High returns demand high risk. Gold is no exception.

KEY TAKEAWAYS

-

Gold’s recent surge is not the result of a single catalyst, but rather a long build-up of fear, deficit spending, and currency skepticism finally reaching a tipping point. What changed was not the data, but the volume and confidence of the narrative surrounding it.

-

Gold cannot be valued using traditional financial models, which makes it both powerful and dangerous. When price is driven by belief rather than cash flows, moves can extend far beyond what feels reasonable in either direction.

-

Central bank buying has added real, structural demand to the gold market. However, much of this buying is politically motivated, which increases the likelihood of sharp reversals when flows pause or sentiment shifts.

-

Parabolic price action embeds significant risk by definition. Large, fast gains almost always bring volatility and drawdowns as the cost of admission.

-

This is not the beginning or the end of gold’s story, but the middle. Markets tend to test discipline most aggressively at this stage of a trade.

MY HOT TAKES

-

Gold’s rally has been as much a marketing event as a macro one. Once an asset dominates headlines, podcasts, and social feeds, fragility quietly replaces conviction.

-

Central banks aren’t just buying gold as a hedge–they’re making a statement about the future of money and power. That makes gold a geopolitical asset, not just a financial one.

-

Traders surprised by last week’s volatility weren’t paying attention to positioning. Crowded trades don’t need bad news to unwind–only a lack of new buyers.

-

Silver will exaggerate whatever gold does next. It always runs hotter on the way up and bleeds faster on the way down.

-

The biggest mistake investors can make right now is confusing belief with protection. Gold can hedge fear, but it cannot eliminate risk.

-

You can quote me: “This isn’t the start or the end of gold’s story—it’s the dangerous middle.”

Nerves of gold. Happy Monday? My short trip across the Hudson River this morning took longer than usual. While most people are still deep in REM sleep I brave the cold with a small handful of mostly Wall Street folks on the first ferry out. Today, that meant cutting a path through ice bergs which formed across the river. To be clear, the ferries that ply the Hudson are like tanks and their helmsmen are seasoned like the salts of another era (there is a lot hidden in that sentence). That said, you are reading this so I manage to get to my office in one piece, despite a few moments where even the most outwardly unaffected New Yorkers looked up from their phones after a couple of large iceberg strikes. We all got to our Bloomberg terminals to this rather unfamiliar site. Have a look at this chart and keep reading.

You probably don’t have to squint too hard to recognize that this is a time series bar chart of Spot Gold. How do you know? Well, how about its parabolic growth since 2024–that’s how. Actually, I use the term parabolic liberally, in a mathematical sense. There are some periods in which the metal grew geometrically, but we often use the term–on Wall Street at least–to describe something that gained a lot in a short period of time. In fact, the term is often used to describe growth with an implication that the growth is unsustainable or unrealistic. This goes hand-in-hand with the saying imprinted in my trusty, old Wall Street Sayings notebook that goes something like: “if it seems to be too good to be true, it isn’t.” I think that is on one of the first few pages, and indicator of how important it is.

The broader “business” community is taught early to be skeptical of any claim that appears to show returns in the shape of a “hockey stick.” Hockey stick returns are not impossible, but any projections that appear to have them require a bit of extra diligence. 😉 Parabolic returns are like a hockey stick on steroids, curving upwards. Getting back to that gold chart above, you will note that it is not a projection, but rather a reality. It actually happened. All along, Wall Street veterans–like present company incoming–were all quite skeptical along the way.

And that skepticism is exactly where this conversation should begin, because gold is one of the few assets that refuses to behave politely in a spreadsheet. There is no dividend to discount, no cash flow to model, no earnings call to parse for guidance. You cannot drop gold into a DCF (discounted cash flow) model and expect enlightenment. Gold trades on something far messier and far more human: fear, trust, belief, and the perceived durability of money itself. That is not an academic statement. It is the reason gold has survived thousands of years of financial innovation and still manages to steal the spotlight every time confidence starts to wobble.

The recent meteoric rise in gold did not come out of thin air. Nor did it arrive because deficits suddenly appeared, currencies suddenly weakened, or governments suddenly discovered the joys of borrowing. Those conditions have been with us for quite some time now. Trillion-dollar deficits have become a line item rather than a headline. Currency debasement is no longer whispered about in academic journals; it is debated openly at dinner tables and on social media feeds. Even my favorite indicator–my mother-in-law–has brought it to my attention. 😉 Fear, too, has been a steady companion of the post-pandemic world, cycling through different disguises depending on the week.

