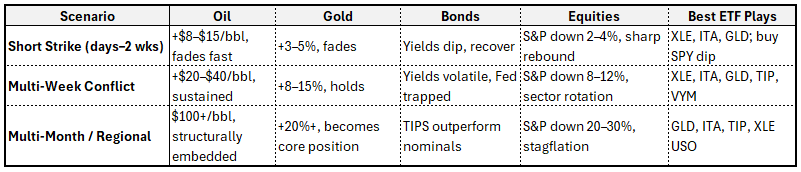

Let’s consider three scenarios: a short strike (days to ~ 2 weeks), multi-week conflict, and multi-month / regional conflict.

The short strike is the most likely path because it’s the most familiar. We’ve seen this movie before. Think of it as the sequel to Operation Midnight Hammer. Cruise missiles. B-2s lifting off in the dark. Precision strikes on IRGC command nodes, military infrastructure, maybe facilities that sit just close enough to the nuclear line to make a point. It’s surgical. It’s loud. It dominates headlines for 72 hours. Then it becomes leverage.

Iran, in that script, retaliates, but carefully. Just enough to save face domestically. A calibrated missile volley at a US base in Qatar or Iraq. Some proxy rocket fire from what’s left of Hezbollah’s arsenal. Symbolic, not suicidal. No one actually closes the Strait of Hormuz. That’s the red line neither side wants to test.

Markets know this playbook too. Oil jumps fast–$8 to $15 per barrel overnight as the risk premium gets slapped on. S&P futures drop a couple percent before the open because that’s what futures do when something explodes while you’re sleeping. Treasury yields pull back as money runs for cover. Gold pops because it always pops when missiles fly. And then, if the guns quiet down, the relief trade begins. By week two, markets start clawing back the losses, sometimes fully reversing them.

In that scenario, the ETF positioning is straightforward and tactical. A tilt toward XLE (Energy Select Sector SPDR) gives you exposure to Exxon, Chevron, Conoco–names that move tightly with crude. ITA (iShares US Aerospace & Defense ETF) captures the defense contractors–Lockheed, RTX, Northrop–the companies actually building the hardware in this particular drama. GLD (SPDR Gold Shares) is the clean gold hedge. The discipline is just as important as the positioning: you exit energy and gold once the market prices in resolution. And yes, the buy-the-dip trade through SPY has historically worked in limited strikes. But timing matters.

Now let’s talk about the multi-week conflict. This is where it gets uncomfortable. In this version, Iran doesn’t blink after the first round. Naval forces begin harassing tankers near the Strait of Hormuz, not closing it, but reminding everyone that they could. Roughly 13 million barrels per day moved through that strait last year–that’s nearly a third of global seaborne crude flows. You don’t have to shut it down to cause trouble. Freight rates surge. Oil doesn’t just spike, it stays elevated.

When crude pushes toward $85, $90, $100 per barrel, something else happens. Inflation, which had been behaving, starts acting up again. Remember in just this past CPI print, energy deflated. The Fed, which is already walking a tightrope between a softer labor market and sticky prices, finds itself further boxed in. Rate cut expectations get shoved further out. The rate-sensitive corners of the market, tech, real estate, and our high-growth favorite names, take it on the chin. Broad indices could correct high-single to low-double-digits percents in that environment.

In a multi-week conflict, the energy and defense exposure from scenario one still makes sense. But now you might consider layering in TIP (Treasury Inflation-Protected Securities) as a direct inflation hedge. You rotate away from growth-heavy exposure and toward VYM (Vanguard High Dividend Yield ETF), which leans into cash-generating sectors like healthcare, consumer staples, and financials. Be mindful of your jumpy tech weighting. And if you’re serious about tracking the situation, you watch tanker traffic data in the Gulf–you know I will be doing this and reporting to you. 😉

The multi-month regional conflict is the tail risk. Most analysts still put it in the single digits or low teens probability-wise. But the current military posture and regional alliances make it more plausible than in prior Iran flare-ups. This is the version where Iran activates its full terror network: Hezbollah remnants in Lebanon, Houthi drones out of Yemen, militia rocket fire from Iraq. Iran simultaneously threatens the Strait of Hormuz with anti-ship missiles or mines. Saudi and UAE energy infrastructure could become fair game.

At that point, you’re not talking about a temporary oil spike. You’re talking about a core supply shock. Oil north of $100 per barrel isn’t out of the question. And possibly the word stagflation, which most of my readers under 45 have only read about in textbooks, suddenly enters the chat.

In a genuine stagflation environment, equities can experience painful declines, with the nastiest drawdowns in consumer discretionary, tech, and anything that depends on cheap capital. The portfolio posture shifts from opportunistic to defensive. GLD is no longer a quick trade–it’s a longer-hold position. ITA stays because a regional war is effectively a defense contractor backlog machine. TIP remains in place. If you’re feeling aggressive, USO (United States Oil Fund) offers more direct crude exposure, but it is volatile and not for the faint of heart. In this scenario, capital preservation outranks return maximization. Check out the following summary table for your quick reference. 😉

On probabilities, the short strike carries roughly 55% to 60%, depending on who you ask. It’s the most historically precedented outcome and aligns with the administration’s demonstrated preference for precision pressure as a negotiating tool. The multi-week conflict sits around 25% to 30%, dependent on miscalculation or political escalation. The multi-month regional war remains a 10% to 15% tail risk. Low enough to tempt complacency. High enough that ignoring it would be foolish.

