Why the NYSE might have more influence over rates than the White House

KEY TAKEAWAYS

-

The Fed, not the President, controls interest rates

-

Employment data has weakened with three months of downward revisions

-

Core goods inflation is rising slowly but steadily

-

Markets are pricing in two rate cuts by year-end, with high odds of one in September

-

The Fed may be forced to follow the market’s lead

MY HOT TAKES

-

Powell’s independence is under maximum political pressure

-

Tariff-driven inflation is on the Fed’s radar but not yet an emergency

-

The labor market’s weakness gives the Fed cover to cut

-

Market expectations are boxing the Fed into action

-

Wall Street, not Washington, is setting the tone for rates

-

You can quote me: “In 2025, the strongest signal to the Fed is coming from 11 Wall Street, not the White House."

I am the new captain. Who’s in charge here, after all? Jerome Powell probably has the biggest office with the best views at the Fed’s HQ. Speaking of views, I was visiting my daughter in Washington DC a few weeks ago, and she hosted my wife and I for dinner at her swanky, private club known to be a hotspot for political power brokering. I could see why, as the views from its exclusive dining room were unbelievable. I was sitting in a spot which allowed me to view the US Treasury, the Washington Monument, and the White House. The only thing in my way was my daughter, who sat directly across from me–she wanted me to have the view. ♥️ Later in the meal, our server told us that my daughter was sitting in Treasury Secretary Scott Bessent’s favorite seat. I thought to myself, “wow,” this is where it all goes down. Treasury right beneath my nose and the White House off to the right. Powell’s office, out of view, was within walking distance–a 10 minute walk tops.

I thought that it was within that triangle of power that the sparks of the economy and markets originated. Sounds corny, right? COME ON, REALLY? I am a New Yorker, and you know my favorite building. That’s right, the iconic New York Stock Exchange. Once the epicenter of world financial markets, it still stands as the symbol of true capitalism the world over, even though stocks are traded electronically, in the ether these days. Being that a data center in Mahwah, New Jersey (that’s a real place–you can Google it) is not exactly an awe-inspiring building, we will use 11 Wall Street as its proxy. One last word on the NYSE. Even though the specialists and trading posts are no longer present, nor are the knee-high piles of ticker tape, the trading floor is still quite lively and worth a visit, if you can manage a tour.

So, we have the White House, The Treasury, and the New York Stock Exchange. Which of the three influences interest rates the most? That seems to be the question of the day, doesn’t it. More specifically, the rift between the President and the Fed Chair has been quite public with the President making a hard press for lower rates and Powell digging his feet in. The President is a strong willed man and, unarguably, the most powerful human on the planet. However, his power stops just short of interest rate policy, which is constitutionally protected. Only the Fed Chairman along with 11 Federal Open Market Committee members can adjust the Fed Funds Rate. They are independent of the goings on at 1600 Pennsylvania Ave (White House) and 1500 Pennsylvania Ave (Treasury).

The President and his high-powered cabinet has done everything legal to try and cause the Fed to lower interest rates, but alas, they remain powerless. The FOMC is data dependent, independent, and… um, hiding behind the data, using it as an excuse to do nothing at the moment. The data that the Fed should be most interested in is employment data and inflation data. Those two inform the Fed’s dual mandate of stable prices and healthy employment.

Prices have not exactly been stable these past several years, but employment has been rather healthy. Prices had been disinflating slowly and heading toward the Fed’s 2% target as Trump took the helm in DC and began his aggressive tariff-based trade policy. Tariffs are unarguably inflationary, HOWEVER, it is unclear as to whether or not that inflation will be sticky, and the magnitude of the inflationary influence. In other words, would it just be one-time price bumps, and how much of the tariffs would be passed along to consumers? The Fed was taking no chances and committed to keep interest rates restrictive, just in case.

IN THE MEAN TIME, employment seems to have become a bit unhealthy under our noses. As we learned a few weeks back, new monthly hires had fallen off significantly for 3 months in a row, and we got all that bad news in one release–there were significant downward revisions of prior months. So, mandate #2 of 2 is starting to look as if it needs attention.

And mandate #1 of 2, inflation? Well, that had been kind of going in the wrong direction, but really slowly, hardly at an alarming rate. Services inflation reflects the remnants of the pandemic inflation that has since abated, while goods inflation has slowly picked up over the past year. Goods inflation is where we are likely to find signs of tariff-borne inflation–that thing that everyone is looking for. Have a quick look at the following chart, then follow me to the close.

This is a chart of Core Goods Inflation, a component of the Consumer Price Index / CPI, going back 10 years. You can see the clear pandemic spike and subsequent pullback to the point of deflation in the first half of 2024 (prices were actually falling). But starting last fall, inflation began to pick up slowly and actually tail upward in the past few months. This, my friends, is what the Fed is concerned about. Looking back prior to the pandemic, we can see that this number typically averaged around 0, so even a reading of 1.17% is noteworthy, but more importantly, its strongly positive recent trend. How high it will get, whether it will continue to rise, and how long it remains at those levels is very much the concern of the FOMC.

Yesterday’s headline CPI read of 2.7% was below estimates and level with last month’s year-over-year read. In this highly-charged environment, that is considered a benign inflation reading and is likely the cause of yesterday’s rally. Fed Funds Futures markets reacted as well causing probabilities of a 25 basis point September rate cut to go from 88% to 96%. On Wall Street, both of those would be considered HIGHLY likely. Looking back, futures were predicting only a 40% chance of that occurrence just prior to the monthly employment number release earlier this month.

