Tariffs, inflation, and Fed uncertainty — here’s how to keep your investor calm when cannonballs are flying.

KEY TAKEAWAYS

-

Stocks remain expensive, with the S&P 500 at 25x earnings

-

Tariffs up 16 percentage points on average in under a year, hitting core goods

-

Inflation creeping back, especially in transportation and furnishings

-

Fed policy remains restrictive amid political uncertainty

-

Markets still rising despite economic fatigue and policy headwinds

MY HOT TAKES

-

This market is more resilient than headlines suggest

-

Tariffs are a slow-burning inflationary fuse

-

Fed policy is restrictive, but political noise is muddying the outlook

-

High valuations don’t automatically mean a crash, but they do demand caution

-

Calm execution beats emotional trading every time

-

You can quote me: “The economy may be tired, but it’s still moving forward, so should you!”

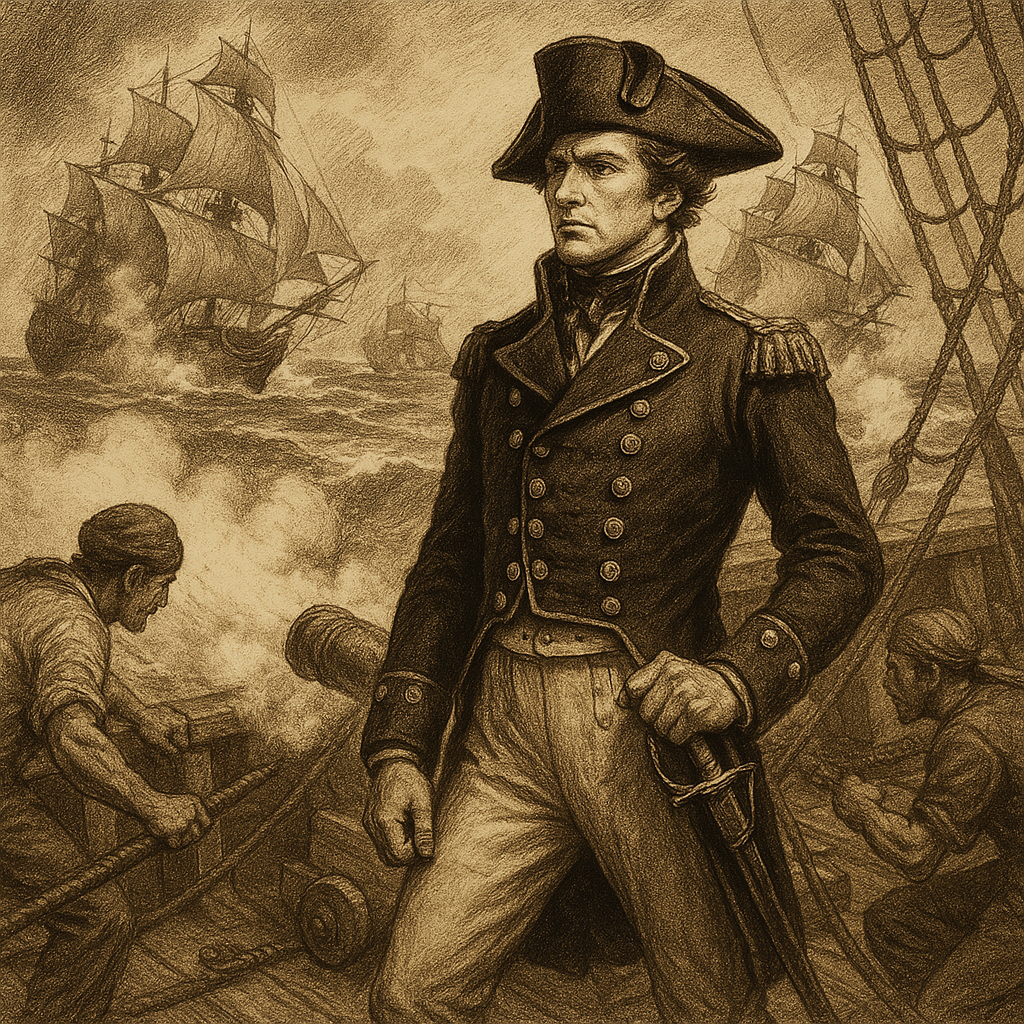

Just breathe. I grew up very near the sea’s edge. I, like most folks in my town, spent a good deal of time on the shores of the Atlantic and the bodies of water that dotted the nearby coastline. Sailing became my passion early on, and that passion would spark my interest and deep love for naval literature. My first taste came from the C.S. Forestar’s Horatio Hornblower series and ultimately Patrick O’Brian’s Aubrey-Maturin series. Both follow the exploits of courageous, adventurous British naval officers Horatio Hornblower and Jack Aubrey during the Napoleonic wars. Both series go into the intricacies of many famous and not-so-famous naval actions. And through all those battles, the one thing that always stood out in my mind was how the lead characters would maintain their composure during pitch battles. In the midst of flying grapeshot, whizzing cannon balls, colliding ships of the line, smoke, fire, splintering wood… flying body parts, the officers remained calm and in charge.

If I asked you a year ago about your thoughts of global tariffs, some reaching 3 figures, you would have responded in a chuckle. How about companies trading at 200 times their earnings and still going higher? What about all the major indexes trading at multiples above their long-run averages? Mortgage rates would be higher than they have been in decades and bond yields remaining stubbornly high. Speaking of stubborn, the Fed Funds rate would also be stuck at restrictive levels for 3 years and the Fed unwavering. What if inflation began to pick up again, for whatever reason, and unemployment picked up suddenly? What if retail sales were sluggish and consumer confidence was bouncing around? You would exclaim, “never happen!” If I asked you how you would expect the markets to respond to such a tariff–if it did happen–you would probably forecast disaster.