What is new, however, is the amplification. Gold has not just risen; it has been marketed. It has been talked about, written about, televised, reposted, and–dare I say–public-relations-ed (is that even a word?) into the collective consciousness. The narrative around gold has become louder, more confident, and more unified. When an asset begins to dominate the conversation this much, it draws in participants who were not there for the early chapters. That does not make the move wrong, but it does make it more fragile.

Layered on top of this narrative machine is another powerful force: central bank buying. This is not retail speculation or hedge fund momentum chasing. This is structural, balance-sheet-level demand. And the list of buyers matters. The central banks most aggressively accumulating gold are not doing so in a vacuum. China, India, and Turkey are not shy about their motivations. Accumulating gold reduces reliance on the US dollar, diversifies reserves, and, perhaps most importantly, sends a message. Whether you call it hedging, signaling, or outright currency competition, the effect is the same. Gold becomes a tool not just of financial preservation, but of geopolitical expression. Please re-read that last sentence–it’s important. 👀

That does not mean gold is suddenly immune to gravity. In fact, it means the opposite. When flows become concentrated and motivations become political, price can overshoot reality faster than fundamentals can catch up. Traders should not be surprised by the action we saw Thursday, Friday, and again this morning. Sharp moves are the natural byproduct of crowded trades colliding with profit-taking. Gold does not need a villain or a catalyst to pull back. It only needs a pause in incremental buyers.

This is where basic finance reasserts itself, even in a market as emotional as precious metals. High returns demand high risk. That is not a moral judgment; it is a law. You do not get a month-to-date gain north of 20 percent without paying for it somewhere along the way. Sometimes the payment comes in volatility. Sometimes it comes in drawdowns. Sometimes it comes in both, delivered at inconvenient hours when liquidity is thin and emotions are high.

Silver, which often behaves like gold’s more excitable younger sibling, is even more vulnerable to this dynamic. Silver trades with a foot in both camps: monetary metal and industrial input. When sentiment turns, it can sprint ahead of gold on the way up and trip over its own feet on the way down. That does not invalidate the long-term case for silver any more than a gold pullback invalidates gold’s role in a diversified portfolio. It simply reminds us that speed cuts both ways.

I am often asked whether this recent surge marks the beginning of some new golden era or the end of the trade. The honest answer is neither. This is not the last chapter in the book of gold. Far from it. But it is also not page one. We are somewhere in the middle of the story, where enthusiasm runs high, skepticism gets quieter, and discipline becomes optional. That is usually when markets test it the hardest.

One of the most useful pages in my Wall Street Sayings notebook reads simply, “What goes up must come down.” It is not poetic, and it is not clever, but it has survived every market cycle I have lived through. The phrase does not imply doom. It implies rhythm. Markets breathe in and out. Trends advance, consolidate, and retrace. Gold is no different, no matter how compelling the narrative or how powerful the buyers.

So stay focused. Understand why gold has risen, respect the forces behind it, and acknowledge that fear and currency skepticism are not going away anytime soon. But also respect the price. Respect the speed. Respect the risk embedded in those eye-catching returns. There will be more opportunities, more chapters, and more charts that make people stop scrolling and look up from their phones. Just don’t confuse conviction with invincibility. Please remember, pages one through five of my war-torn sayings notebook exist for a reason.

