Stocks traded higher on Friday capping off a tumultuous week with wild swings as investors prepared for this week, one filled with important releases. Stocks managed to claw back much of the losses from earlier in the week leaving traders wondering if the turbulence is gone.

Back to Brat. It was a brat market in a brat summer. Don’t try to look up the word “brat” as I have used it in this sentence, you won’t find it in a conventional dictionary. If you have a Gen Z lying around, you can simply ask them. I decided, while staring directly into the sun yesterday as I pondered the week ahead, that there is no better definition of this market other than this pretty-newly-minted adjective. I found a Gen Z and asked her if I was using the word correctly and I got the thumbs up. But here’s the thing. Even if you decide to use the word as you know it to describe the market, it still works. This has indeed been a bratty market!

You love the gains gotten in those cute stocks, but you have to admit that while staring at them they somehow taunt you. Admiring them, you are left with a sense of “is this real?” You had somehow convinced yourself that the cuteness could not last and at any moment your portfolio would throw itself on the floor and throw an embarrassing tantrum. These past couple of weeks have left shareholders on edge. Earnings season travelled from sector to sector, and everyone was expecting fireworks when the parade arrived at the megacap tech companies. Indeed, fireworks were set off, but unfortunately, the show was not as spectacular as viewers were hoping for. Investors had, after all, become accustomed to dazzle with a capital “D.” I mean, how can you beat earnings growth, in some cases, as high as +50%. For the record, earnings were still spectacular along with expected growth, but just a bit more realistic. Still, the lack of dazzle left investors with a sense of discomfort.

Enter the procession of I-told-you-so money managers who sold 25% ago. They certainly didn’t help the mood. Oh, are we in the middle of a presidential election? Yep. And guess what, the race, based on the most recent polls, has the candidates neck and neck. The Republicans are mostly clear with their policy priorities while the Democrats have yet to air theirs. Interestingly though, some of the more recent Democratic rhetoric seems to be consistent with Republicans, from a business standpoint. All this makes things very confusing for a stock market that prefers knowing over not-knowing. Who will be better for taxes? Who will be better for businesses, and which sectors? Who will make you feel better about your tech stocks that got smashed last Monday? Folks, if you are having a hard time answering those questions, you are not alone, even the experts are trying to figure it out 😉.

Two weeks ago, Chairman Powell joined the rave all but promising to cut rates in September. Say whatever you want, Powell’s messaging was pretty clear, and the markets got down with the beat drop. The good vibes wore off quickly by that Friday when a weak manufacturing number hooked up with a weaker-than-expected employment number leaving everyone nervous. With nerves exposed, partiers started to seriously worry that the merrymaking would be broken up by a recession. Japanese markets were trounced over the weekend with a big carry-trade unwind and traders in the US woke up to pure carnage. Not a great way to start the week. The I-told-you-so guys were back on TV saying how they knew the rally would break. Thankfully you didn’t listen to them before you made all those great gains since mid-2023.

Still those gains continued to tease you. The wise held on and managed to recover much of the losses from earlier in the week. The easily perturbed exited and are now searching for a way to get back in. The storm appears to have passed. It was a strong one, a violent one. It took down trees, caused flash floods, and spoiled lots of plans. Those storms are typical of summer… especially a brat summer. Stay focused, we are still very much in the woods and volatility is likely to continue. The next Fed meeting is September 18th, just a few days before summer officially ends.

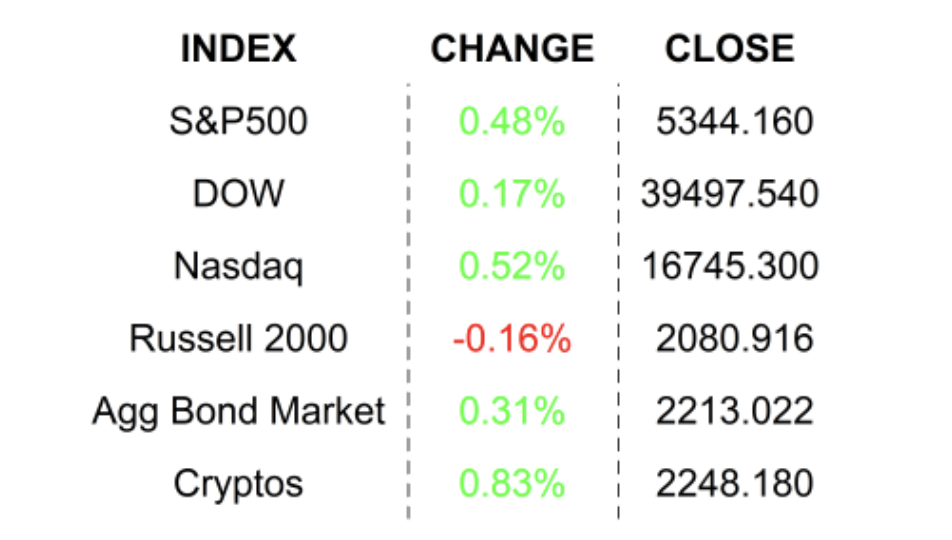

FRIDAY’S MARKETS

NEXT UP

- NY Fed Inflation Expectations (July) came in at +3.02% in June and economists AND THE FED are eager to see if those changed.

- Later this week we will get Producer Price Index / PPI, Consumer Price Index / PPI, Retail Sales, Industrial Production, and housing numbers. Earnings season winds down this week, but we still have some important releases. Download the attached economic and earnings calendars for times and details.

.png)