Well, guess what, my friends we are here. Stocks are expensive by historic standards. The economy is moving forward but showing some signs of tiring. Tariffs are in place and, on average, 16 percentage points higher than they were just 9 months ago. We just had three months in a row of nasty job growth, and the person responsible for the agency that reports those numbers was just fired. Retail sales have been somewhat sluggish and inflation fears are not helping. It’s not just fears, inflation has been slowly picking up. That has provided a solid alibi for the Fed, which appears–for the moment at least–unwilling to ease up on monetary policy. The guy in charge over there has not been fired, but surely would have been if it were legal to do so. There are many cannonballs whizzing by right now.

This morning, we will get a critical data point on inflation, the Consumer Price Index / CPI, which is expected to have picked up slightly on a year-over-year basis. Economists are closely watching core goods inflation, which is where tariffs could have the most and direct impact. Prices there have been climbing slowly while core service inflation–a remnant of the pandemic inflation–has been easing at the speed of molasses on winter’s day. Annual inflation is expected to come in at 2.8%, diverging from the Fed’s 2% target. It almost got there earlier this year, touching 2.3%, a number not seen since 2021. But it would not last.

Looking across the top three weighted categories in core goods, we have transportation, household furnishings, and apparel. Transportation is dominated by automobiles, which, in case you have forgotten, are subject to a 25% tariff. Even US automakers will be affected by this–it's really complicated. Cars imported from Japan and the EU are subject to a 15% tariff, based on recent negotiations. Ford and GM alone anticipate that they will take a $7 - $8 billion hit from tariffs this year alone. That seems like a really strong incentive to raise prices to minimize losses. Those levels are inching higher, and it is not hard to imagine that they will get higher yet as inventories are worked down.

Household furnishings inflation is climbing as well. Those products rely heavily on imports, and importers will be feeling that margin compression as they too work their inventories down. We have already witnessed a modest uptick in inflation in this category. Finally, we have apparel, which is synonymous with foreign manufacturing. This category is interesting in that it is technically deflating. That means prices are lower than a year ago. However, that deflationary gap is narrowing, meaning, prices are going up! It is these three categories that are being most closely watched for tariff-borne inflation.