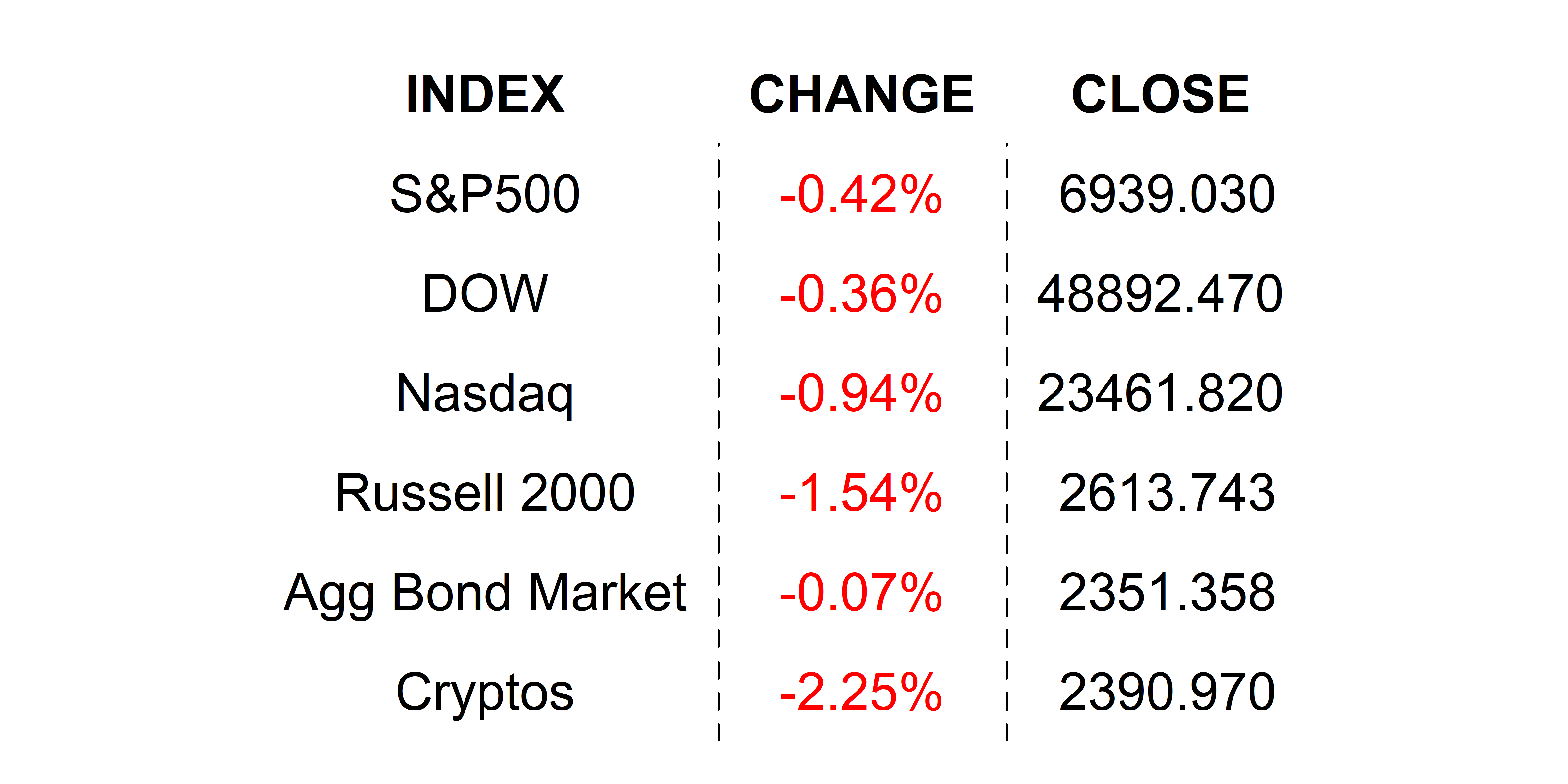

FRIDAY’S MARKETS

Stocks got trounced on Friday closing lower despite desperate attempts at recovery throughout the session. Stocks just could not escape the volatility in Gold, Silver, and the Dollar, sparked partially by President Trump’s selection of Kevin Warsh–former monetarist hawk–to succeed lame-duck Powell. Where did the other part of the selling come from? See above 🙃.

NEXT UP

-

S&P Global US Manufacturing PMI (January) is expected to be revised up slightly to 52.0 from 51.9.

-

ISM Manufacturing (January) may have risen to 48.5 from 47.9.

-

Atlanta Fed President Raphael Bostic will speak today.

-

Later this week: lots of important earnings announcements. Also JOLTS Job Openings, ADP Employment Change, more PMIs, monthly employment numbers, and University of Michigan Sentiment. Missing these numbers in a market like this is like leaving the house without your pants on. Avoid that embarrassment by downloading the attached economic and earnings calendars.

-

Important earnings today: Tyson Foods, Walt Disney, IDEXX Labs, Simon Property Group, Palantir, and Teradyne.

.png)