Despite the rise in core goods prices, markets are very much factoring in rate cuts at this point. A good chance of 1 next month, a 62% chance of another in October, and a 100% chance of that second cut by December with a 47% chance of a third cut by December. So, looks like 2 locked in and 47% chance of a third by year end. Now, it is important to note that these things change minute by minute and in a big way with economic releases. But right now this is what is on the table: a clearly distressed-but not broken labor market, a rising-but not by too much inflation picture, a rare double dissent on the FOMC with a new dove about to join the pack, and a market that is screaming “cut rates now!”

So, what does the Fed do? Well, believe it or not, there is an unwritten feedback mechanism between the markets and the Fed. There are times when the market displays its willingness to accept rate hikes, almost saying to the Fed, “go ahead, we can take it,” and there are other times when the market says “cut rates, or else.” The Fed used the market pass in its aggressive rate hiking in ‘22 and ‘23, and it is likely to have to relent to the markets in 2025, but this time with cuts. At this point, the FOMC now stands alone with very little to hide behind to avoid making its next move. Now, we will still get another inflation release (PCE Price Index) and another monthly employment situation before the FOMC meets next month. Those can surely change the course of strategy, but if those numbers are in line with their last prints, it is safe to say that the Fed is likely to listen to the message coming from… 11 Wall Street in New York City.

I can’t think of a better cocktail than the one mixed by the bartender in the Founder’s Room at my daughter’s club. The view along with my company made it a spectacular evening. I plan to go back soon, but only if I can get Bessent’s seat. Before then, I will happily settle for coffee and my daily walk past the NYSE–that is where the real action is.

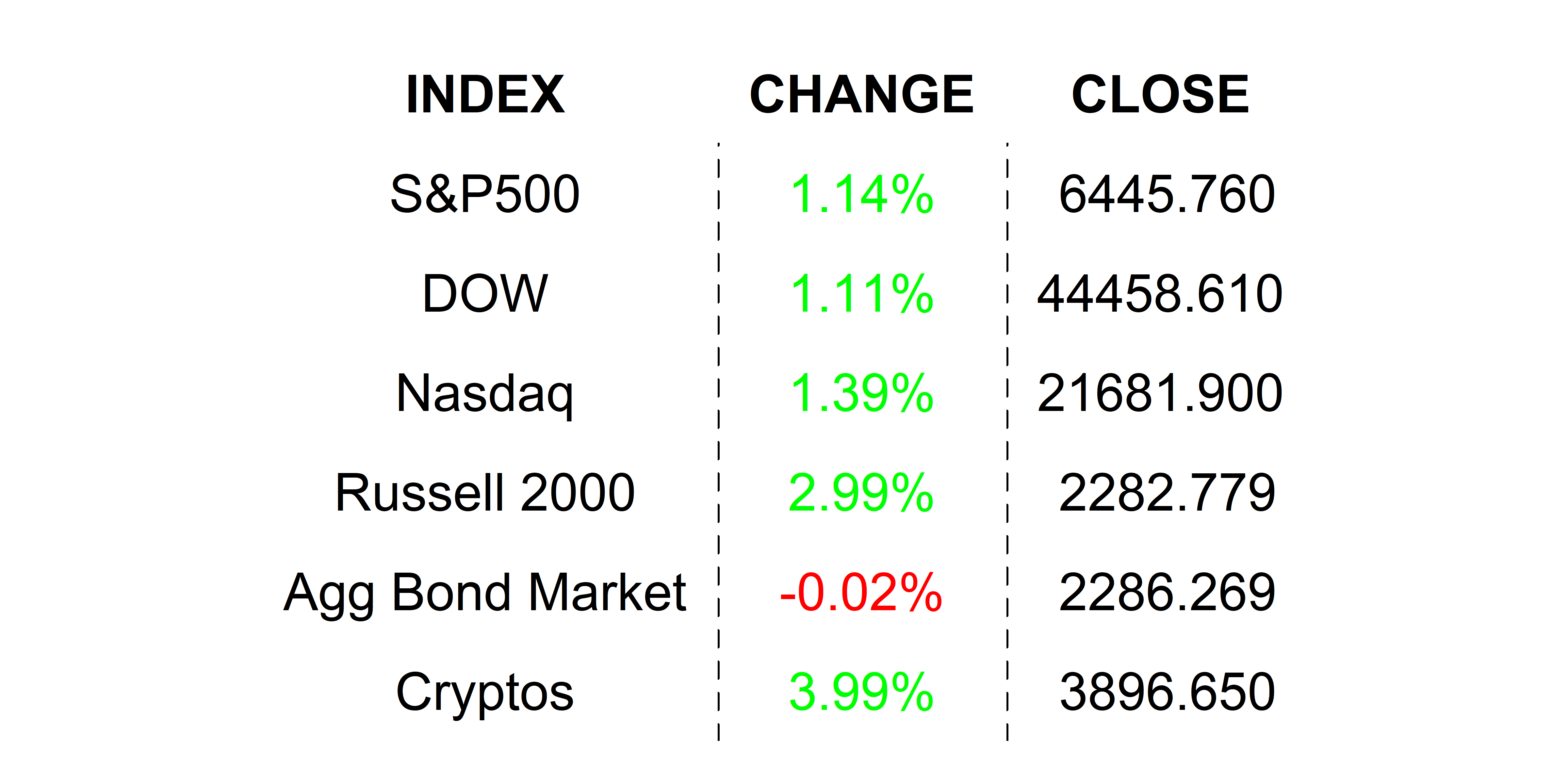

YESTERDAY’S MARKETS

Stocks jumped to new highs yesterday as bets for Fed cuts increased in response to a slightly better inflation print. Yields on 2-year Treasury Notes slipped in response to the CPI release, predicting lower short term rates.

NEXT UP

-

Fed speakers today include Barkin, Goolsbee, and Bostic.

-

Important earnings today: Performance Food Group, Cisco Systems, and Brinker International.

.png)