Stocks, still recovering from last month’s celebrations, limped into the new year with losses. Manufacturing slipped further into contraction territory according to the latest PMI revision from S&P Global.

Baked Apple. Did you know that on this very day in 1977 Apple Computer was officially incorporated? Unless you have a Bloomberg and read this morning’s headlines, you may not have, but I am sure you know that Apple has been around for a while. You probably also know about Steve Jobs and his somewhat nerdier cofounder Steve Wozniak. The cuddlier and fuzzier Wozniak mostly stayed out of the spotlight while Jobs, ever the showman, became the face of Apple during its meteoric rise from a Los Altos garage to the Nasdaq. It was not always a straight line, though it feels that way today as we think back on the company’s history. I can remember Wozniak in a Datsun 280-ZX commercial back in 1983. That was… um, still IS a really cool car, and the commercial featured him calling the car “awesome.” He sported a full beard, which was uncommon back then. In those days, a bearded, pudgy, computer engineer driving a sports car was an interesting contrast, while today, one would be less surprised to see a computer nerd in a private jet, still bearded, and most likely trimmer. Steve Jobs was far smoother and more well suited for the press… and investors. Jobs was less a Datsun man and more of a Porsche fan in those days. There is a famous story from when he briefly left Apple to found Next, which was ultimately acquired by Apple. Jobs had just bought 2 new Porsche 911s and he had one parked outside his office at Next. One day, he realized that a prospective investor was coming, and he could be heard screaming frantically “hide the Porsche, hide the Porsche!” The Porsche was probably hidden, and the money safely secured. GOOD THING… for the investor! Did you know that Jobs and Woz (as he is affectionately known) had a third partner? It’s true. Ronald Wayne was partner number 3.

Wayne, amongst other things, was responsible for the first Apple I prototype’s wire wrap schematics. Side note: I built one using wire wrap in 1980 and I still have it somewhere in storage. Wayne was a critical part of the company’s founding and he owned 10% of the company. Can you imagine what he must be worth today? What if I told you that he sold his entire stake in the company for $800 in 1977? Well, he did, so I guess you could say that he was a bit short-sighted. Today Apple sits atop the most noted S&P500 large cap index; that means that it’s the largest large cap around. Apple did OK last year, logging a +48.8% gain. Ya, that’s 48 with a 4 and an 8, which is a healthy return! If you simply held the stock without worrying about it day in and day out, you would be pretty proud to have held it. If you watched it day by day, you may have had a different experience. I can illustrate that quite easily with the following stock chart for 2023.

Looking at the chart, one can say, “it had its ups and downs.” For sure, but the net result was still a nearly +50% gain. Some folks may step back and look at the chart and interpret the last 6 months as a sideways, loss of momentum. Just yesterday, Barclays downgraded its rating to UNDERWEIGHT, in a rare move. The analyst noted the stock’s recent price trend and was unimpressed with Apples unit sales of its latest iPhone. When I heard the news, I dug a bit further. I can report to you that for 2023 looking back to 2019, total product revenues grew at +77.8%, +80.2%, +81.3%, and +80.4%. It is, indeed, notable that last year’s growth was slightly lower than the prior year’s. When I dug deeper, I noted that iPhone sales growth for 2023 was +52.3%, which was very much in line with prior years. Services, on the other hand grew faster last year than in previous years. Likewise, wearables (watches) have been holding their own. Revenues were $394 billion in 2022 and $383 billion in 2023. Sure, it was lower than 2022, but it is still higher than 2021 and higher yet than all the years prior. Then I realized that the Barclays analyst was referring to the iPhone 15, which, as its moniker describes, is the 15th version of the popular phone. I suddenly recalled similar reports for the 14 versions that preceded the current one. I then plotted a longer-term stock chart of the company. I don’t have to share that because you know what it looks like. Finally, I thought that it would be nice to ask Ronald Wayne what he would do with the stock right here. He may have changed his views slightly since 1977. He would most likely tell you to remain focused on your long-term goals.

WHAT’S “AWESOME” THIS MORNING

Rockwell Automation Inc (ROK) shares are higher by +1.34% in the premarket after UBS upgraded the company to BUY from NEUTRAL and raised its target to $360 from $205. IN the past month, 4 analysts have raised targets, while only 1 has lowered. Dividend yield: 1.63%. Potential average analyst target upside: -0.9%. WHY IS THIS NUMBER NEGATIVE? Because the current stock price is above the median target price of analysts that cover the stock. While this can be interpreted as the stock being expensive, it does not mean that the stock cannot continue to climb.

Verizon Communications Inc (VZ) shares are up by +1.16% in the premarket after it was upgraded to OVERWEIGHT from SECTOR WEIGHT by KeyBanc. The analyst cited high hopes for the wireless market this year. One would think that may help Apple sell some of those iPhone 15s, eh? Dividend yield: 6.84%. Potential average analyst target upside: +5.3%.

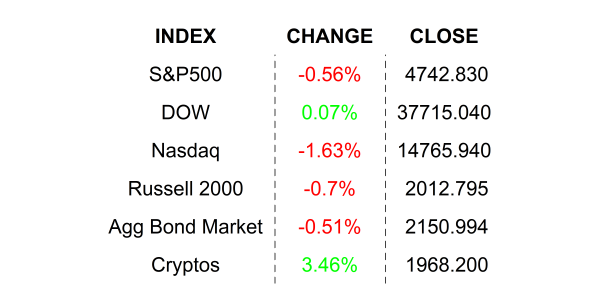

YESTERDAY’S MARKETS

NEXT UP

- ISM Manufacturing (Dec) may have ticked up to 47.1 from 46.7.

- JOLTS Job Openings (Nov) is expected to show 8.821 million job vacancies, slightly more than October’s 8.733 million openings.

- FOMC Meeting Minutes will be released at 14:00 Wall Street time. This can be a market mover as traders try to assess just how committed policy makers are to rate CUTS next year.

.png)