Beige book tells a story of forming clouds on the horizon

Stocks slipped yesterday after a lackluster session in which traders could not muster the strength… or confidence to keep indexes in the green. The latest JOLTS report confirms that the labor market is slackening which is a sign of potential economic weakness brewing.

A Fed book with any other color is still beige. Ok, is beige even a color anymore? I am surrounded by people who are well-versed in the latest trends in style. It’s not just clothing. It’s autos, furniture, nail polish, curtains… even dogs. If you haven’t noticed, there are many interesting colors flying around these days, and I have to admit that sometimes, I get a bit lost. I remember, when I was still in short pants, the day I got my first Crayola Crayon upgrade to the 64-crayon box. Not only were there colors that I never heard of in it, but it came with a handy, built-in sharpener. As I unwrapped the box, my mind soared with the new possibilities of what I could now create with these additional 52 colors. There was Periwinkle, Spring Green, Orchid, Sepia, and even Burnt Orange. It was truly amazing! Not even 6 months after I received the treasure for my birthday, interestingly enough, there were still about 52 of those colors that sat in the box completely unused and the black crayon was in 2 or three pieces, almost completely unusable. There is a moral to that story, but that is not the concern of this morning’s note.

No, this morning’s note is all about the color beige… which, by the way, was not included in the 64-crayon box. Eight times a year, the Federal Reserve releases its Beige Book. It is no coincidence that there are eight releases, nor is the timing of those releases. The Fed Beige Book summarizes current economic conditions across the 12 Federal Reserve districts based on anecdotal information from business contacts, economists, and market experts. It is meant to provide qualitative insights into regional economic trends, including employment, inflation, and consumer spending. The Book is released prior to each FOMC and it is meant to inform monetary policy decision-making. Wait, what? There is a book that is publicly available that talks about economic conditions… produced BY THE FED… FOR THE FED… to help make policy decisions? Yes, indeed! The next FOMC meeting is a little less than 2 weeks away and, I would say, the world – yes, the WORLD – is very much focused on what the Bankers will do. Will it be -25 basis points, or -50? Or any at all? Futures and swaps traders have their money on -25 basis points, though there is still a 30% to 40% that the cut will be -50. So, which will it be?

Well, we know, based on past minutes, that policy makers endure at least a solid day of number and chart-rich presentations from a brigade of nerd-economists to help them. AND we also know that FOMC members will, at least, browse the Beige Book, so, we may as well see what’s inside. Wouldn’t you agree? You may have seen it pop up in my NEXT UP section from time to time, but you will rarely hear anything about it onTV or in the press. I mean, with all those great colors available these days, who wants to read a book with a beige cover? Sorry, that’s not a good excuse, the Fed meeting is looming, and the market is on tenterhooks, so, folks it is a must-read. Don’t worry, I read it, so you don't have to.

Here is summary of the Fed’s Beige Book, released yesterday. Overall economic growth was flat or declining in most districts, with mixed outlooks for improvement. Consumer spending declined slightly, with auto sales varying across regions with high interest rates diminishing demand. Manufacturing activity declined in most districts, reflecting ongoing contractions and weaker demand for manufactured goods. Inflation was modest, and input cost pressures eased slightly in some sectors such as food and construction materials. Ok, I VERY BRIEFLY summarized the Beige Book in 4 sentences. Now, I would rate the sentiment in those sentences as follows, respectively: cautiously negative, negative (you know I am very sensitive to consumer spending), negative (see yesterday’s note), and, thankfully, POSITIVE. Now I selectively covered areas which I think are important at the moment; the report covers many other areas, which are informative as well. The FOMC will be particularly concerned with these areas, save the employment situation, which I left out so I can highlight it separately. On that front, the report reflects that employment remains steady, however businesses are being more selective in hiring, and some are even reducing hours or shifts. I would classify that as curiously negative, and the Fed is particularly sensitive to the employment situation as it is ½ of its dual mandate, AND it is the half that the Fed has been talking a lot about lately.

SO, to sum up my summary, inflation is improving, but economic conditions appear to be weakening. If you were an FOMC member, what conclusion would you come to? Would you cut interest rates? Sure, you would. Would you cut by -25 or -50 basis points? Well, you are most likely not an FOMC member, but if you are, thank you for reading my market note, and I hope that your takeaway is “don’t miss the boat this time, please!” Also, please consider changing the color of the book. Martha Stewart recommends Sherwin-Williams “Upward” as an important trending color for 2024. I have no idea what that color is but, I certainly like the name. If you are interested, Stewart describes it as a “blissful blue hue inspired by coastal aesthetics.” Yes, let’s go with that.