Earnings season is winding down, but it is far from over. With another 44 S&P 500 companies that have yet to announce, anything can happen. Notable amongst those who will be announcing in coming days is superstar NVIDIA, which could certainly be referred to as the founder of this feast; it is at the core of AI which has been at the core of most of the market's bullishness these past few years. To date, S&P earnings have come in above estimates by an average of 8.4% with a nearly 11.4% growth over last year. That is pretty strong considering the macro headwinds that have prevailed.

Still, the biggest questions that remain are tariffs, the Fed, and of course, the economy. Tariffs–which are very much here and very much real–are extremely complicated. First, you would be hard-pressed to find anyone out there who can tell you what tariffs exist, what is exempted, what isn’t exempted, what might be delayed, and what is already being collected on. We know that a great deal of duties have already been collected to date, so we know that there is some drag, somewhere, though we may not have witnessed those costs being passed to the consumer… yet. In other words, it’s super complicated and will continue to get even more complicated with the White House’s rather fluid rollout and enforcement.

The Fed, always a complicated factor, is a very large moving part of the equation these days. Fed policy is still restrictive! That means we are riding the brakes. If you drive a car, you know that riding the brakes slows your car down. 😉 It is a drag on economic growth. The Fed is trying to do its job as an independent policy body that reacts only to data, but all that is getting muddy as well. Starting with the data, this last BLS release of monthly employment numbers have thrown the agency’s credibility into doubt. That was not helped with the administration replacing its head with a known BLS detractor. Adding more mud to the water is the President's future appointments to fill a now vacant Governor seat and a Fed Chair nomination. Yesterday we got news that Treasury Secretary Scott Bessent is interviewing candidates for the Fed’s top job that won’t be vacant until next spring. Still, the candidates being considered are known doves and one surprising uber hawk (Lori Logan). More confusion.

Finally, we have the economy and the mixed stream of numbers we have been receiving. The economy contracted in Q1 but has rebounded beyond estimates in Q2. Those numbers were sullied by net exports swinging wildly in response to the onslaught of tariffs, but there were signs of a slowdown in consumption and investment as well–both hidden by the net export resurgence. Employment which is at the core of all growth–strong employment = strong economy, always–has been showing some clear signs of distress.

All this and stocks continue to edge higher and valuations continue to grow. Think of a P/E multiple of 20 times as being a heuristic threshold for the S&P 500 being considered expensive. It is currently trading at around 25 times earnings. Information technology, consumer discretionary, and industrials are trading at 32x, 30x, and 26x respectively. You read that right… industrials. Only 3 sectors are trading below 20x (financials, healthcare, and energy), so, by rule-of-thumb, it can be argued that stocks are relatively expensive.

Does this not all evoke the feelings of mayhem within you? Can you not see yourself as a captain in charge of a ship in the midst of a pitch battle these days? I understand. There are many coping mechanisms. One prominent one is to ignore it all. Another is to trade for the sake of trading. And then there is the panic and sell everything along with its close-cousin strategy: invest nothing.

This is the time to channel your inner Admiral of the Fleet Hornblower and Rear Admiral of Blue Aubrey. Take a deep breath, purse your lips, squint your eyes, and pay very close attention. Don’t panic and don’t fret. If you look closely, you will see that the battle is progressing in your favor. Quitting is not an option, and extra points are awarded for not flinching. Things are complicated and the battle is far from over, but rest assured, I am here with you, and we will get through this battle together. Those 31 well-worn, dusty books are still somewhere in storage but they remain fresh as the day I read them in my mind.

YESTERDAY’S MARKETS

Traders flinched yesterday after flirting with highs as they awaited this morning’s important economic numbers. This week’s numbers will be critical in the equation for rate hikes in September. Crude and yields remained stable, gold slipped, and cryptos gained.

.png)