And now for the part that matters. In the 1983 film WarGames, the WOPR supercomputer runs thousands of nuclear simulations and eventually reaches a conclusion: “The only winning move is not to play.” Markets, thankfully, are not thermonuclear chess. They are not zero-sum. The S&P 500 has recovered from every geopolitical shock it has faced. Think Korea, Vietnam, 9/11, Iraq, and yes, last summer’s Iran strikes.

The investors who do best are not the ones who panic-sell into red headlines. They’re the ones who think through the scenarios calmly, position thoughtfully, and execute with discipline. You don’t need perfect foresight. You need preparation. So that when the phone rings, metaphorically speaking of course–you already know your move.

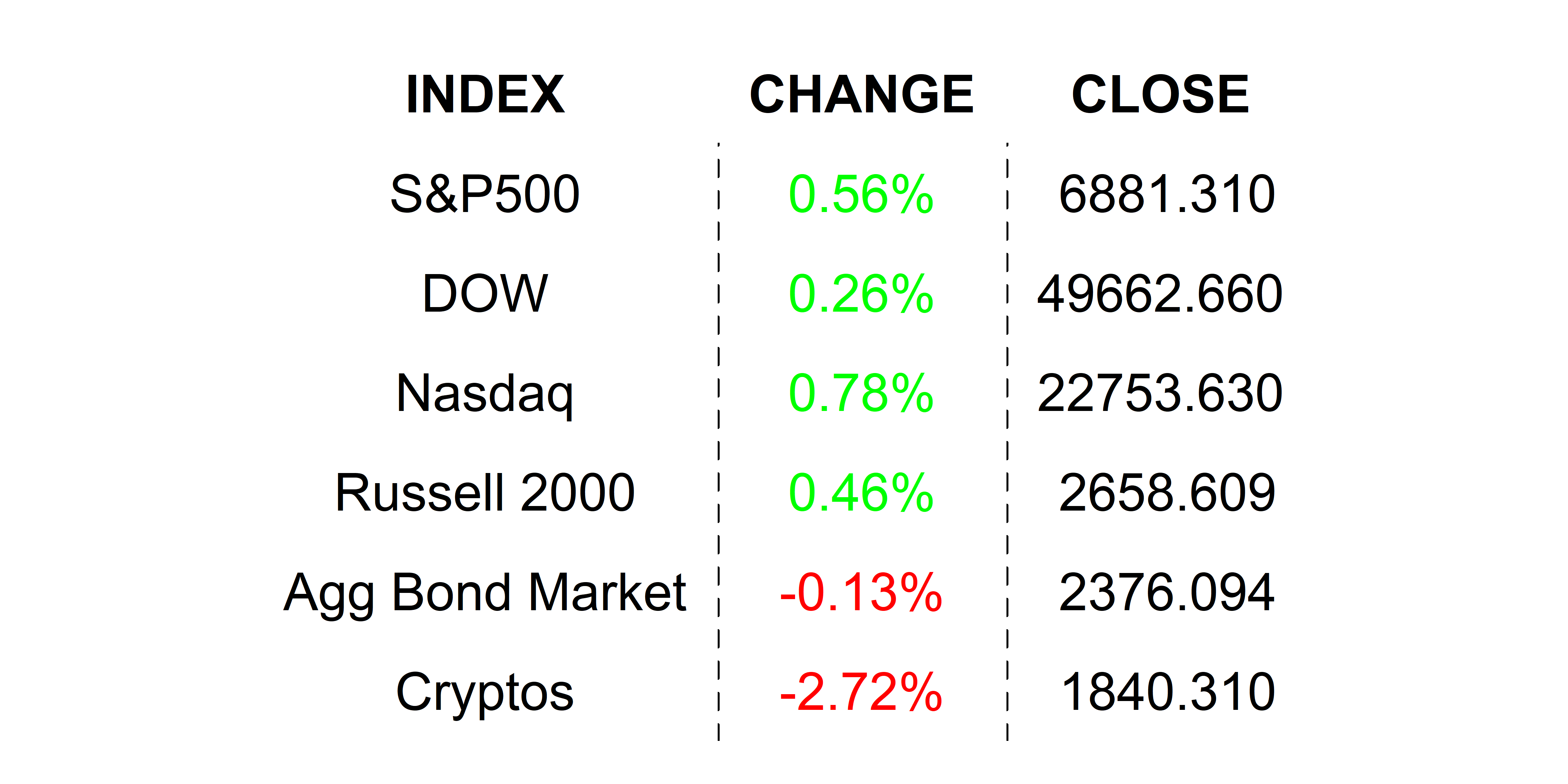

YESTERDAY’S MARKETS

Stocks closed higher after making a round trip in response to weak economic data then to FOMC minutes which hinted at longer wait times for rate cuts. Gold ticked higher amidst the confusion and Bitcoin lost ground. 2-year Note yields climbed in response to the hawky FOMC minutes.

NEXT UP

-

Initial Jobless claims (February 14th) came in lower than expected at 206k and below last week’s 229k claims.

-

Leading Economic Index (December) may have slipped by -0.2% after declining by -0.3% in November.

-

Pending Home Sales (January) probably increased by 2.0% after dipping by -9.3% in the prior period.

-

Fed speakers today: Bostic, Bowman, Kashkari, and Goosbee.

-

Important earnings today: Six Flags, Wayfair, Lemonade, Pool Corp, Etsy, Walmart, Southern Company, Akamai, Onto Innovation, Live Nation, Newmont, and Guardant.

.png)