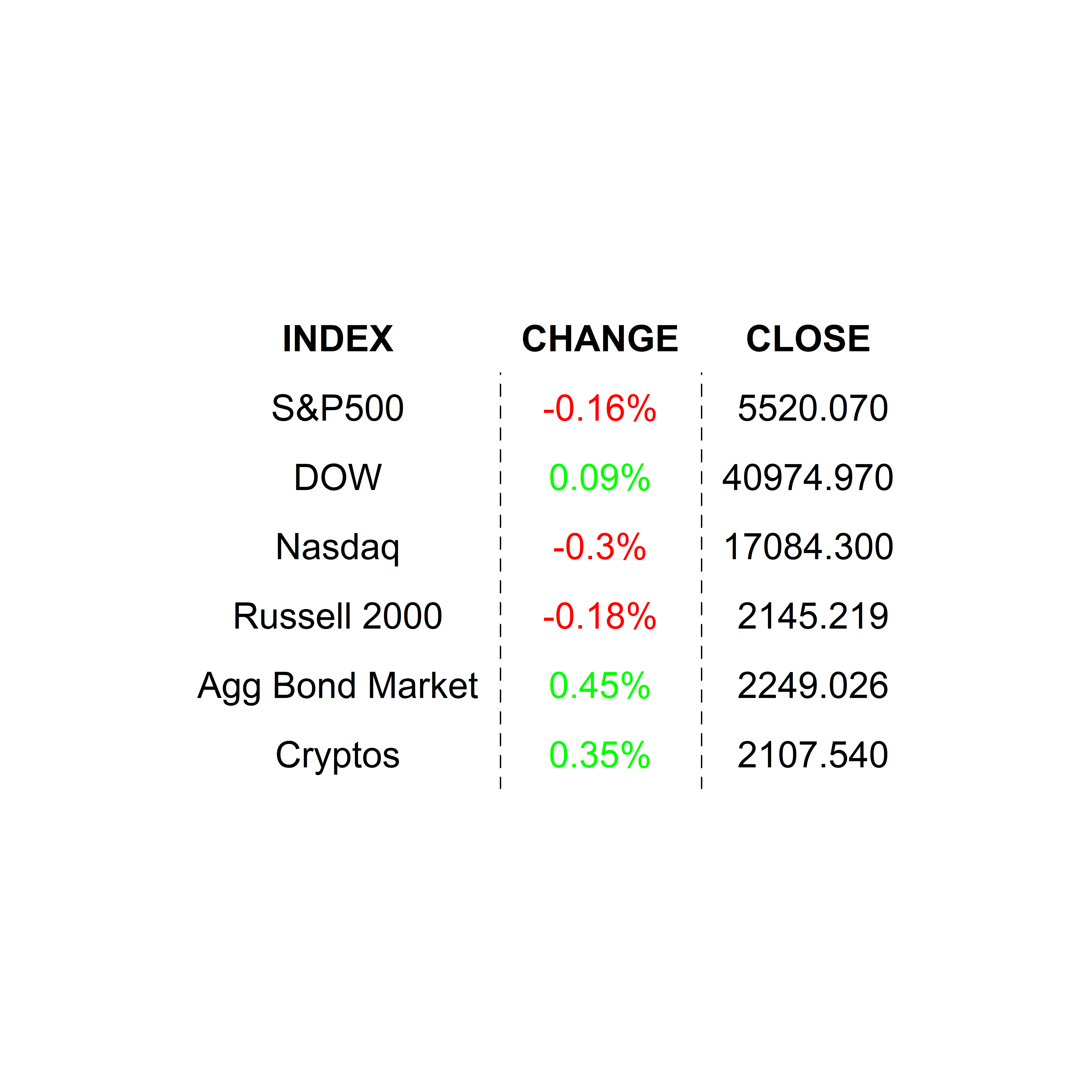

YESTERDAY’S MARKETS

NEXT UP

- ADP Employment Change (August) is expected to show +145k new job additions, an increase over last month’s +122k adds.

- Initial Jobless Claims (August 31st) is expected to come in at 230k, a hair less than last week’s 231k claims.

- ISM Services Index (August) may have remained unchanged at 51.4.

- After the closing bell earnings: Broadcom, Samsara, DocuSign, Guidewire Software, and UiPath.

.png)